BBAI Stock: A Deep Dive Into The Q1 Earnings Report And Market Reaction

Table of Contents

BBAI Q1 Earnings Report: A Detailed Breakdown

BBAI's Q1 2024 earnings report revealed a mixed bag of results, prompting a complex market response. Let's delve into the specifics.

Revenue Analysis

BBAI reported total revenue of $X million for Q1 2024 (replace X with actual figure). This represents a Y% increase compared to Q4 2023 and a Z% increase (or decrease) compared to Q1 2023 (replace Y and Z with actual figures). While the year-over-year growth is (positive/negative), the quarter-over-quarter growth indicates (positive/negative) momentum. This revenue growth (or decline) can be attributed to (explain reasons, e.g., increased sales in specific product lines, successful marketing campaigns, or challenges in specific markets). Compared to analyst estimates of $W million (replace W with actual figure), BBAI’s revenue performance was (above/below/in line with) expectations.

- Total revenue for Q1: $X million

- Revenue growth (YoY): Z%

- Revenue growth (QoQ): Y%

- Comparison to analyst estimates: (Above/Below/In line)

Earnings Per Share (EPS)

BBAI reported an EPS of $A (replace A with actual figure) for Q1 2024. This compares to $B (replace B with actual figure) in Q4 2023 and $C (replace C with actual figure) in Q1 2023. The (increase/decrease) in EPS is largely attributable to (explain reasons, e.g., cost-cutting measures, increased efficiency, or changes in operating expenses). Compared to the consensus analyst forecast of $D (replace D with actual figure), BBAI’s EPS was (above/below/in line with) expectations. A significant factor affecting EPS was (mention any significant one-time events or adjustments).

- Reported EPS for Q1: $A

- Comparison to Q4 2023: $B

- Comparison to Q1 2023: $C

- Comparison to analyst forecasts: (Above/Below/In line)

Key Metrics and Financial Highlights

Beyond revenue and EPS, other key metrics provide a more complete picture of BBAI's financial health. The gross margin stood at X%, while the operating margin was at Y%. Net income was reported at $Z million, and the company's cash flow showed (positive/negative) growth. These figures suggest (positive/negative) trends in (mention specific areas, e.g., profitability, operational efficiency). The overall financial health of BBAI appears to be (strong/weak/stable) based on these key indicators.

- Gross Margin: X%

- Operating Margin: Y%

- Net Income: $Z million

- Cash Flow: (Positive/Negative) growth

Management's Guidance for Future Quarters

BBAI's management provided guidance for the remainder of 2024, projecting revenue in the range of $X to $Y million (replace X and Y with actual figures). This indicates (positive/negative) growth compared to 2023. Management cited (mention specific factors) as key drivers of this projection. The cautious (or optimistic) outlook has been (well/poorly) received by investors, influencing the market's overall sentiment towards BBAI stock.

- Key guidance highlights: Revenue projection of $X to $Y million

- Impact on investor sentiment: (Positive/Negative/Mixed)

- Comparison with previous guidance: (Higher/Lower/Similar)

Market Reaction to BBAI Q1 Earnings

The market reacted swiftly to BBAI's Q1 earnings announcement, revealing a complex interplay of investor sentiment and market forces.

Stock Price Movement

Immediately following the earnings release, BBAI stock experienced a significant (increase/decrease) of X%, reaching a high of $Y and a low of $Z. In the days and weeks following the release, the stock price continued to (increase/decrease) before stabilizing around $W. This volatility highlights the market's uncertainty regarding BBAI’s future performance.

- Percentage change immediately after release: X%

- Stock price movement in subsequent days/weeks: (Increase/Decrease/Stabilization)

- Highs and lows: $Y and $Z

Investor Sentiment and Analyst Ratings

Following the earnings release, investor sentiment towards BBAI stock was initially (positive/negative/mixed). This was reflected in (mention specific examples, e.g., online forum discussions, social media sentiment, news articles). Analyst ratings (increased/decreased/remained unchanged), with several analysts (upgrading/downgrading/maintaining) their outlook for BBAI stock.

- Changes in analyst ratings: (Increased/Decreased/Unchanged)

- Major news articles and reports: (List key sources)

- Overall investor sentiment: (Positive/Negative/Neutral)

Trading Volume and Volatility

Trading volume for BBAI stock (increased/decreased) significantly around the earnings release, indicating (increased/decreased) investor interest. This heightened trading activity contributed to the increased volatility observed in the stock price. The beta of BBAI stock (increased/decreased), reflecting its (increased/decreased) sensitivity to market fluctuations.

- Changes in trading volume: (Increased/Decreased)

- Explanation for changes: (Increased investor interest/Uncertainty)

- Volatility measures: (Beta increased/decreased)

Conclusion: Investing in BBAI Stock After Q1 – Key Takeaways and Next Steps

BBAI's Q1 2024 earnings report presented a complex picture, with some positive indicators offset by areas needing improvement. While revenue and EPS showed growth, certain key metrics require closer examination. The market's reaction was initially positive but then showed volatility, reflecting uncertainty about the company's future prospects. Investors should carefully weigh the risks and rewards before making any investment decisions concerning BBAI stock. Continue your due diligence on BBAI stock by researching further into its long-term strategic plans and competitive landscape. Consider the overall market conditions and your personal risk tolerance before investing in BBAI. Learn more about BBAI stock performance by consulting additional financial resources and analyst reports.

Featured Posts

-

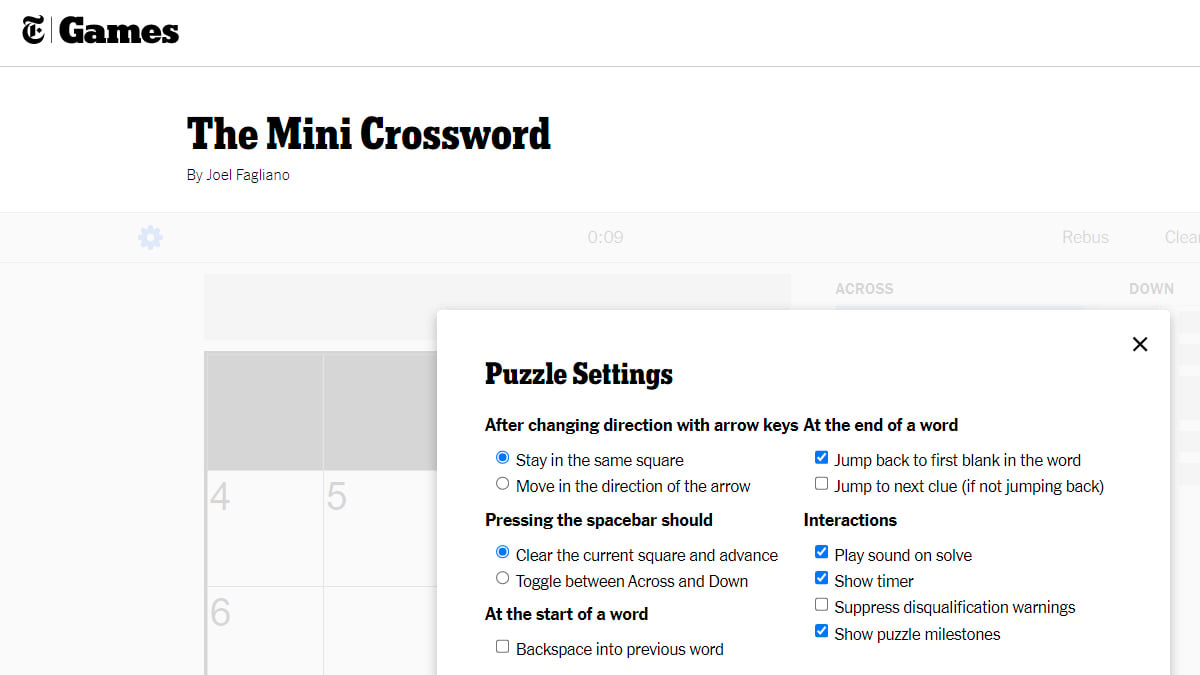

Todays Nyt Mini Crossword Answers March 15

May 20, 2025

Todays Nyt Mini Crossword Answers March 15

May 20, 2025 -

Understanding The Drier Weather Forecast For Your Area

May 20, 2025

Understanding The Drier Weather Forecast For Your Area

May 20, 2025 -

Suki Waterhouse On This Love A Complete Guide To The Lyrics

May 20, 2025

Suki Waterhouse On This Love A Complete Guide To The Lyrics

May 20, 2025 -

Colombian Models Death Highlights Rise In Femicide A Wake Up Call

May 20, 2025

Colombian Models Death Highlights Rise In Femicide A Wake Up Call

May 20, 2025 -

Exploring The Meaning Behind Suki Waterhouses On This Love Lyrics

May 20, 2025

Exploring The Meaning Behind Suki Waterhouses On This Love Lyrics

May 20, 2025

Latest Posts

-

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025 -

Representatives Pledge To Recoup 1 231 Billion From 28 Oil Companies

May 20, 2025

Representatives Pledge To Recoup 1 231 Billion From 28 Oil Companies

May 20, 2025 -

Understanding The Old North State Report Of May 9 2025

May 20, 2025

Understanding The Old North State Report Of May 9 2025

May 20, 2025 -

Oil Companies Face 1 231 Billion Recovery Effort By Representatives

May 20, 2025

Oil Companies Face 1 231 Billion Recovery Effort By Representatives

May 20, 2025 -

The Old North State Report May 9 2025 Summary And Analysis

May 20, 2025

The Old North State Report May 9 2025 Summary And Analysis

May 20, 2025