Best Personal Loan Rates Today: Secure Your Financing Now

Table of Contents

Understanding Personal Loan Rates and Factors Affecting Them

Before diving into finding the best personal loan rates today, it's crucial to understand the key terms and factors influencing them. The Annual Percentage Rate (APR) represents the total cost of your loan, including the interest rate and any fees. Interest rates are the percentage charged on the borrowed amount, while fees can include origination fees, late payment fees, and prepayment penalties. Lower APRs translate to lower overall loan costs.

Factors Influencing Your Personal Loan Rate:

Several factors significantly impact the personal loan interest rate you qualify for. Understanding these helps you improve your chances of securing the best possible rates.

-

Credit Score: Your credit score is a crucial factor. Lenders use it to assess your creditworthiness. A higher credit score (750+) often qualifies you for lower rates, while a lower score may result in higher rates or even loan denial. Make sure to check your credit report from annualcreditreport.com for any errors that could be affecting your score.

-

Debt-to-income ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt payments. A lower DTI indicates better financial stability, making you a less risky borrower and improving your chances of securing favorable loan rates. A high DTI might lead to higher interest rates or loan rejection.

-

Loan Amount and Term: The amount you borrow and the loan term (repayment period) influence your interest rate. Larger loan amounts might come with slightly higher rates. Shorter loan terms generally mean higher monthly payments but lower overall interest because you pay off the principal faster.

-

Lender Type: Different lenders – banks, credit unions, and online lenders – offer varying interest rates. Credit unions often offer more competitive rates for their members, while online lenders may provide a wider range of options and faster processing.

-

Examples:

- A higher credit score (750+) often qualifies you for lower rates.

- Shorter loan terms generally mean higher monthly payments but lower overall interest.

- A lower debt-to-income ratio improves your chances of securing better loan rates.

How to Find the Best Personal Loan Rates Today

Finding the best personal loan rates requires a strategic approach. Here's how to maximize your chances:

Online Comparison Tools:

Leveraging online loan comparison websites is highly beneficial. These platforms allow you to compare offers from multiple lenders simultaneously, saving you significant time and effort. Reputable sites often provide unbiased comparisons and detailed information about different loan products. Be sure to research the site's reputation before using it.

Checking with Multiple Lenders:

Don't limit yourself to a single lender. Compare offers from various banks, credit unions, and online lenders. Each institution has its own lending criteria and rate structures. Shopping around increases your chances of finding the lowest rates.

Pre-qualification vs. Application:

Pre-qualification allows you to check your potential eligibility and estimated interest rates without impacting your credit score. This helps you narrow your search before formally applying. A full application involves a hard credit check, which can temporarily lower your score.

- Actionable Tips:

- Shop around and compare at least 3-5 offers.

- Use online tools to pre-qualify without affecting your credit score.

- Read the fine print carefully before signing any loan agreement.

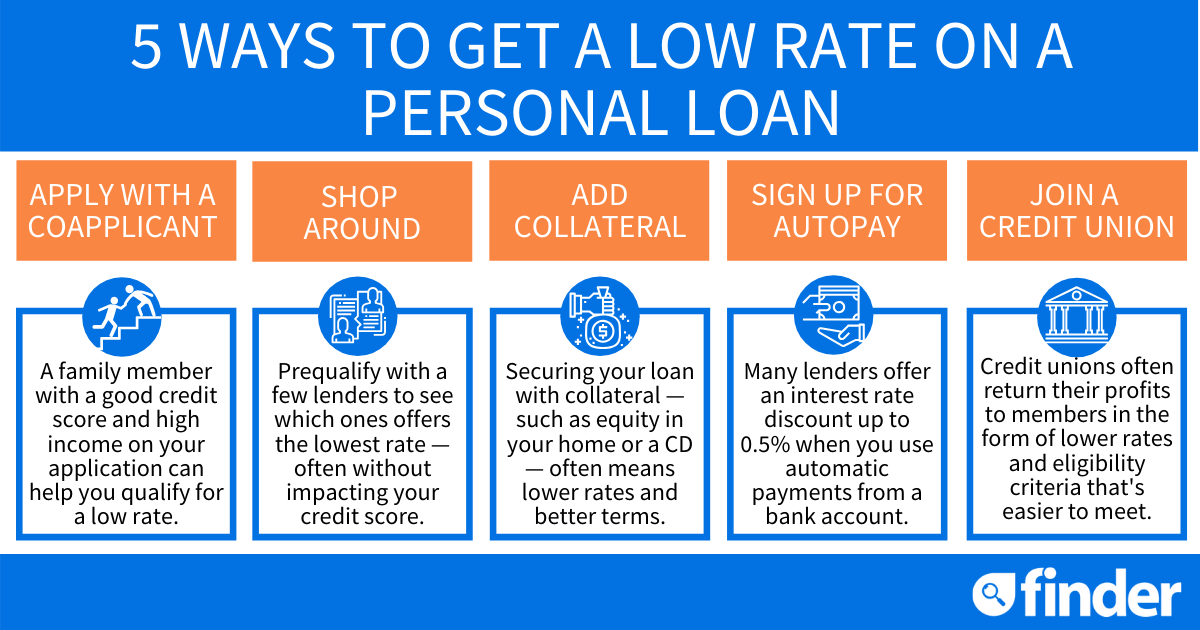

Tips for Securing the Lowest Possible Interest Rate

Several proactive steps can significantly improve your chances of securing the lowest interest rate:

Improve Your Credit Score:

Improving your credit score is the most effective way to qualify for better loan rates. Focus on paying your bills on time, keeping your credit utilization low (the amount of credit you use relative to your total available credit), and avoiding opening too many new accounts in a short period.

Negotiate with Lenders:

Don't be afraid to negotiate. Once you have several loan offers, you can use them to leverage a better rate from other lenders. Explain your situation and inquire about potential discounts or promotions.

Consider a Secured Loan:

A secured loan uses an asset (like a car or savings account) as collateral. This reduces the lender's risk and can lead to lower interest rates. However, it also involves the risk of losing the asset if you default on the loan. Weigh the pros and cons carefully.

- Practical Tips:

- Pay down existing debts to lower your DTI.

- Ask lenders about potential discounts or promotions.

- Explore co-signing options if your credit is weak.

Avoiding Personal Loan Scams and Protecting Yourself

Unfortunately, loan scams exist. Protecting yourself is vital.

Identifying Legitimate Lenders:

Be wary of lenders promising unrealistically low rates or pressuring you into quick decisions. Verify the lender's license and registration with your state's financial regulatory authority. Check online reviews and look for signs of legitimacy.

Understanding Loan Terms and Fees:

Thoroughly review all loan documents before signing. Understand the APR, interest rate, fees, and repayment schedule. Don't hesitate to ask questions if anything is unclear.

Secure Online Applications:

Use secure websites with "https" in the address bar when applying for a loan online. Never share sensitive information via email or unsecured websites.

- Safety Measures:

- Beware of lenders promising unrealistically low rates.

- Verify the lender's license and registration.

- Never share sensitive information via email or unsecured websites.

Conclusion

Finding the best personal loan rates today requires careful research and planning. By understanding the factors that influence interest rates, comparing offers from multiple lenders, and taking steps to improve your creditworthiness, you can significantly increase your chances of securing the most favorable financing terms. Don't delay – start your search for the best personal loan rates today and secure the funds you need for your financial goals. Remember to always compare offers and read the fine print carefully before committing to a loan.

Featured Posts

-

South Korean Presidential Election A Deep Dive Into The Contenders

May 28, 2025

South Korean Presidential Election A Deep Dive Into The Contenders

May 28, 2025 -

Europes Auto Industry Faces Headwinds Amidst Economic Slowdown

May 28, 2025

Europes Auto Industry Faces Headwinds Amidst Economic Slowdown

May 28, 2025 -

Cuaca Jawa Barat 7 Mei Peringatan Hujan Sepanjang Hari

May 28, 2025

Cuaca Jawa Barat 7 Mei Peringatan Hujan Sepanjang Hari

May 28, 2025 -

No Credit Check Loans Direct Lender Understanding Guaranteed Approval

May 28, 2025

No Credit Check Loans Direct Lender Understanding Guaranteed Approval

May 28, 2025 -

Hailee Steinfeld Addresses Engagement Rumors And Future With Josh Allen

May 28, 2025

Hailee Steinfeld Addresses Engagement Rumors And Future With Josh Allen

May 28, 2025

Latest Posts

-

Aurelien Veron Et Laurent Jacobelli Sur Europe 1 Week End

May 30, 2025

Aurelien Veron Et Laurent Jacobelli Sur Europe 1 Week End

May 30, 2025 -

Municipales Metz 2026 Laurent Jacobelli Candidat

May 30, 2025

Municipales Metz 2026 Laurent Jacobelli Candidat

May 30, 2025 -

Attaques Contre Des Prisons En Isere La Visite Ministerielle Critiquee

May 30, 2025

Attaques Contre Des Prisons En Isere La Visite Ministerielle Critiquee

May 30, 2025 -

Negociations Retraites Le Rn Explore Une Collaboration Avec La Gauche

May 30, 2025

Negociations Retraites Le Rn Explore Une Collaboration Avec La Gauche

May 30, 2025 -

Europe 1 Le Week End Avec Aurelien Veron Et Laurent Jacobelli

May 30, 2025

Europe 1 Le Week End Avec Aurelien Veron Et Laurent Jacobelli

May 30, 2025