Best Tribal Loans For Bad Credit: Direct Lenders & Guaranteed Approval

Table of Contents

Understanding Tribal Loans and Their Advantages

Tribal loans are offered by lending institutions connected to Native American tribes. These loans operate under tribal sovereignty, which means they are governed by tribal laws rather than state or federal regulations in certain aspects. This unique legal framework is often cited as a reason for potentially faster processing times and a willingness to lend to individuals with bad credit. However, it's crucial to remember that tribal loan companies, like any other lender, are businesses operating to make a profit.

- Legal Framework: The legal landscape surrounding tribal lending is complex and constantly evolving. Some aspects are governed by federal law while others fall under tribal jurisdiction, creating a grey area that requires careful navigation.

- Comparison to Payday Loans: Tribal loans are sometimes compared to payday loans, but they differ in key aspects such as loan amounts, repayment terms, and regulatory oversight. Unlike payday loans, tribal loans may offer longer repayment periods, potentially making them a more manageable option.

- Advantages & Disadvantages: Potential advantages include quicker approval processes and access to credit for those with poor credit histories. However, disadvantages may include higher interest rates than traditional loans and complex legal considerations. Be aware that loan terms can vary dramatically between lenders.

- Interest Rates: It's critical to understand that interest rates on tribal loans can be significantly higher than those offered by banks or credit unions. Always compare interest rates and fees before committing to a loan.

Finding Reputable Direct Tribal Lenders

Navigating the world of tribal lending requires vigilance. Avoiding predatory practices and hidden fees is paramount, and this starts with choosing the right lender. It is strongly recommended to deal directly with the lender rather than using third-party brokers. Finding a reputable direct tribal lender requires thorough research and careful consideration.

- Verifying Legitimacy: Check if the lender is properly licensed and registered within their tribal jurisdiction. Look for transparent information about their contact details, physical address, and licensing.

- Reading Loan Agreements: Always read the loan agreement meticulously before signing. Understand all fees, interest rates, repayment terms, and any potential penalties for late payments.

- Checking Reviews and Complaints: Utilize online resources such as the Better Business Bureau and consumer protection websites to check for reviews, complaints, and any history of predatory lending practices.

- Avoiding Scams: Beware of lenders who promise "guaranteed approval" without proper due diligence or who demand upfront fees for loan processing. These are often red flags signaling a scam.

The Reality of "Guaranteed Approval" for Tribal Loans

The term "guaranteed approval" is often used by lenders to attract borrowers with poor credit, but it's rarely accurate. No legitimate lender can guarantee approval for a loan. Approval depends entirely on your individual circumstances and whether you meet the lender's specific criteria.

- Factors Influencing Loan Approval: Your credit score, income, debt-to-income ratio, employment history, and overall financial stability all influence your chances of loan approval.

- Application Process: The application process usually involves submitting personal information, financial documents, and undergoing a credit check.

- Responsible Borrowing: Even if you are approved for a loan, it is crucial to borrow responsibly. Only borrow what you can realistically repay, and create a repayment plan that fits within your budget.

- Pre-Approval vs. Final Approval: Pre-approval is not a guarantee of final approval. While pre-approval indicates that you meet some basic requirements, final approval hinges on a more comprehensive review of your financial situation.

Alternatives to Tribal Loans for Bad Credit

If you are struggling with bad credit, exploring alternative solutions is essential. Tribal loans might not be the best choice for everyone.

- Credit Repair: Working on repairing your credit score over time can significantly improve your chances of qualifying for more favorable loan terms from traditional lenders.

- Credit Counseling: A credit counselor can help you create a budget, manage your debt effectively, and develop strategies for improving your financial situation.

- Personal Loans: Banks and credit unions offer personal loans, although these often require a better credit score than tribal loans. Explore your options and consider improving your credit score before applying.

Conclusion

Securing a loan with bad credit can be challenging, and tribal loans represent one option to consider. However, it is crucial to understand the complexities involved. Finding reputable direct tribal lenders is essential to avoid hidden fees and predatory lending practices. Remember that the phrase "guaranteed approval" is often misleading. Responsible borrowing is key, and always weigh the interest rates and terms carefully. Before committing to a tribal loan or any other loan, explore all available options and ensure you can comfortably manage the repayment schedule. Find the best tribal loan for your needs by thoroughly researching lenders and comparing their offers, but always prioritize responsible borrowing practices. Remember, carefully consider the financial implications before taking out any loan.

Featured Posts

-

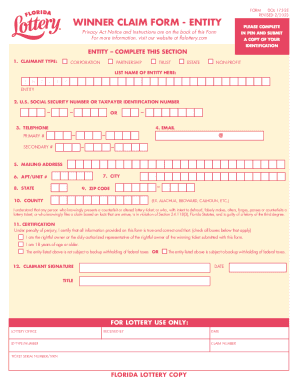

Dont Miss Out Claim Your 300 000 Euro Millions National Lottery Prize

May 28, 2025

Dont Miss Out Claim Your 300 000 Euro Millions National Lottery Prize

May 28, 2025 -

Bianca Censoris Bra And Thong Roller Skating Style

May 28, 2025

Bianca Censoris Bra And Thong Roller Skating Style

May 28, 2025 -

Jadwal Penerbangan Saudia Bali Jeddah

May 28, 2025

Jadwal Penerbangan Saudia Bali Jeddah

May 28, 2025 -

Your Guide To Wrexhams History And Heritage

May 28, 2025

Your Guide To Wrexhams History And Heritage

May 28, 2025 -

Tyrese Haliburtons Availability Pacers Game Vs Bulls

May 28, 2025

Tyrese Haliburtons Availability Pacers Game Vs Bulls

May 28, 2025

Latest Posts

-

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025 -

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025 -

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025