Betting On Uber's Driverless Future: ETFs That Could Pay Off

Table of Contents

Understanding the Potential of Autonomous Vehicles and Their Impact on Uber

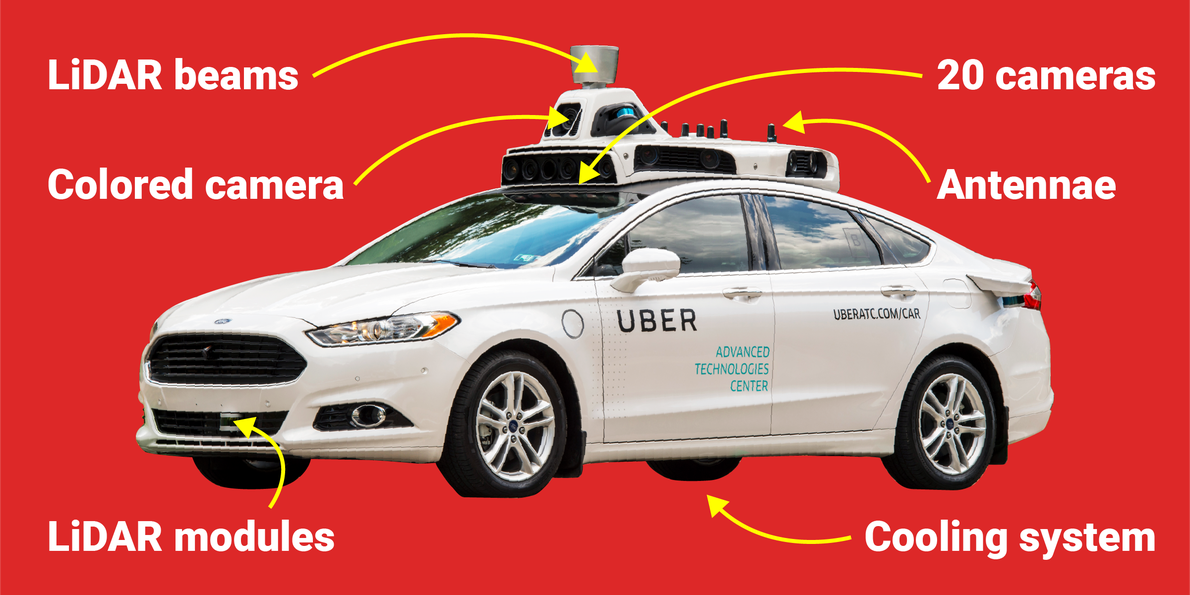

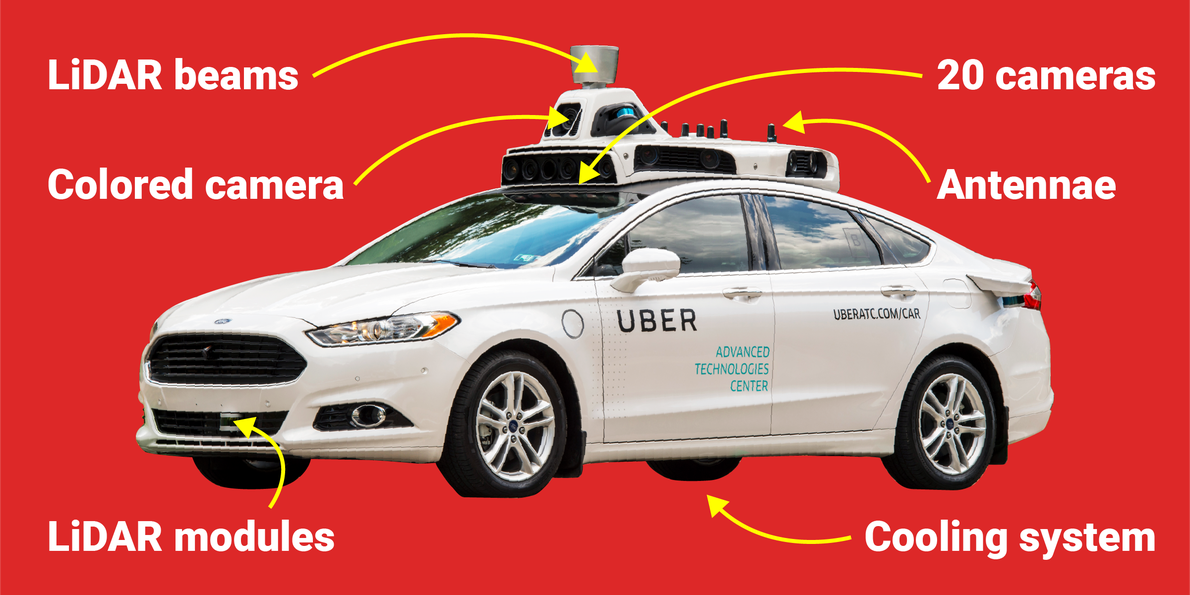

Uber's foray into autonomous vehicles represents a significant bet on the future of transportation. The company's investment in and plans for self-driving technology aim to fundamentally reshape its ride-hailing business and potentially disrupt other sectors. The potential market disruption is enormous, promising significant growth opportunities for companies involved in developing and implementing this technology. However, challenges remain. Regulatory hurdles, safety concerns, and public acceptance are all crucial factors that could influence the sector's growth trajectory.

- Uber's history with autonomous vehicle development: Uber has invested heavily in developing its self-driving technology, including acquisitions and extensive research and development. Past attempts, though encountering setbacks, have shaped the company's current approach.

- Projected market size for autonomous vehicles: Market research firms predict a massive market for autonomous vehicles in the coming decades, with projections reaching trillions of dollars. This substantial growth potential is a key driver for investment in this sector.

- Key regulatory hurdles for autonomous vehicles: Government regulations regarding safety standards, liability, and testing protocols are still evolving. Navigating these regulatory landscapes presents a significant challenge for companies developing autonomous vehicles.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Several ETFs offer exposure to companies involved in the autonomous vehicle revolution, allowing investors to participate in the growth potential without needing to pick individual stocks. These ETFs employ various investment strategies, focusing on specific sectors or employing thematic approaches. (Note: Specific ETF examples and ticker symbols would be included here after thorough research, ensuring accuracy and relevance. Examples could include ETFs focused on technology, robotics, or transportation. Expense ratios and performance history would be compared).

- Examples of ETF ticker symbols and their focus: [Insert researched ETF examples and their ticker symbols here, e.g., "Tech ETF 1 (TICKER1) focuses on semiconductor companies crucial for autonomous vehicle sensors."].

- Explanation of the underlying holdings of each ETF: [Detailed descriptions of the holdings of each ETF, highlighting companies involved in AI, sensor technology, mapping, and other relevant areas.]

- Comparison of expense ratios and performance history: [A comparison table highlighting the expense ratios and past performance of the selected ETFs].

Analyzing the Risks and Rewards of Investing in Autonomous Vehicle ETFs

Investing in emerging technologies, like autonomous vehicles, carries inherent risks. Regulatory uncertainty, technological setbacks, and intense competition all present potential downsides. For example, unexpected delays in regulatory approvals or technological breakthroughs by competitors could impact the profitability of companies in this space. However, the potential rewards are substantial. If the autonomous vehicle sector experiences the predicted growth, these ETFs could deliver significant returns.

- Potential risks associated with investing in this sector: Include regulatory hurdles, technological challenges (software glitches, unforeseen safety issues), cybersecurity vulnerabilities, and competition.

- Strategies to mitigate investment risk: Diversification is key. Including autonomous vehicle ETFs as a small part of a broader, well-diversified portfolio helps reduce overall investment risk.

- Potential returns on investment in this sector: The potential for substantial returns is a significant driver of investment in this sector, but it's crucial to remember that these returns are not guaranteed.

Due Diligence and Investment Strategies for Autonomous Vehicle ETFs

Before investing in any ETF, thorough research is essential. Understanding the ETF's investment strategy, its underlying holdings, and its expense ratio is crucial. Consulting with a qualified financial advisor is highly recommended, especially for investors who are new to ETFs or unfamiliar with the complexities of the autonomous vehicle sector. Consider your personal risk tolerance and investment timeline when making decisions.

- Steps to take before investing in ETFs: Research the ETF's prospectus, understand its holdings, assess its expense ratio, and review its past performance.

- Importance of understanding your risk tolerance: Autonomous vehicle technology is still in its relatively early stages; thus, the investment carries greater risk than more established sectors.

- Long-term vs. short-term investment strategies: Investing in autonomous vehicle ETFs is generally considered a long-term strategy, as the sector's growth is expected to unfold over many years.

Ride the Wave of Innovation: Investing in Uber's Driverless Future with ETFs

The potential of autonomous vehicles is undeniable, and ETFs provide a convenient way to participate in this transformative technology. While significant rewards are possible, careful research and risk management are essential. By understanding the opportunities and challenges associated with investing in autonomous vehicle ETFs, you can make informed decisions about incorporating these investments into your portfolio. Explore ETFs focused on autonomous vehicles, research the options discussed above, and consider them as part of a diversified investment strategy for the future of transportation. Remember to consult with a financial advisor before making any investment decisions. Bet on the driverless revolution and invest in the future of transportation today!

Featured Posts

-

Prosvjednici U Berlinu Upad U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025

Prosvjednici U Berlinu Upad U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025 -

How Missed Student Loan Payments Affect Your Credit

May 17, 2025

How Missed Student Loan Payments Affect Your Credit

May 17, 2025 -

Pistons Game 4 Loss A Costly Foul Call And Its Aftermath

May 17, 2025

Pistons Game 4 Loss A Costly Foul Call And Its Aftermath

May 17, 2025 -

Wnba Strike Threat Angel Reese And Di Jonai Carrington Sound The Alarm

May 17, 2025

Wnba Strike Threat Angel Reese And Di Jonai Carrington Sound The Alarm

May 17, 2025 -

Talleres Vs Alianza Lima Resultado Final 2 0 Goles Y Analisis Del Encuentro

May 17, 2025

Talleres Vs Alianza Lima Resultado Final 2 0 Goles Y Analisis Del Encuentro

May 17, 2025