BigBear.ai (BBAI): Analyzing The Impact Of The Recent Analyst Downgrade

Table of Contents

H2: Reasons Behind the Analyst Downgrade of BBAI Stock

Several factors contributed to the negative assessment of BBAI stock by analysts. These concerns, while potentially impacting short-term performance, don't necessarily negate BBAI's long-term potential in the rapidly expanding AI and government contracting sectors.

-

Concerns about Revenue Growth: Some analysts expressed concerns about BBAI's ability to sustain its revenue growth trajectory. This is partly due to the competitive nature of the AI market and the cyclical nature of government contracts. [Insert link to analyst report if available].

-

Intense Competition: The AI and big data analytics industry is incredibly competitive. BBAI faces stiff competition from established tech giants and emerging startups. This competitive pressure can impact BBAI's ability to secure lucrative contracts and maintain profit margins. [Insert link to relevant market research if available].

-

Contract Wins and Pipeline: The success of BBAI significantly depends on winning government contracts. Any perceived slowdown in securing new contracts or a weaker-than-expected contract pipeline could negatively influence investor sentiment and lead to a stock price decline. [Insert link to news article regarding contract wins/losses if available].

-

Profitability Challenges: BBAI, like many growth-oriented companies, may be facing challenges in achieving profitability. High operating costs, including research and development, could be impacting the company's bottom line. [Insert link to BBAI financial statements if available].

-

Debt Levels: High levels of debt can pose a significant risk to a company's financial health and stability. Analysts might have flagged concerns about BBAI's debt-to-equity ratio or its ability to manage its debt obligations. [Insert link to relevant financial analysis if available].

H2: Market Reaction to the BBAI Downgrade

The immediate market reaction to the BBAI downgrade was swift and negative. BBAI's stock price experienced a significant drop following the announcement, reflecting a decrease in investor confidence. [Insert chart showing BBAI stock price movement around the time of the downgrade]. Trading volume also spiked, indicating increased activity as investors reacted to the news.

Investor sentiment, as observed on social media platforms and financial news websites, reflected a mix of concern and uncertainty. Some investors chose to sell their holdings, contributing to the price decline, while others adopted a wait-and-see approach. The broader market conditions, including overall economic uncertainty, also likely influenced the intensity of the reaction. [Insert link to news articles or social media sentiment analysis if available].

H2: Assessing BigBear.ai's (BBAI) Long-Term Prospects

Despite the recent challenges, BigBear.ai possesses several strengths that could contribute to its long-term success. Its strategic focus on AI and big data analytics positions it well within a rapidly growing market.

-

Growth Potential: The continued growth in government spending on technology and the expanding use of AI in various sectors present substantial growth opportunities for BBAI.

-

Competitive Advantages: BBAI's specialized expertise in government contracting and its ability to leverage its AI capabilities to address complex national security challenges give it a distinct competitive advantage.

-

Financial Health: While profitability remains a challenge, a detailed analysis of BBAI’s financial statements will reveal the overall financial health and its potential to overcome current hurdles. [Insert link to BBAI financial statements if available]

-

Future Catalysts: Successful contract bids, significant technological advancements, and the formation of strategic partnerships could all act as positive catalysts, potentially boosting BBAI's future performance.

H2: Investment Implications for BBAI

The investment implications of the BBAI downgrade depend heavily on an investor's risk tolerance and investment horizon.

-

Investment Strategies: Conservative investors might consider selling their BBAI holdings, while more aggressive investors could view the price drop as a buying opportunity. A “hold” strategy might be suitable for those with a long-term perspective and belief in BBAI’s long-term potential.

-

Entry and Exit Points: Determining optimal entry and exit points requires careful analysis of technical indicators, such as moving averages and relative strength index (RSI). [Insert relevant technical indicators and charts if available].

-

Risk Assessment: Investing in BBAI, or any stock, carries inherent risks. The company's performance is subject to various factors, including economic conditions, competition, and government regulations.

-

Alternative Investments: Investors could explore other companies in the AI or government contracting sectors as alternative investment options.

H3: Conclusion: BigBear.ai (BBAI) Downgrade: A Comprehensive Analysis and Next Steps

The analyst downgrade of BigBear.ai (BBAI) stems from concerns about revenue growth, competition, contract wins, profitability, and debt levels. While the immediate market reaction was negative, BBAI’s long-term prospects remain promising, given its position in a rapidly expanding market and its specialized expertise. The investment strategy should depend on the investor's risk tolerance and timeframe. Remember to conduct thorough due diligence and consider consulting a financial advisor before making any BBAI stock investment decisions. Stay informed about BigBear.ai (BBAI) developments and make informed investment decisions related to BBAI stock.

Featured Posts

-

Premier League Forward Transfer Manchester United And Newcastle In Contention

May 20, 2025

Premier League Forward Transfer Manchester United And Newcastle In Contention

May 20, 2025 -

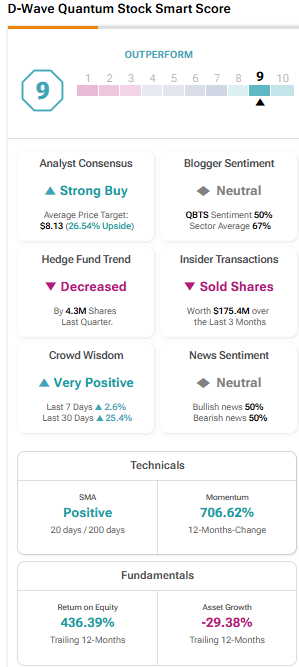

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

Leclercs Clear Message Analysis Of The Ferrari Hamilton Post Race Drama

May 20, 2025

Leclercs Clear Message Analysis Of The Ferrari Hamilton Post Race Drama

May 20, 2025 -

Jennifer Lawrence Ponovno Majka Docekala Drugo Dijete

May 20, 2025

Jennifer Lawrence Ponovno Majka Docekala Drugo Dijete

May 20, 2025 -

Nj Transit Avoids Further Disruption With Union Deal

May 20, 2025

Nj Transit Avoids Further Disruption With Union Deal

May 20, 2025

Latest Posts

-

The Goldbergs A Nostalgic Journey Through The 80s

May 21, 2025

The Goldbergs A Nostalgic Journey Through The 80s

May 21, 2025 -

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 21, 2025

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 21, 2025 -

The Goldbergs A Comparison To Other Family Sitcoms

May 21, 2025

The Goldbergs A Comparison To Other Family Sitcoms

May 21, 2025 -

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025 -

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025