BigBear.ai (BBAI) Stock: A 2025 Market Analysis Of Its Sharp Decline

Table of Contents

Understanding BigBear.ai's Business Model and Market Position

BigBear.ai offers AI-powered solutions across various sectors, primarily focusing on defense, intelligence, and commercial applications. Their services leverage advanced data analytics, artificial intelligence, and cybersecurity expertise to provide clients with critical insights and solutions.

Core Offerings and Target Markets

BigBear.ai's core offerings include:

-

Artificial intelligence (AI) driven data analytics: Processing vast datasets to extract actionable intelligence.

-

Cybersecurity solutions: Protecting sensitive information and infrastructure from cyber threats.

-

Advanced analytics for defense and intelligence: Supporting national security missions with cutting-edge technology.

-

Commercial solutions for various industries: Applying AI capabilities to optimize processes and improve decision-making.

-

Key Clients and Partnerships: BigBear.ai has established relationships with several government agencies and commercial entities, though specific details are often confidential due to the nature of their work. Strong partnerships are crucial for future growth.

-

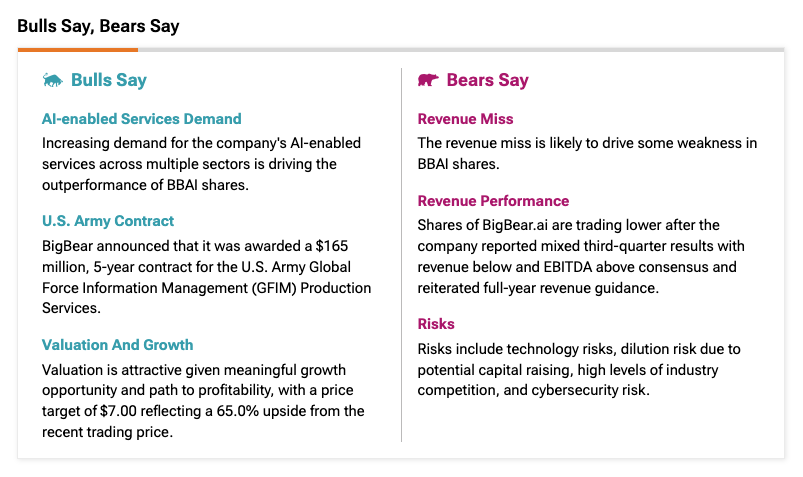

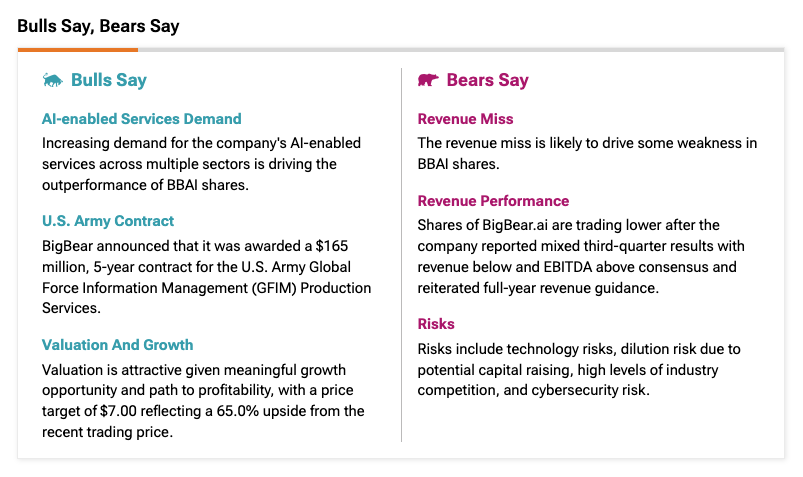

Competitive Advantages and Disadvantages: BigBear.ai possesses advanced AI capabilities and a strong team of experts. However, competition within the AI sector is fierce, with larger companies possessing greater resources. Maintaining a competitive edge will be vital for sustained success.

-

Market Share: Precise market share data for BigBear.ai within the broader AI industry is limited publicly. However, their focus on niche markets offers a potential competitive advantage.

Financial Performance and Key Metrics

Analyzing BBAI's recent financial reports reveals fluctuating revenue growth, and profitability remains a challenge. Understanding key metrics is crucial for assessing investment potential.

- Key Financial Figures: (Note: This section requires accessing and reporting on current financial data from publicly available sources like SEC filings. Specific numbers would be inserted here). Include revenue, net income/loss, debt-to-equity ratio, and EPS.

- Significant Changes and Trends: Highlight any significant increases or decreases in revenue, profitability, or debt levels. Explain the underlying causes of these changes.

- Comparison Against Competitors: Compare BBAI's performance against key competitors in the AI sector, focusing on relevant metrics like revenue growth and market capitalization.

Factors Contributing to BBAI Stock's Decline

BBAI's stock price decline is attributable to a confluence of macroeconomic factors and company-specific challenges.

Macroeconomic Factors

The broader economic climate has significantly impacted BBAI's stock performance.

- Correlation with Macroeconomic Indicators: Explain how factors like inflation, rising interest rates, and recessionary fears negatively correlate with tech stock valuations, including BBAI.

- Investor Sentiment: Negative investor sentiment towards the tech sector and concerns about future growth have contributed to the stock price decline.

- Geopolitical Events: Geopolitical instability can impact investor confidence and create market volatility, affecting BBAI's stock price.

Company-Specific Challenges

Internal factors also contributed to BBAI’s stock decline.

- Negative News and Announcements: Report on any negative news, such as missed earnings targets, contract losses, or management changes, that negatively impacted investor confidence.

- Company Response to Challenges: Analyze how BBAI has responded to these challenges and whether their strategies are effective in addressing the issues.

- Potential Internal Weaknesses: Identify potential areas for improvement, such as operational efficiency or strategic focus, that could hinder future growth.

Potential Future Trajectories for BBAI Stock in 2025

Despite the challenges, BBAI possesses the potential for future growth. However, significant risks remain.

Growth Opportunities and Catalysts

Positive developments could propel BBAI's stock price.

- New Contracts and Market Expansion: Discuss potential opportunities for securing new government contracts or expanding into new commercial markets.

- Technological Advancements: Highlight how technological advancements in AI and data analytics could enhance BBAI's offerings and drive future growth.

- Effectiveness of Strategic Initiatives: Evaluate the effectiveness of BBAI's strategic initiatives in addressing challenges and positioning the company for future success.

Risks and Challenges Ahead

Significant risks could hinder BBAI’s future performance.

- Competition: Analyze the competitive landscape and identify potential threats from larger, more established AI companies.

- Financial Risks: Evaluate BBAI’s financial stability, including debt levels, cash flow, and potential for future losses.

- Regulatory Risks: Discuss potential regulatory hurdles or changes in government policy that could negatively impact BBAI's operations.

Conclusion

BigBear.ai (BBAI) stock has experienced a significant downturn, driven by a combination of macroeconomic headwinds and company-specific challenges. While risks remain, particularly concerning competition and macroeconomic uncertainty, potential growth opportunities exist within the rapidly expanding AI sector. Thorough due diligence is crucial before investing in BBAI stock. Understanding the factors contributing to its decline, alongside its potential for future growth, will help investors make informed decisions. Further research into BigBear.ai (BBAI) stock and the broader AI market is strongly recommended before any investment decisions are made. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Restaurant Panoramique Biarritz Imanol Harinordoquy And Jean Michel Suhubiette Aux Galeries Lafayette

May 20, 2025

Restaurant Panoramique Biarritz Imanol Harinordoquy And Jean Michel Suhubiette Aux Galeries Lafayette

May 20, 2025 -

Find The Nyt Mini Crossword Answers For March 18 Here

May 20, 2025

Find The Nyt Mini Crossword Answers For March 18 Here

May 20, 2025 -

Jennifer Lawrence Surpreende Magra E Radiante Apos Rumores De Nascimento

May 20, 2025

Jennifer Lawrence Surpreende Magra E Radiante Apos Rumores De Nascimento

May 20, 2025 -

Benjamin Kaellman Maalit Kehitys Ja Huuhkajien Tulevaisuus

May 20, 2025

Benjamin Kaellman Maalit Kehitys Ja Huuhkajien Tulevaisuus

May 20, 2025 -

Yeni Formula 1 Sezonuna Hazir Olun Geri Sayim Ve Oenemli Detaylar

May 20, 2025

Yeni Formula 1 Sezonuna Hazir Olun Geri Sayim Ve Oenemli Detaylar

May 20, 2025

Latest Posts

-

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025 -

Thqyq Albrlman Aleraqy Fy Mkhalfat Dywan Almhasbt 2022 2023

May 20, 2025

Thqyq Albrlman Aleraqy Fy Mkhalfat Dywan Almhasbt 2022 2023

May 20, 2025 -

May 9 2025 The Old North State Report Highlights

May 20, 2025

May 9 2025 The Old North State Report Highlights

May 20, 2025 -

The Trump Bill And Ai Examining The Short And Long Term Impact

May 20, 2025

The Trump Bill And Ai Examining The Short And Long Term Impact

May 20, 2025