BigBear.ai (BBAI) Stock: Buy Rating Holds Steady In Anticipation Of Defense Spending

Table of Contents

The Growing Demand for BigBear.ai's AI Solutions in the Defense Sector

BigBear.ai's success is intrinsically linked to the growing demand for sophisticated AI and data analytics solutions within the defense sector. The company's technology is rapidly becoming indispensable for modern military operations and national security initiatives.

Enhanced National Security Capabilities

BBAI's AI-powered solutions are significantly enhancing national security capabilities across various domains.

- Cybersecurity solutions: Protecting critical infrastructure and sensitive data from cyber threats.

- Predictive modeling for threat assessment: Improving intelligence gathering and proactive threat mitigation.

- Improved intelligence analysis: Processing and interpreting vast amounts of data to identify patterns and insights.

- Optimized resource allocation: Improving efficiency and effectiveness of resource deployment.

For example, BBAI has secured contracts with various government agencies to provide advanced cybersecurity solutions, leveraging its expertise in threat detection and response. Their involvement in these projects underscores their crucial role in safeguarding national security.

Modernization of Military Technology

BigBear.ai is playing a pivotal role in the modernization of military technology through the integration of AI.

- AI-powered weaponry: Contributing to the development of more accurate and efficient weapons systems.

- Autonomous systems development: Developing and deploying AI-driven autonomous vehicles and drones.

- Logistical optimization: Improving supply chain management and resource distribution within military operations.

- Training and simulation improvements: Creating realistic training simulations for enhanced military preparedness.

BBAI's technological edge lies in its ability to seamlessly integrate AI into existing military systems, providing a significant competitive advantage in the defense technology market. Their innovative approach sets them apart from competitors and positions them for continued growth.

Positive Analyst Sentiment and Buy Ratings for BBAI Stock

The consistent positive analyst sentiment and buy ratings for BBAI stock are based on several key factors.

Reasons Behind the Buy Ratings

Several factors underpin the continued optimistic outlook for BBAI stock:

- Strong growth potential: The expanding defense budget creates a significant opportunity for BBAI to secure more government contracts.

- Anticipated increase in government contracts: Increased defense spending directly translates into more opportunities for BBAI's services.

- Successful product launches: BBAI's consistent track record of successful product launches demonstrates its innovation and market viability.

- Innovative technology: The company's cutting-edge AI solutions are highly sought after in the competitive defense technology market.

- Favorable market conditions: The overall positive market sentiment towards AI and defense technology further strengthens the outlook for BBAI.

Many prominent analysts have issued buy ratings for BBAI stock, citing its strong growth prospects and the potential for significant returns. These reports highlight BBAI's potential for substantial revenue growth in the coming years.

Potential Risks and Considerations

While the outlook for BBAI is positive, investors should be aware of potential risks:

- Market volatility: The stock market is inherently volatile, and BBAI stock is not immune to market fluctuations.

- Dependence on government contracts: BBAI's revenue is largely dependent on government contracts, making it susceptible to changes in government spending.

- Competition from larger players: The defense technology sector is highly competitive, with larger players vying for market share.

- Technological challenges: The rapid evolution of technology necessitates continuous innovation to maintain a competitive edge.

- Geopolitical uncertainties: Global political instability can impact government spending and influence the demand for defense technology.

A balanced approach requires acknowledging these potential downsides and incorporating them into your investment strategy.

BBAI Stock Valuation and Investment Strategy

Understanding BBAI's valuation and potential investment strategies is crucial for investors.

Current Market Performance and Future Projections

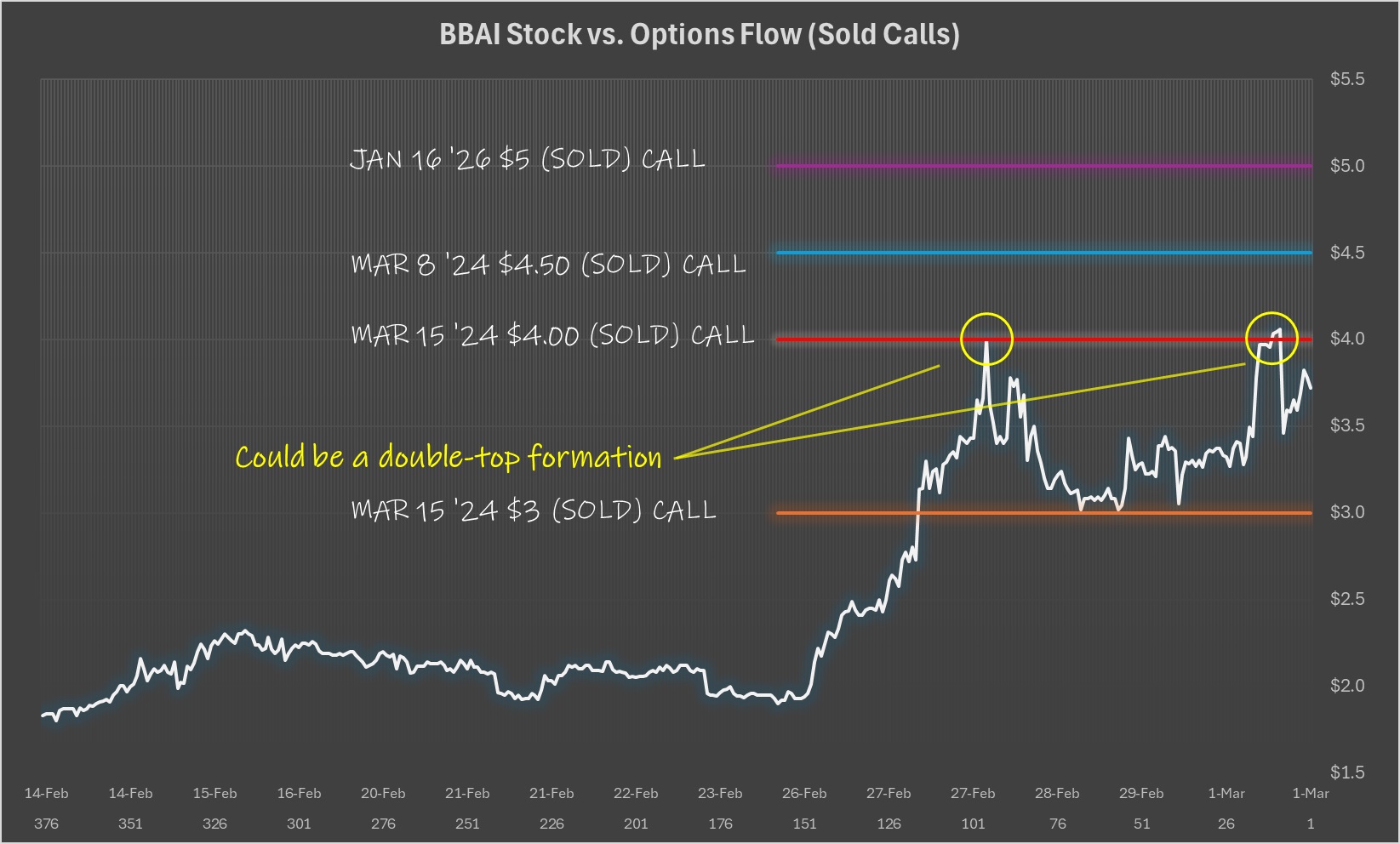

BBAI's current market capitalization reflects its potential for growth within the defense technology sector. Analyzing historical stock price performance alongside current valuation metrics (such as the P/E ratio) provides a clearer picture. Projected revenue growth and expected earnings per share (EPS) offer insights into the company's future financial performance, based on the anticipated increase in defense spending. Visual representations, such as charts and graphs depicting historical performance and future projections, can enhance understanding.

Investment Strategies for BBAI Stock

Several investment strategies can be considered for BBAI stock:

- Buy and hold strategy: A long-term investment approach based on the belief in BBAI's long-term growth potential.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of stock price fluctuations.

- Diversification strategies: Spreading investments across multiple assets to reduce overall portfolio risk.

- Risk management techniques: Implementing strategies to mitigate potential losses, such as stop-loss orders.

Investors should tailor their investment strategies to their individual risk tolerance and financial goals.

Conclusion

BigBear.ai (BBAI) stock presents a potentially lucrative investment opportunity within the rapidly expanding defense technology sector. The consistent "buy" rating, driven by the anticipated increase in defense spending and the company's strong position in AI-driven solutions, offers significant potential for growth. However, potential investors must carefully assess the inherent risks before committing. Thorough research into BBAI stock and a clear understanding of your own risk tolerance are crucial before making any investment decision. Remember to diversify your portfolio and seek professional financial advice. Is BBAI stock the right addition to your investment portfolio? Conduct further research to determine if it aligns with your investment objectives and risk appetite. Keywords: BBAI investment, BBAI stock analysis, BigBear.ai investment strategy, defense stock investment.

Featured Posts

-

Tikkie And Bankrekeningen Een Gids Voor Essentiele Nederlandse Bankzaken

May 21, 2025

Tikkie And Bankrekeningen Een Gids Voor Essentiele Nederlandse Bankzaken

May 21, 2025 -

Do The Hunter Biden Audio Recordings Show Evidence Of Cognitive Decline In Joe Biden

May 21, 2025

Do The Hunter Biden Audio Recordings Show Evidence Of Cognitive Decline In Joe Biden

May 21, 2025 -

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025 -

Self Guided Walking Tour Of Provence A Mountain To Mediterranean Coast Journey

May 21, 2025

Self Guided Walking Tour Of Provence A Mountain To Mediterranean Coast Journey

May 21, 2025 -

Allentown Makes History At Penn Relays First Sub 43 4x100 Relay

May 21, 2025

Allentown Makes History At Penn Relays First Sub 43 4x100 Relay

May 21, 2025

Latest Posts

-

Beenie Mans It Strategy A New York Power Play

May 22, 2025

Beenie Mans It Strategy A New York Power Play

May 22, 2025 -

Vybz Kartel Tour A Dream Realized For Nuphy

May 22, 2025

Vybz Kartel Tour A Dream Realized For Nuphy

May 22, 2025 -

Is Beenie Mans Nyc Move A Sign Of The Times In It

May 22, 2025

Is Beenie Mans Nyc Move A Sign Of The Times In It

May 22, 2025 -

Beenie Man Announces Nyc Domination A New Era In It

May 22, 2025

Beenie Man Announces Nyc Domination A New Era In It

May 22, 2025 -

The Untold Story Vybz Kartel On Prison Family And His Musical Future

May 22, 2025

The Untold Story Vybz Kartel On Prison Family And His Musical Future

May 22, 2025