BigBear.ai (BBAI) Stock: Buy Rating Maintained Amidst Defense Sector Growth

Table of Contents

BigBear.ai's (BBAI) Core Business and Competitive Advantage

AI-Powered Solutions for National Security

BigBear.ai provides cutting-edge AI-powered solutions primarily focused on national security and defense. Their offerings significantly enhance intelligence gathering, analysis, and decision-making capabilities for government agencies and defense contractors.

- Intelligence Analysis: BBAI's AI algorithms sift through vast amounts of data to identify critical patterns and insights, accelerating threat detection and response.

- Cybersecurity: Their AI-driven cybersecurity solutions proactively identify and mitigate cyber threats, protecting critical infrastructure and sensitive data.

- Predictive Modeling: BBAI leverages AI to develop predictive models, forecasting potential security risks and optimizing resource allocation.

BigBear.ai has secured several key contracts and partnerships, demonstrating strong market penetration within the defense sector. These collaborations solidify their position as a trusted provider of advanced AI solutions for national security applications. Their technological edge stems from their proprietary algorithms and deep expertise in AI, providing a competitive advantage in the rapidly evolving defense technology landscape.

Growth Potential within the Expanding Defense Technology Market

The defense technology market is poised for substantial growth in the coming years. Increased government spending on national security, coupled with the increasing adoption of AI and other advanced technologies, are key drivers of this expansion.

- Market Size Projections: Industry analysts predict significant growth in the defense technology market, reaching billions of dollars in the next decade.

- Growth Drivers: Government investments in modernization initiatives, the need for advanced threat detection systems, and the ongoing development of AI-powered defense technologies are all contributing to this expansion.

- BBAI's Potential Market Share: BigBear.ai, with its strong technological capabilities and strategic partnerships, is well-positioned to capture a significant share of this growing market.

This robust growth trajectory, combined with BBAI's innovative solutions, strongly supports the positive outlook for the company's future performance.

Financial Performance and Future Projections

While detailed financial analysis requires reviewing official financial reports, BBAI's recent performance indicators, coupled with analyst projections, offer a positive picture. Revenue growth, while potentially volatile in the short-term, shows a significant upward trend reflecting increasing demand for their services. Profitability, while still developing, points to a positive trajectory as BBAI scales its operations and secures larger contracts. Key financial ratios suggest a healthy balance sheet and positive outlook for long-term growth, further underpinning the "buy" rating. Several analyst firms have published optimistic forecasts for BBAI's future revenue and earnings, corroborating the positive investment sentiment.

Analysis of the "Buy" Rating and Associated Risks

Justification for the Maintained Buy Rating

The maintained "buy" rating for BBAI stock reflects a confluence of positive factors. Analysts cite several key reasons for their optimistic outlook:

- Strong Revenue Growth Projections: Analysts predict significant revenue growth driven by continued demand for BBAI's AI-powered solutions.

- Successful Contract Wins: The company's consistent success in winning new contracts with government agencies and defense contractors signals strong market demand and validates their technological capabilities.

- Favorable Industry Trends: The ongoing growth of the defense technology market, driven by increasing geopolitical uncertainty and the need for advanced defense technologies, provides a strong tailwind for BBAI's growth.

Several prominent investment firms have issued "buy" ratings, further reinforcing the positive sentiment surrounding BBAI stock. The credibility of these firms adds weight to the investment recommendation.

Potential Risks and Challenges

While the outlook is positive, it's crucial to acknowledge potential risks associated with investing in BBAI stock:

- Market Volatility: The stock market is inherently volatile, and BBAI stock price may fluctuate significantly depending on broader market trends and company-specific news.

- Competition: The defense technology sector is competitive, and BBAI faces competition from established players and new entrants.

- Dependence on Government Contracts: A significant portion of BBAI's revenue comes from government contracts. Changes in government priorities or budget cuts could impact their revenue stream.

- Technological Disruptions: Rapid technological advancements could render existing technologies obsolete, necessitating continuous investment in research and development.

A balanced assessment requires considering these potential drawbacks alongside the positive factors.

Investment Strategies for BigBear.ai (BBAI) Stock

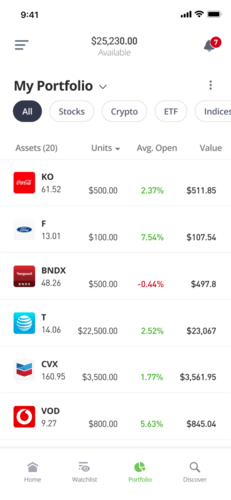

Considering BBAI within a Diversified Portfolio

BBAI should be considered as part of a well-diversified investment portfolio. This helps mitigate risks associated with investing in a single stock.

- Risk Tolerance: Investors should carefully assess their personal risk tolerance before investing in BBAI stock.

- Investment Timeline: The investment timeline should align with the investor's long-term financial goals.

- Asset Allocation: BBAI should be integrated into a diversified portfolio that includes various asset classes to spread risk effectively.

Long-Term vs. Short-Term Investment Horizons

Both long-term and short-term investment horizons can be considered for BBAI stock.

- Long-Term Gains: BBAI's long-term growth potential, fueled by the expanding defense technology market and their leading AI capabilities, suggests the possibility of significant long-term gains.

- Short-Term Returns: Short-term returns can be more volatile, influenced by market sentiment and company-specific news. A disciplined approach is crucial for short-term strategies.

Careful consideration of the investor's financial goals and risk tolerance will guide the optimal investment strategy.

Conclusion: Is BigBear.ai (BBAI) Stock a Wise Investment?

BigBear.ai (BBAI) stock presents a compelling investment opportunity within the rapidly growing defense technology sector. The maintained "buy" rating from several analysts reflects the company's strong growth potential, driven by its innovative AI-powered solutions and increasing demand for advanced defense technologies. However, it is crucial to acknowledge the inherent risks associated with any investment, particularly in a volatile sector like defense technology. Thorough due diligence, including reviewing the company's financial statements, understanding the competitive landscape, and assessing personal risk tolerance, is essential before making any investment decision. Consider adding BigBear.ai (BBAI) stock to your portfolio after conducting thorough research and considering your personal risk tolerance. Learn more about BBAI and other defense sector stocks to make informed investment decisions. Remember, this is not financial advice; always consult with a qualified financial advisor before making investment decisions.

Featured Posts

-

Trumps Tariffs Statehood Remarks Ignite Debate Wayne Gretzkys Canadian Loyalty Questioned

May 20, 2025

Trumps Tariffs Statehood Remarks Ignite Debate Wayne Gretzkys Canadian Loyalty Questioned

May 20, 2025 -

Il Gioco Di Hercule Poirot Ps 5 Offerta Amazon Sotto I 10 E

May 20, 2025

Il Gioco Di Hercule Poirot Ps 5 Offerta Amazon Sotto I 10 E

May 20, 2025 -

Revealed Paulina Gretzkys Most Stunning Photos

May 20, 2025

Revealed Paulina Gretzkys Most Stunning Photos

May 20, 2025 -

Escape From Trumpism The Surge In American Applications For European Passports

May 20, 2025

Escape From Trumpism The Surge In American Applications For European Passports

May 20, 2025 -

Nyt Mini Crossword March 22 Answer Key

May 20, 2025

Nyt Mini Crossword March 22 Answer Key

May 20, 2025

Latest Posts

-

Wasikowska And Waititi Team Up For Family Film

May 20, 2025

Wasikowska And Waititi Team Up For Family Film

May 20, 2025 -

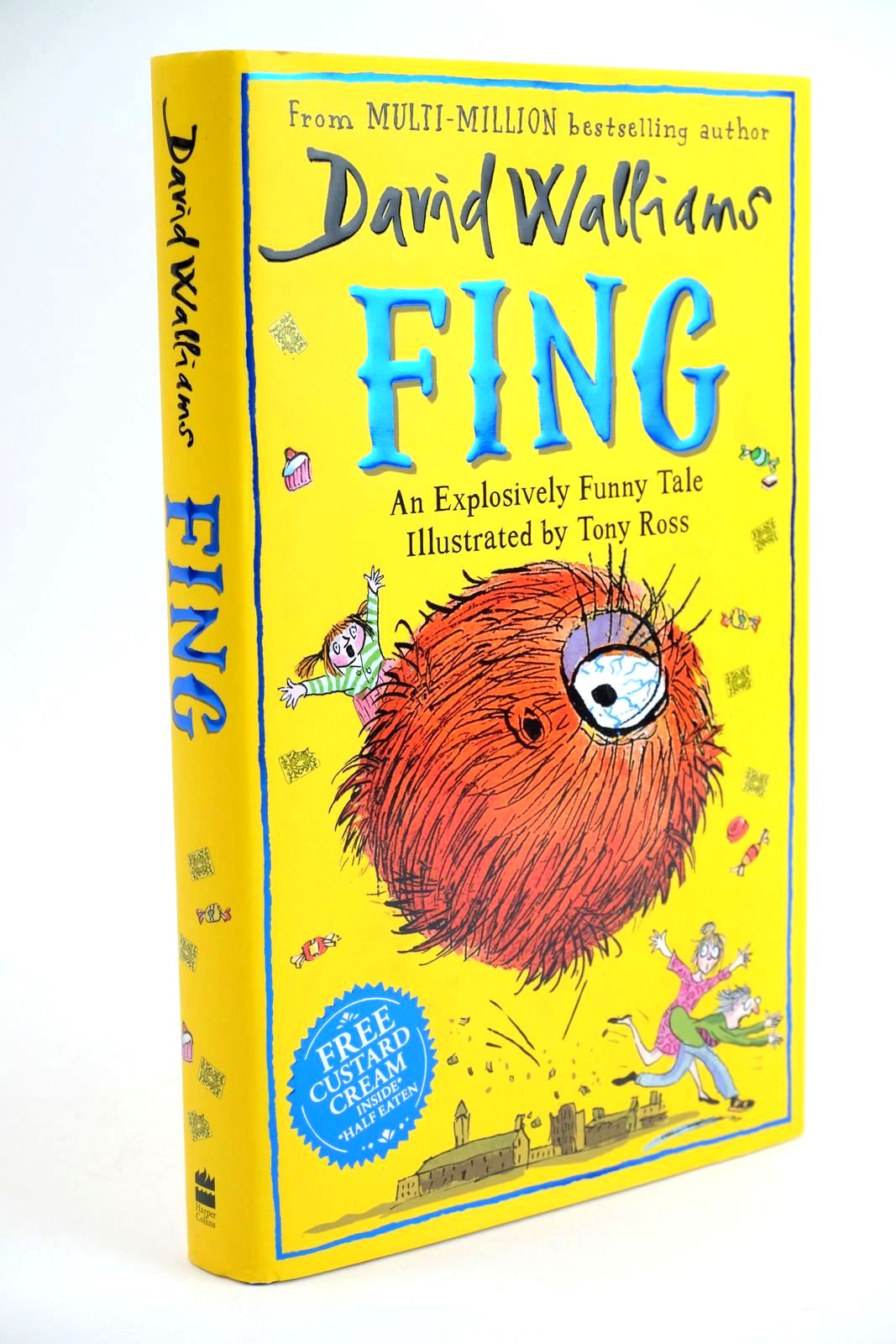

David Walliams And Stan Partner On New Fantasy Film Fing

May 20, 2025

David Walliams And Stan Partner On New Fantasy Film Fing

May 20, 2025 -

New Family Movie Featuring Mia Wasikowska And Taika Waititi

May 20, 2025

New Family Movie Featuring Mia Wasikowska And Taika Waititi

May 20, 2025 -

Fing David Walliams Fantasy Film Gets The Go Ahead From Stan

May 20, 2025

Fing David Walliams Fantasy Film Gets The Go Ahead From Stan

May 20, 2025 -

Stan Approves David Walliams Fing Fantasy Film In Development

May 20, 2025

Stan Approves David Walliams Fing Fantasy Film In Development

May 20, 2025