BigBear.ai Holdings (BBAI): Sharp Decline Following Disappointing Earnings

Table of Contents

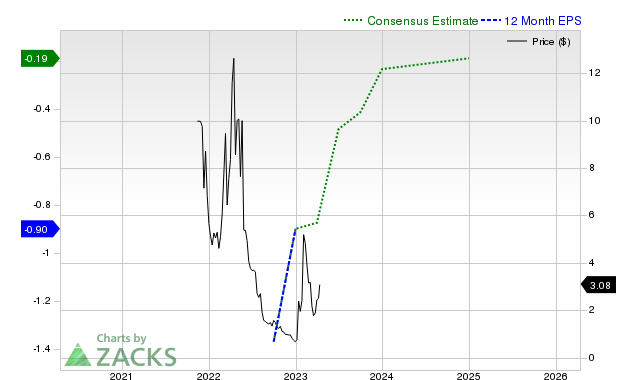

Disappointing Financial Performance: Key Metrics That Drove the Decline

The recent earnings report revealed several key areas of underperformance that fueled the BBAI stock price plunge. The financial results fell short of analysts' expectations across multiple key metrics, significantly impacting investor sentiment.

-

Revenue Miss: BigBear.ai missed its revenue targets, reporting significantly lower-than-anticipated income. This shortfall indicates challenges in securing new contracts and potentially slower-than-expected growth in existing projects. The revenue miss is a crucial factor contributing to the negative market reaction.

-

Earnings Per Share (EPS) Disappointment: The earnings per share (EPS) figure also fell below expectations, further exacerbating the negative sentiment surrounding the BBAI stock. This reflects the company's lower-than-projected profitability.

-

Guidance Downgrade: A critical factor in the decline was the company's downgrade of its future guidance. This suggests that the company anticipates continued challenges in the near term, further dampening investor enthusiasm and contributing to the sell-off. This lack of confidence in future financial performance directly impacted the BBAI stock price.

These disappointing financial results highlight concerns about BigBear.ai's ability to achieve its stated goals, leading to a significant decrease in investor confidence and the subsequent decline in the BBAI stock price. The poor financial performance overshadowed any positive aspects of the report.

Impact of Macroeconomic Factors on BBAI Stock

The decline in BBAI stock isn't solely attributable to the disappointing earnings report. The broader macroeconomic environment also played a significant role. Several factors contributed to this confluence of negative influences on the AI stock market and BBAI specifically:

-

Interest Rate Hikes: Rising interest rates make borrowing more expensive, impacting companies' ability to invest in growth initiatives. This is particularly relevant for technology companies like BigBear.ai, which often rely on capital expenditure for research and development.

-

Inflationary Pressures: High inflation erodes purchasing power, affecting consumer spending and potentially reducing demand for BigBear.ai's services. This broader economic uncertainty adds to the risk perception surrounding BBAI.

-

Negative Market Sentiment: The overall negative market sentiment, fueled by economic uncertainty and recessionary fears, contributed to a sell-off across various sectors, including the technology sector and particularly AI stocks like BBAI. This overall market downturn amplified the impact of the company's disappointing earnings.

The combination of these macroeconomic factors exacerbated the negative impact of BigBear.ai's disappointing earnings report, resulting in a more significant decline in its stock price than might have been seen under more favorable economic conditions.

Analyst Reactions and Future Outlook for BBAI

Following the release of the disappointing earnings report, several financial analysts downgraded their ratings and price targets for BBAI stock. The reactions highlight the concerns surrounding the company's near-term prospects.

-

Rating Adjustments: Many analysts lowered their ratings, reflecting a more pessimistic outlook for BigBear.ai's performance. Some shifted from "buy" to "hold" or even "sell" ratings, contributing to the selling pressure on BBAI.

-

Price Target Changes: Analysts significantly reduced their price targets for BBAI, indicating a lower valuation of the company's future earnings potential. These revisions directly influenced investor perception and contributed to the decline in the BBAI stock price.

Despite the current challenges, some analysts maintain a long-term positive outlook for BigBear.ai, citing the potential for growth in the artificial intelligence sector. However, these positive predictions are largely contingent on BigBear.ai successfully addressing the issues that led to the disappointing earnings report. The future outlook for BBAI remains uncertain and highly dependent on the company’s ability to navigate its current challenges and execute its long-term strategy.

BigBear.ai's Strategic Initiatives and Long-Term Vision

BigBear.ai's long-term vision centers around providing cutting-edge AI solutions and data analytics services across various sectors. While the recent earnings report indicates significant challenges, the company continues to pursue strategic initiatives to drive future growth.

-

AI-Focused Solutions: BigBear.ai is developing sophisticated AI solutions to address the needs of its clients in sectors such as defense, intelligence, and commercial markets. Their investments in R&D reflect a continued commitment to technological innovation.

-

Market Positioning: BigBear.ai aims to establish a strong market position in the rapidly growing AI market. Their long-term growth strategy depends on successfully competing against established players and emerging startups in the technology sector.

Despite the recent setbacks, the company's strategic focus on artificial intelligence and data analytics positions it within a high-growth market. The success of its long-term vision is crucial for a potential recovery in the BBAI stock price. The ability to execute these strategies and overcome current challenges will be key to its future.

Conclusion: Assessing the Future of BigBear.ai Holdings (BBAI) Investment

The sharp decline in BigBear.ai Holdings (BBAI) stock price is primarily attributable to disappointing earnings, coupled with the impact of unfavorable macroeconomic factors. The revenue miss, lower-than-expected EPS, and the guidance downgrade significantly impacted investor confidence. The broader economic uncertainty and negative market sentiment further contributed to the BBAI stock decline.

While the short-term outlook remains uncertain, BigBear.ai's long-term vision within the burgeoning artificial intelligence sector presents potential growth opportunities. However, investors need to carefully consider the challenges the company currently faces and the execution of its strategic initiatives.

Before making any investment decisions related to BigBear.ai Holdings (BBAI) stock, conduct thorough research. Explore further analysis of the BBAI stock price, examine its recent financial performance, and consider the overall market outlook. A careful assessment of these factors is crucial before making any investment in BBAI.

Featured Posts

-

Bevestigd Jennifer Lawrence Is Weer Moeder

May 20, 2025

Bevestigd Jennifer Lawrence Is Weer Moeder

May 20, 2025 -

Salaries De La Gaite Lyrique Quittent Les Lieux Securite Publique En Question

May 20, 2025

Salaries De La Gaite Lyrique Quittent Les Lieux Securite Publique En Question

May 20, 2025 -

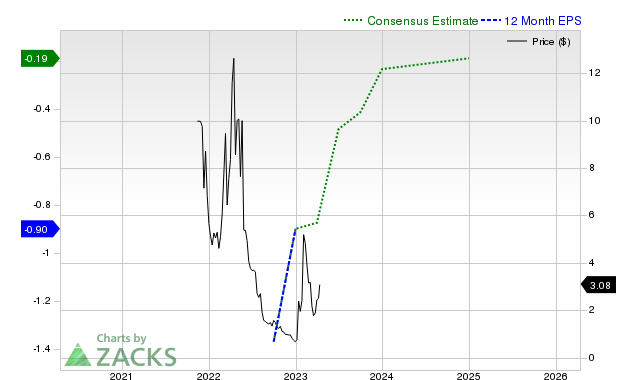

Will Trents Ramon Rodriguez 3 Scorpion Stings During Sleep

May 20, 2025

Will Trents Ramon Rodriguez 3 Scorpion Stings During Sleep

May 20, 2025 -

Understanding Ftv Lives Hell Of A Run A Critical Analysis

May 20, 2025

Understanding Ftv Lives Hell Of A Run A Critical Analysis

May 20, 2025 -

Conviction In Major Navy Corruption Case Former Second In Command Sentenced

May 20, 2025

Conviction In Major Navy Corruption Case Former Second In Command Sentenced

May 20, 2025

Latest Posts

-

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025

Old North State Report May 9 2025 A Comprehensive Overview

May 20, 2025 -

Thqyq Albrlman Aleraqy Fy Mkhalfat Dywan Almhasbt 2022 2023

May 20, 2025

Thqyq Albrlman Aleraqy Fy Mkhalfat Dywan Almhasbt 2022 2023

May 20, 2025 -

May 9 2025 The Old North State Report Highlights

May 20, 2025

May 9 2025 The Old North State Report Highlights

May 20, 2025 -

The Trump Bill And Ai Examining The Short And Long Term Impact

May 20, 2025

The Trump Bill And Ai Examining The Short And Long Term Impact

May 20, 2025