BigBear.ai Holdings (BBAI) Stock Performance In 2025: A Deep Dive

Table of Contents

Analyzing Current Market Trends and their Impact on BBAI

Understanding the broader market context is crucial for predicting BBAI's stock performance. Investor sentiment towards AI and data analytics companies is currently a mixture of optimism and caution.

Market Sentiment towards AI and Data Analytics

The AI and data analytics sector is experiencing explosive growth, fueled by advancements in machine learning and the increasing availability of data. However, several factors temper this enthusiasm:

- Government Regulations: Increasing regulatory scrutiny regarding data privacy (GDPR, CCPA) and AI ethics could impact the growth trajectory of companies like BBAI.

- Competitor Analysis: The AI space is highly competitive, with established tech giants and numerous startups vying for market share. BBAI needs to maintain a competitive edge.

- Market Saturation Potential: Concerns exist about potential market saturation as the AI market matures.

- Technological Advancements: Rapid technological advancements mean companies must continuously innovate to stay relevant; failure to do so could hinder BBAI's growth.

BBAI's Competitive Landscape

BBAI faces competition from both direct and indirect players in the market. Direct competitors may include companies offering similar AI-powered data analytics solutions, while indirect competitors might be firms providing alternative solutions to the same business problems. A thorough competitive analysis comparing market share, pricing strategies, and technological capabilities is essential to assessing BBAI's position.

- Direct Competitors: Identifying and analyzing the strategies of direct competitors is key to understanding BBAI's competitive advantages and disadvantages.

- Indirect Competitors: Companies offering alternative solutions should also be considered.

- Market Share Comparison: Tracking BBAI's market share against competitors provides insights into its growth potential.

- Competitive Advantages of BBAI: Identifying BBAI's unique selling propositions (USPs) is crucial for predicting its future success.

Macroeconomic Factors Affecting BBAI's Stock

Broader economic factors significantly impact BBAI's stock price. Factors such as inflation, interest rates, and recessionary fears all play a role.

- Impact of Inflation: High inflation can increase operational costs for BBAI, impacting profitability and potentially slowing growth.

- Interest Rate Hikes: Increased interest rates can make borrowing more expensive, potentially hindering investment and expansion plans.

- Potential Recession: A recessionary environment could lead to reduced demand for BBAI's services and a negative impact on its stock price.

- Government Spending on Technology: Government investment in AI and data analytics can positively influence the sector, potentially benefiting BBAI.

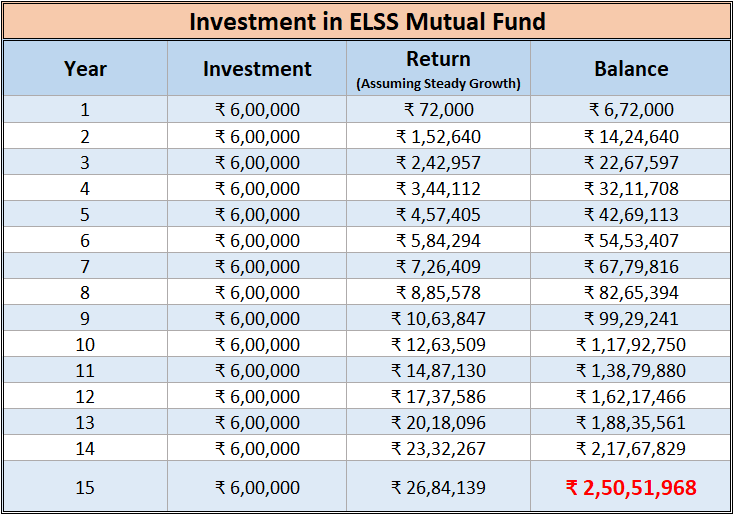

Evaluating BBAI's Financial Performance and Growth Potential

Analyzing BBAI's financial performance and growth potential is crucial for predicting its 2025 stock value.

Revenue Growth and Profitability

Examining BBAI's historical revenue growth, profit margins, and debt levels provides a foundation for projecting future performance. Analyzing key financial ratios like debt-to-equity ratio and return on equity gives crucial insight.

- Revenue Growth Rate: A consistent high revenue growth rate indicates strong market demand and potential for future growth.

- Profit Margins: Healthy profit margins suggest efficient operations and strong pricing power.

- Debt-to-Equity Ratio: A low debt-to-equity ratio indicates financial stability.

- Projected Revenue for 2025: Based on past performance and market projections, an estimate of 2025 revenue can be made.

Key Partnerships and Contracts

Strategic partnerships and large contracts significantly impact BBAI's future performance. Securing new contracts and expanding existing partnerships can significantly boost revenue and market share.

- List of Key Partners and Clients: Identifying key partnerships and clients provides insights into BBAI's market penetration and stability.

- Contract Values: The value of secured contracts provides a measure of BBAI's revenue potential.

- Potential Future Contracts: Analyzing BBAI's pipeline of potential contracts allows for more accurate revenue projections.

Technological Advancements and Innovation

BBAI's ability to innovate and develop new technologies is crucial for maintaining its competitive edge. Investment in research and development (R&D) is a key indicator of future growth potential.

- New Technologies Being Developed: The development of innovative technologies can lead to new revenue streams and market opportunities.

- Patents Held: A strong patent portfolio protects BBAI's intellectual property and provides a competitive advantage.

- R&D Spending: Significant R&D investment signals a commitment to innovation and future growth.

Risk Assessment and Potential Challenges for BBAI in 2025

While BBAI shows promise, several risks could impact its performance.

Geopolitical Risks

Geopolitical instability can affect BBAI's operations and stock price. International conflicts, trade wars, and sanctions can disrupt supply chains and limit market access.

- Specific Geopolitical Risks and their Potential Impact on BBAI: Identifying potential geopolitical risks and their likely impact is crucial for risk mitigation.

Technological Disruption

The rapid pace of technological change means BBAI must adapt to stay competitive. Disruptive technologies could render its current offerings obsolete.

- Potential Disruptive Technologies and Mitigation Strategies: Identifying potential disruptive technologies and developing mitigation strategies is essential for BBAI's long-term survival.

Regulatory Changes

Changes in data privacy regulations and cybersecurity laws can significantly affect BBAI's operations. Compliance costs and potential penalties could impact profitability.

- Potential Regulatory Changes and their Impact: Analyzing potential regulatory changes and assessing their impact is crucial for responsible financial planning.

Conclusion: Investing in BigBear.ai Holdings (BBAI) Stock – A 2025 Outlook

Predicting BBAI's stock performance in 2025 requires considering its position within the broader AI and data analytics market, its financial health, and the inherent risks. While the company shows potential for growth given its focus on a rapidly expanding sector, significant challenges remain, including intense competition and the ever-present risk of technological disruption. A cautiously optimistic outlook seems appropriate, contingent upon successful execution of its strategic plans and navigating the macroeconomic and geopolitical landscape effectively. Remember, this is not financial advice. Conduct thorough due diligence, considering your personal risk tolerance before investing in BBAI stock or any other security. Consult with a qualified financial advisor for personalized guidance. For in-depth analysis, research BigBear.ai Holdings (BBAI) financial statements, industry reports, and expert opinions on 2025 market predictions. Remember, informed investment decisions are crucial for success in the volatile world of BBAI stock and the wider market.

Featured Posts

-

Amazon Faces Union Challenge Following Quebec Warehouse Closure

May 20, 2025

Amazon Faces Union Challenge Following Quebec Warehouse Closure

May 20, 2025 -

The Impact Of A Mangas Disaster Prediction On Japanese Tourism

May 20, 2025

The Impact Of A Mangas Disaster Prediction On Japanese Tourism

May 20, 2025 -

Bucharest Open 2024 Flavio Cobolli Secures Maiden Atp Win

May 20, 2025

Bucharest Open 2024 Flavio Cobolli Secures Maiden Atp Win

May 20, 2025 -

Nyt Mini Crossword Puzzle Answers For April 13th

May 20, 2025

Nyt Mini Crossword Puzzle Answers For April 13th

May 20, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025

Latest Posts

-

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025 -

Legislators Aim To Recover 1 231 Billion From 28 Oil Companies

May 20, 2025

Legislators Aim To Recover 1 231 Billion From 28 Oil Companies

May 20, 2025 -

1 231 Billion Recovery Sought From Oil Firms Representatives Pledge

May 20, 2025

1 231 Billion Recovery Sought From Oil Firms Representatives Pledge

May 20, 2025 -

Work From Home

May 20, 2025

Work From Home

May 20, 2025 -

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025