BigBear.ai Holdings, Inc. (BBAI): A Top AI Penny Stock Pick?

Table of Contents

BigBear.ai's Business Model and AI Capabilities

BigBear.ai (BBAI) provides advanced AI and big data solutions primarily to the government, defense, and commercial sectors. Their core offerings include data analytics, AI-powered decision support systems, and cybersecurity solutions. They leverage cutting-edge AI technologies, including machine learning (ML), natural language processing (NLP), and deep learning, to deliver impactful results for their clients.

- Successful AI Projects: BigBear.ai has been involved in several high-profile projects, including the development of predictive maintenance systems for critical infrastructure and the creation of advanced analytics platforms for intelligence analysis. Specific details about these projects are often confidential due to their nature.

- Strategic Partnerships: Collaborations with technology leaders enhance their capabilities. While specific partners may not be publicly disclosed for competitive reasons, the presence of these partnerships signifies BigBear.ai's commitment to staying at the forefront of AI innovation.

- Competitive Advantages: BigBear.ai's competitive advantages lie in its deep expertise in government and defense contracting, its highly skilled data scientists, and its ability to integrate diverse data sources for comprehensive analysis. This specialization provides a significant barrier to entry for competitors.

Financial Performance and Investment Risks of BBAI

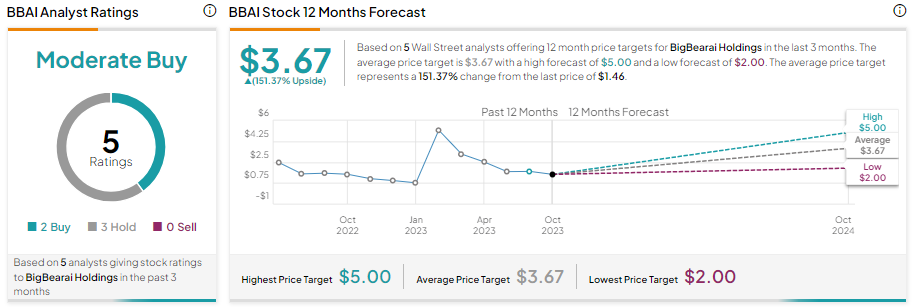

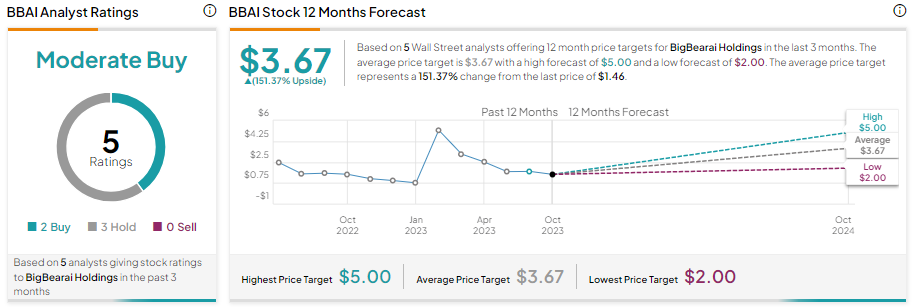

Evaluating BBAI's financial health requires a careful review of its recent performance. While specific financial data will fluctuate and requires independent verification from financial reporting sources, investors should examine key metrics such as revenue growth, earnings per share (EPS), and the debt-to-equity ratio. Analyzing these figures alongside industry benchmarks provides crucial context. Visual aids like charts and graphs illustrating BBAI's financial trends, accessible from reputable financial websites, can greatly improve the clarity of this analysis.

- Key Financial Ratios: Understanding ratios such as the Price-to-Earnings (P/E) ratio and the debt-to-equity ratio is crucial for assessing BBAI's valuation and financial stability. High P/E ratios can suggest growth potential, but also increased risk. High debt can hinder future growth.

- Growth Potential and Future Projections: While the AI market presents significant growth potential, forecasting BBAI's future performance requires careful consideration of various factors including competition, technological advancements, and economic conditions. Any projections should be treated with caution.

- Investment Risks: Investing in BBAI, like any AI penny stock, entails considerable risk. Market volatility, intense competition, regulatory changes within the AI sector, and the inherent uncertainty associated with a growth-stage company all contribute to this risk.

BigBear.ai's Growth Potential and Future Outlook in the AI Market

The global artificial intelligence market is experiencing explosive growth, and BigBear.ai is well-positioned to capitalize on this trend. Its expertise in high-value sectors like government and defense, coupled with its commitment to AI innovation, suggests substantial long-term growth potential.

- Market Size and Growth Projections: Numerous market research reports highlight the significant growth projected for the AI market across various sectors. BigBear.ai's ability to tap into these burgeoning markets is a key driver of its potential.

- Expansion Opportunities: BigBear.ai could expand its product offerings and target new markets to further drive revenue growth. This diversification could mitigate risks associated with reliance on any single sector.

- Technological Advancements: The rapid pace of advancements in AI technologies presents both opportunities and challenges. BigBear.ai's capacity to adapt and integrate cutting-edge technologies will be crucial for its future success.

Comparing BBAI to Other AI Penny Stocks

To gain perspective, comparing BigBear.ai to its competitors within the AI penny stock landscape is essential. A comparative analysis should consider factors such as market capitalization, revenue growth, profitability, and technological differentiation.

- Comparison Table: A table directly comparing key metrics for BBAI and its competitors (where publicly available data permits) would facilitate a clear understanding of relative strengths and weaknesses.

- Competitive Landscape: Analyzing the competitive landscape highlights the intensity of competition within the AI sector. BBAI's ability to establish a strong competitive advantage will be critical for its success.

- Unique Selling Proposition (USP): Identifying BigBear.ai's unique selling proposition – what sets it apart from competitors – is vital in evaluating its investment potential.

Conclusion: Is BigBear.ai (BBAI) a Smart AI Penny Stock Investment?

BigBear.ai (BBAI) presents a compelling case as a potential AI penny stock investment, leveraging expertise in AI and big data within lucrative sectors. However, the inherent volatility and risks associated with penny stocks, especially within the rapidly evolving AI industry, cannot be overlooked. While the company shows promise and the AI market exhibits substantial growth potential, financial performance and competitive pressures remain significant considerations. Its success hinges on its ability to secure and execute new contracts, maintain innovation, and effectively navigate the competitive landscape. Therefore, before considering an investment in BigBear.ai (BBAI), thorough due diligence is crucial. Research BigBear.ai (BBAI) thoroughly, consider your investment strategy carefully, and understand the risks of AI penny stocks before making any investment decisions. Remember, this analysis is not financial advice; conduct your own research before investing in any penny stock, including BigBear.ai (BBAI).

Featured Posts

-

Hamilton Vs Leclerc Analyzing Where The Seven Time Champion Is Falling Short

May 20, 2025

Hamilton Vs Leclerc Analyzing Where The Seven Time Champion Is Falling Short

May 20, 2025 -

Hmrc Payslip Check Find Out If You Re Due A Refund

May 20, 2025

Hmrc Payslip Check Find Out If You Re Due A Refund

May 20, 2025 -

Israel Intercepts Missile Targeting Ben Gurion Airport Russia Cracks Down On Amnesty International Sofrep Evening Brief

May 20, 2025

Israel Intercepts Missile Targeting Ben Gurion Airport Russia Cracks Down On Amnesty International Sofrep Evening Brief

May 20, 2025 -

D Wave Quantum Qbts Explaining The Friday Stock Price Jump

May 20, 2025

D Wave Quantum Qbts Explaining The Friday Stock Price Jump

May 20, 2025 -

Restrictions Pour Deux Roues Et Trois Roues Sur Le Boulevard Fhb Ex Vge Debut Le 15 Avril

May 20, 2025

Restrictions Pour Deux Roues Et Trois Roues Sur Le Boulevard Fhb Ex Vge Debut Le 15 Avril

May 20, 2025

Latest Posts

-

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlathy Jdyd Dmn Qaymt Bwtshytynw

May 21, 2025 -

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Jdyd Tht Qyadt Bwtshytynw

May 21, 2025

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Jdyd Tht Qyadt Bwtshytynw

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025 -

3 1

May 21, 2025

3 1

May 21, 2025