BigBear.ai Holdings, Inc. (BBAI) Stock Crash: 17.87% Plunge Explained

Table of Contents

The recent dramatic 17.87% plunge in BigBear.ai Holdings, Inc. (BBAI) stock sent shockwaves through the market. This significant drop in the BBAI stock price raises crucial questions for investors: What caused this sudden decline? What are the implications for future investment in BBAI? This article delves into the factors contributing to the BBAI stock crash, offering insights into the current market sentiment and potential future scenarios for this artificial intelligence stock.

Analyzing the Immediate Triggers of the BBAI Stock Crash

Lack of Positive Earnings Report

BigBear.ai's recent earnings report significantly missed analysts' expectations, triggering the sharp decline in BBAI stock. The report revealed key financial metrics that disappointed investors, highlighting a considerable downturn compared to previous quarters. This negative performance fueled the BBAI stock crash.

- Missed revenue projections by 15%: The company fell significantly short of its projected revenue, indicating weaker-than-anticipated demand for its AI and data analytics solutions.

- Lower than anticipated contract awards: A reduced number of new contract awards suggests challenges in securing crucial government and commercial partnerships, impacting future revenue streams.

- Increased operating expenses: Rising operational costs further squeezed profit margins, adding to investor concerns about the company's financial health and BBAI stock performance. This is a common concern in the technology sector, especially amongst rapidly growing AI companies.

This combination of negative factors created a perfect storm, leading to a significant sell-off in BBAI stock. The comparison to the previous quarter's performance emphasized the severity of the decline, causing investors to re-evaluate their investment in this technology stock.

Negative Market Sentiment and Broader Tech Stock Sell-Off

The BBAI stock crash didn't occur in isolation. Negative market sentiment and a broader sell-off in technology stocks contributed significantly to the decline. Concerns about rising interest rates, inflation, and a potential recession created a risk-averse environment, pushing investors to divest from higher-risk investments like BBAI.

Many technology stocks, particularly those in the artificial intelligence sector, experienced similar declines during this period. This broader market trend amplified the impact of BigBear.ai's disappointing earnings report, exacerbating the BBAI stock price drop. [Link to relevant news article on broader tech sell-off]

Long-Term Factors Contributing to BBAI Stock Volatility

Competitive Landscape and Market Saturation

BigBear.ai operates in a highly competitive landscape, facing established giants with significant resources and market share. The artificial intelligence and data analytics industry is rapidly evolving, with new players constantly emerging. This intense competition impacts BBAI's ability to secure contracts and maintain profitability, contributing to BBAI stock volatility. The potential for market saturation further adds to the challenges facing the company and puts pressure on its future growth prospects.

Company-Specific Challenges and Risks

Beyond the competitive landscape, BigBear.ai faces several internal challenges that contribute to its stock volatility.

- Dependence on government contracts: A significant portion of BigBear.ai's revenue comes from government contracts. Changes in government policy or budget cuts could severely impact the company's financial stability.

- Integration challenges following acquisitions: Previous acquisitions may have resulted in integration difficulties, hindering efficiency and potentially impacting profitability.

- High debt levels: High debt levels increase the company's financial risk and vulnerability to economic downturns.

These internal challenges, coupled with the external pressures, contribute to the overall volatility observed in the BBAI stock.

Conclusion

The 17.87% plunge in BigBear.ai (BBAI) stock was a multi-faceted event, triggered by a combination of factors. A disappointing earnings report, negative market sentiment affecting the broader technology sector, and long-term concerns regarding the competitive landscape and internal challenges all played a significant role. Understanding these contributing factors is crucial for investors assessing the risk and potential reward associated with BBAI stock.

Call to Action: While the recent BBAI stock crash presents challenges, careful analysis of the company's fundamentals and future outlook is essential for informed investment decisions. Continue researching BBAI, monitor market developments, and stay updated on news affecting the artificial intelligence and data analytics sectors to make strategic decisions about your investment in BigBear.ai stock. Consider diversifying your portfolio to mitigate the risk associated with volatile technology stocks like BBAI.

Featured Posts

-

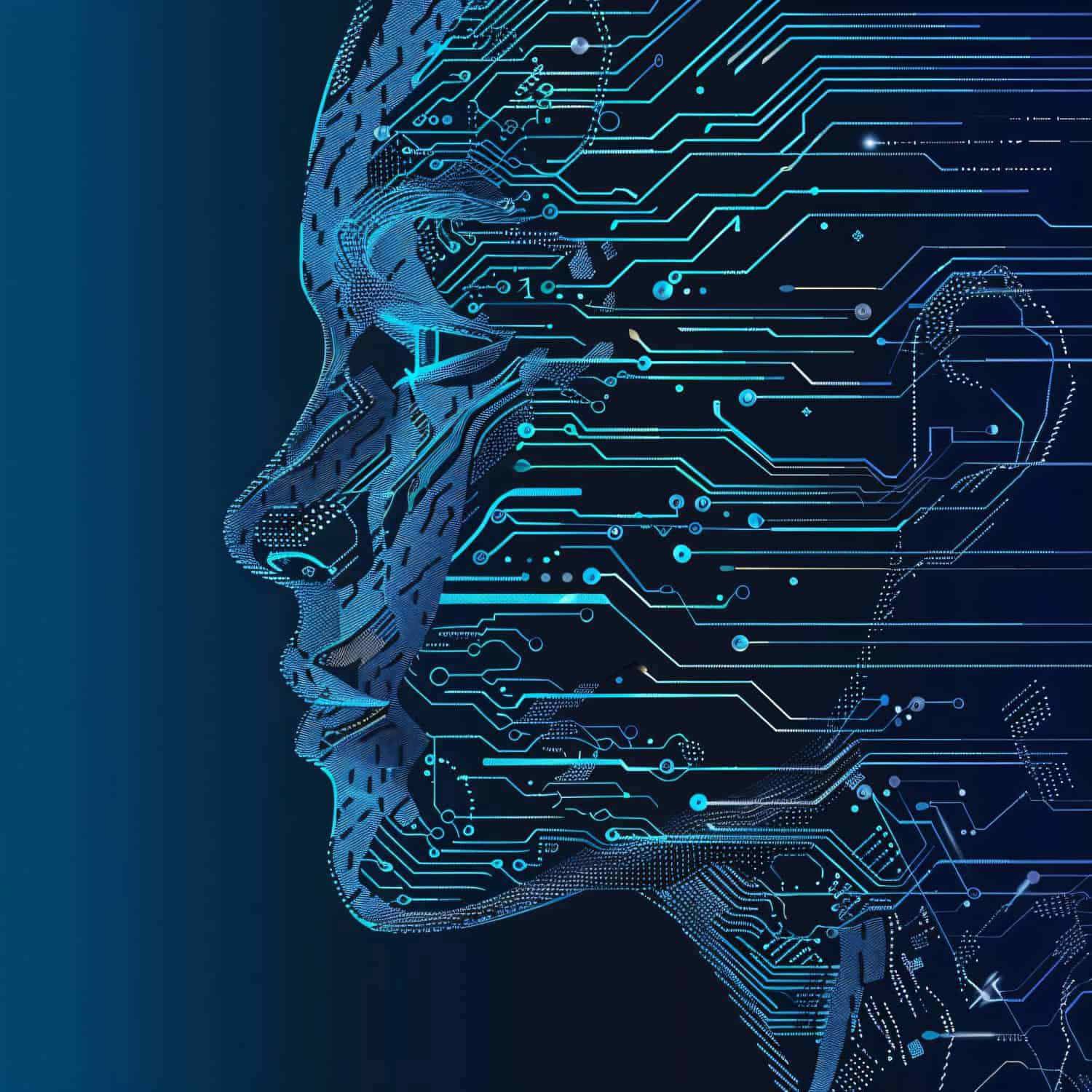

Todays Nyt Mini Crossword Solution March 31

May 20, 2025

Todays Nyt Mini Crossword Solution March 31

May 20, 2025 -

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025 -

Jennifer Lawrence Is Voor De Tweede Keer Moeder Geworden

May 20, 2025

Jennifer Lawrence Is Voor De Tweede Keer Moeder Geworden

May 20, 2025 -

Watch Sandylands U Episode Guide And Where To Stream

May 20, 2025

Watch Sandylands U Episode Guide And Where To Stream

May 20, 2025 -

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025

Latest Posts

-

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Ne Anlama Geliyor

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Ne Anlama Geliyor

May 21, 2025 -

Liverpools Klopp Era From Doubt To Dominance A Comprehensive Review

May 21, 2025

Liverpools Klopp Era From Doubt To Dominance A Comprehensive Review

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025 -

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025 -

Juergen Klopp Un Bir Sonraki Adimi Transfer Soeylentileri Ve Analiz

May 21, 2025

Juergen Klopp Un Bir Sonraki Adimi Transfer Soeylentileri Ve Analiz

May 21, 2025