BigBear.ai Holdings, Inc. Sued: Implications For Investors

Table of Contents

Details of the Lawsuit Against BigBear.ai

The lawsuit against BigBear.ai, the specifics of which are still unfolding, [insert details of the lawsuit here, e.g., alleges securities fraud related to misleading statements about the company's financial performance and the success of its AI-driven projects]. The plaintiff(s) [insert plaintiff(s) name and details] claim that [summarize the key allegations clearly and concisely]. These allegations, if proven true, could have serious repercussions for BigBear.ai.

- Nature of the Lawsuit: [Specify the type of lawsuit: e.g., Securities fraud class-action lawsuit]

- Plaintiff(s): [Name the plaintiff(s) and briefly describe their involvement.]

- Key Allegations: [List the key allegations with bullet points. For example: * Misrepresentation of revenue figures, * Overstated projections for future growth, * Failure to disclose material risks related to specific projects.]

- Potential Impact: The lawsuit could lead to significant financial penalties, reputational damage, and a decline in investor confidence, impacting the company's ability to secure future funding and partnerships.

[Insert links to relevant legal documents or news articles here.] This information is crucial for understanding the nuances of the BigBear.ai lawsuit details and the BBAI legal action.

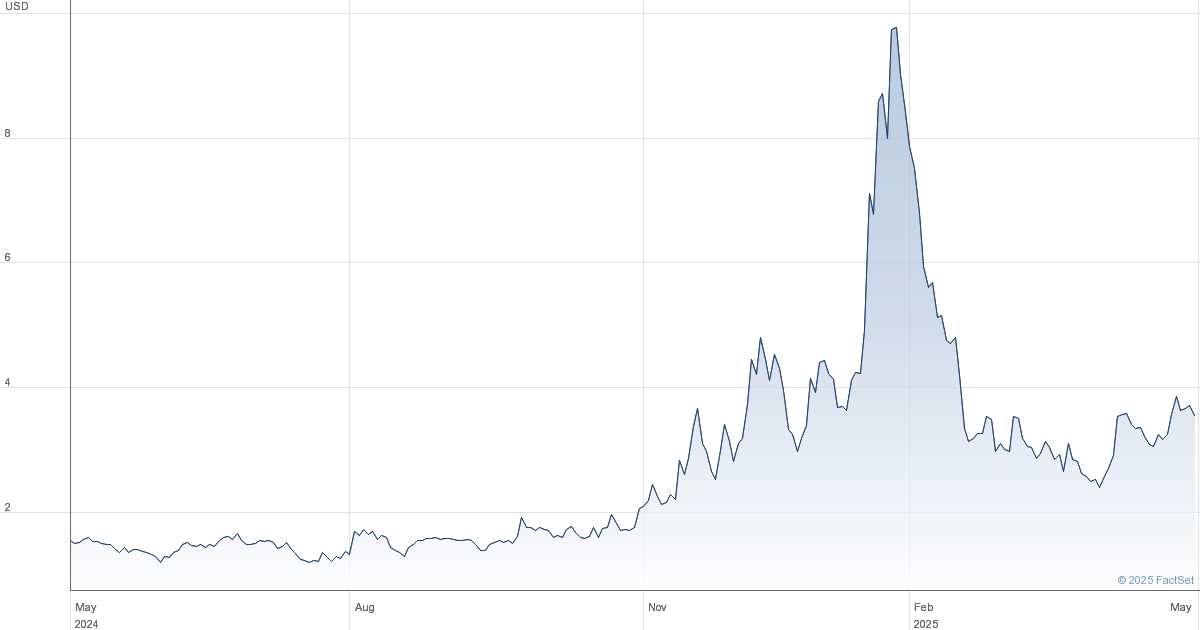

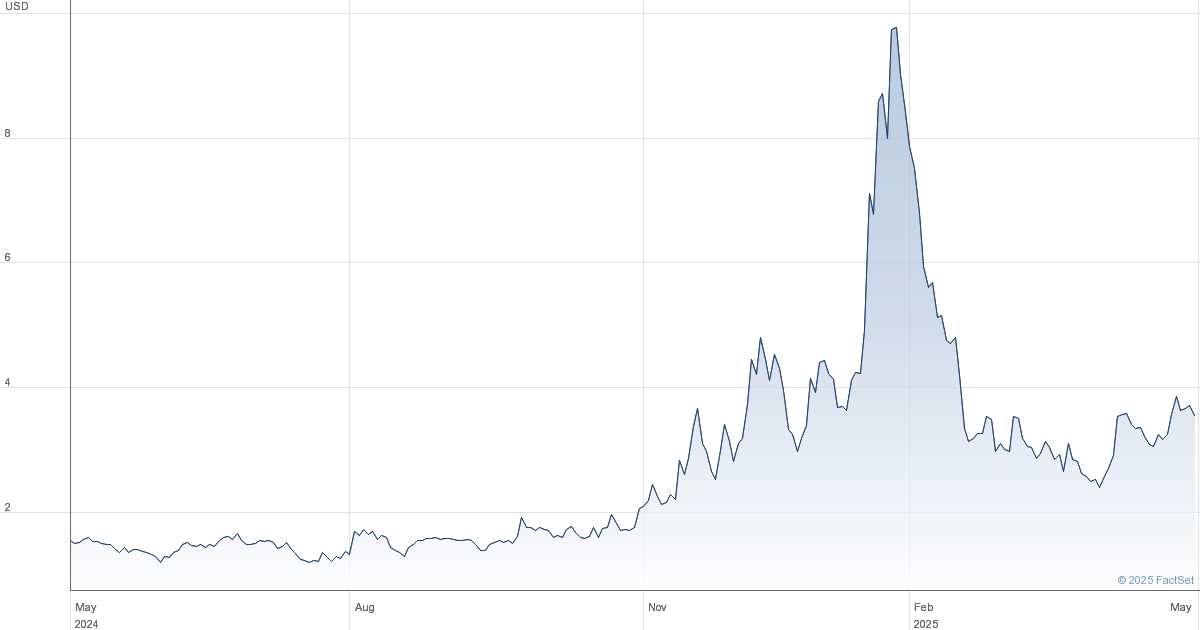

Potential Financial Impact on BigBear.ai and its Stock Price (BBAI)

The BigBear.ai lawsuit carries substantial potential for financial repercussions. The short-term impact could manifest as increased legal fees, a drop in BBAI stock price due to negative publicity, and a potential decrease in investor confidence. In the long term, the outcomes could range from relatively minor financial penalties to substantial fines and even bankruptcy, depending on the court's decision.

- Short-Term Impacts: Expect volatility in the BBAI stock price, reduced trading volume, and potentially a negative impact on revenue projections due to uncertainty.

- Long-Term Impacts: Depending on the outcome, the company might face significant legal settlements or fines, potentially leading to reduced profitability and a decreased market capitalization. A prolonged legal battle could also distract management from core business operations.

- Potential Scenarios:

- Best-Case Scenario: The lawsuit is dismissed, and BigBear.ai experiences minimal financial impact.

- Worst-Case Scenario: The lawsuit is successful, resulting in substantial fines and settlements, impacting the company's financial stability.

- Likely Scenario: A settlement is reached, resulting in a financial penalty and potential reputational damage.

The BBAI stock price will undoubtedly be highly sensitive to developments in this case. Careful monitoring of news and financial reports is crucial for investor confidence.

How Investors Should Respond to the BigBear.ai Lawsuit

The BigBear.ai lawsuit presents a complex situation requiring careful consideration from investors. The first step is to honestly assess your risk tolerance. Are you comfortable with the potential for further losses in your BBAI investment?

-

Options for Investors:

- Hold: Maintain your current position, hoping for a positive resolution to the lawsuit. This strategy is suitable for long-term investors with a higher risk tolerance.

- Sell: Liquidate your BBAI holdings to mitigate potential losses. This is a more conservative approach, suitable for investors seeking to reduce risk.

- Buy More (Cautiously): This is generally not advisable unless you've conducted extensive due diligence and believe the current stock price presents a compelling buying opportunity despite the legal risks.

-

Crucial Steps:

- Consult a Financial Advisor: Seek advice from a qualified professional to develop an investment strategy tailored to your individual circumstances.

- Monitor News and Developments: Stay informed about the lawsuit's progress through reputable news sources and official company statements.

- Conduct Thorough Due Diligence: Before making any decisions, conduct independent research to understand the legal implications and potential financial consequences.

Diversification and Risk Management Strategies

Regardless of your decision regarding BBAI, remember the importance of portfolio diversification. Over-reliance on a single stock, particularly one facing legal challenges, is a risky strategy.

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Risk Management: Establish a well-defined investment strategy that includes risk tolerance assessment, regular portfolio reviews, and emergency funds to withstand market fluctuations.

- Alternative Investments: Consider allocating some of your capital to less volatile investment options to balance your overall risk exposure.

Conclusion: BigBear.ai Lawsuit: Navigating the Uncertainty for Investors

The lawsuit against BigBear.ai presents significant uncertainty for investors. The BigBear.ai lawsuit implications are far-reaching, and the potential impact on the BBAI stock price remains volatile. Informed decision-making is paramount, requiring thorough research and a clear understanding of your risk tolerance. Remember to monitor developments closely and consult with a financial advisor before making any investment decisions regarding BigBear.ai (BBAI) stock. Understanding the potential lawsuit implications for BBAI is crucial for effective risk management. Take proactive steps to protect your investment and conduct further research by accessing reliable resources and seeking professional financial guidance.

Featured Posts

-

Schumacher Vuela De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025

Schumacher Vuela De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025 -

Tyler Bates Wwe Raw Return Reunited With Pete Dunne

May 20, 2025

Tyler Bates Wwe Raw Return Reunited With Pete Dunne

May 20, 2025 -

Sandylands U Tv Listings And Showtimes

May 20, 2025

Sandylands U Tv Listings And Showtimes

May 20, 2025 -

Endgueltige Formgebung Entscheidungen Der Architektin Vor Ort

May 20, 2025

Endgueltige Formgebung Entscheidungen Der Architektin Vor Ort

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon

May 20, 2025

Understanding The Billionaire Boy Phenomenon

May 20, 2025

Latest Posts

-

Klopp To Real Madrid Agent Comments On Ancelotti Replacement

May 21, 2025

Klopp To Real Madrid Agent Comments On Ancelotti Replacement

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025 -

From Anfield To Hout Bay Klopps Impact On A South African Football Club

May 21, 2025

From Anfield To Hout Bay Klopps Impact On A South African Football Club

May 21, 2025 -

Duenya Futbolunda Yeni Bir Doenem Klopp Geri Doenueyor

May 21, 2025

Duenya Futbolunda Yeni Bir Doenem Klopp Geri Doenueyor

May 21, 2025 -

Klopp Real Madrid In Teknik Direktoerue Olabilir Mi

May 21, 2025

Klopp Real Madrid In Teknik Direktoerue Olabilir Mi

May 21, 2025