BigBear.ai Stock Performance And Buy Recommendations

Table of Contents

BigBear.ai Stock Performance Analysis

Historical Stock Price Trends

Analyzing BigBear.ai's (BBAI) stock price reveals a volatile yet potentially rewarding trajectory. While specific historical data requires up-to-date charting tools (easily found online through financial sites like Yahoo Finance or Google Finance), a visual representation of the BigBear.ai stock price over the past year, five years, and year-to-date would clearly illustrate key trends. This would show periods of significant growth alongside periods of correction. Looking at the BBAI stock chart, investors can identify major events – such as contract wins or market downturns – that have influenced the BigBear.ai stock history.

- Year-to-date performance: [Insert data and analysis here. Include a chart.]

- One-year performance: [Insert data and analysis here. Include a chart.]

- Five-year performance (if available): [Insert data and analysis here. Include a chart.]

Key price movements should be highlighted and explained in the context of market conditions and company news.

Financial Performance Indicators

Understanding BigBear.ai financials is crucial. We need to examine key metrics such as:

- Revenue growth: Is BigBear.ai demonstrating consistent revenue growth, indicating strong demand for its services? Compare this to competitors' AI company financials.

- Earnings per share (EPS): What is the trend in EPS? Are earnings increasing, showing profitability and investor value?

- Profit margins: What are BigBear.ai's profit margins compared to its competitors? This indicates efficiency and pricing strategies.

- Debt levels: Is the company heavily indebted, potentially hindering future growth? This is vital for assessing BBAI revenue sustainability.

By comparing BigBear.ai earnings and other key metrics to those of its competitors, we can better assess its financial health and future growth prospects.

Analyst Ratings and Price Targets

Consulting leading financial analysts provides valuable insight. Summarize the consensus ratings (Buy, Hold, Sell) and the range of BBAI price targets. Note any recent upgrades or downgrades of the BigBear.ai analyst rating. These BigBear.ai stock forecasts, while not guarantees, offer a valuable perspective on market sentiment and future expectations. Understanding the probabilities associated with each price target is important for risk assessment.

Factors Influencing BigBear.ai Stock

Market Sentiment and Investor Confidence

Analyzing BigBear.ai investor sentiment is vital. Is the market optimistic or pessimistic about BigBear.ai's future? News events, announcements, and overall AI market outlook greatly influence investor confidence. High BBAI short interest might indicate potential short squeezes but also signals uncertainty amongst some investors. Understanding this dynamic is crucial to predicting price volatility.

Competitive Landscape and Industry Trends

BigBear.ai operates in a competitive AI market. A thorough competitive analysis BigBear.ai should highlight:

- Competitive advantages: What makes BigBear.ai unique? Its focus on government contracts, proprietary technology, or strong partnerships can be advantages.

- Competitive disadvantages: What challenges does it face from competitors? Pricing pressure or technological limitations are possible drawbacks.

- AI industry trends: How are broader trends affecting BigBear.ai? Growth in the AI sector is a positive, but specific niches and technological advancements are important to understand.

Company-Specific Developments

Significant BigBear.ai news events impact the stock price. This includes:

- New contracts: Large government or commercial contracts significantly boost revenue and investor confidence.

- Product launches: Introducing new AI solutions demonstrates innovation and growth potential.

- Strategic partnerships: Collaborations with other companies can enhance BigBear.ai’s capabilities and market reach.

Analyzing the impact of these events on BBAI contract wins and overall performance provides a clearer picture. Potential risks and uncertainties facing the company should also be addressed.

BigBear.ai Stock Buy Recommendations

Buy, Hold, or Sell Recommendation

Based on the above analysis, a clear BigBear.ai buy recommendation (or Hold/Sell) can be made. This recommendation needs justification, supported by concrete evidence and risk assessment. Are the potential returns worth the inherent risks?

Potential Entry and Exit Strategies

- Entry points: Identify potential entry points based on technical analysis or price targets, considering risk tolerance.

- Exit points: Define exit strategies, including stop-loss orders to limit potential losses. This is crucial BigBear.ai trading strategy.

- Risk Management: Always diversify investments and never invest more than you can afford to lose.

The importance of BigBear.ai investment strategy that incorporates risk management cannot be overstated.

Conclusion: Should You Invest in BigBear.ai Stock?

This analysis of BigBear.ai stock performance and the factors influencing its price provides a framework for making an informed investment decision. Remember, the BigBear.ai future is uncertain, and this article doesn't constitute financial advice. While this analysis suggests a [Buy/Hold/Sell] recommendation (depending on your findings), conducting your own thorough research and understanding the risks associated with BigBear.ai stock outlook before investing is paramount. Stay updated on the latest BigBear.ai news to make the best choices for your investment portfolio. Consider the potential of BigBear.ai stock within your broader investment strategy and always prioritize informed decisions.

Featured Posts

-

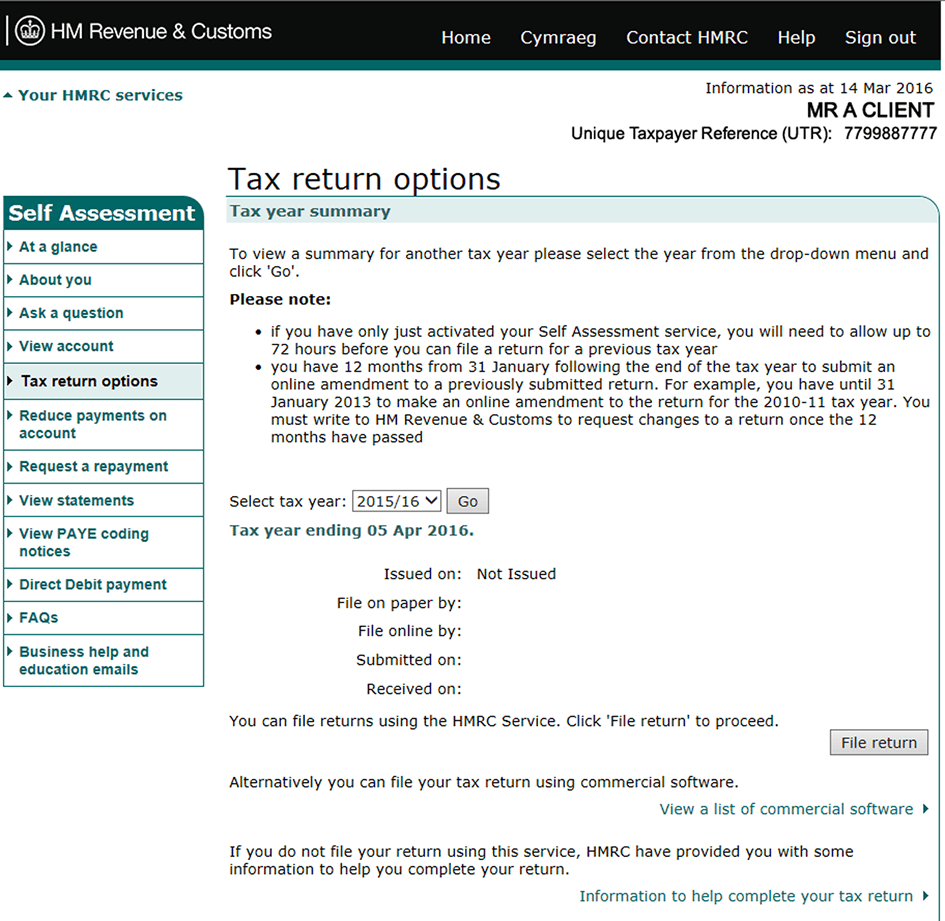

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025 -

Analyzing The Us Missile Launcher Implications For Us China Relations

May 20, 2025

Analyzing The Us Missile Launcher Implications For Us China Relations

May 20, 2025 -

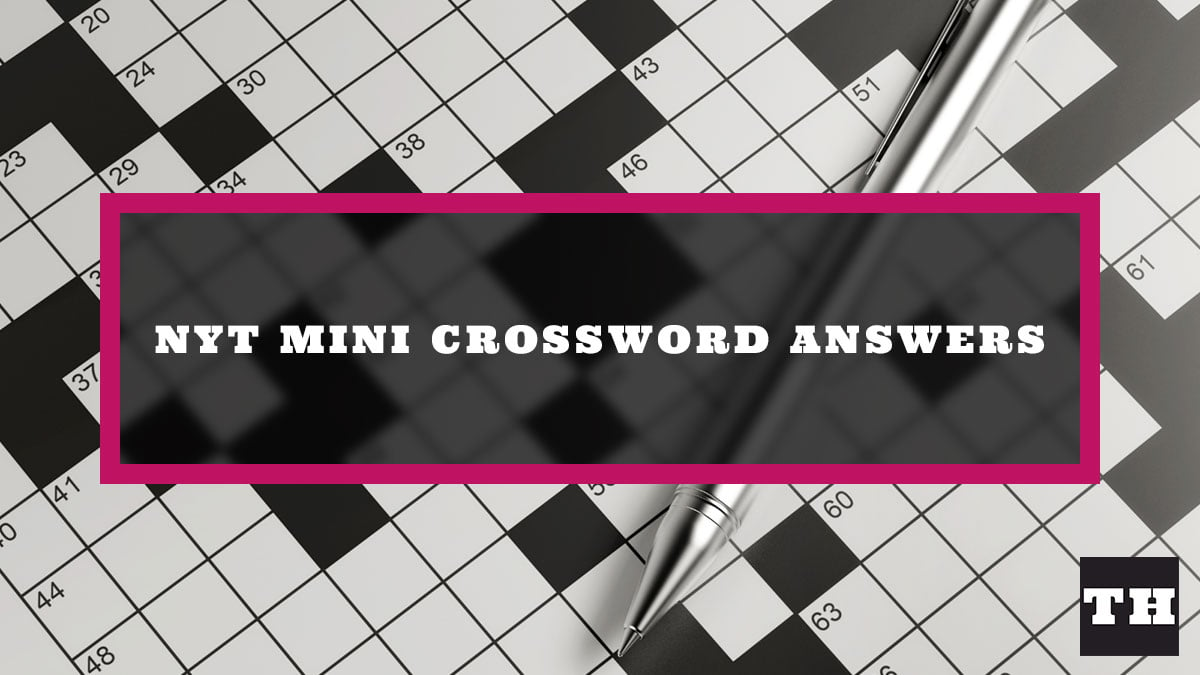

Finding The Answers Nyt Mini Crossword Hints For April 18 2025

May 20, 2025

Finding The Answers Nyt Mini Crossword Hints For April 18 2025

May 20, 2025 -

Oil Companies Face 1 231 Billion Recovery Effort By Representatives

May 20, 2025

Oil Companies Face 1 231 Billion Recovery Effort By Representatives

May 20, 2025 -

Suki Waterhouses Met Gala Evolution A Complete Look

May 20, 2025

Suki Waterhouses Met Gala Evolution A Complete Look

May 20, 2025

Latest Posts

-

Billionaire Boy Inheritance Influence And Impact

May 20, 2025

Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025 -

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon

May 20, 2025

Understanding The Billionaire Boy Phenomenon

May 20, 2025 -

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025