BigBear.ai Stock Performance And Future Outlook

Table of Contents

BigBear.ai Stock Performance Analysis

Analyzing BigBear.ai's stock performance requires examining various aspects of its financial health and market perception.

2.1 Recent Stock Price Movements

The BigBear.ai stock price (BB.AI) has experienced fluctuations, reflecting the inherent risks and rewards associated with investing in a growth-oriented technology company. Tracking the BigBear.ai share price history reveals periods of both significant gains and losses. Recent highs and lows should be carefully considered in conjunction with major news events. For example, a substantial contract win with a government agency might drive the BigBear.ai stock price upward, while missed earnings expectations could trigger a decline. [Insert chart illustrating BigBear.ai stock price movement over the last year, for example]. Analyzing the BigBear.ai stock chart provides valuable context for interpreting short-term price movements.

2.2 Financial Performance Indicators

A thorough evaluation of BigBear.ai's financial performance is vital. Examining key metrics like BigBear.ai revenue growth, profitability (or losses), and debt levels helps ascertain the company's financial stability and growth potential. Comparing these BigBear.ai earnings and revenue figures to industry competitors provides valuable insights into its relative performance. Analyzing BigBear.ai financial statements offers a deeper understanding of its financial health and whether it’s generating sufficient cash flow to sustain operations and fund growth initiatives. Key questions include:

- What is the trajectory of BigBear.ai revenue? Is it consistently increasing, or are there periods of decline?

- Is BigBear.ai profitable? If not, when is profitability expected?

- What are BigBear.ai's debt levels, and how manageable are they?

- How does BigBear.ai's debt-to-equity ratio compare to its competitors?

2.3 Investor Sentiment and Analyst Ratings

Investor sentiment toward BigBear.ai, whether bullish or bearish, significantly influences its stock price. Monitoring BigBear.ai analyst ratings and price targets from reputable financial institutions can provide valuable insights into expert opinions. Discrepancies between investor sentiment and the company's fundamental financial performance warrant careful consideration. For example:

- Are analysts generally positive or negative about BigBear.ai’s future prospects?

- Are there significant differences between the analyst consensus and the current market price?

- How is the investor sentiment reflected in trading volume and price volatility?

Factors Influencing BigBear.ai's Future Outlook

Predicting BigBear.ai's future performance requires considering several factors that could significantly impact its trajectory.

3.1 Market Opportunities and Competition

The AI and data analytics market is experiencing rapid growth, creating significant market opportunities for BigBear.ai. However, the competitive landscape is intense. Understanding BigBear.ai's competitive advantage within this market is key. Analyzing the size of the AI market and the specific niche BigBear.ai occupies allows for a clearer assessment of its potential for expansion. Key government contracts play a significant role in BigBear.ai's revenue stream, and their renewal or acquisition of new contracts impacts future performance. Questions to consider:

- How large is the total addressable market for BigBear.ai's services?

- What are the major competitors in this space, and what are their strengths and weaknesses?

- What is BigBear.ai's competitive advantage, and is it sustainable?

- What is the impact of securing large government contracts on BigBear.ai’s long-term growth?

3.2 Technological Advancements and Innovation

BigBear.ai's investment in research and development (R&D) is crucial for its long-term success. Analyzing BigBear.ai technology, its AI capabilities, and any patents or intellectual property provides a perspective on its innovative capacity. The company's ability to adapt to rapid technological advancements and maintain a competitive edge in AI and data analytics will shape its future. Key areas to investigate include:

- What are BigBear.ai's core technological competencies?

- Is BigBear.ai investing significantly in R&D?

- Does BigBear.ai hold any key patents or intellectual property that provide a competitive advantage?

- How effectively is BigBear.ai adapting to emerging AI trends?

3.3 Macroeconomic Factors and Risks

Macroeconomic factors and geopolitical events can significantly influence BigBear.ai's performance. Analyzing potential regulatory risks, industry-specific challenges, and the impact of economic downturns or supply chain disruptions is crucial. Assessing these BigBear.ai risk factors helps paint a realistic picture of the potential challenges and opportunities. Questions to ask:

- How vulnerable is BigBear.ai to economic downturns?

- What are the key regulatory risks facing BigBear.ai and the AI industry as a whole?

- What is the potential impact of geopolitical instability on BigBear.ai's operations?

- What are the potential challenges related to talent acquisition and retention?

Conclusion: BigBear.ai Stock: A Look Ahead

BigBear.ai stock presents a complex investment proposition. While the company operates within a high-growth market with substantial potential, significant risks and challenges remain. Its future success hinges on several key factors: securing and maintaining significant government contracts, sustaining technological innovation, effectively managing competition, and navigating macroeconomic uncertainties. While this analysis provides insights into BigBear.ai stock, further due diligence is crucial before making any investment decisions. Stay informed about BigBear.ai stock performance and the broader market trends to make educated choices. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to BigBear.ai stock.

Featured Posts

-

Descubre 5 Podcasts Que Te Atraparan Si Te Gusta El Misterio Y El Terror

May 21, 2025

Descubre 5 Podcasts Que Te Atraparan Si Te Gusta El Misterio Y El Terror

May 21, 2025 -

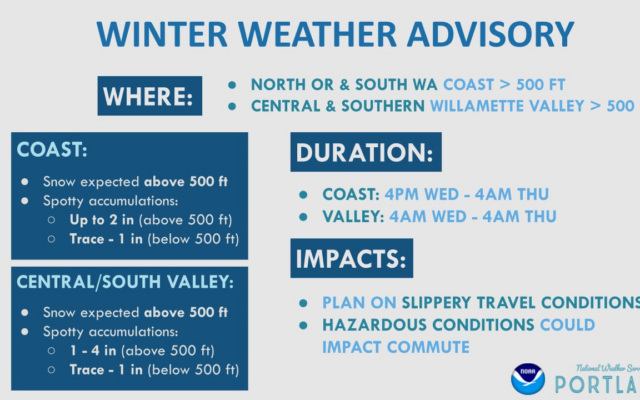

Winter Weather Advisory Impacts On Schools And Transportation

May 21, 2025

Winter Weather Advisory Impacts On Schools And Transportation

May 21, 2025 -

Son Dakika Juergen Klopp Hangi Takima Transfer Olacak

May 21, 2025

Son Dakika Juergen Klopp Hangi Takima Transfer Olacak

May 21, 2025 -

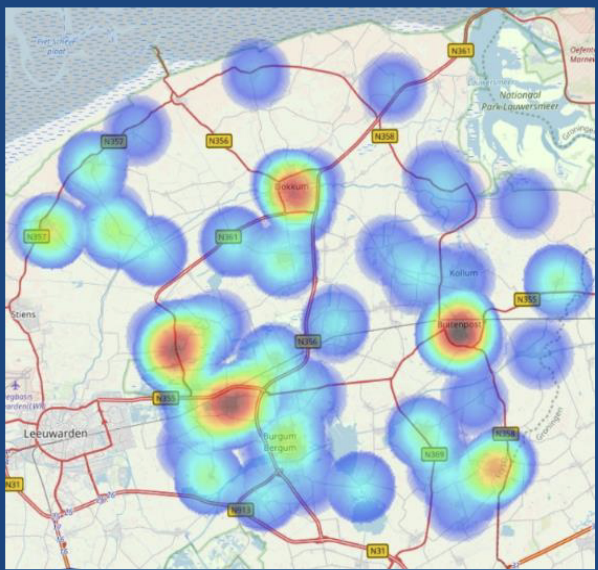

Occasionmarkt Bloeit Abn Amro Ziet Forse Toename In Verkoop

May 21, 2025

Occasionmarkt Bloeit Abn Amro Ziet Forse Toename In Verkoop

May 21, 2025 -

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 21, 2025

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 21, 2025

Latest Posts

-

Cassis Blackcurrant A Deep Dive Into The Flavor Profile

May 22, 2025

Cassis Blackcurrant A Deep Dive Into The Flavor Profile

May 22, 2025 -

Le Festival Le Bouillon A Clisson Une Programmation Engagee

May 22, 2025

Le Festival Le Bouillon A Clisson Une Programmation Engagee

May 22, 2025 -

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025 -

Le Bouillon De Clisson Un Festival Engage

May 22, 2025

Le Bouillon De Clisson Un Festival Engage

May 22, 2025 -

Exploration De L Architecture Toscane De La Petite Italie De L Ouest

May 22, 2025

Exploration De L Architecture Toscane De La Petite Italie De L Ouest

May 22, 2025