BigBear.ai's Q1 Financial Report: A Detailed Analysis Of The Stock Decline

Table of Contents

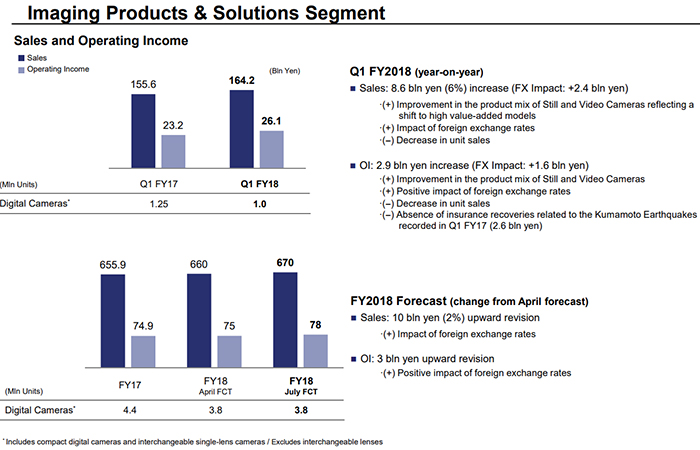

Revenue and Earnings Miss

BigBear.ai's Q1 earnings fell short of analyst expectations, resulting in a substantial revenue shortfall and a decline in earnings per share (EPS). The reported figures revealed a significant gap between projected and actual performance, raising concerns among investors.

- Revenue: [Insert actual revenue figure] vs. [Expected revenue figure] – a shortfall of [Percentage or dollar amount].

- EPS: [Insert actual EPS figure] vs. [Expected EPS figure] – a decline of [Percentage or dollar amount].

Potential reasons for this miss include:

- Contract Delays: Delays in securing or executing key contracts could have significantly impacted Q1 revenue.

- Increased Competition: Intense competition within the AI and big data analytics market may have put downward pressure on pricing and profitability.

- Operational Inefficiencies: Internal operational challenges could have hampered the company's ability to deliver projects on time and within budget.

Contract Performance and Pipeline

The success of BigBear.ai hinges on its ability to secure and deliver lucrative contracts. A closer look at Q1 contract performance reveals potential contributing factors to the overall financial underperformance.

- New Contract Wins: [Insert number and value of new contracts secured in Q1]. While [mention specific wins if available], the overall number and value may have fallen short of expectations.

- Contract Losses: [Mention any significant contract losses and their impact]. This could indicate challenges in retaining existing clients or facing stronger competition.

- Pipeline Strength: The current contract pipeline needs to be evaluated. A strong pipeline suggests future opportunities, while a weak pipeline indicates potential risks. [Insert analysis of the pipeline strength, including its size and the probability of conversion].

Operational Expenses and Margins

Analyzing BigBear.ai's operational expenses provides crucial insights into its profitability and efficiency. An increase in expenses relative to revenue directly impacts profit margins.

- Key Expense Categories: [List key expense categories like R&D, sales & marketing, and general & administrative expenses, including percentage changes from the previous quarter or year]. Significant increases in any of these areas could explain the lower margins.

- Profit Margins: [Insert actual profit margin figures and compare them to previous quarters/years and industry averages]. A decline in profit margins points towards the need for cost optimization strategies.

- Cost Optimization Strategies: To improve profitability, BigBear.ai might consider streamlining operations, negotiating better contracts with suppliers, or focusing resources on its most profitable products/services.

Market Sentiment and Investor Confidence

The Q1 report's impact on investor sentiment and confidence was immediate and negative. The stock price reacted accordingly, reflecting the market's perception of the company's performance.

- Analyst Downgrades: Following the report, several analysts may have downgraded their ratings for BigBear.ai's stock, further impacting investor confidence. [Cite specific examples if available].

- Stock Price Volatility: [Include a chart illustrating the stock price movement following the Q1 report]. The sharp decline shows the market's immediate reaction to the disappointing results.

- Investor Reaction: The overall market reaction needs to be analyzed by looking at trading volume and investor commentary.

Comparison to Competitors (Optional)

[This section would include a comparison of BigBear.ai's Q1 performance against key competitors like [Competitor A] and [Competitor B]. This analysis should highlight any significant differences in their financial results and market positioning, providing context to BigBear.ai's relative performance].

Conclusion: Understanding the BigBear.ai Q1 Stock Decline and Future Outlook

BigBear.ai's Q1 financial report revealed a significant revenue and earnings miss, driven by contract delays, potential operational inefficiencies, and increased competition. This resulted in decreased profit margins and negatively impacted investor sentiment, leading to a decline in the stock price. While challenges exist, BigBear.ai possesses potential opportunities for future growth. Careful analysis of the contract pipeline, strategic cost optimization, and addressing operational inefficiencies will be crucial for the company's recovery. Staying updated on BigBear.ai's future financial reports and conducting further due diligence on the BigBear.ai stock is crucial for making informed investment decisions. Review BigBear.ai's investor relations page for further details and upcoming reports.

Featured Posts

-

Oh Jun Sung Wins Wtt Star Contender Chennai Match Highlights

May 21, 2025

Oh Jun Sung Wins Wtt Star Contender Chennai Match Highlights

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025 -

Fremantle Reports 5 6 Q1 Revenue Decline Budget Cuts Take Toll

May 21, 2025

Fremantle Reports 5 6 Q1 Revenue Decline Budget Cuts Take Toll

May 21, 2025 -

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025 -

O Giakoymakis Kai To Mls Pithanotites Epistrofis

May 21, 2025

O Giakoymakis Kai To Mls Pithanotites Epistrofis

May 21, 2025

Latest Posts

-

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Acceptance

May 22, 2025

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Acceptance

May 22, 2025 -

Understanding The Success And Longevity Of The Goldbergs

May 22, 2025

Understanding The Success And Longevity Of The Goldbergs

May 22, 2025 -

31 Pay Cut For Bps Chief Executive Officer

May 22, 2025

31 Pay Cut For Bps Chief Executive Officer

May 22, 2025 -

The Goldbergs Characters Relationships And Lasting Impact

May 22, 2025

The Goldbergs Characters Relationships And Lasting Impact

May 22, 2025 -

Significant Drop In Bp Chief Executives Pay Down 31

May 22, 2025

Significant Drop In Bp Chief Executives Pay Down 31

May 22, 2025