Big Wall Street Comeback: Bear Market Bets Upended

Table of Contents

Economic Resilience Fuels the Wall Street Rebound

The strength of the US economy has been a major catalyst in the Big Wall Street Comeback. Contrary to pessimistic predictions, several key economic indicators have pointed towards unexpected resilience.

Stronger-than-Expected Economic Data

- Job Growth: Employment numbers have consistently exceeded expectations, with significant job creation across various sectors. The unemployment rate remains low, indicating a strong labor market.

- GDP Figures: GDP growth, while fluctuating, has shown surprising strength, surpassing many analysts' forecasts for a significant contraction.

- Inflation Data: While inflation remains a concern, recent data suggests a slowing trend, easing fears of runaway price increases and giving investors more confidence. This positive movement has significantly impacted market sentiment. The lessening fear of hyperinflation contributed to the positive investor sentiment observed in the recent market upturn.

These positive economic indicators have instilled confidence among investors, leading to increased market activity and a significant upward trend in stock prices. The better-than-expected economic data significantly boosted investor confidence, fueling this impressive Wall Street comeback.

Consumer Spending Remains Robust

Despite persistent inflation, consumer spending has remained remarkably strong. This unwavering consumer demand has been a crucial element supporting business performance and overall market confidence. Several factors contribute to this resilience:

- Pent-up demand: Following pandemic lockdowns, consumers have been eager to spend, driving sales in various sectors.

- Strong labor market: The robust job market provides consumers with financial security and increased spending power.

- Government stimulus: While tapering off, previous government stimulus measures have had a lingering positive effect on consumer spending.

This robust consumer spending supports the overall health of the economy and provides a strong foundation for corporate earnings, directly contributing to the Big Wall Street Comeback narrative.

Federal Reserve Policy Shifts and Market Reaction

The Federal Reserve's approach to monetary policy has significantly influenced the market's trajectory.

The Pivot from Aggressive Rate Hikes

The Federal Reserve's initial strategy involved aggressive interest rate hikes to combat inflation. However, recent economic data prompted a significant shift. The pivot away from aggressive rate hikes signals a more cautious approach, aiming to avoid triggering a recession.

- Rationale: The Fed's decision reflects a reassessment of the inflation outlook and a concern about the potential negative impact of overly restrictive monetary policy.

- Market Response: The markets largely reacted positively to this shift, viewing it as a sign of stability and reduced risk. The slowing of rate hikes contributed significantly to the positive sentiment fueling the Big Wall Street Comeback.

This policy adjustment has played a major role in calming investor anxieties and contributing to the market's upward trajectory.

Impact on Inflation Expectations

The Federal Reserve's policy changes have directly affected inflation expectations.

- Easing Inflation Concerns: The slower pace of rate hikes has eased concerns about excessively aggressive tightening, leading to a more moderate outlook on future inflation.

- Investor Behavior: Lower inflation expectations have influenced investor behavior, leading to increased willingness to invest in riskier assets. This shift in investor behavior has been a key element in the recent market rally.

- Future Policy Adjustments: The path of future interest rate adjustments remains uncertain, and any future shifts in Federal Reserve policy will continue to be closely scrutinized by investors.

Bear Market Bets and Their Unexpected Losses

The unexpected Big Wall Street Comeback has resulted in significant losses for those who bet on a prolonged bear market.

The Miscalculations of Bearish Investors

Many bearish investors made assumptions that proved incorrect:

- Overestimation of Inflation's Impact: The impact of inflation on consumer spending and economic growth was overestimated.

- Underestimation of Economic Resilience: The underlying strength of the US economy was underestimated.

- Incorrect Timing: The timing of the anticipated economic downturn was misjudged.

These miscalculations led to significant losses for investors who employed strategies designed to profit from a prolonged bear market.

Lessons Learned from the Market Upturn

The recent market upturn offers several crucial lessons for investors:

- Market Uncertainty: The inherent uncertainty in market forecasting is a critical reminder to exercise caution and avoid overly aggressive bets.

- Diversification: Diversifying investment portfolios across different asset classes is a crucial risk-management strategy.

- Long-Term Strategy: Focusing on a long-term investment strategy rather than short-term market speculation is essential for successful investing.

Conclusion: Navigating the Post-Bear Market Landscape

The Big Wall Street Comeback has been fueled by economic resilience, shifts in Federal Reserve policy, and the surprising inaccuracy of many bearish predictions. Investors who bet against the market have experienced significant losses, highlighting the unpredictability of market movements. The lessons learned emphasize the importance of diversification, a long-term investment strategy, and a keen understanding of the complex interplay between economic indicators, central bank policy, and investor sentiment. Understand the dynamics of a Big Wall Street Comeback and adjust your investment strategy accordingly. Learn more about navigating market uncertainty today!

Featured Posts

-

Boris Johnson Y El Incidente Con Un Avestruz En Texas Detalles De La Visita Familiar

May 11, 2025

Boris Johnson Y El Incidente Con Un Avestruz En Texas Detalles De La Visita Familiar

May 11, 2025 -

Jose Aldo Back In Featherweight Challenges And Expectations

May 11, 2025

Jose Aldo Back In Featherweight Challenges And Expectations

May 11, 2025 -

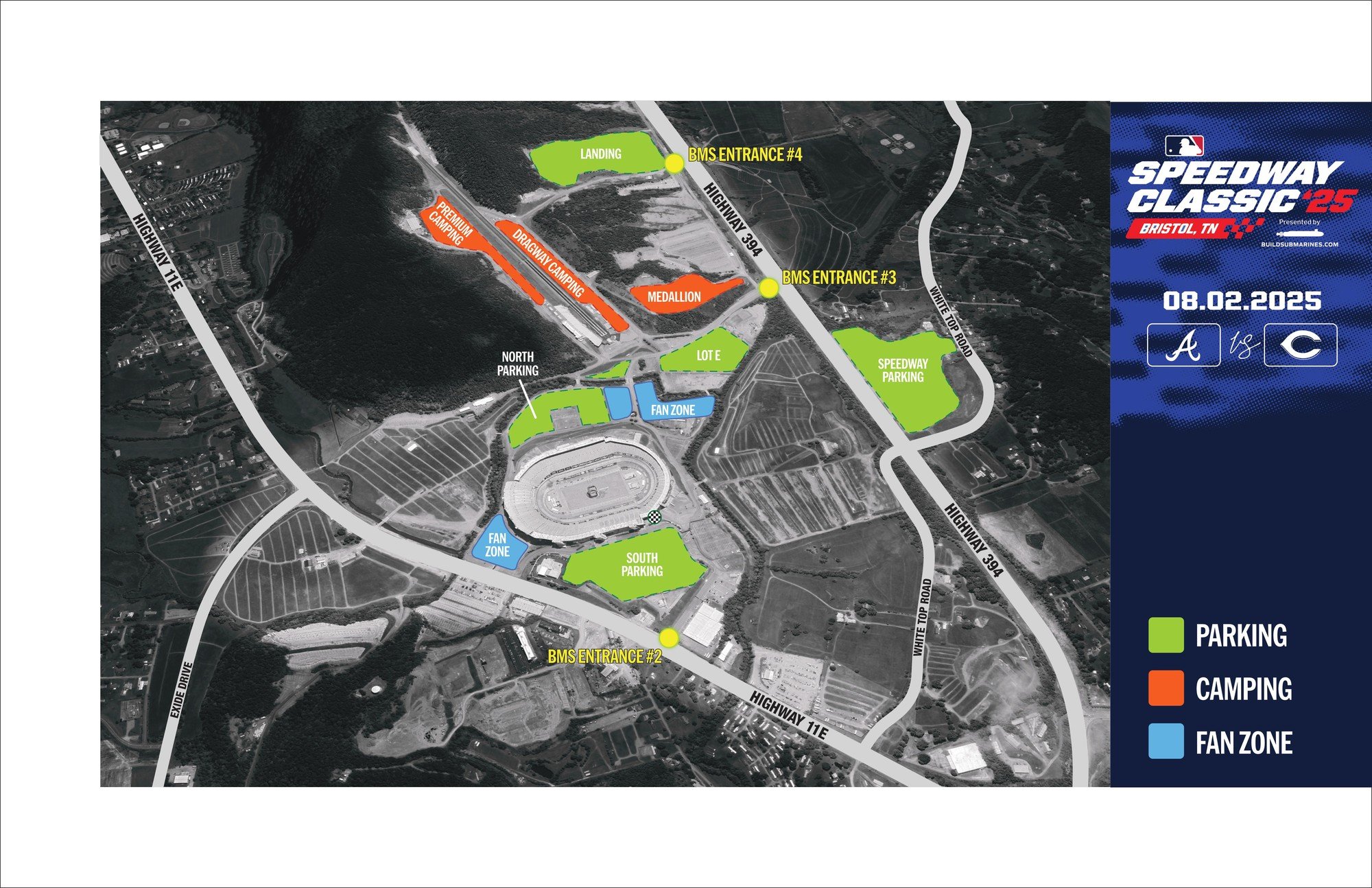

Manfred On The Speedway Classic Key Takeaways And Analysis

May 11, 2025

Manfred On The Speedway Classic Key Takeaways And Analysis

May 11, 2025 -

Sin Costo Billetera Digital Uruguaya Para Usuarios Argentinos

May 11, 2025

Sin Costo Billetera Digital Uruguaya Para Usuarios Argentinos

May 11, 2025 -

Mm Amania Coms Ufc 315 Betting Odds Analysis Weekend Picks

May 11, 2025

Mm Amania Coms Ufc 315 Betting Odds Analysis Weekend Picks

May 11, 2025