Billionaires' Favorite ETF: Predicted 110% Surge In 2025?

Table of Contents

Identifying the Billionaires' Top ETF Choice

Unveiling the Mystery ETF

While pinpointing the exact ETF favored by billionaires remains shrouded in secrecy, we can examine the characteristics of a hypothetical high-performing ETF likely attracting such attention. We'll refer to it as the "Hypothetical High-Growth ETF" (HHGE). This isn't a recommendation of any specific fund but rather an analysis of a hypothetical portfolio. Identifying the specific ETF would require insider information and is not the focus of this educational piece.

Analyzing the Underlying Assets

The HHGE likely invests in a carefully curated blend of asset classes known for high growth potential. These could include:

- Technology ETF components: A significant weighting on disruptive technology companies driving innovation in sectors like artificial intelligence, biotechnology, and renewable energy. This exposure to the rapidly expanding tech sector is a key driver of potential high returns.

- Renewable Energy ETF holdings: Investments in companies at the forefront of the green energy revolution, capitalizing on the global shift towards sustainable practices. This sector is experiencing explosive growth and presents a compelling long-term investment opportunity.

- Emerging Market ETF exposure: Strategic allocation to promising emerging markets poised for significant economic expansion, offering diversification and exposure to high-growth regions.

The ETF might also employ sophisticated strategies such as:

- Factor investing ETF methodologies: Focusing on specific factors like value, momentum, or quality, aiming to outperform the broader market.

- ESG ETF considerations: Incorporating Environmental, Social, and Governance (ESG) criteria into its investment decisions, appealing to investors prioritizing ethical and sustainable investing.

Why Billionaires Are Drawn to This ETF

Billionaires are attracted to investment vehicles with substantial growth potential, diversification, and tax efficiency. The HHGE likely possesses these attributes:

- Long-term growth potential: Exposure to high-growth sectors like technology and renewable energy promises substantial returns over the long term.

- Diversification benefits: A blend of asset classes reduces overall portfolio risk compared to concentrating investments in a single sector.

- Tax efficiency: Strategic investment strategies and structure may minimize tax liabilities, enhancing overall returns.

- Expert portfolio management: Top-tier portfolio managers with a proven track record of delivering exceptional returns.

- Sophisticated risk management: Employing proactive risk management strategies to mitigate potential market downturns.

The 110% Surge Prediction: A Realistic Outlook?

Analyzing the Prediction's Foundation

The 110% surge prediction, while ambitious, might stem from several factors:

- Positive market analysis: Reputable financial analysts might point to strong underlying market trends supporting such projections.

- Technological advancements: Breakthroughs in AI, biotech, and renewable energy could fuel exponential growth in related sectors.

- Favorable economic forecast: Global economic growth and supportive regulatory environments could further contribute to the predicted surge.

Potential Risks and Considerations

While the potential upside is significant, investors must also consider potential risks:

- Market volatility: The market can experience unpredictable fluctuations, impacting investment returns.

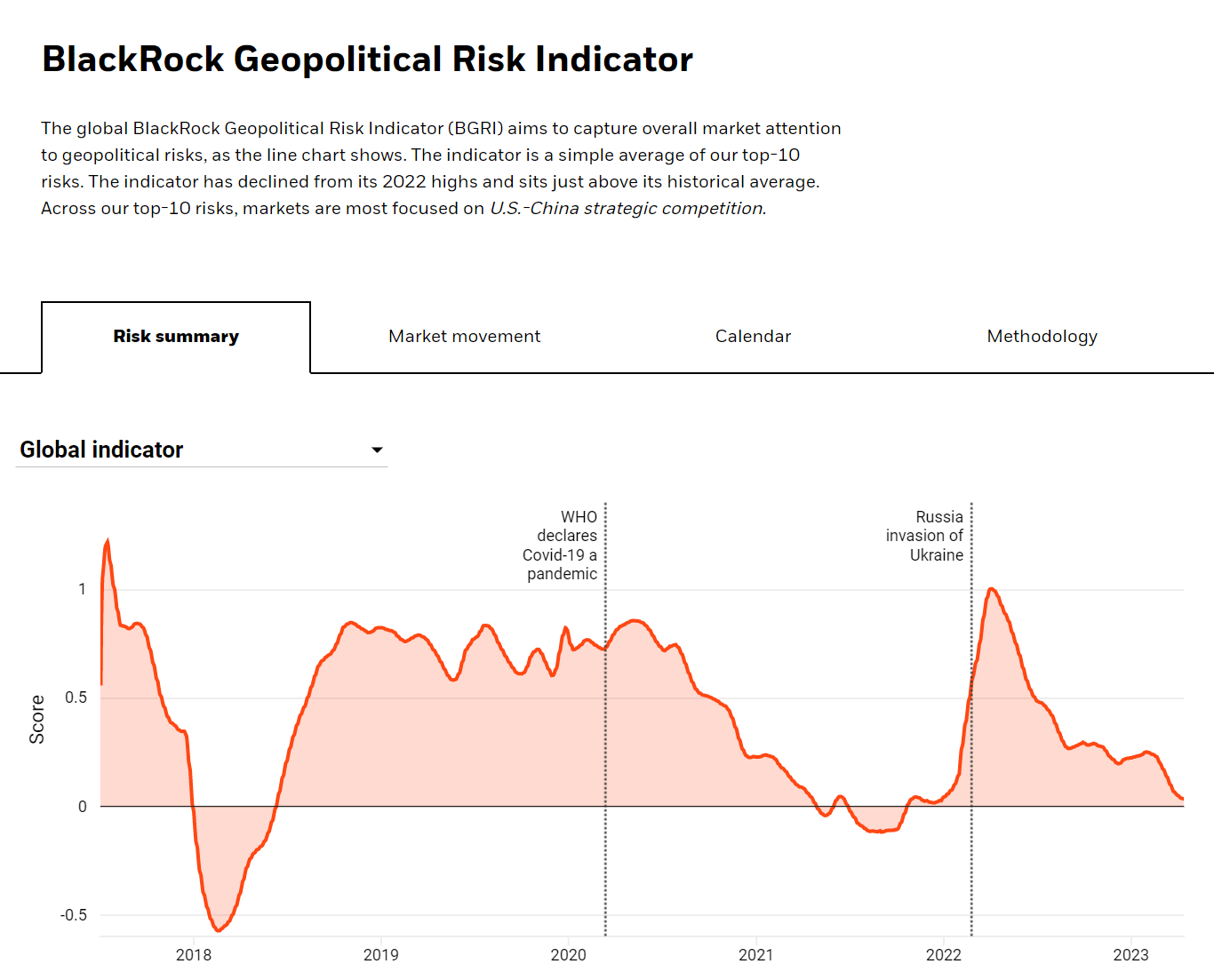

- Geopolitical risks: International events and political instability can significantly influence market performance.

- Interest rate fluctuations: Changes in interest rates can affect investment valuations and returns.

Is This ETF Right for You?

Assessing Your Investment Profile

The suitability of the HHGE depends on your investment profile:

- Beginner investors: This type of ETF might be too risky for beginners. A more conservative approach is generally recommended.

- Intermediate investors: With appropriate risk tolerance and diversified portfolio, it could be a potential addition.

- Advanced investors: May find it an attractive option within a well-diversified, high-growth portfolio.

Thorough due diligence is crucial. Consult financial statements, understand the fund's investment strategy, and assess the associated risks.

Alternative Investment Options

Investors seeking different risk profiles should explore alternative ETFs, such as those focused on established sectors, or consider other strategies like index funds or bonds.

Conclusion: Making Informed Decisions About the Billionaires' Favorite ETF

The potential for a 110% surge in a billionaires' favorite ETF in 2025 is exciting, but it's vital to approach such predictions with caution. While the hypothetical HHGE offers alluring prospects, significant risks exist. Thorough research, understanding your risk tolerance, and seeking professional financial advice are crucial steps before considering this or any high-growth investment. Learn more about the different types of ETFs available and build a diversified portfolio that aligns with your financial goals. Consider consulting a financial advisor to determine if a billionaires' favored ETF, or a similar high-growth ETF, is appropriate for your investment strategy. Remember, this article is for informational purposes only and doesn't constitute financial advice.

Featured Posts

-

Billionaires Favorite Etf Predicted 110 Surge In 2025

May 08, 2025

Billionaires Favorite Etf Predicted 110 Surge In 2025

May 08, 2025 -

Ai Fears Halt Publication Of Star Wars Andor Novel

May 08, 2025

Ai Fears Halt Publication Of Star Wars Andor Novel

May 08, 2025 -

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025 -

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025 -

Eliminatorias Sudamericanas Neymar Convocado Y Listo Para Jugar Contra Messi

May 08, 2025

Eliminatorias Sudamericanas Neymar Convocado Y Listo Para Jugar Contra Messi

May 08, 2025