Binance Bitcoin Trading: Buyers Dominate After Six-Month Slump

Table of Contents

The Six-Month Slump: A Market Analysis

Factors Contributing to the Decline

The six-month period leading up to the current surge was characterized by a significant downturn in the cryptocurrency market. Several factors contributed to this decline:

- Macroeconomic Factors: High inflation rates and aggressive interest rate hikes by central banks globally dampened investor risk appetite, leading to capital flight from riskier assets like Bitcoin.

- Regulatory Uncertainty: Increased regulatory scrutiny and uncertainty surrounding cryptocurrency regulations in various jurisdictions created a climate of fear and uncertainty.

- Bear Market Sentiment: Negative market sentiment, fueled by negative news and price predictions, further exacerbated the decline.

- The collapse of FTX: The November 2022 collapse of the FTX cryptocurrency exchange significantly impacted investor confidence and market sentiment, leading to a prolonged period of bearishness.

This period saw Bitcoin's price plummet, reaching lows not seen in years. Binance Bitcoin trading volume also experienced a considerable reduction, reflecting the overall bearish market sentiment. Data from [insert source, e.g., CoinMarketCap] shows a [specific percentage]% decrease in trading volume on Binance during this period compared to the preceding six months. As one leading analyst, [Analyst's Name], stated, "[Quote from analyst about the slump and its impact on Binance]."

Impact on Binance Bitcoin Trading Volume

The decrease in Binance Bitcoin trading volume during the slump was dramatic. The following chart illustrates the sharp decline:

[Insert chart showing Binance Bitcoin trading volume during the slump]

Compared to other major exchanges like Coinbase and Kraken, Binance, while still the leading exchange by volume, also experienced a proportional decline in Bitcoin trading activity, indicating a market-wide downturn rather than a Binance-specific issue.

The Recent Surge: Signs of a Bull Market Rebound?

Indicators Pointing to Increased Buyer Activity

The recent resurgence in Binance Bitcoin trading is characterized by several key indicators pointing towards increased buyer activity:

- Rising Trading Volume on Binance: Trading volume on Binance has seen a significant uptick in recent weeks, surpassing previous levels.

- Price Increases: Bitcoin's price has experienced a notable increase, recovering from its previous lows.

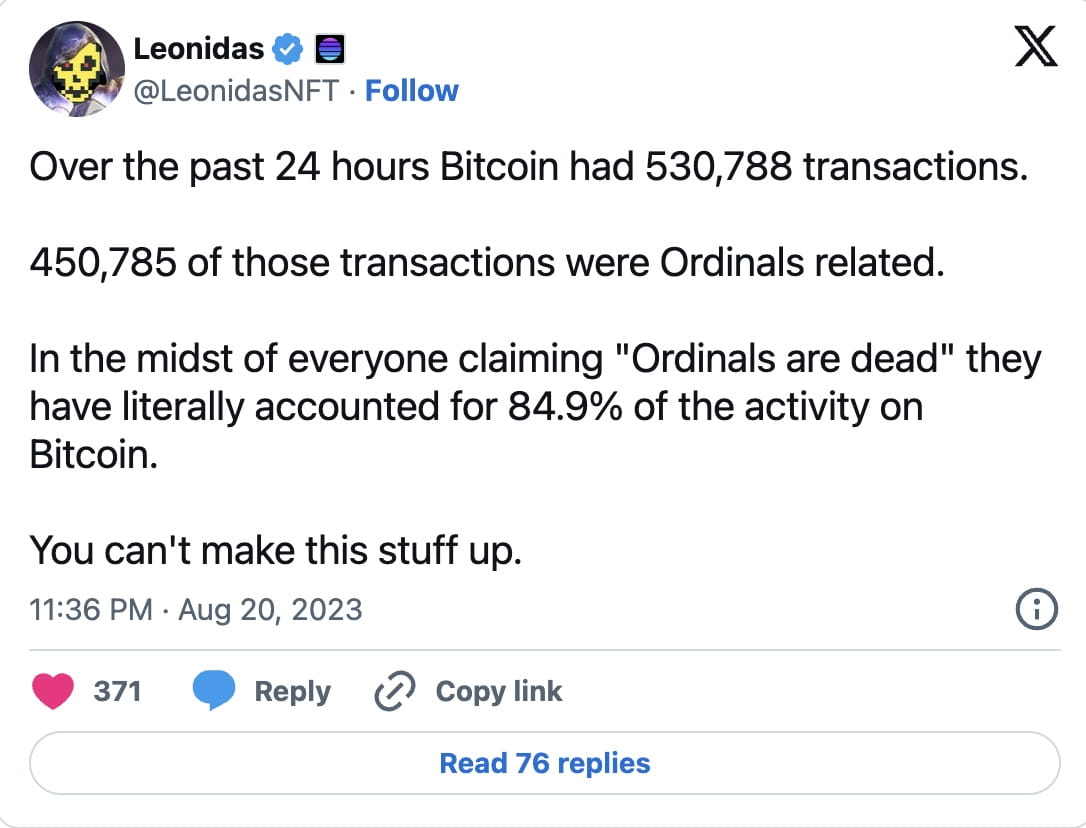

- Increased On-Chain Activity: On-chain metrics like the number of transactions and active addresses have also shown an increase, suggesting greater network activity.

- Positive Sentiment Shift: Market sentiment has shifted towards optimism, fueled by positive news and speculation about future price increases.

Data from [insert source] shows a [specific percentage]% increase in Binance Bitcoin trading volume compared to the previous month, with the average daily trading volume reaching [specific number]. Technical analysis, including moving averages and RSI, supports this upward trend, suggesting a potential bull market rebound.

Analysis of Buyer Behavior on Binance

Order book analysis reveals a significant increase in buy orders exceeding sell orders, a clear indication of buyer dominance. There's also evidence of a potential influx of new users to the Binance platform, further contributing to increased trading activity. The shift in trading strategies also seems to favor longer-term holding, suggesting a more bullish sentiment among traders.

Potential Reasons for the Shift in Market Sentiment

Positive News and Developments

Several factors could be contributing to the positive shift in market sentiment:

- Positive Regulatory Developments: Some positive regulatory developments in certain jurisdictions have instilled more confidence in the cryptocurrency market.

- Institutional Investments: Increased institutional investment in Bitcoin has provided support to the market.

- Binance Platform Upgrades: Upgrades and improvements to the Binance platform might have also attracted new users and increased trading activity.

- Positive Bitcoin-related news: Positive news regarding Bitcoin adoption, development, and technological advancements can significantly impact market sentiment.

Market Psychology and FOMO (Fear Of Missing Out)

Market psychology plays a crucial role. As Bitcoin's price started to rise, the "fear of missing out" (FOMO) might have encouraged more investors to jump in, further fueling the upward momentum.

Risks and Considerations for Binance Bitcoin Trading

Volatility and Market Risk

It's crucial to remember that the cryptocurrency market is inherently volatile. Bitcoin's price can fluctuate significantly in short periods, leading to potential losses. Risk management strategies are essential for anyone engaging in Binance Bitcoin trading.

Security and Platform Risk

While Binance is a major and generally secure platform, it's important to practice good security habits and manage your risk responsibly. Always utilize strong passwords, two-factor authentication, and other security measures to protect your assets.

Conclusion: Binance Bitcoin Trading – A Look Ahead

This article has explored the remarkable shift in Binance Bitcoin trading from a six-month slump to a period dominated by buyers. While the recent surge is encouraging, it's crucial to maintain a cautious outlook. Market volatility remains a significant factor, and future price movements could be influenced by various macroeconomic and regulatory developments.

Staying informed about the latest trends in Binance Bitcoin trading and conducting thorough research before making any trading decisions is crucial. Learn more about secure Bitcoin trading practices on Binance and make informed decisions. Understand the inherent risks involved before engaging in any cryptocurrency trading activity. The future of Binance Bitcoin trading remains dynamic, presenting both opportunities and challenges for investors.

Featured Posts

-

Selling Sunset Star Highlights Post Fire Landlord Exploitation In La

May 08, 2025

Selling Sunset Star Highlights Post Fire Landlord Exploitation In La

May 08, 2025 -

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025 -

Psg Nice Canli Yayin Izlemenin En Iyi Yollari

May 08, 2025

Psg Nice Canli Yayin Izlemenin En Iyi Yollari

May 08, 2025 -

Neymar Regresa A La Seleccion Brasilena Enfrentara A Messi En El Monumental

May 08, 2025

Neymar Regresa A La Seleccion Brasilena Enfrentara A Messi En El Monumental

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025