Bitcoin And Ethereum Options Expiration: Billions At Stake, Market Brace For Volatility

Table of Contents

Understanding Bitcoin and Ethereum Options

Bitcoin and Ethereum options are financial derivatives that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of Bitcoin or Ethereum at a predetermined price (strike price) on or before a specific date (expiration date). These options are traded on various exchanges, offering leveraged exposure to price movements without requiring the outright purchase of the underlying cryptocurrency.

Open interest, representing the total number of outstanding option contracts, is a crucial indicator of market sentiment and potential volatility. High open interest suggests significant market participation and potentially larger price swings upon expiration. Options expiration itself marks the final day the option contract can be exercised. If the market price is favorable to the option holder (e.g., above the strike price for a call option), they may choose to exercise their right and profit from the price difference. Conversely, if the market price is unfavorable, the option expires worthless.

- Strike Price: The predetermined price at which the option holder can buy or sell the underlying cryptocurrency.

- In-the-Money (ITM): An option that is profitable to exercise immediately. For a call option, this means the market price is above the strike price; for a put option, it means the market price is below the strike price.

- At-the-Money (ATM): An option where the market price is equal to the strike price.

- Out-of-the-Money (OTM): An option that is not profitable to exercise immediately. For a call option, this means the market price is below the strike price; for a put option, it means the market price is above the strike price.

- Leverage: Options trading offers leverage, magnifying potential profits but also significantly increasing potential losses. A small investment can control a much larger position in the underlying asset.

- Risks: Options trading carries substantial risk. Investors can lose their entire investment if the market moves against their position.

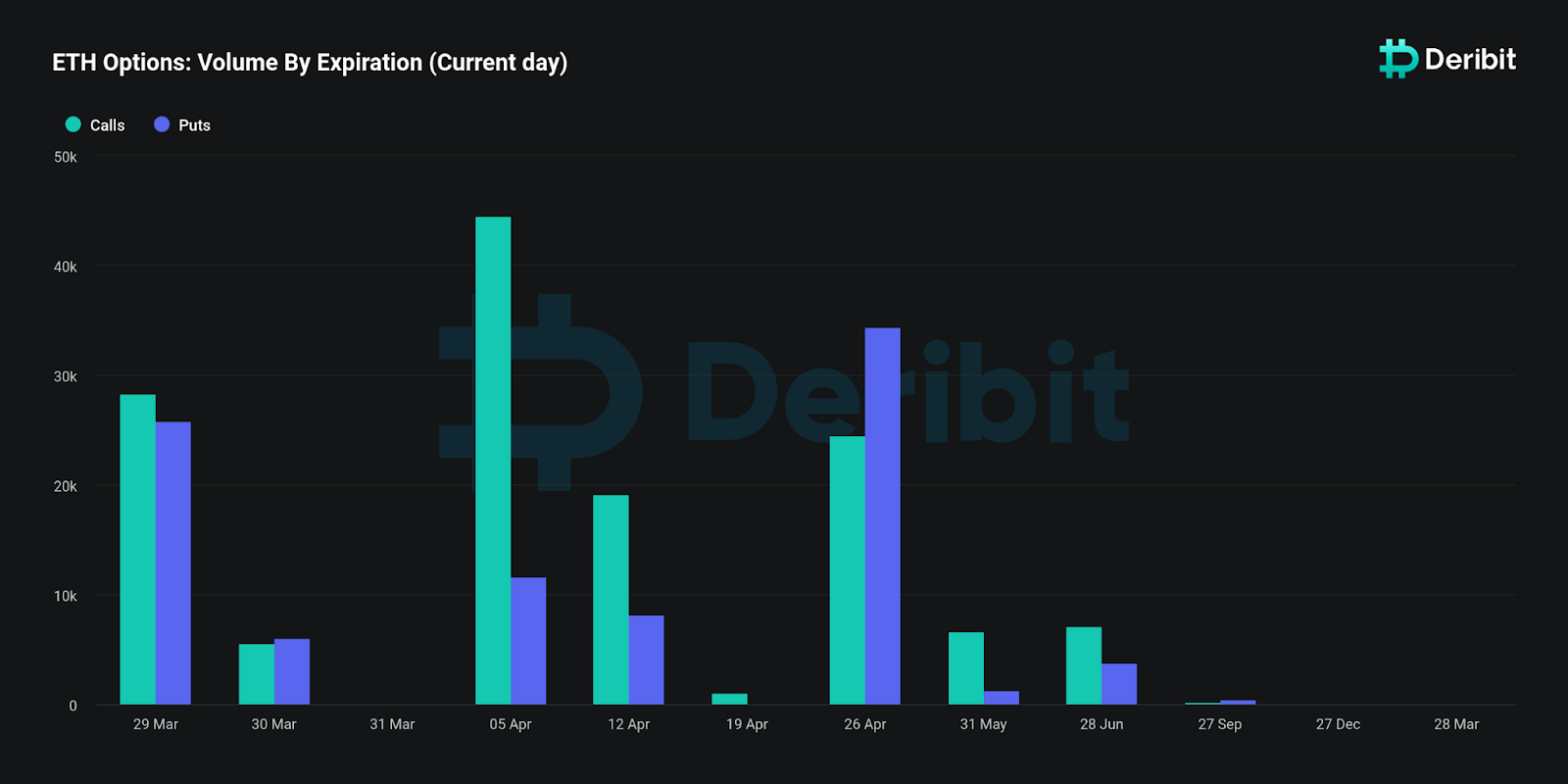

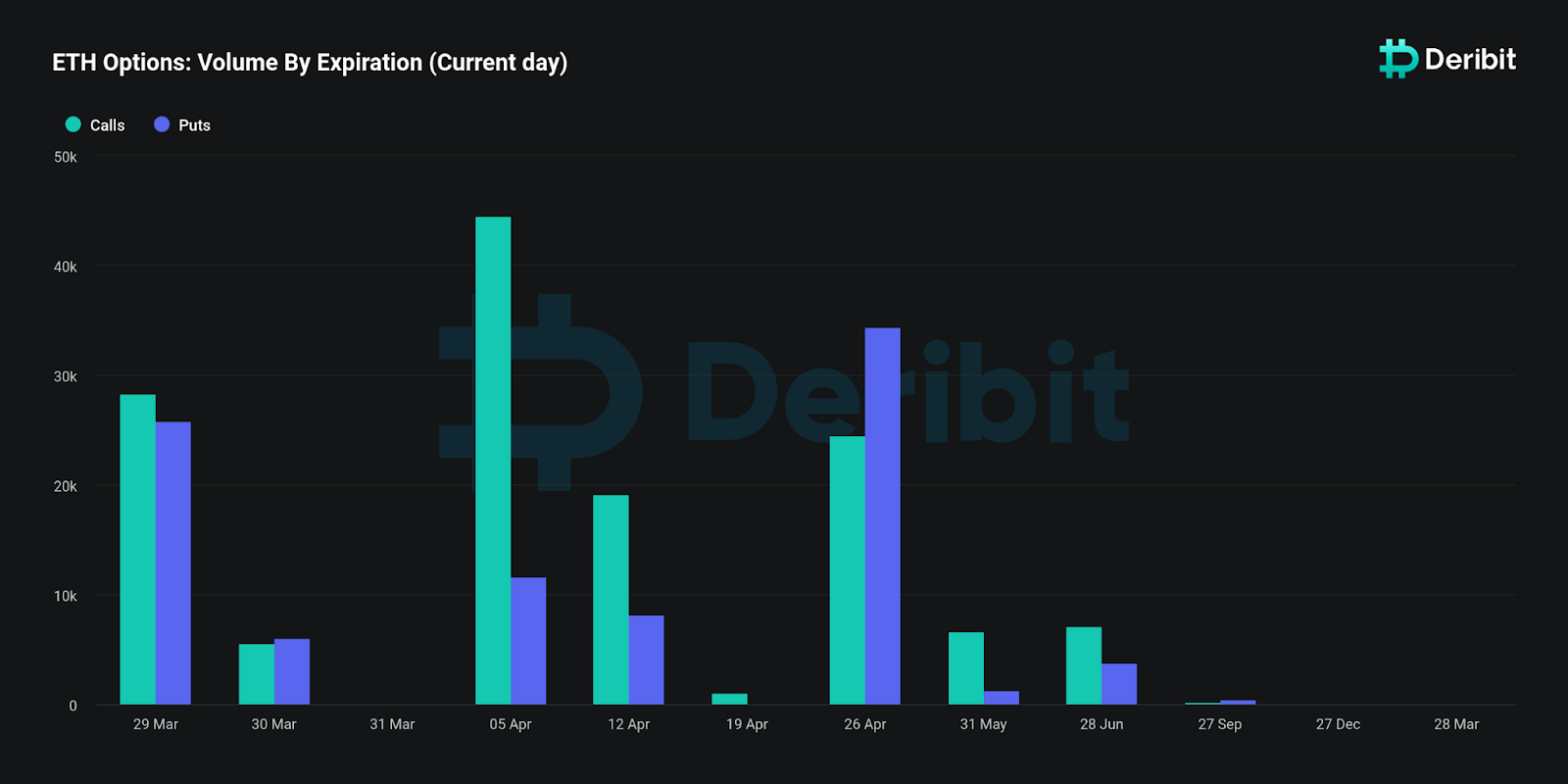

Billions at Stake: The Scale of the Expiring Options

The total value of Bitcoin and Ethereum options expiring on a given date can reach billions of dollars, depending on market conditions and open interest. This concentration of expiring contracts creates a significant potential for market impact. Both institutional investors and retail traders hold these options, meaning the liquidation of large positions can trigger significant price movements.

- Data Sources: Exchanges like Deribit and the CME Group publish data on options open interest and volume, providing insights into the scale of expiring contracts.

- Market Growth: The options market for Bitcoin and Ethereum has experienced significant growth in recent years, reflecting increased institutional participation and sophistication.

- Institutional Involvement: The growing involvement of institutional investors in crypto options markets adds to the potential for large-scale price swings during expiration periods. Hedge funds and other large players can significantly influence market dynamics.

Predicting Market Volatility During and After Expiration

Historically, options expirations have often coincided with periods of increased volatility in the crypto market. The convergence of multiple factors can amplify price swings. Analyzing current market conditions, including macroeconomic factors (e.g., interest rate hikes, inflation), regulatory news, and Bitcoin and Ethereum's price action leading up to expiration, is essential for predicting potential volatility.

- Technical Analysis: Technical indicators like Bollinger Bands, relative strength index (RSI), and moving averages can help gauge potential volatility and identify potential support and resistance levels.

- Sentiment Analysis: Monitoring social media sentiment and news coverage surrounding Bitcoin and Ethereum can offer insights into overall market sentiment.

- Support and Resistance Levels: Identifying key price levels where buying or selling pressure is expected to be significant can help in predicting potential price movements after Bitcoin and Ethereum options expiration.

Risk Management Strategies for Investors

Navigating the volatility surrounding Bitcoin and Ethereum options expiration requires a robust risk management strategy. This includes careful position sizing, diversification, and hedging techniques.

- Hedging: Using strategies like buying put options to protect against potential price declines can mitigate downside risk.

- Diversification: Diversifying a crypto portfolio beyond Bitcoin and Ethereum can help reduce overall portfolio volatility.

- Position Sizing: Investing only a small percentage of one's capital in any single trade, particularly during periods of high volatility, is crucial for risk management.

Conclusion

The expiration of billions of dollars in Bitcoin and Ethereum options presents a significant event for the cryptocurrency market, potentially leading to considerable volatility. Understanding the mechanics of options trading, the scale of the expiring contracts, and the potential catalysts for price movements is crucial for informed decision-making. By implementing appropriate risk management strategies, investors can navigate this period of uncertainty and potentially capitalize on market opportunities. Stay informed about upcoming Bitcoin and Ethereum options expiration events to better manage your cryptocurrency investments. Learn more about effectively managing your risk during future Bitcoin and Ethereum options expiration periods.

Featured Posts

-

Building Trust In Crypto Why Reliable News Sources Are Essential

May 08, 2025

Building Trust In Crypto Why Reliable News Sources Are Essential

May 08, 2025 -

Kendrick Raphael Decommits From Nc State A Setback For The Wolfpack

May 08, 2025

Kendrick Raphael Decommits From Nc State A Setback For The Wolfpack

May 08, 2025 -

Crypto Market Uptick Bitcoin Benefits From Improved Us China Relations

May 08, 2025

Crypto Market Uptick Bitcoin Benefits From Improved Us China Relations

May 08, 2025 -

Jan 6th Falsehoods Trump Supporter Ray Epps Files Defamation Suit Against Fox News

May 08, 2025

Jan 6th Falsehoods Trump Supporter Ray Epps Files Defamation Suit Against Fox News

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Speculation Among Fans

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Speculation Among Fans

May 08, 2025