Bitcoin Hits Record High: US Regulatory Optimism Fuels Surge

Table of Contents

Increased Regulatory Clarity in the US

The recent surge in Bitcoin's price is inextricably linked to a gradual but significant shift in the US government's approach towards cryptocurrency regulation. This increased regulatory clarity is boosting investor confidence and encouraging broader adoption.

Gradual Shift in Government Approach

Several positive regulatory developments have contributed to this shift:

- Increased Clarity on Taxation: The IRS has provided more specific guidance on Bitcoin taxation, reducing ambiguity and making it easier for investors to comply with regulations. [Link to IRS guidance on cryptocurrency taxation]

- Fewer Restrictions on Institutional Investment: Regulatory bodies are becoming more accommodating towards institutional investors, easing concerns about compliance and risk. [Link to relevant SEC or other regulatory filing]

- Positive Statements from Government Officials: Several high-ranking officials have issued statements indicating a more favorable stance towards Bitcoin and the broader cryptocurrency market, fostering a more positive regulatory environment. [Link to news article with official statement]

These developments significantly impact investor confidence. Reduced uncertainty encourages more investors to allocate capital to Bitcoin, leading to increased demand and ultimately, a higher price.

Impact on Institutional Adoption

Clearer regulations are vital for attracting institutional investors. Hedge funds, asset managers, and other large financial institutions are now more willing to allocate significant capital to Bitcoin, driven by the reduced regulatory risks.

- Examples of Institutional Adoption: Several major financial institutions have publicly announced investments in Bitcoin or Bitcoin-related products. [Link to examples of institutional investment news]

- The Role of ETFs: The potential for Bitcoin exchange-traded funds (ETFs) to gain approval in the US is a major catalyst for institutional investment, offering a more accessible and regulated pathway for participation. [Link to news articles on Bitcoin ETF applications]

Growing Institutional Demand Driving Bitcoin's Price

The surge in Bitcoin's price is directly correlated with the escalating demand from institutional investors. This increased demand, coupled with Bitcoin's inherent scarcity, is creating a perfect storm for price appreciation.

Increased Trading Volume

Data from major cryptocurrency exchanges reveals a significant increase in Bitcoin trading volume, directly reflecting the growing institutional interest. [Link to data from a reputable cryptocurrency exchange]. This heightened trading activity signals strong demand, pushing the price upwards. Increased volume often precedes and accompanies significant price movements in any market.

Limited Supply & High Demand

Bitcoin's fixed supply of 21 million coins is a key factor driving price increases. This inherent scarcity, coupled with the growing demand from both institutional and retail investors, creates a situation where the limited supply cannot meet the increasing demand, resulting in upward pressure on the price. The principle of scarcity is fundamental to asset valuation, making Bitcoin increasingly attractive as a store of value.

Bitcoin as a Hedge Against Inflation

Many investors view Bitcoin as a hedge against inflation and economic uncertainty. Concerns about fiat currency devaluation are driving investors to seek alternative assets, with Bitcoin emerging as a compelling option due to its decentralized nature and limited supply. The potential for Bitcoin to retain or increase its value during periods of inflation is a key driver of its appeal.

Market Sentiment and Speculation

Beyond fundamental factors, market sentiment and speculation also play a crucial role in Bitcoin's price movements.

Positive Media Coverage

Increased positive media coverage contributes to a more favorable public perception of Bitcoin, further fueling demand. This is amplified by social media, where discussions and trends can significantly impact short-term price fluctuations. [Link to examples of positive media coverage]

FOMO (Fear of Missing Out)

As Bitcoin's price rises, the fear of missing out (FOMO) can trigger a self-fulfilling prophecy, with more investors rushing to buy before the price increases further. This speculative element can significantly accelerate price appreciation.

Technical Analysis (Optional)

(This section can be included if the author is qualified to provide technical analysis and it adds value to the article. Otherwise, it is best omitted.) Technical indicators, such as moving averages and RSI, can provide insights into potential price trends, suggesting further increases are possible. However, technical analysis should always be viewed as one factor among many.

Bitcoin's Future and the Impact of US Regulatory Optimism

In conclusion, the recent record high in Bitcoin's price is primarily attributable to the increasing regulatory clarity in the US, leading to a surge in institutional investment. The combination of positive regulatory developments, growing institutional demand, and market sentiment has created a powerful upward momentum. While Bitcoin's inherent volatility remains a factor, the long-term outlook, particularly with continued US regulatory support, suggests significant potential for further growth. However, it’s crucial to remember that cryptocurrency markets are highly unpredictable and involve significant risk.

Stay informed about the latest developments in the Bitcoin market and explore the potential of this revolutionary asset. Learn more about Bitcoin investment strategies and stay ahead of the curve.

Featured Posts

-

Thlyl Daks 30 Tjawz Aldhrwt Alsabqt Wtwqeat Alswq Alawrwbyt

May 24, 2025

Thlyl Daks 30 Tjawz Aldhrwt Alsabqt Wtwqeat Alswq Alawrwbyt

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025 -

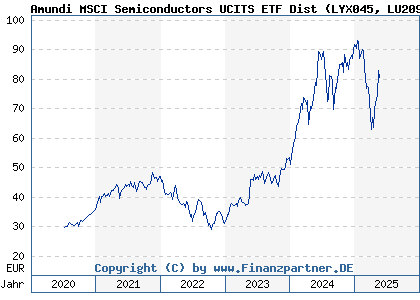

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025 -

Analiz Stati Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Latest Posts

-

Memorial Day 2025 Find The Best Appliance Sales Forbes Approved

May 24, 2025

Memorial Day 2025 Find The Best Appliance Sales Forbes Approved

May 24, 2025 -

Neal Mc Donough The Last Rodeo A Conversation On Bull Riding And The Pope

May 24, 2025

Neal Mc Donough The Last Rodeo A Conversation On Bull Riding And The Pope

May 24, 2025 -

Memorial Day Travel Fuel Costs At Historic Lows

May 24, 2025

Memorial Day Travel Fuel Costs At Historic Lows

May 24, 2025 -

Your Guide To Memorial Day 2025 In Michigan Open Businesses And Activities

May 24, 2025

Your Guide To Memorial Day 2025 In Michigan Open Businesses And Activities

May 24, 2025 -

Memorial Day 2025 Store Hours Publix Walmart And More In Florida

May 24, 2025

Memorial Day 2025 Store Hours Publix Walmart And More In Florida

May 24, 2025