Bitcoin Price: A Critical Juncture And What To Expect

Table of Contents

Macroeconomic Factors Influencing Bitcoin Price

Global macroeconomic conditions significantly impact the Bitcoin price. Factors like inflation, interest rates, recessionary fears, and the evolving regulatory environment all play crucial roles. The correlation between these macroeconomic indicators and Bitcoin's price is a complex one, often requiring nuanced analysis.

-

Inflation and Bitcoin: Many view Bitcoin as a hedge against inflation, believing its limited supply protects its value against currency devaluation. High inflation can drive investors towards Bitcoin as a store of value, increasing demand and potentially boosting its price.

-

Interest Rate Hikes and Risk Assets: Rising interest rates generally reduce the appeal of riskier assets, including Bitcoin. Higher rates make bonds and other fixed-income investments more attractive, potentially diverting capital away from cryptocurrencies and leading to price declines.

-

Government Regulations and Cryptocurrency Adoption: The regulatory landscape surrounding cryptocurrencies is constantly evolving. Stringent regulations can stifle innovation and adoption, negatively impacting the Bitcoin price. Conversely, clear and supportive regulations can foster growth and increase investor confidence.

-

Economic Uncertainty and Safe Haven Assets: During times of economic uncertainty, investors often seek safe haven assets. Whether Bitcoin fits this description is a subject of ongoing debate. Some believe its decentralized nature makes it a safe haven, while others remain skeptical. This uncertainty can lead to significant price volatility.

Supply and Demand Dynamics in the Bitcoin Market

Bitcoin's price is fundamentally driven by the interplay of supply and demand. Its limited supply of 21 million coins is a key feature, contrasting sharply with inflationary fiat currencies. However, demand fluctuates significantly, impacting price.

-

The Bitcoin Halving: The Bitcoin halving, an event that occurs approximately every four years, reduces the rate at which new Bitcoins are mined. This reduction in supply often leads to increased scarcity and historically has been followed by periods of price appreciation.

-

Institutional Investment: The growing involvement of institutional investors, such as hedge funds and corporations, significantly impacts Bitcoin's price. Their large-scale investments can propel the price upward, while their selling can trigger downward pressure.

-

Retail Investor Sentiment: The sentiment among individual investors plays a crucial role. Periods of high enthusiasm and FOMO (fear of missing out) can drive prices up, while fear and uncertainty can trigger sell-offs. Trading volume often reflects this sentiment.

-

Bitcoin Adoption in Emerging Markets: The increasing adoption of Bitcoin in emerging markets with unstable currencies or limited access to traditional financial systems fuels demand and presents significant growth potential.

Technological Developments and Their Impact on Bitcoin Price

Technological advancements within the Bitcoin ecosystem directly influence its price and adoption rate. Improved scalability and reduced transaction costs are key factors driving increased utility and wider appeal.

-

The Lightning Network: The Lightning Network is a layer-2 scaling solution designed to enable faster and cheaper Bitcoin transactions. Its successful implementation and wider adoption could significantly improve Bitcoin's usability and potentially boost its price.

-

Other Scalability Solutions: Various other scalability solutions are being developed to address Bitcoin's limitations. Their success in improving transaction speed and reducing fees will directly impact Bitcoin's appeal and price.

-

Impact on Utility and Appeal: Technological developments enhance Bitcoin's functionality and make it more attractive to a wider range of users and businesses. This increased utility translates to higher demand and potential price increases.

The Role of Social Media and News Sentiment

Social media and news coverage play a disproportionately large role in shaping public perception and influencing the Bitcoin price. Sentiment analysis of social media platforms and news articles can provide valuable insights into market trends.

-

News and Price Correlation: Positive news often correlates with price increases, while negative news (FUD – Fear, Uncertainty, and Doubt) can trigger sharp price drops.

-

Influence of Key Figures: Statements and opinions from influential figures in the crypto space, whether positive or negative, can significantly sway market sentiment and drive price volatility.

-

Potential for Market Manipulation: The decentralized nature of Bitcoin makes it vulnerable to manipulation through coordinated social media campaigns designed to artificially inflate or deflate the price.

Conclusion

The Bitcoin price is at a critical juncture, shaped by a complex interaction of macroeconomic factors, supply and demand dynamics, and technological advancements. While predicting the future price of Bitcoin is impossible, understanding these influencing factors is crucial for navigating the market. The interplay between global economic trends, technological innovations, and investor sentiment will continue to shape the Bitcoin price in the months and years to come.

Call to Action: Stay informed about the evolving dynamics of the Bitcoin price. Continuously monitor news, technological advancements, and macroeconomic conditions to make informed decisions regarding your Bitcoin investments. Understanding the intricacies of the Bitcoin price is key to successful long-term investment strategies. Remember to conduct thorough research and consult with financial advisors before making any investment decisions.

Featured Posts

-

Andor Season 2 What We Know About The Release Date And Trailer

May 08, 2025

Andor Season 2 What We Know About The Release Date And Trailer

May 08, 2025 -

The Road To 3 40 Ripple Xrp Price Outlook

May 08, 2025

The Road To 3 40 Ripple Xrp Price Outlook

May 08, 2025 -

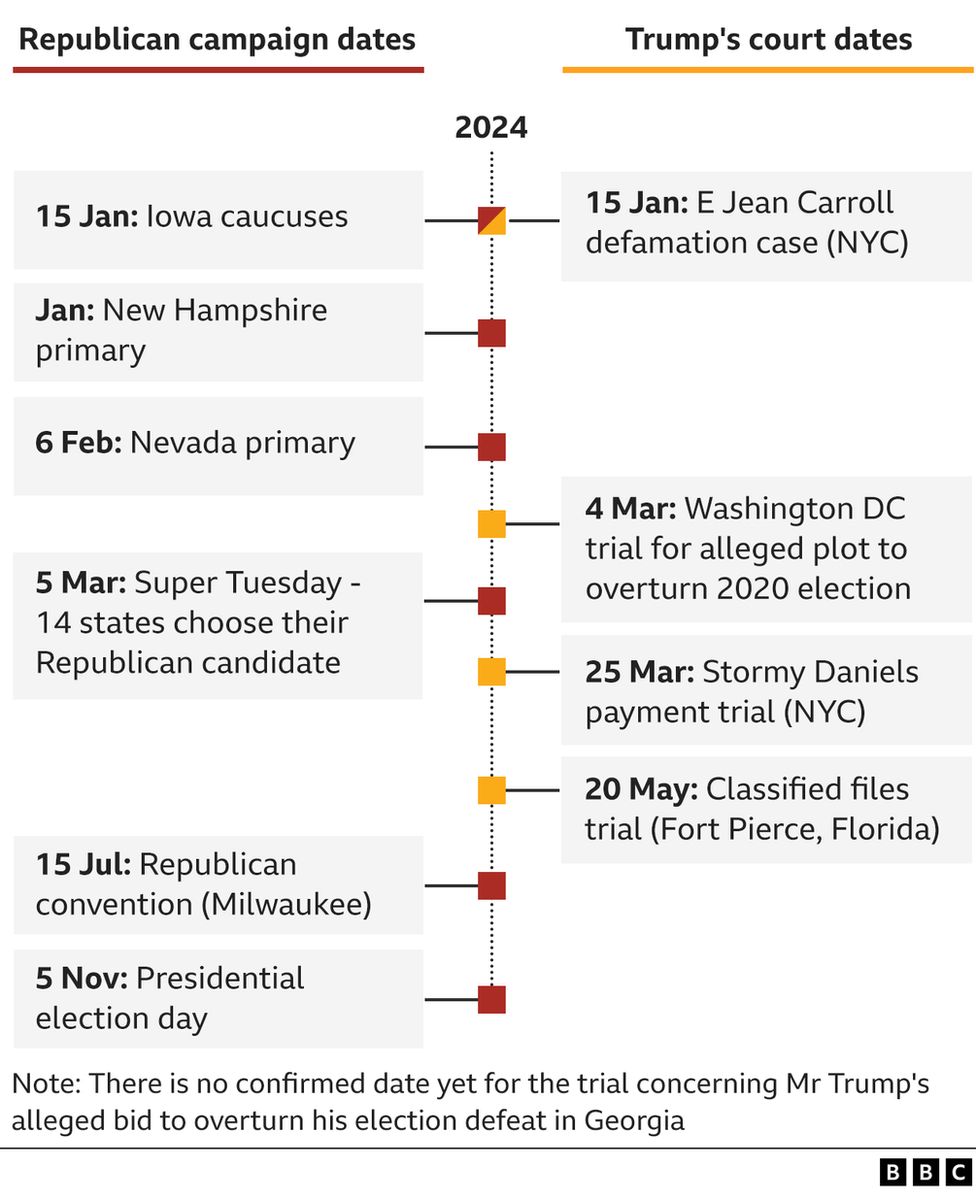

The Trump Factor How Presidential Policies Could Affect Bitcoins Price

May 08, 2025

The Trump Factor How Presidential Policies Could Affect Bitcoins Price

May 08, 2025 -

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025 -

7 Surprisingly Great Movies Streaming On Paramount Right Now

May 08, 2025

7 Surprisingly Great Movies Streaming On Paramount Right Now

May 08, 2025