Bitcoin Price Forecast: Evaluating The Impact Of Trump's 100-Day Speech

Table of Contents

Trump's Potential Policy Impacts on Bitcoin

Regulatory Uncertainty

A Trump administration's stance on cryptocurrency regulation could significantly influence Bitcoin's price. The level of regulatory clarity directly impacts investor confidence and market stability.

-

Potential scenarios:

- Increased regulation: This could lead to decreased adoption as hurdles to entry increase, potentially suppressing Bitcoin's price. Compliance costs for businesses could also hinder growth.

- Lax regulation: A lack of clear rules could lead to increased volatility as the market becomes more susceptible to manipulation and scams.

- Clear regulatory framework: A well-defined regulatory framework could foster stability and growth, attracting institutional investors and boosting confidence, leading to a potential price increase.

-

Keywords: Bitcoin regulation, cryptocurrency regulation, Trump administration, regulatory uncertainty, Bitcoin price volatility, Bitcoin market capitalization.

Fiscal Policy and Inflation

Trump's fiscal policies, such as tax cuts or increased government spending, could impact inflation. This, in turn, could affect Bitcoin's value as a potential hedge against inflation.

-

Potential scenarios:

- High inflation: High inflation could increase Bitcoin demand as investors seek to preserve their purchasing power. Bitcoin's decentralized nature and limited supply could make it an attractive alternative.

- Low inflation: Low inflation could decrease Bitcoin's appeal as an inflation hedge, potentially reducing demand and impacting its price negatively.

-

Keywords: Bitcoin inflation hedge, fiscal policy, inflation, Trump economics, Bitcoin price prediction, quantitative easing (QE), monetary policy.

Geopolitical Instability and Safe-Haven Demand

Geopolitical events and uncertainty could drive investors towards Bitcoin as a safe-haven asset, impacting its price. Bitcoin's decentralized nature makes it less susceptible to geopolitical risks than traditional assets.

-

Potential scenarios:

- Increased global uncertainty: Times of increased global uncertainty, such as trade wars or political instability, could lead to higher Bitcoin demand as investors seek a store of value outside of traditional financial systems.

- Periods of relative stability: During periods of relative geopolitical stability, Bitcoin's safe-haven appeal may diminish, potentially leading to price corrections.

-

Keywords: Bitcoin safe haven, geopolitical risk, Bitcoin investment, Trump foreign policy, Bitcoin price movement, Bitcoin as a store of value.

Analyzing Historical Bitcoin Price Reactions to Political Events

Past Presidential Elections and Bitcoin

Examining how Bitcoin's price reacted to previous presidential elections can offer insights into potential future responses. Analyzing historical data can reveal correlations and patterns.

- Data points: Analyzing price movements during and after past US presidential elections (including the 2016 election) can help identify correlations between political events and Bitcoin price changes. Consider both short-term spikes and longer-term trends.

- Keywords: Bitcoin election, historical Bitcoin price, political impact on Bitcoin, presidential election impact, Bitcoin historical data analysis.

Market Sentiment and Media Influence

Analyzing media coverage and investor sentiment surrounding Trump's announcements and their impact on Bitcoin is crucial. News sentiment and media narratives significantly influence investor behavior.

- Data points: Track news sentiment (positive, negative, neutral) around Trump's statements regarding the economy and financial markets; measure the correlation between the media narrative and Bitcoin price fluctuations using sentiment analysis tools.

- Keywords: Bitcoin news, media sentiment, investor sentiment, Bitcoin market analysis, Trump news impact, social media sentiment, fear, uncertainty, and doubt (FUD).

Predicting Future Bitcoin Price Movements Based on Hypothetical Trump Statements

Scenario Planning

Creating hypothetical scenarios based on potential Trump statements regarding Bitcoin allows for a more detailed Bitcoin price forecast.

-

Hypothetical scenarios:

- Trump advocating for Bitcoin adoption: A positive statement could trigger a significant price surge due to increased investor confidence and potential institutional adoption.

- Trump criticizing Bitcoin: Negative statements could lead to a temporary price drop due to increased uncertainty and negative sentiment.

- Trump remaining silent on Bitcoin: Silence might not have a significant impact, or it could be interpreted positively or negatively depending on the overall market sentiment.

-

Keywords: Bitcoin price prediction, Bitcoin future, hypothetical scenarios, Trump Bitcoin stance, Bitcoin price volatility.

Technical Analysis Integration

Combining fundamental analysis (impact of Trump's speech) with technical analysis (chart patterns, indicators) refines the forecast. Technical indicators provide additional insights.

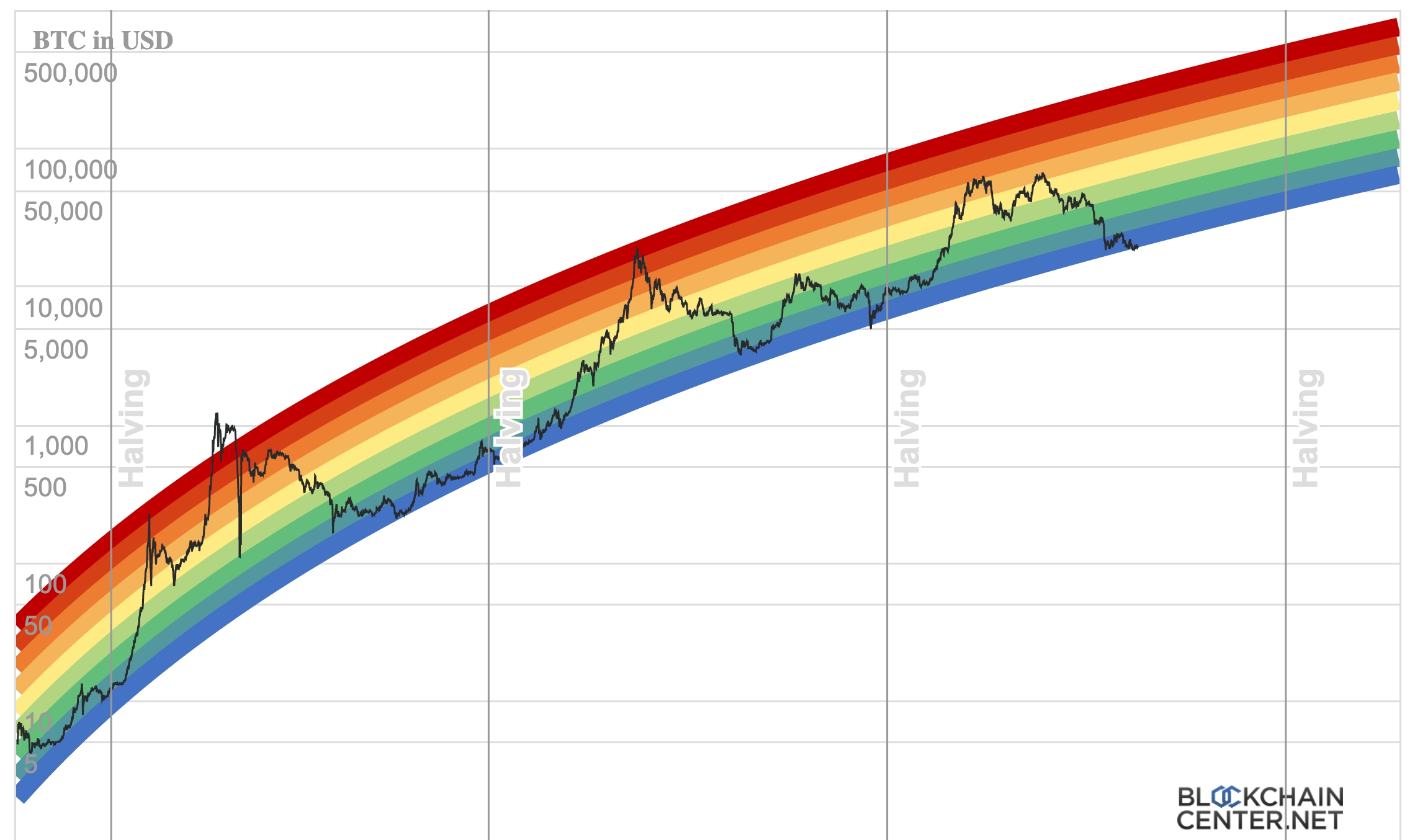

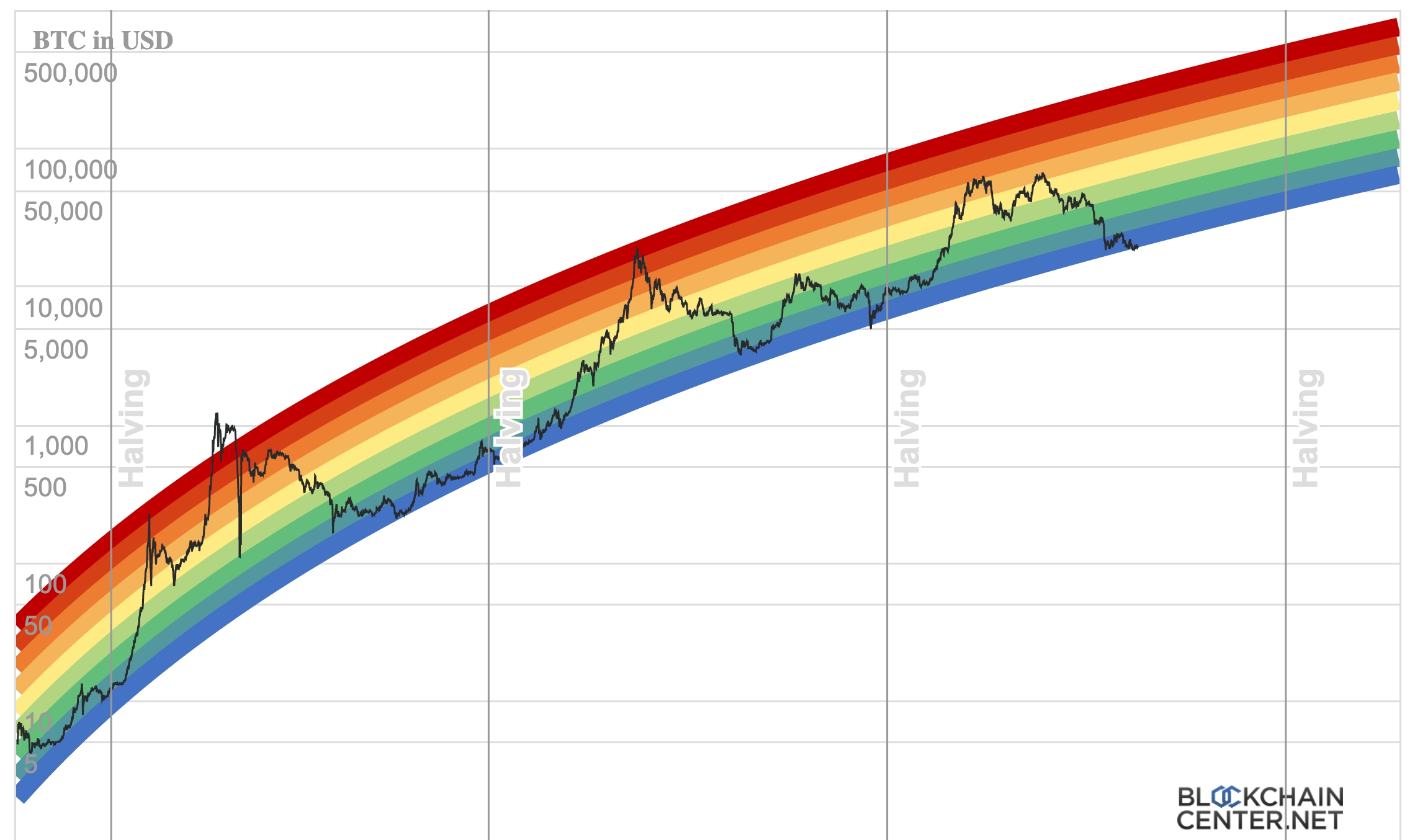

- Data points: Use chart analysis (candlestick patterns, moving averages), technical indicators (RSI, MACD, Bollinger Bands), and support and resistance levels to identify potential price targets.

- Keywords: Bitcoin technical analysis, Bitcoin charts, price support, price resistance, Bitcoin trading indicators, technical indicators.

Conclusion

This article explored the potential impact of (hypothetical) pronouncements in a Trump 100-day speech on the Bitcoin price forecast. By analyzing potential policy impacts, historical trends, and market sentiment, we can better understand the complexities influencing Bitcoin's value. While predicting the future price of Bitcoin remains inherently challenging, considering the interplay between political events and market dynamics provides a more nuanced perspective. Continue to monitor the news and conduct your own research to form your own informed Bitcoin price forecast. Understanding the potential impact of political events on your Bitcoin investments is crucial for effective portfolio management.

Featured Posts

-

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025 -

Review Dc Comics Krypto The Last Dog Of Krypton

May 08, 2025

Review Dc Comics Krypto The Last Dog Of Krypton

May 08, 2025 -

X Men Rogues Costume Evolution More Than Just A Wardrobe Change

May 08, 2025

X Men Rogues Costume Evolution More Than Just A Wardrobe Change

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Injury Update And Tonights Game

May 08, 2025

Celtics Vs Nets Jayson Tatum Injury Update And Tonights Game

May 08, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

May 08, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

May 08, 2025