Bitcoin Price Golden Cross: What It Means For Investors

Table of Contents

Understanding the Bitcoin Golden Cross

A golden cross is a bullish technical indicator formed when a shorter-term moving average crosses above a longer-term moving average. In the context of Bitcoin, this typically involves the 50-day moving average (MA) crossing above the 200-day MA. Let's define these terms:

- Moving Average (MA): A technical indicator that smooths out price fluctuations by averaging prices over a specific period. It helps identify trends and potential support/resistance levels.

- 50-day MA: The average closing price of Bitcoin over the past 50 days.

- 200-day MA: The average closing price of Bitcoin over the past 200 days.

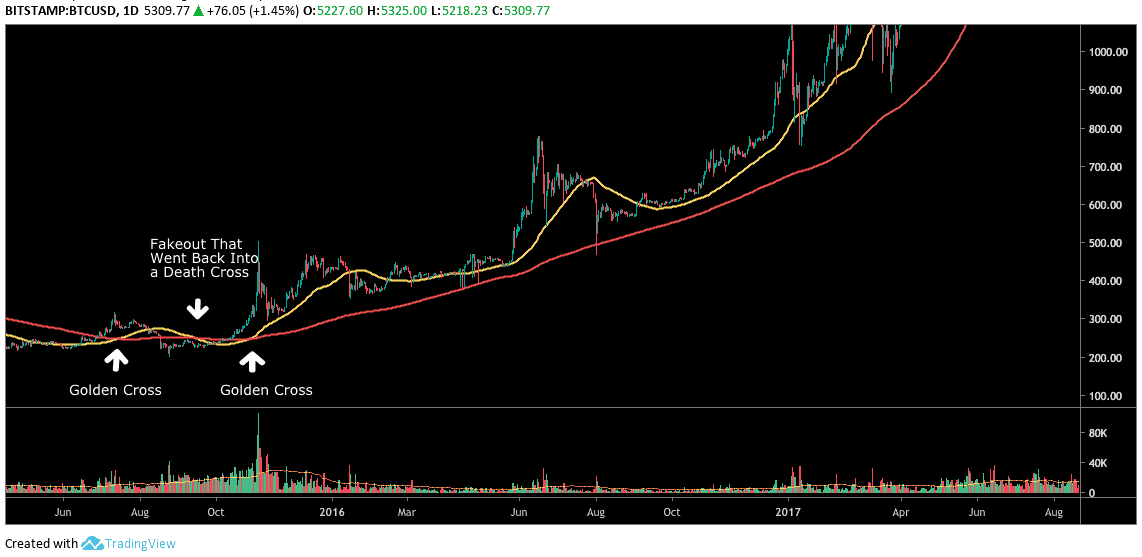

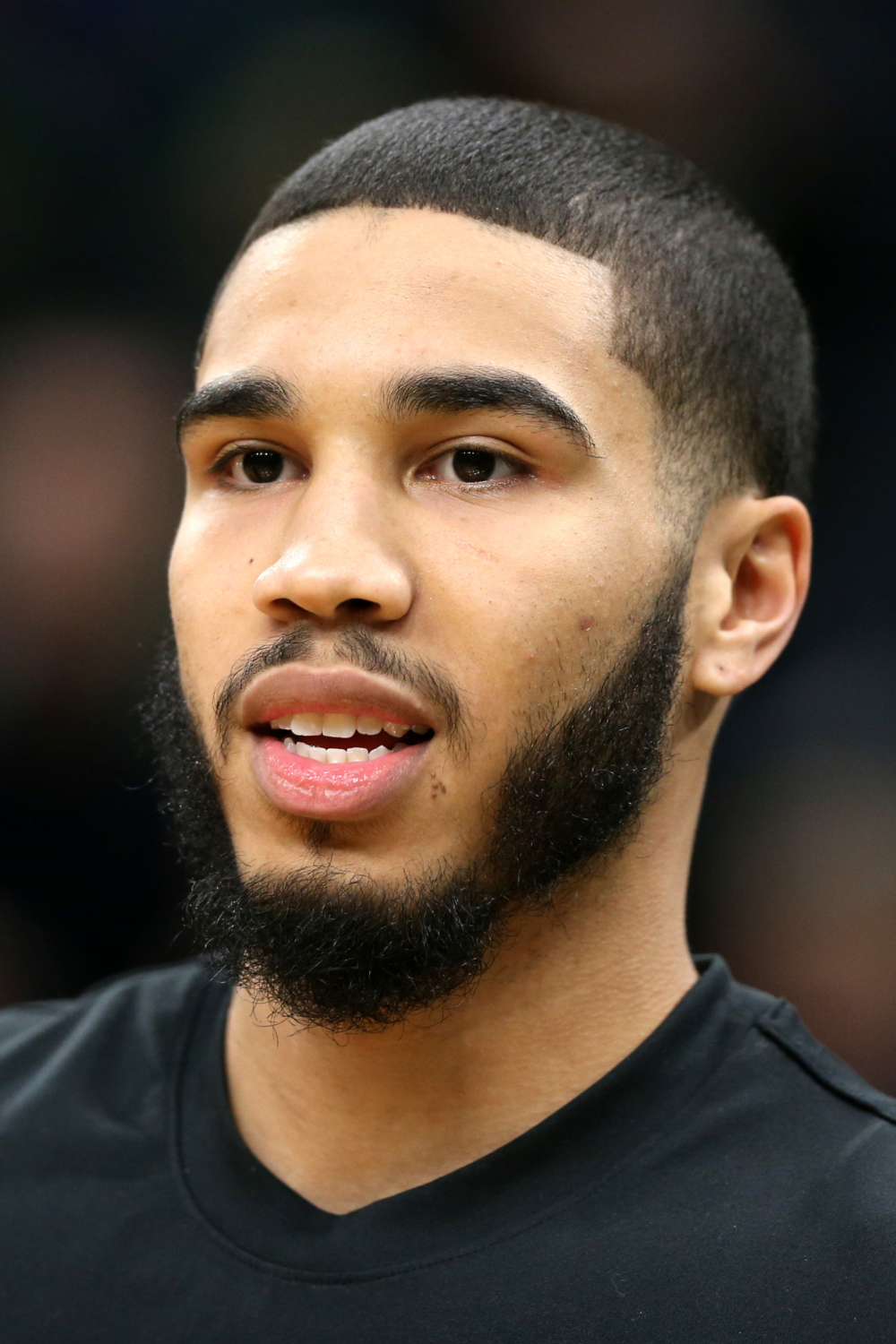

The golden cross is calculated by plotting both the 50-day and 200-day MAs on a Bitcoin price chart. When the 50-day MA crosses above the 200-day MA, a golden cross is formed. This is visually represented as the shorter-term average line breaking through and staying above the longer-term average line. (Insert a simple chart here illustrating a Bitcoin golden cross)

- Illustrates a potential shift in market sentiment from bearish to bullish.

- Often associated with bullish trends and potential price increases.

- Not a foolproof predictor of future price movements; it's just one piece of the puzzle.

Historical Performance of Bitcoin Golden Crosses

Analyzing past instances of Bitcoin golden crosses reveals mixed results. While some occurrences have indeed preceded significant price rallies, others have yielded less impressive outcomes, highlighting the limitations of relying solely on this indicator.

- Case study 1: In [Insert Date], a Bitcoin golden cross occurred at approximately [Insert Price]. The subsequent price action saw a [Percentage]% increase over the following [Time Period].

- Case study 2: In [Insert Date], another golden cross emerged around [Insert Price]. However, the price increase following this event was significantly less pronounced, with only a [Percentage]% rise over [Time Period]. (Insert relevant charts showcasing these examples)

This variability underscores the importance of considering other factors beyond the golden cross when making investment decisions. It's vital to acknowledge that the indicator's effectiveness can vary depending on broader market conditions.

Factors Influencing the Effectiveness of the Bitcoin Golden Cross

The effectiveness of a Bitcoin golden cross is significantly influenced by several factors:

-

Market Conditions and Overall Sentiment: A golden cross in a bearish market is less likely to lead to a significant price surge than one in a bullish or sideways market. General market sentiment plays a crucial role.

-

News Events and Regulatory Changes: Major news events, such as regulatory announcements or significant technological developments, can override the signal provided by the golden cross.

-

Bitcoin Adoption and Technological Developments: Widespread adoption and crucial technological upgrades often positively impact Bitcoin's price, potentially amplifying the effects of a golden cross.

-

The Need for Additional Indicators: Relying solely on the golden cross is risky. Combining it with other technical indicators, like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD), provides a more comprehensive view.

-

Importance of considering volume confirmation: A golden cross accompanied by a surge in trading volume is a stronger signal.

-

The role of other technical analysis tools (e.g., RSI, MACD) provides a more robust assessment of market momentum.

-

Impact of broader market trends (e.g., stock market performance): A general downturn in global markets can negatively impact Bitcoin's price, even following a golden cross.

How to Use the Bitcoin Golden Cross in Your Investment Strategy

The Bitcoin golden cross should not be considered a stand-alone trading signal. It's most effective when used in conjunction with other forms of analysis:

- Fundamental Analysis: Understanding the underlying technology, adoption rates, and regulatory landscape of Bitcoin is essential.

- Technical Analysis: Combining the golden cross with other indicators such as RSI, MACD, and support/resistance levels provides a more holistic perspective.

Risk management is paramount in Bitcoin investment:

- Develop a robust trading plan with clearly defined entry and exit points.

- Set stop-loss orders to limit potential losses.

- Diversify your portfolio to mitigate risk.

- Never invest more than you can afford to lose.

Conclusion

The Bitcoin price golden cross is a valuable technical indicator that can provide insights into potential shifts in market momentum. However, it's crucial to remember that it's not a self-sufficient predictor of future price movements. Successful Bitcoin investment requires a holistic approach, combining technical analysis like the golden cross with fundamental analysis and sound risk management.

Call to Action: Understanding the nuances of the Bitcoin price golden cross is vital for navigating the cryptocurrency market. Stay informed, conduct thorough research, and develop a well-defined investment strategy to effectively utilize this indicator and other tools in your Bitcoin trading journey. Learn more about interpreting Bitcoin price signals and other crucial indicators for successful investing.

Featured Posts

-

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

The Unplanned Power Of Unscripted Moments In Saving Private Ryan

May 08, 2025

The Unplanned Power Of Unscripted Moments In Saving Private Ryan

May 08, 2025 -

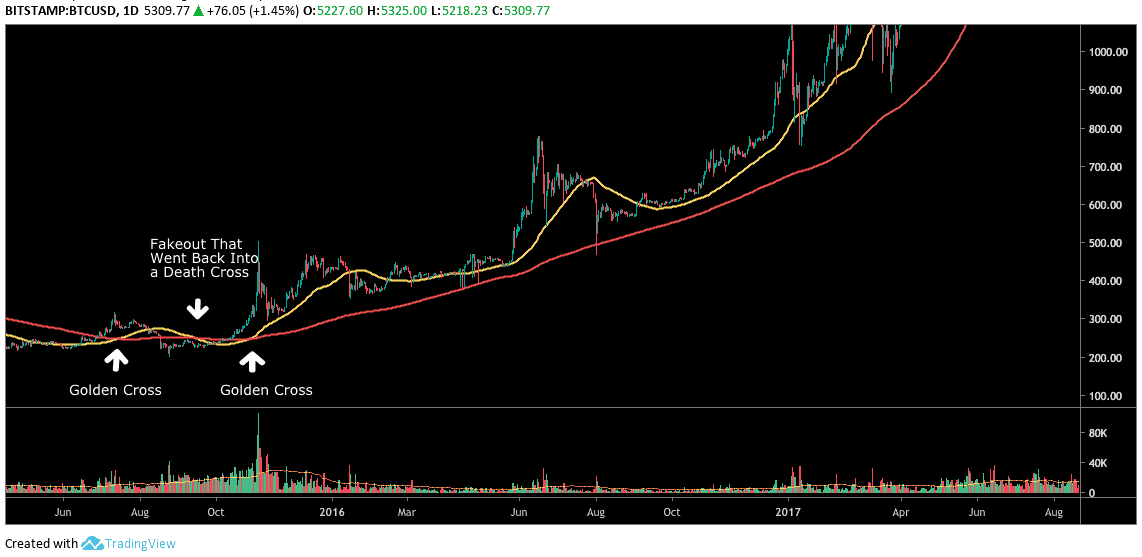

Check The April 12th Lotto Results Saturday Jackpot Numbers

May 08, 2025

Check The April 12th Lotto Results Saturday Jackpot Numbers

May 08, 2025 -

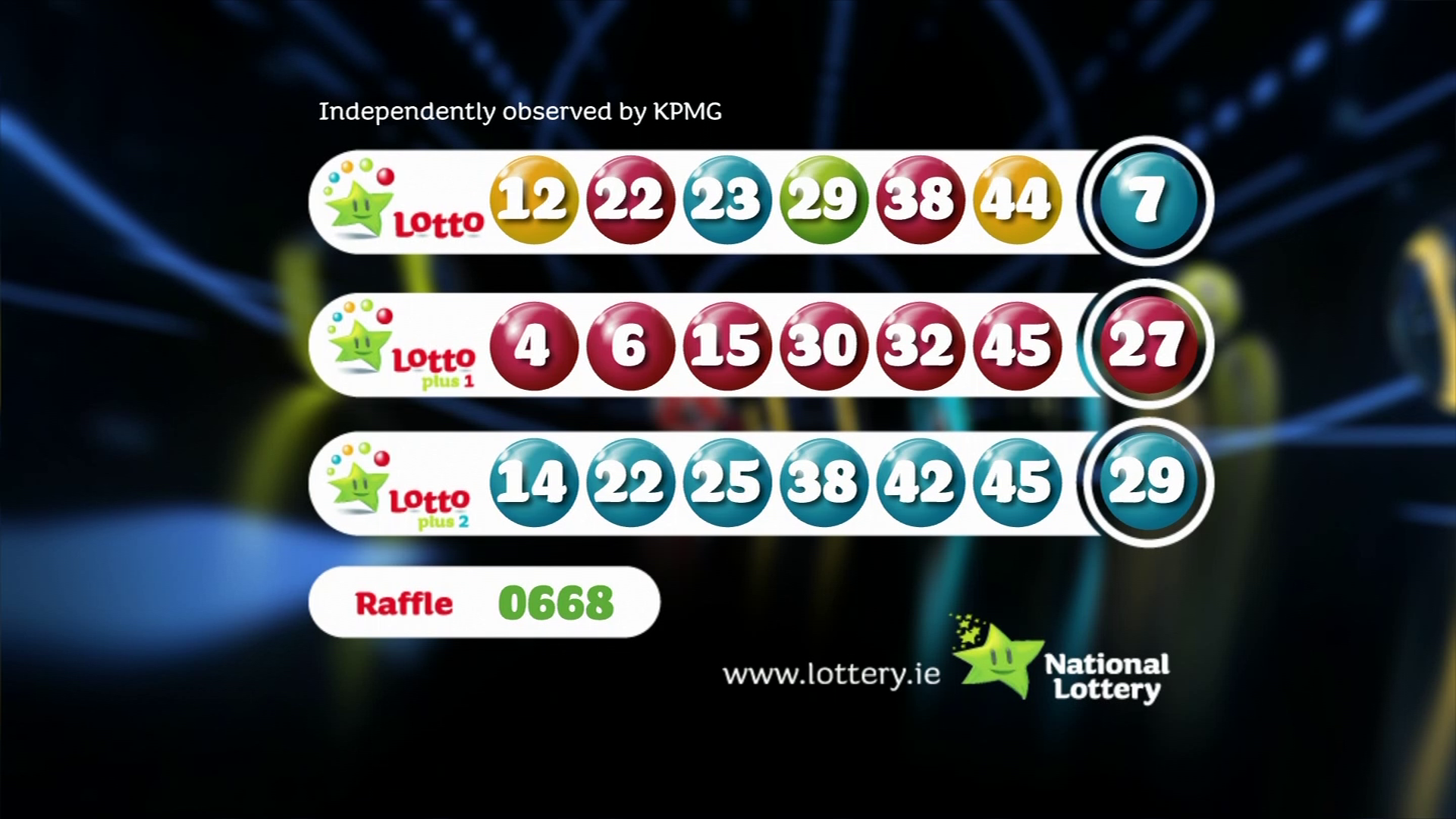

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025 -

Senizatsionalna Pobeda Na Vesprem Protiv Ps Zh

May 08, 2025

Senizatsionalna Pobeda Na Vesprem Protiv Ps Zh

May 08, 2025