Bitcoin Price Prediction: Will Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Influence on Bitcoin

Trump's pronouncements and policies have consistently impacted global markets. His influence on Bitcoin's price is a complex issue, with potential positive and negative consequences.

Economic Policies and Bitcoin: Trump's economic policies, particularly those related to fiscal stimulus and deregulation, could significantly impact Bitcoin's price.

- Fiscal Stimulus: Increased government spending could lead to inflation, potentially driving investors towards Bitcoin as an inflation hedge. This increased demand could push the price upward.

- Deregulation: A less regulated financial environment could lead to greater institutional adoption of Bitcoin, boosting its price. However, overly lax regulation could also introduce risks and volatility.

- Monetary Policy: Changes in interest rates and monetary policy directly affect market liquidity and investor sentiment, influencing Bitcoin's price.

Geopolitical Instability and Safe-Haven Assets: Bitcoin has often been viewed as a safe-haven asset during times of geopolitical uncertainty. Trump's statements and actions on the international stage could trigger market volatility, potentially driving investors towards Bitcoin as a hedge against risk.

- Global Uncertainty: Periods of international tension or conflict can lead to a flight to safety, with investors seeking refuge in assets perceived as less vulnerable to geopolitical shocks. Bitcoin often benefits from this.

- Inflation Concerns: Trump's economic policies could influence inflation rates. If inflation rises, Bitcoin's value as a store of value could increase, driving demand.

Technical Analysis of Bitcoin's Price

Analyzing Bitcoin's price trends using technical indicators provides valuable insights into its potential future movement.

Current Market Trends: Examining key technical indicators is crucial to predict short-term trends.

- Trading Volume: High trading volume suggests strong market interest and potential for significant price movements. Low volume might indicate a period of consolidation.

- Market Capitalization: Bitcoin's market capitalization relative to other cryptocurrencies and traditional assets gives an indication of its overall strength.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) helps identify potential support and resistance levels.

- RSI (Relative Strength Index): RSI indicates whether Bitcoin is overbought or oversold, providing signals for potential price reversals. (Charts and graphs would ideally be included here).

Historical Price Performance: Examining Bitcoin's past performance in response to major political events provides valuable context.

- Past Reactions: Analyzing Bitcoin's price reactions to past presidential elections or significant policy announcements can offer clues about potential future behavior. However, past performance is not necessarily indicative of future results.

Factors Beyond Trump's Speech

While Trump's speech is a significant factor, several other elements contribute to Bitcoin's price trajectory.

Adoption and Regulation: Institutional adoption and regulatory clarity are key drivers of Bitcoin's price.

- Institutional Investors: Increased investment from large institutional players can significantly impact Bitcoin's price by increasing liquidity and driving demand.

- Regulatory Changes: Clearer and more favorable regulations can attract more institutional investment and boost confidence in the market, leading to price appreciation. Conversely, restrictive regulations can lead to a price decline.

Overall Market Sentiment: Broader market sentiment significantly influences Bitcoin's price.

- Social Media Trends: News and sentiment expressed on social media platforms can impact investor behavior and price volatility.

- Investor Confidence: Positive news and increasing adoption generally lead to higher investor confidence and thus, higher prices. Conversely, negative news or uncertainty can trigger sell-offs.

Conclusion

Predicting Bitcoin's price is inherently challenging due to its volatile nature and the multitude of influencing factors. While Trump's 100-day speech and related policy announcements could significantly impact Bitcoin's price, it's impossible to definitively say whether it will push BTC past $100,000. Positive economic policies and increased geopolitical uncertainty might drive investors toward Bitcoin as a safe haven and inflation hedge, pushing prices higher. However, negative regulatory changes or a shift in overall market sentiment could have the opposite effect. It's crucial to consider all contributing factors before making any investment decisions.

To make informed investment choices, continue to follow Bitcoin price predictions, conduct thorough research, and consult with financial advisors before investing in cryptocurrencies. Stay updated on the latest Bitcoin price forecast and BTC price prediction analyses to navigate this dynamic market effectively.

Featured Posts

-

U S Intensifies Greenland Surveillance Exclusive Intelligence Report

May 08, 2025

U S Intensifies Greenland Surveillance Exclusive Intelligence Report

May 08, 2025 -

Dont Lose Out Understanding The 6 828 Dwp Letter Penalty

May 08, 2025

Dont Lose Out Understanding The 6 828 Dwp Letter Penalty

May 08, 2025 -

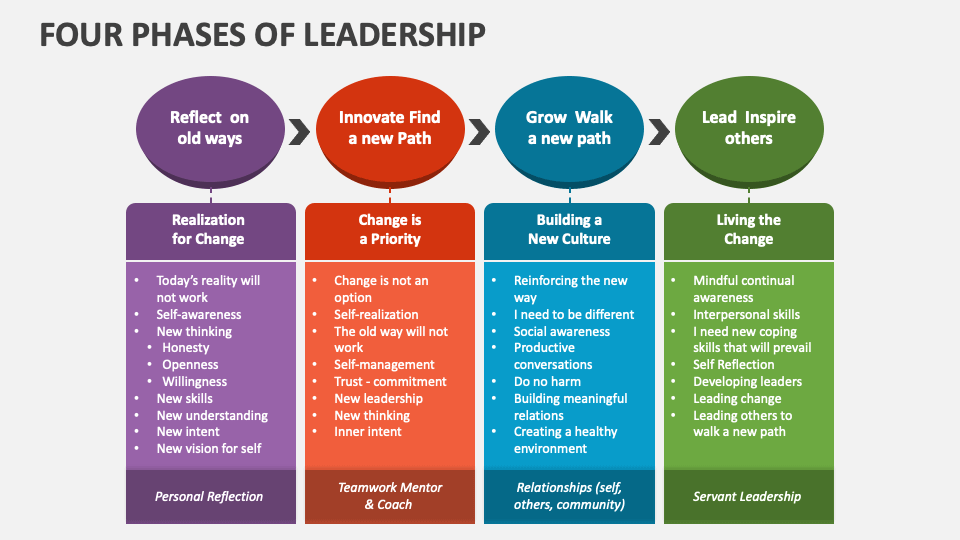

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025 -

Hidden Superman Easter Egg James Gunns Jimmy Olsen Anniversary Photo Hints At A Strange Surprise

May 08, 2025

Hidden Superman Easter Egg James Gunns Jimmy Olsen Anniversary Photo Hints At A Strange Surprise

May 08, 2025 -

Andor Season 2 Will Familiar Rebels Join Cassian Andor Exploring The Timeline

May 08, 2025

Andor Season 2 Will Familiar Rebels Join Cassian Andor Exploring The Timeline

May 08, 2025