Bitcoin Price Rebound: What To Expect Next

Table of Contents

Factors Contributing to the Bitcoin Price Rebound

Several key factors are contributing to the recent Bitcoin price rebound. Understanding these factors is crucial for predicting future price movements and making informed investment decisions in the cryptocurrency market.

Increased Institutional Investment

Institutional investment is playing a significant role in Bitcoin's price stability and potential for growth. The growing acceptance of Bitcoin as a legitimate asset class is driving this trend.

- Growing adoption by major corporations: Companies like MicroStrategy and Tesla have made substantial Bitcoin purchases, signaling a shift in how institutions view digital assets.

- Grayscale Bitcoin Trust holdings: The Grayscale Bitcoin Trust (GBTC) continues to accumulate BTC, demonstrating persistent institutional demand.

- Positive regulatory developments in certain jurisdictions: More favorable regulatory frameworks in some countries are encouraging institutional participation in the cryptocurrency market.

- Diversification strategies of institutional investors: Many institutional investors are incorporating Bitcoin into their portfolios as a means of diversification, hedging against traditional market risks.

The influx of institutional capital provides Bitcoin with a level of stability previously unseen. This sustained buying pressure helps to mitigate the impact of short-term price fluctuations and contributes to a more predictable, albeit still volatile, market. For example, MicroStrategy's significant investments have demonstrably impacted Bitcoin's price, showing the power of institutional buying.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price. The current inflationary environment and weakening fiat currencies are contributing factors to the recent rebound.

- Inflation concerns: As inflation erodes the purchasing power of fiat currencies, investors are increasingly seeking alternative assets, including Bitcoin, as a hedge against inflation.

- Weakening fiat currencies: The declining value of certain national currencies is driving demand for Bitcoin, seen as a potentially more stable store of value.

- Safe-haven asset status of Bitcoin: Bitcoin's decentralized nature and limited supply contribute to its perception as a safe-haven asset during times of economic uncertainty.

The correlation between macroeconomic instability and Bitcoin's price is becoming increasingly evident. As inflation continues to be a concern globally, investors are turning to Bitcoin as a potential safeguard, driving up demand and, consequently, the price.

Technological Advancements

Continuous technological advancements within the Bitcoin ecosystem are enhancing its scalability, security, and overall utility, further fueling the price rebound.

- The Lightning Network: This layer-2 scaling solution facilitates faster and cheaper Bitcoin transactions, addressing one of the network's primary limitations.

- Taproot upgrade: This upgrade improved Bitcoin's privacy and efficiency, enhancing its functionality and appeal.

- Layer-2 scaling solutions: Various Layer-2 solutions are under development and deployment, aiming to significantly increase Bitcoin's transaction throughput.

These improvements enhance the functionality and efficiency of the Bitcoin network, making it more attractive to both individual and institutional users. The ongoing development and implementation of these technologies contribute to Bitcoin's long-term value proposition.

Technical Analysis and Price Predictions

Analyzing technical indicators and expert opinions provides valuable insights into potential Bitcoin price movements, although predicting the exact price remains challenging.

Chart Patterns and Indicators

Technical analysis offers clues about potential price trajectories. Examining various indicators can give a clearer picture, though it should not be interpreted as definitive price prediction.

- Support and resistance levels: Identifying key support and resistance levels on the price chart can indicate potential price reversal points.

- Moving averages: Moving averages help to smooth out price fluctuations and identify potential trends.

- Relative Strength Index (RSI): The RSI helps to determine whether Bitcoin is overbought or oversold, indicating potential price corrections.

- MACD: The Moving Average Convergence Divergence (MACD) can help identify changes in momentum and potential trend reversals.

Analyzing these indicators in conjunction can paint a more complete picture of potential price movements. However, it's vital to remember that technical analysis is not foolproof, and unforeseen events can significantly impact the price.

Expert Opinions and Market Sentiment

While expert opinions should be considered, they are not guarantees. Market sentiment plays a crucial role in influencing Bitcoin's price.

- Analysis from renowned cryptocurrency analysts and commentators: Following the opinions of respected analysts offers valuable perspectives, though their views should not be blindly followed.

- Overall market sentiment (bullish vs. bearish): A predominantly bullish market sentiment typically leads to price increases, while bearish sentiment can trigger price declines.

Combining technical analysis with expert opinions and gauging the overall market sentiment provides a more comprehensive perspective on the potential for a continued Bitcoin price rebound.

Risks and Considerations for Bitcoin Investors

Despite the potential for growth, investing in Bitcoin carries inherent risks that investors must acknowledge.

Volatility and Market Risk

Bitcoin's price is highly volatile, meaning it's susceptible to significant and sudden price swings.

- High volatility: Bitcoin's price can fluctuate dramatically in short periods, leading to substantial gains or losses.

- Potential for significant price drops: Corrections and sharp price drops are a common occurrence in the cryptocurrency market.

- Importance of risk management: Employing risk management strategies, such as diversification and dollar-cost averaging, is crucial for mitigating potential losses.

Understanding and accepting the high volatility of Bitcoin is crucial before investing. Diversification across different asset classes and careful risk management are essential to mitigate potential losses.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies remains uncertain, creating potential risks for investors.

- Varying regulatory approaches across different countries: Different countries have adopted varying regulatory approaches, leading to inconsistencies and uncertainty.

- Potential for increased regulation: Governments worldwide are actively considering and implementing new regulations for cryptocurrencies, which could impact Bitcoin's price and accessibility.

- Impact on Bitcoin's price and accessibility: Regulatory changes can negatively or positively impact Bitcoin's price and its accessibility to investors.

Staying informed about regulatory developments is crucial for investors. Uncertainty in this area can significantly influence Bitcoin's price and adoption.

Conclusion

The recent Bitcoin price rebound is driven by a confluence of factors, including increased institutional investment, favorable macroeconomic conditions, technological advancements, and positive technical indicators. While the potential for further growth exists, investors must also consider the inherent volatility and regulatory uncertainties associated with Bitcoin. Understanding these dynamics is essential for making informed investment decisions.

While the future of Bitcoin's price is never certain, understanding the current market dynamics is crucial for informed investment decisions. Stay informed on the latest developments and continue to research the potential of a Bitcoin price rebound to make strategic choices in your cryptocurrency portfolio. Learn more about analyzing Bitcoin price trends and making smart Bitcoin investments.

Featured Posts

-

Arsenal Psg Champions League Semi Final Match Preview And Potential Lineups

May 08, 2025

Arsenal Psg Champions League Semi Final Match Preview And Potential Lineups

May 08, 2025 -

Wednesday April 9th Lottery Results Jackpot Numbers Revealed

May 08, 2025

Wednesday April 9th Lottery Results Jackpot Numbers Revealed

May 08, 2025 -

Tfasyl Sadmt Barbwza W Khsart Alasnan Fy Marakana

May 08, 2025

Tfasyl Sadmt Barbwza W Khsart Alasnan Fy Marakana

May 08, 2025 -

The Biggest Oscars Snubs Of All Time Shocking Omissions From The Academy Awards

May 08, 2025

The Biggest Oscars Snubs Of All Time Shocking Omissions From The Academy Awards

May 08, 2025 -

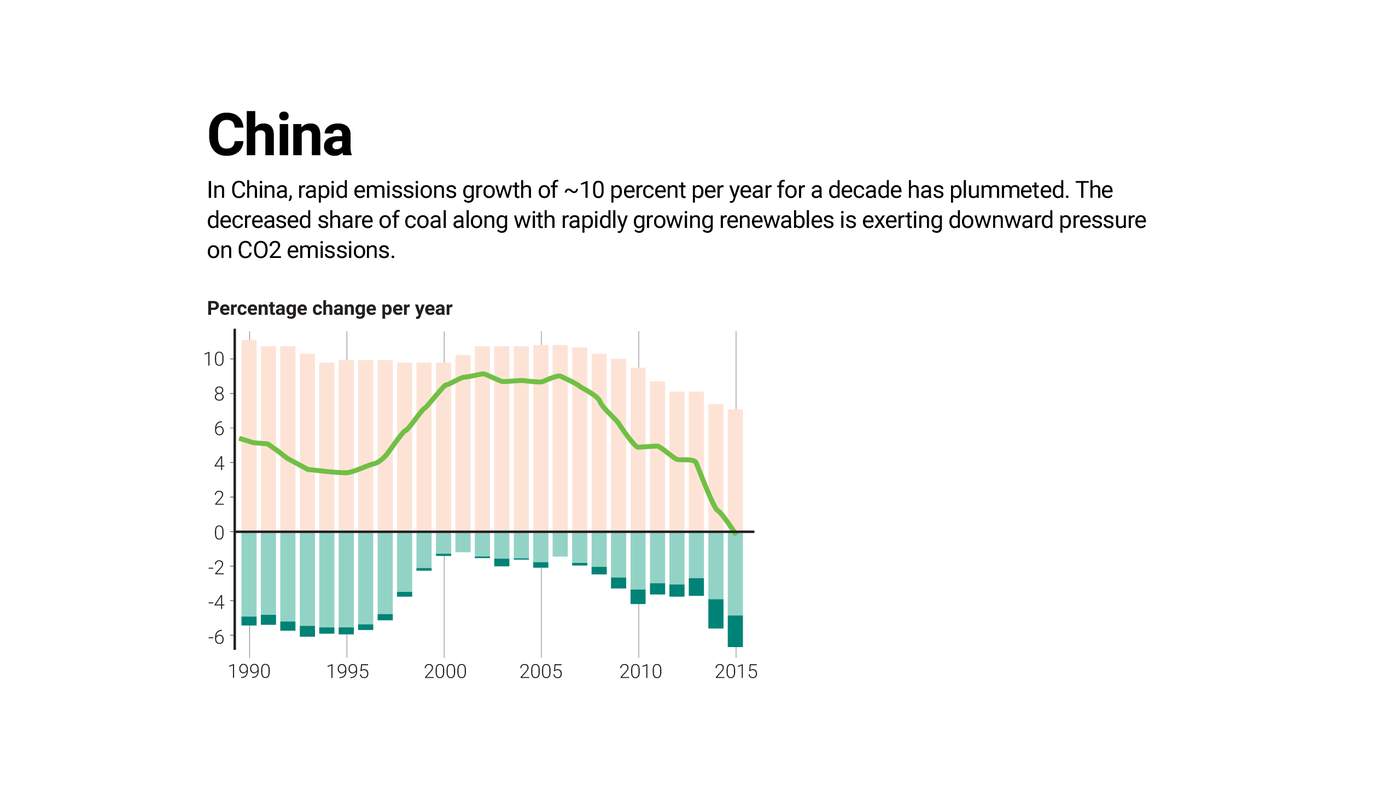

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025