Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Rebound

The current Bitcoin rebound isn't just a fleeting price increase; several factors suggest a more significant shift in market sentiment. Let's explore the key indicators:

Technical Indicators Pointing to a Potential Bull Run

Technical analysis plays a crucial role in understanding market trends. Several key indicators point towards bullish momentum:

- Relative Strength Index (RSI): The RSI has broken above the oversold level, suggesting potential upward momentum. A sustained move above 50 would confirm this bullish trend.

- Moving Average Convergence Divergence (MACD): The MACD histogram shows a potential bullish crossover, indicating a shift in momentum. A clear bullish crossover, coupled with rising price action, is a strong confirmation signal.

- Support and Resistance Levels: Bitcoin's price has recently bounced off key support levels, suggesting strong buying pressure at those price points. Conversely, breaching key resistance levels would signal further upward movement. [Insert chart/graph visualizing RSI, MACD, and support/resistance levels here].

On-Chain Metrics Suggesting Increased Accumulation

On-chain data provides valuable insights into the behavior of Bitcoin holders. Several metrics suggest increased accumulation:

- Exchange Inflows/Outflows: A decrease in Bitcoin supply on exchanges indicates that holders are moving their coins to cold storage, suggesting a long-term holding strategy rather than short-term trading.

- Miner Behavior: Analyzing miner behavior, particularly their selling pressure, can offer valuable insights. Reduced selling pressure suggests increased confidence in the Bitcoin price.

- Coin Days Destroyed (CDD): This metric measures the movement of older coins, indicating whether long-term holders are selling or holding. A lower CDD suggests a strong holding pattern.

Macroeconomic Factors Influencing Bitcoin's Price

Global economic conditions significantly influence Bitcoin's price:

- Inflation and Interest Rates: High inflation and rising interest rates can drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation and currency devaluation.

- Global Economic Uncertainty: Periods of geopolitical instability and economic uncertainty can increase demand for Bitcoin as a safe-haven asset.

- Traditional Market Correlation: While Bitcoin's price often moves independently, it can still be influenced by movements in traditional markets.

Potential Catalysts for a Bitcoin Bull Run

Several factors could further accelerate a Bitcoin bull run:

Institutional Adoption and Investment

The growing involvement of institutional investors is a significant catalyst:

- Grayscale Bitcoin Trust: Grayscale's continued accumulation of Bitcoin demonstrates the increasing confidence of institutional investors in Bitcoin as an asset class.

- MicroStrategy and Other Corporations: Several large corporations have made significant Bitcoin investments, demonstrating its potential as a long-term treasury asset.

- Pension Funds and Endowments: The entry of pension funds and endowments into the Bitcoin market would mark a massive shift in the institutional landscape.

Regulatory Clarity and Development

Clearer regulatory frameworks can boost investor confidence:

- Positive Regulatory Developments: Positive regulatory developments in major jurisdictions, such as the US and EU, could encourage greater institutional investment and wider adoption.

- Regulatory Certainty: Reduced regulatory uncertainty can provide a more predictable environment for investors, fostering confidence and further investment.

Technological Advancements in the Bitcoin Ecosystem

Technological advancements are constantly improving Bitcoin's efficiency and usability:

- The Lightning Network: The Lightning Network's scalability improvements have the potential to make Bitcoin transactions faster and cheaper, increasing its usability for everyday payments.

- Taproot Upgrade: This upgrade significantly enhances Bitcoin's privacy and smart contract capabilities, attracting developers and increasing the platform's functionality.

Potential Risks and Challenges

Despite the positive indicators, several risks and challenges remain:

Volatility and Market Corrections

Bitcoin's price is inherently volatile, and significant corrections are possible:

- Market Volatility: Investors should be prepared for substantial price swings and potential market corrections.

- Risk Management: Implementing effective risk management strategies, such as diversification and stop-loss orders, is crucial.

Regulatory Uncertainty and Potential Bans

Regulatory uncertainty remains a major risk:

- Stricter Regulations: Governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and tighter regulations could negatively impact Bitcoin's price.

- Potential Bans: Although less likely in developed economies, outright bans on Bitcoin in certain jurisdictions are still a potential risk.

Competition from Other Cryptocurrencies

Bitcoin faces competition from other cryptocurrencies:

- Altcoin Competition: The emergence of successful altcoins with innovative features could divert investment away from Bitcoin.

- Maintaining Dominance: Bitcoin needs to maintain its first-mover advantage and adapt to remain the dominant cryptocurrency.

Conclusion

The recent Bitcoin rebound presents a compelling case for a potential bull run, fueled by positive technical indicators, on-chain data, and growing institutional interest. However, it is crucial to acknowledge the inherent volatility and risks associated with Bitcoin investment. While the future remains uncertain, careful analysis of these factors is essential for informed decision-making. Further research into the Bitcoin rebound and its implications for the future is advised before making any investment decisions. Stay informed about the latest developments in the Bitcoin market to make sound judgments regarding this exciting asset. Continue monitoring the Bitcoin rebound and its potential to signal a new bull run. Remember to conduct your own thorough research and consider seeking advice from a qualified financial advisor before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Cantina Canalla Tu Guia Completa Al Mejor Restaurante Mexicano De Malaga

May 08, 2025

Cantina Canalla Tu Guia Completa Al Mejor Restaurante Mexicano De Malaga

May 08, 2025 -

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025 -

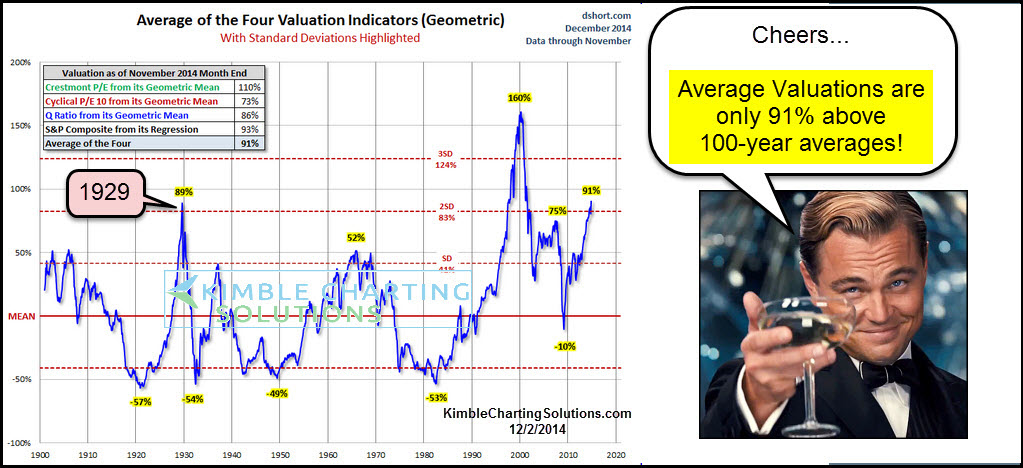

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 08, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 08, 2025 -

Tatum Praises Curry Following Nba All Star Game Performance

May 08, 2025

Tatum Praises Curry Following Nba All Star Game Performance

May 08, 2025 -

Paris Walk Off Homer Secures Angels Win Over White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Over White Sox Despite Rain

May 08, 2025