Bitcoin Soars To New High On Expected US Regulatory Clarity

Table of Contents

The Role of US Regulatory Clarity in Bitcoin's Price Surge

Historically, Bitcoin's price has been notoriously volatile, largely due to the uncertainty surrounding its regulatory landscape. The lack of clear guidelines from governments worldwide, particularly the US, has created a climate of risk aversion among some institutional investors. However, the expectation of clearer regulations is dramatically altering this situation. Reduced regulatory uncertainty significantly decreases investor risk, encouraging institutional participation and driving price increases.

- Reduced regulatory uncertainty leads to increased institutional adoption: Large financial institutions are more likely to invest in Bitcoin when regulatory risks are minimized, leading to substantial capital inflows.

- Clarity on taxation and compliance simplifies Bitcoin transactions: Clearer tax laws and compliance frameworks make it easier for businesses and individuals to transact with Bitcoin, boosting its overall usability.

- Positive regulatory signals attract new investors: Any indication of a favorable regulatory environment, even tentative, attracts a flood of new investors seeking opportunities in this burgeoning market.

- Increased confidence boosts trading volume: As investor confidence grows, trading volume increases, further fueling the price surge and creating a positive feedback loop.

Key Indicators Driving the Bitcoin Price Increase

While the anticipated US regulatory clarity plays a significant role, several other factors are contributing to Bitcoin's price increase. These include:

- Growing adoption by mainstream businesses and institutions: More and more companies, from established corporations to smaller businesses, are accepting Bitcoin as a payment method, increasing demand.

- Increased demand from retail investors fueled by positive news and media coverage: Positive media coverage and increasing awareness among the general public have spurred retail investor interest, creating further upward pressure on the price.

- Scarcity of Bitcoin – limited supply and growing demand: Bitcoin's fixed supply of 21 million coins creates inherent scarcity, driving up its value as demand continues to grow.

- Technological advancements in the Bitcoin ecosystem (e.g., Lightning Network): Improvements in Bitcoin's underlying technology, such as the Lightning Network, enhance scalability and transaction speed, making it more attractive for everyday use.

Potential Risks and Challenges Despite the Positive Momentum

Despite the overwhelmingly positive sentiment, it's crucial to acknowledge the potential risks and challenges:

- Volatility remains inherent in the cryptocurrency market: While regulatory clarity reduces some uncertainty, Bitcoin's price is still susceptible to significant fluctuations.

- Regulatory changes could still be unfavorable despite current expectations: Even with positive signals, future regulatory changes could negatively impact Bitcoin's price.

- Potential for market manipulation and price bubbles: The cryptocurrency market is not immune to manipulation, and the potential for price bubbles always exists.

- Environmental concerns related to Bitcoin mining: The energy consumption associated with Bitcoin mining remains a significant environmental concern that could attract negative regulatory scrutiny.

What the Future Holds for Bitcoin: Predictions and Analysis

Predicting the future price of Bitcoin is inherently speculative, but several analysts offer insights based on current trends and market conditions. Short-term predictions vary widely, with some suggesting continued upward momentum, while others caution against over-optimism. Long-term forecasts are similarly diverse, but many analysts believe Bitcoin’s value will continue to grow as its adoption increases and its role in the financial landscape expands. The impact of global macroeconomic factors, such as inflation and economic uncertainty, will also play a critical role in shaping Bitcoin's future value. Bitcoin's position as a potential hedge against inflation and its potential role in the future of decentralized finance continue to fuel much of the bullish sentiment.

- Analyst predictions for Bitcoin's price in the coming months and years: Reputable sources such as CoinDesk and Bloomberg offer regular analyses and predictions that should be considered.

- Impact of inflation and economic uncertainty on Bitcoin's appeal as a hedge asset: As traditional assets lose value, Bitcoin's appeal as a store of value and hedge against inflation is likely to increase.

- The role of Bitcoin in the future of finance and decentralized technologies: Bitcoin's potential to revolutionize the financial system and drive innovation in decentralized technologies continues to be a key factor driving its long-term value.

Conclusion

Bitcoin's recent surge to new highs is primarily driven by the anticipated US regulatory clarity, reducing uncertainty and attracting institutional investment. While other factors, such as growing mainstream adoption and technological advancements, contribute significantly, potential risks such as volatility and environmental concerns remain. Staying informed about market trends and developments is crucial for navigating this dynamic landscape.

Call to Action: Stay updated on the latest news about Bitcoin and its potential to soar even higher with increased US regulatory clarity. Subscribe to our newsletter for in-depth analysis and insights into the Bitcoin market and other cryptocurrency trends! [Link to Newsletter Signup] You can also follow reputable news sources for the latest updates on Bitcoin price and regulatory developments.

Featured Posts

-

Mz

May 23, 2025

Mz

May 23, 2025 -

Harsh Words For Ten Hag Luis Castro Speaks Out On Ronaldos Treatment

May 23, 2025

Harsh Words For Ten Hag Luis Castro Speaks Out On Ronaldos Treatment

May 23, 2025 -

The Who An Octogenarian Rock Stars Life

May 23, 2025

The Who An Octogenarian Rock Stars Life

May 23, 2025 -

England Lions Vs India A Woakes Comeback Highlights 15 Player Squad

May 23, 2025

England Lions Vs India A Woakes Comeback Highlights 15 Player Squad

May 23, 2025 -

Helicopter And Ground Evacuation Of Livestock Amidst Swiss Landslide Risk

May 23, 2025

Helicopter And Ground Evacuation Of Livestock Amidst Swiss Landslide Risk

May 23, 2025

Latest Posts

-

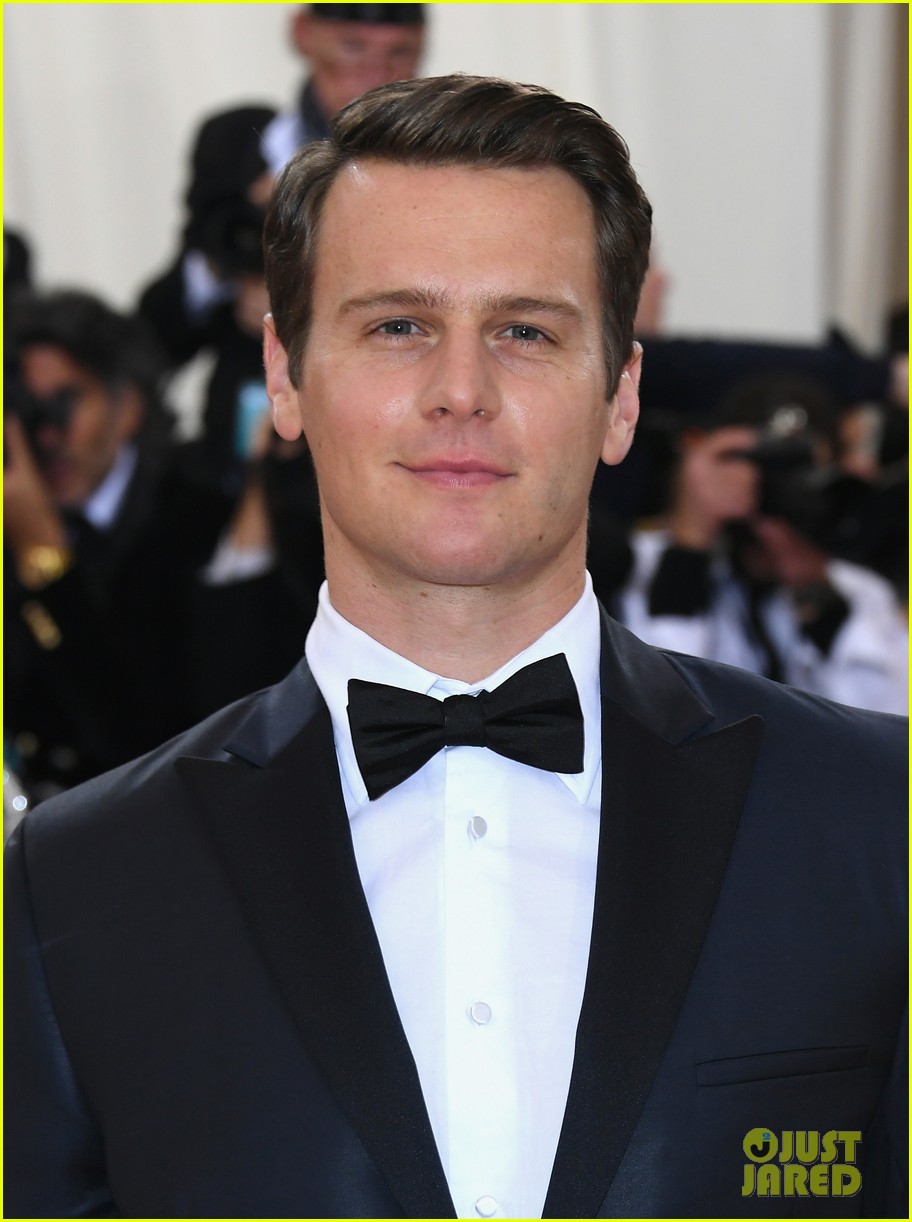

Jonathan Groff And Just In Time A Broadway Tony Awards Prediction

May 23, 2025

Jonathan Groff And Just In Time A Broadway Tony Awards Prediction

May 23, 2025 -

Just In Time Jonathan Groffs Broadway Performance And Tony Prospects

May 23, 2025

Just In Time Jonathan Groffs Broadway Performance And Tony Prospects

May 23, 2025 -

The Jonas Brothers Joe Jonas And A Hilarious Fan Encounter

May 23, 2025

The Jonas Brothers Joe Jonas And A Hilarious Fan Encounter

May 23, 2025 -

The Best Response How Joe Jonas Handled A Couples Argument

May 23, 2025

The Best Response How Joe Jonas Handled A Couples Argument

May 23, 2025 -

Jonathan Groff Could Just In Time Lead To A Historic Tony Win

May 23, 2025

Jonathan Groff Could Just In Time Lead To A Historic Tony Win

May 23, 2025