Bitcoin Vs MicroStrategy Stock: Investment Analysis For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

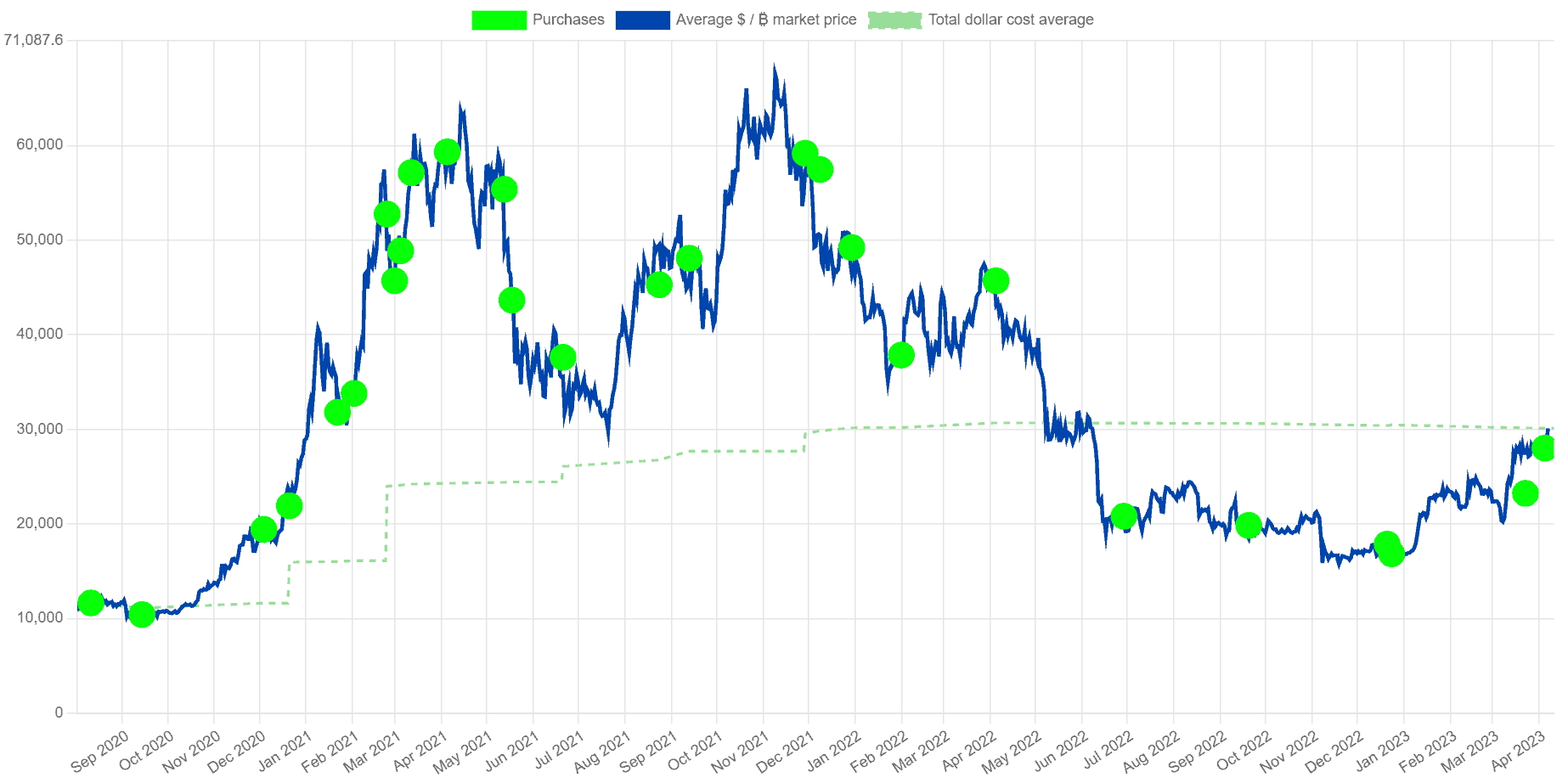

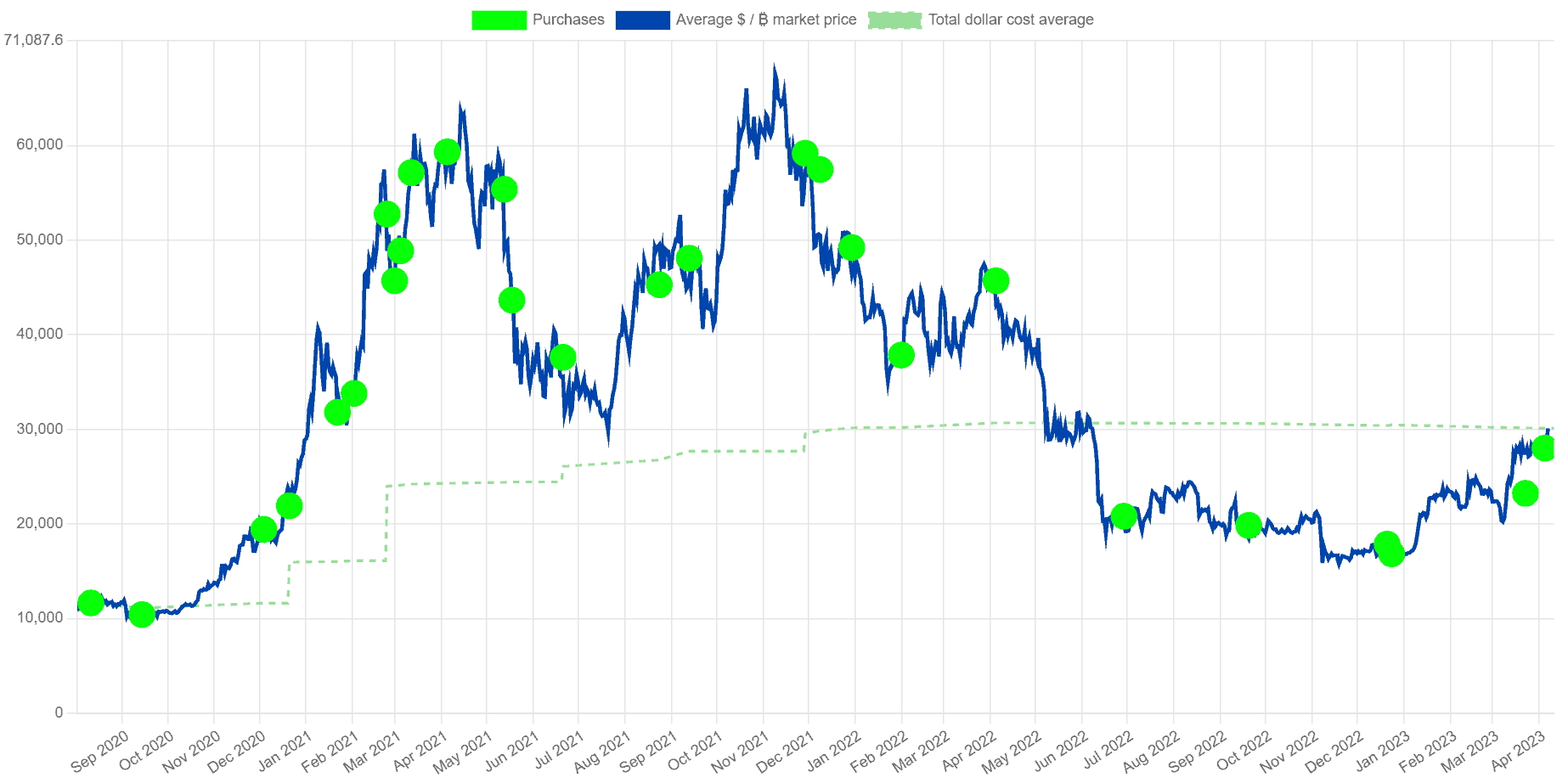

Bitcoin's Price Volatility and Growth Projections

Bitcoin's price has historically shown significant volatility. Dramatic price swings are a characteristic feature of this nascent asset class. However, its price movements are influenced by a complex interplay of factors. Predicting its future price with certainty is impossible, but analyzing potential drivers can provide a clearer picture for 2025.

Potential price drivers for Bitcoin in 2025 include:

- Increased Institutional Adoption: Further adoption by large financial institutions and corporations could significantly boost demand and price.

- Regulatory Clarity: Clearer and more favorable regulatory frameworks globally could legitimize Bitcoin's status as an asset class, attracting more institutional and retail investors.

- Technological Advancements: Improvements in scalability, such as the Lightning Network, could enhance Bitcoin's usability and transaction efficiency, driving adoption.

- Macroeconomic Factors: Global economic instability and inflation could drive investors towards Bitcoin as a hedge against inflation and a store of value.

Several price prediction models exist, ranging from extremely bullish to bearish scenarios. However, it's crucial to remember that these models are based on assumptions and historical data, and their accuracy is uncertain.

- Bullish Scenarios: Increased institutional adoption, successful Lightning Network scaling, and growing global adoption could propel Bitcoin's price to significantly higher levels.

- Bearish Scenarios: Stringent regulatory crackdowns, major security breaches, or a broader cryptocurrency market crash could lead to significant price declines.

Bitcoin's Role in a Diversified Portfolio

Portfolio diversification is a cornerstone of sound investment strategy. It helps mitigate risk by spreading investments across different asset classes. Bitcoin, due to its low correlation with traditional assets like stocks and bonds, can play a valuable role in a diversified portfolio.

- Hedge Against Inflation: Bitcoin's limited supply and decentralized nature can make it an attractive hedge against inflation, particularly during periods of economic uncertainty.

- Store of Value: Many investors view Bitcoin as a store of value, similar to gold, although its volatility makes this a controversial view.

- Correlation with Traditional Assets: Empirical evidence suggests a relatively low correlation between Bitcoin and traditional assets. This makes it a potentially useful tool for reducing overall portfolio risk.

Allocating Bitcoin within a diversified portfolio requires careful consideration of your risk tolerance and investment goals. A common approach is to allocate a small percentage (e.g., 5-10%) of your portfolio to Bitcoin, depending on your risk appetite.

Analyzing MicroStrategy's Stock Performance and Bitcoin Holdings

MicroStrategy's Business Model and Financial Health

MicroStrategy's core business is enterprise analytics and software, but its substantial Bitcoin holdings have become a defining characteristic. The company's financial health is inextricably linked to the performance of Bitcoin. Analyzing its financial performance is vital for assessing its investment potential.

Key financial metrics to consider include:

- Revenue Growth: Examining MicroStrategy's revenue growth trends reveals the underlying health of its core business operations.

- Debt-to-Equity Ratio: This metric provides insight into the company's financial leverage and risk.

- Profit Margins: Analyzing profit margins reveals the profitability and efficiency of MicroStrategy's operations.

A thorough assessment of these metrics provides a picture of MicroStrategy's long-term financial sustainability independent of its Bitcoin holdings.

The Impact of Bitcoin's Price on MicroStrategy's Stock

MicroStrategy's stock price is highly sensitive to fluctuations in Bitcoin's price. As the company holds a significant amount of Bitcoin, a rise or fall in Bitcoin's value directly affects the company's valuation. This correlation presents both opportunities and risks:

- Positive Correlation: When Bitcoin's price rises, MicroStrategy's stock price typically follows suit, leading to potential capital gains for investors.

- Negative Correlation: Conversely, a decline in Bitcoin's price often leads to a decrease in MicroStrategy's stock price, resulting in potential losses.

Analyzing charts and graphs illustrating the historical relationship between Bitcoin's price and MicroStrategy's stock price is crucial for understanding this dynamic. This relationship highlights the inherent risk associated with investing in MicroStrategy due to its heavy reliance on Bitcoin.

Bitcoin vs. MicroStrategy Stock: A Direct Comparison

Risk Tolerance and Investment Goals

Choosing between Bitcoin and MicroStrategy stock depends heavily on your risk tolerance and investment goals.

- Risk Tolerance: Bitcoin is significantly more volatile than MicroStrategy stock. Investors with a higher risk tolerance might find Bitcoin more appealing, while those with a lower risk tolerance might prefer the relative stability of MicroStrategy, although it still carries considerable risk linked to Bitcoin's price.

- Investment Goals: Short-term investors might find the volatility of both assets challenging. Long-term investors, however, may be willing to ride out short-term fluctuations to potentially benefit from the long-term growth of either asset.

| Feature | Bitcoin | MicroStrategy Stock |

|---|---|---|

| Volatility | High | Moderately High |

| Liquidity | Relatively High | High |

| Diversification | Standalone asset | Part of a diversified market |

| Investment type | Cryptocurrency | Traditional Equity |

| Exposure to BTC | Direct | Indirect (through holdings) |

Conclusion

This analysis has compared the investment potential of Bitcoin and MicroStrategy stock for 2025, highlighting their unique risk profiles and potential rewards. Both options present opportunities but require careful consideration of your individual risk tolerance and investment goals. MicroStrategy offers a less volatile entry point into the Bitcoin market, while directly investing in Bitcoin presents potentially higher rewards but also significantly higher risk.

Call to Action: Before making any investment decisions regarding Bitcoin or MicroStrategy stock for 2025, conduct thorough research and consult with a qualified financial advisor. Remember that any investment in Bitcoin or MicroStrategy carries inherent risk. Careful analysis of your individual circumstances and risk tolerance is paramount before committing to a Bitcoin vs. MicroStrategy investment strategy.

Featured Posts

-

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025 -

Darkseids Legion Attacks Dc Comics Superman July 2025 Solicits Revealed

May 08, 2025

Darkseids Legion Attacks Dc Comics Superman July 2025 Solicits Revealed

May 08, 2025 -

Nba Playoff Triple Doubles Leader Quiz Test Your Basketball Knowledge

May 08, 2025

Nba Playoff Triple Doubles Leader Quiz Test Your Basketball Knowledge

May 08, 2025 -

Market Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025