Bitcoin's Critical Juncture: Price Levels And Market Analysis

Table of Contents

Current Bitcoin Price Levels and Support/Resistance

Understanding current Bitcoin price levels and identifying key support and resistance zones is crucial for any market analysis. At the time of writing, Bitcoin is trading around [Insert Current Bitcoin Price – this needs to be updated regularly for accuracy]. This price relates to several significant historical levels. For example, the $20,000 level acted as strong support during previous market downturns, while $30,000 represents a key resistance level. These psychological barriers, often round numbers, exert significant influence on investor sentiment.

- Key Support Levels: $20,000, $18,000 (potential)

- Key Resistance Levels: $30,000, $35,000 (potential)

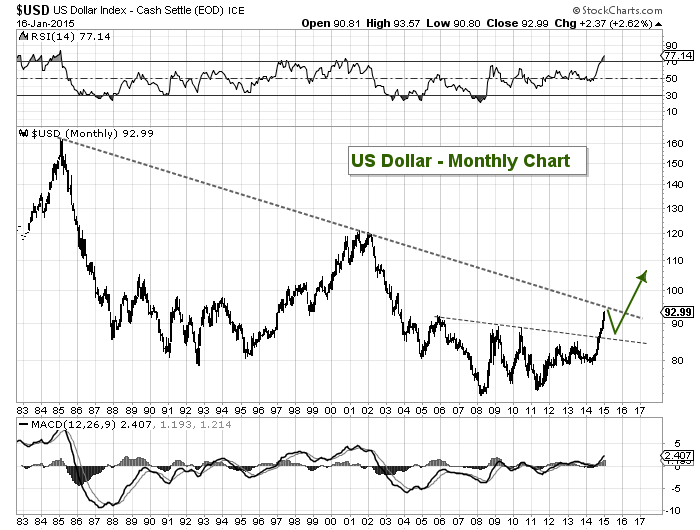

Breaking through these levels can dramatically impact market sentiment. A decisive break above $30,000 could trigger a bullish rally, attracting further investment. Conversely, a fall below $20,000 might intensify bearish pressure, leading to further price declines. Analyzing the Bitcoin price chart using technical indicators like moving averages and Relative Strength Index (RSI) can provide additional insights into potential price movements. [Insert relevant Bitcoin price chart here]. Keywords: Bitcoin price chart, support levels, resistance levels, technical analysis Bitcoin

Macroeconomic Factors Influencing Bitcoin Price

Bitcoin's price isn't immune to macroeconomic conditions. Global economic events significantly influence its value. Several factors are currently at play:

- Inflation: High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against currency devaluation.

- Interest Rates: Rising interest rates can reduce the appeal of riskier assets, potentially impacting Bitcoin's price negatively.

- Recessionary Fears: Economic uncertainty can lead investors to seek safer havens, impacting Bitcoin's price depending on its perceived risk profile.

- Regulatory Uncertainty: Unclear or changing regulations across different jurisdictions create volatility.

Bitcoin's role as a potential inflation hedge is a key driver of its price. Its limited supply of 21 million coins makes it a deflationary asset, contrasting with inflationary fiat currencies. However, the correlation between Bitcoin and traditional markets remains a subject of ongoing debate. While some periods show a correlation, others demonstrate Bitcoin's independence, highlighting its unique characteristics. Keywords: Bitcoin inflation hedge, macroeconomic factors Bitcoin, Bitcoin correlation

Bitcoin Adoption and Network Activity

The growth of Bitcoin adoption and its network activity are vital indicators of its health and future potential. Adoption is increasing across diverse sectors:

- Payments: While still limited, Bitcoin's use as a payment method is gradually growing.

- Decentralized Finance (DeFi): Bitcoin is increasingly integrated into DeFi platforms, unlocking new possibilities.

On-chain metrics provide crucial insights into network health and investor confidence:

- Transaction Volume: High transaction volume indicates strong network activity and potential price growth.

- Hash Rate: A high hash rate signifies a robust and secure network, increasing confidence in Bitcoin's resilience.

- Active Addresses: The number of active addresses reflects the number of unique users interacting with the network.

Increased transaction fees and network congestion can be a double-edged sword. While they signal high demand, they can also deter some users. Miner profitability is also a crucial aspect; if profitability decreases significantly, it can affect the security of the network. Keywords: Bitcoin adoption rate, on-chain metrics, Bitcoin network activity

The Role of Institutional Investors

Large-scale institutional investment profoundly impacts Bitcoin's price stability. The entry of major players like MicroStrategy and Tesla has significantly influenced price movements. Their strategies, which often involve accumulating Bitcoin as a long-term investment, can stabilize prices and reduce volatility.

- Investment Strategies: Institutional investors typically focus on long-term price appreciation.

- Future Inflows: Further institutional adoption could further legitimize Bitcoin and drive price increases. However, sudden large sell-offs from these "Bitcoin whales" can also create significant short-term price drops. Keywords: Institutional Bitcoin investment, Bitcoin whales, large-scale Bitcoin investors

Regulatory Landscape and its Impact

The regulatory landscape surrounding Bitcoin varies considerably across jurisdictions. This uncertainty greatly impacts investor sentiment and price volatility.

- Varying Regulations: Some countries embrace Bitcoin, while others maintain strict regulations or outright bans.

- Potential for Stricter Rules: The evolution of regulatory frameworks globally is ongoing, with potential for stricter rules in the future.

- Government Pronouncements: Statements from governments and regulatory bodies significantly influence market sentiment.

Navigating this regulatory landscape is challenging, but understanding its potential impact is crucial for risk management. Keywords: Bitcoin regulation, cryptocurrency regulation, government Bitcoin policy

Conclusion

Bitcoin’s current price levels represent a critical juncture, influenced by a complex interplay of macroeconomic factors, network activity, institutional investment, and regulatory developments. Understanding these interconnected elements is vital for navigating this dynamic market. While predicting Bitcoin's future price is inherently difficult, careful observation of these key indicators provides a valuable framework for making informed decisions. Stay informed on the latest Bitcoin price levels and market analysis to make well-considered decisions in this dynamic market. Continue your research on Bitcoin price prediction, Bitcoin market trends, and Bitcoin investment strategies for a complete understanding.

Featured Posts

-

Tatums All Star Game Takeaways His Thoughts On Steph Curry

May 08, 2025

Tatums All Star Game Takeaways His Thoughts On Steph Curry

May 08, 2025 -

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Kundrejt Psg Se

May 08, 2025

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Kundrejt Psg Se

May 08, 2025 -

Postane Personel Alimlari 2025 Basvuru Tarihi Ve Detaylar

May 08, 2025

Postane Personel Alimlari 2025 Basvuru Tarihi Ve Detaylar

May 08, 2025 -

Xrp Price Surge Can It Climb Further After A 400 Increase

May 08, 2025

Xrp Price Surge Can It Climb Further After A 400 Increase

May 08, 2025 -

Watch 3 Free Star Wars Andor Episodes On You Tube

May 08, 2025

Watch 3 Free Star Wars Andor Episodes On You Tube

May 08, 2025