Bitcoin's Future: Examining A 1,500% Price Prediction

Table of Contents

Factors Supporting a 1,500% Bitcoin Price Surge

Several key elements could potentially propel Bitcoin's price to unprecedented heights, even to the levels suggested by the 1,500% Bitcoin price prediction.

Increased Institutional Adoption

The growing acceptance of Bitcoin by institutional investors is a significant catalyst for price appreciation. This institutional investment in Bitcoin is no longer a niche phenomenon.

- Examples of Major Firms Adopting Bitcoin: MicroStrategy, Tesla, and several other publicly traded companies have made substantial Bitcoin acquisitions, demonstrating a growing confidence in its long-term value. This signifies a shift from individual investors to large-scale institutional holdings, bolstering price stability.

- Growth in Bitcoin-Related ETFs: The emergence of Bitcoin exchange-traded funds (ETFs) simplifies access for institutional investors, further fueling demand and market liquidity.

- Impact on Price Stability: While not immune to volatility, increased institutional investment generally brings greater price stability and reduced susceptibility to wild swings, paving the way for more sustainable, long-term growth. This influx of capital could be a major factor in any future Bitcoin price prediction.

Growing Global Adoption and Demand

The adoption of Bitcoin is expanding rapidly across the globe, particularly in developing countries where traditional financial systems are less robust. This global Bitcoin adoption is a crucial factor.

- Statistics on Bitcoin Usage in Different Regions: Data shows a significant rise in Bitcoin usage in regions with high inflation or limited access to traditional banking, indicating a growing demand for decentralized financial solutions.

- Impact of Emerging Markets on Bitcoin's Value: Emerging markets are becoming key drivers of Bitcoin demand. As more individuals in these regions embrace Bitcoin, the overall demand and, consequently, the price, is likely to increase. This expanding base of users contributes significantly to any realistic Bitcoin price prediction.

Scarcity and Deflationary Nature of Bitcoin

Bitcoin's inherent scarcity, limited to a maximum of 21 million coins, is a crucial factor contributing to its long-term value proposition. This deflationary nature contrasts sharply with fiat currencies prone to inflation.

- Comparison to Fiat Currencies: Unlike fiat currencies, which central banks can print at will, leading to inflation, Bitcoin's fixed supply creates a deflationary pressure that increases its value over time.

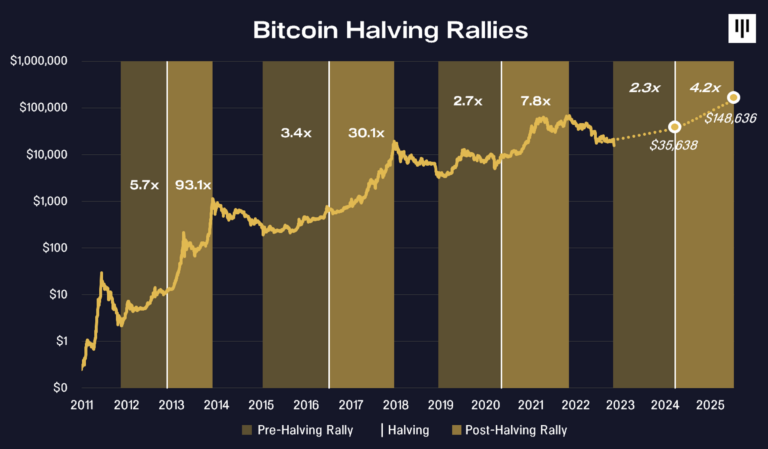

- The Halving Events: The halving events, which reduce Bitcoin's block reward approximately every four years, further contribute to its scarcity and potential for price appreciation.

- Impact of Limited Supply on Long-Term Value: The finite supply makes Bitcoin a potentially attractive store of value, particularly as global inflation concerns rise. This scarcity is a central tenet in many Bitcoin price predictions.

Technological Advancements and Network Effects

Continuous technological advancements and growing network effects are also supporting Bitcoin's growth potential.

- Examples of Layer-2 Solutions Improving Scalability: Layer-2 scaling solutions, such as the Lightning Network, are addressing Bitcoin's scalability challenges, improving transaction speeds and reducing fees. This increased efficiency can boost adoption.

- The Impact of Network Effects on Bitcoin's Dominance: The larger Bitcoin's network grows, the more secure and valuable it becomes. This network effect creates a positive feedback loop, driving further adoption and price appreciation. This is an important factor in long-term Bitcoin price prediction models.

Factors Against a 1,500% Bitcoin Price Surge

Despite the potential for significant growth, several factors could hinder Bitcoin from reaching a 1,500% price increase.

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty and potential government intervention pose significant risks to Bitcoin's price.

- Examples of Regulatory Actions in Different Countries: Governments worldwide are taking different approaches to regulating cryptocurrencies, creating uncertainty and potential for price volatility.

- Potential for Price Suppression: Strict regulations or outright bans could negatively impact Bitcoin's price and adoption rate. This regulatory uncertainty is a crucial factor in any realistic Bitcoin price prediction.

Market Volatility and Potential for Corrections

The cryptocurrency market is inherently volatile, subject to significant price swings and potential corrections.

- Historical Examples of Bitcoin Price Crashes: Bitcoin's history is marked by periods of intense volatility, including significant price drops.

- Factors Contributing to Volatility: Market sentiment, regulatory news, and macroeconomic factors can all contribute to Bitcoin's price volatility, making any long-term Bitcoin price prediction challenging.

Competition from Other Cryptocurrencies

Bitcoin faces competition from other cryptocurrencies (altcoins), which could potentially limit its dominance and impact its price.

- Examples of Competing Cryptocurrencies: Numerous altcoins offer alternative functionalities and features, potentially attracting investors away from Bitcoin.

- Their Strengths and Weaknesses: While Bitcoin benefits from first-mover advantage and established network effects, competing cryptocurrencies often offer faster transaction speeds or enhanced functionalities, posing a challenge to Bitcoin's dominance. This competition is often overlooked in simplistic Bitcoin price predictions.

Conclusion

The 1,500% Bitcoin price prediction is undoubtedly ambitious. While several factors, including increased institutional adoption, global demand, and inherent scarcity, could contribute to significant Bitcoin price growth, the inherent volatility of the market, regulatory uncertainties, and competition from altcoins present substantial challenges. A balanced perspective acknowledges both the potential for remarkable growth and the significant risks involved. While a 1500% price prediction for Bitcoin remains speculative, understanding the factors driving its potential and inherent risks is crucial. Conduct thorough research before making any investment decisions regarding Bitcoin's future. Consider diversifying your portfolio and only invest what you can afford to lose. Remember that any Bitcoin price prediction carries significant uncertainty.

Featured Posts

-

Unlocking Meaning An Ais Approach To Processing Repetitive Scatological Documents For Podcast Creation

May 08, 2025

Unlocking Meaning An Ais Approach To Processing Repetitive Scatological Documents For Podcast Creation

May 08, 2025 -

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025 -

Okc Thunder Portland Trail Blazers Live Stream Tv Broadcast And Game Time March 7

May 08, 2025

Okc Thunder Portland Trail Blazers Live Stream Tv Broadcast And Game Time March 7

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025 -

Wall Streets Next Big Winner Billionaire Backed Black Rock Etf Projected For 110 Gains

May 08, 2025

Wall Streets Next Big Winner Billionaire Backed Black Rock Etf Projected For 110 Gains

May 08, 2025