Bitcoin's Future: Trump's 100-Day Speech And The Road To $100,000

Table of Contents

Trump's 100-Day Plan and its Ripple Effect on Bitcoin

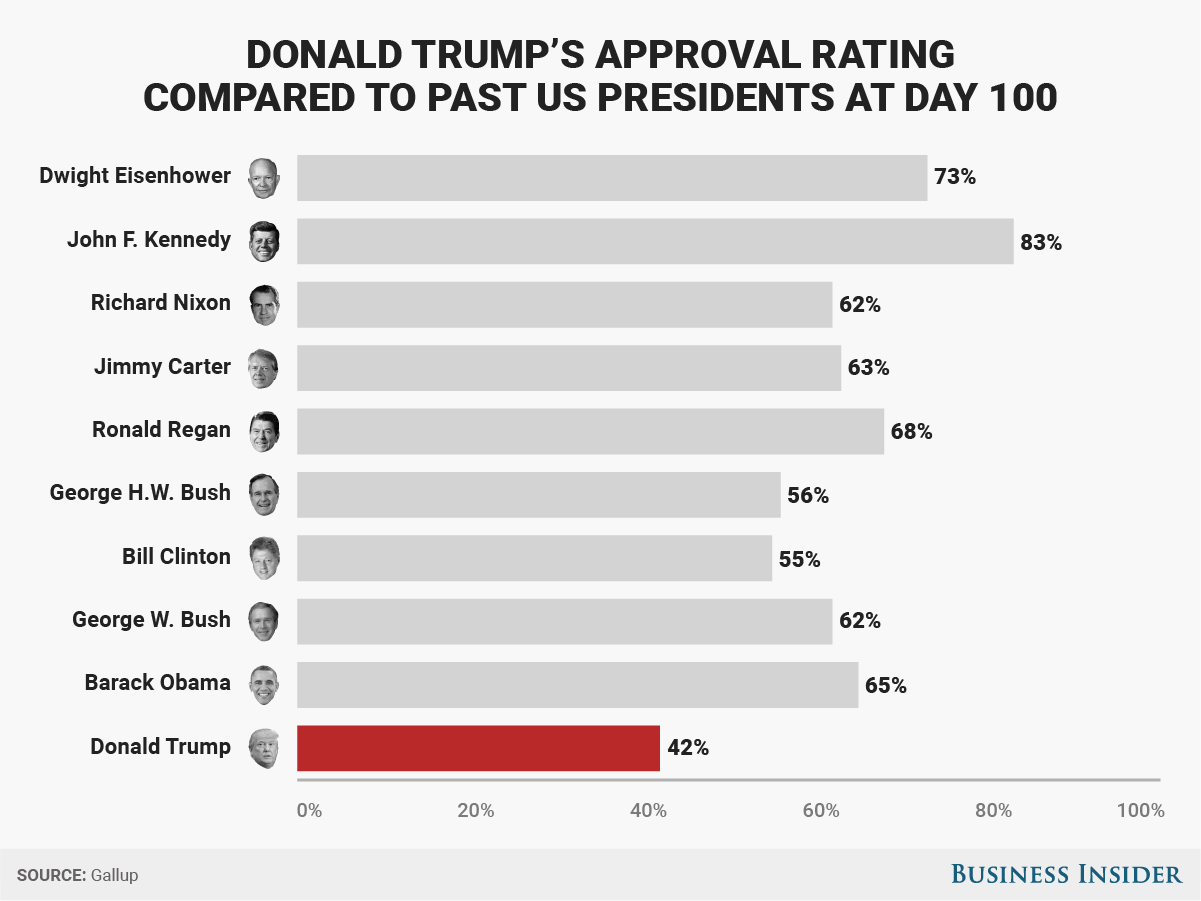

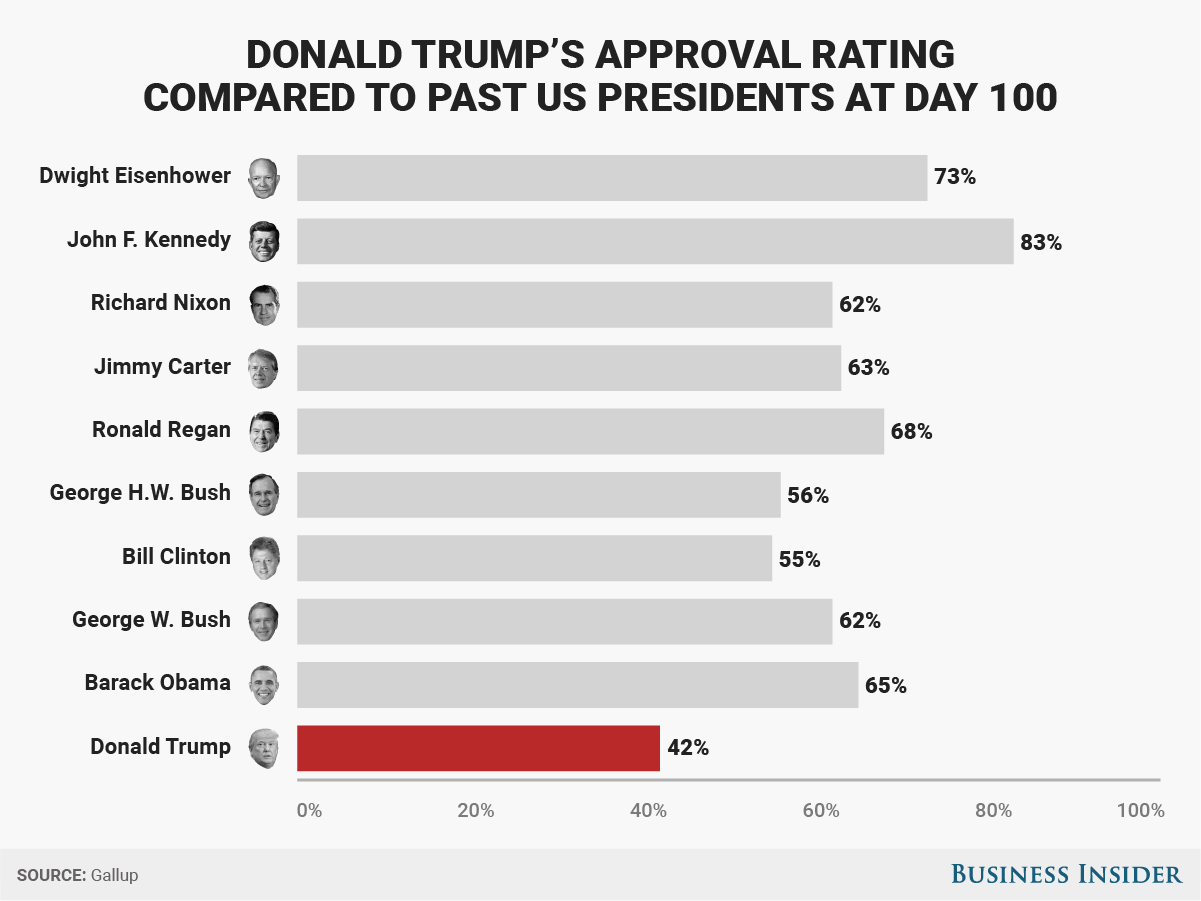

Trump's economic policies, while no longer in effect, had a significant impact on the global economy and, consequently, on Bitcoin's price. Understanding these effects helps us analyze the potential for future Bitcoin price increases.

Fiscal Policy and Inflation

Trump's fiscal policies, characterized by tax cuts and increased government spending, contributed to inflationary pressures. This inflationary environment can drive investors towards Bitcoin, often viewed as a hedge against inflation.

- Inflation and Bitcoin Value: Historically, periods of high inflation have been correlated with increased Bitcoin adoption. Investors seek alternative assets to protect their purchasing power when fiat currencies weaken.

- Historical Examples: The inflationary periods of the 20th century saw the rise of alternative investments. While not a direct parallel, Bitcoin's rise can be partly attributed to periods of economic uncertainty and inflation fears.

- Expert Opinions: Many financial analysts believe that sustained inflation could boost Bitcoin's appeal, driving its price upward. However, this is not universally agreed upon, with some arguing that Bitcoin's price is primarily influenced by market speculation.

- Keywords: Inflation, Bitcoin hedge, inflationary pressures, USD devaluation, Bitcoin price increase.

Regulatory Uncertainty and Bitcoin's Response

The regulatory landscape surrounding Bitcoin remains uncertain, globally. Trump's administration's approach to cryptocurrencies, while not always clearly defined, influenced market sentiment and volatility.

- Positive and Negative Scenarios: Clear, consistent regulations could bring increased institutional investment and legitimacy, boosting Bitcoin's price. Conversely, overly restrictive regulations could stifle innovation and adoption.

- Historical Relationship: Announcements from regulatory bodies like the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) have historically triggered significant Bitcoin price volatility, both positive and negative.

- Keywords: Bitcoin regulation, SEC regulation, regulatory uncertainty, Bitcoin volatility, crypto regulation.

Geopolitical Instability and Bitcoin's Safe Haven Status

Geopolitical instability can significantly impact Bitcoin's price, as investors flock to its decentralized nature seeking a safe haven asset.

- Historical Examples: Events like the 2017-2018 crypto bull run partly coincided with geopolitical uncertainty. The 2020 COVID-19 pandemic also saw a rise in Bitcoin adoption as a store of value.

- Decentralization as a Hedge: Bitcoin's decentralized nature, unlike traditional financial systems, makes it less susceptible to political and economic shocks.

- Keywords: Geopolitical risk, Bitcoin safe haven, decentralized finance (DeFi), Bitcoin as a store of value.

Technological Advancements Fueling Bitcoin's Growth

Technological advancements are key drivers of Bitcoin adoption and price appreciation.

The Lightning Network and Scalability

The Lightning Network, a layer-2 scaling solution, addresses Bitcoin's scalability challenges.

- Benefits of the Lightning Network: This technology enables faster and cheaper transactions, making Bitcoin more suitable for everyday use.

- Transaction Comparisons: Lightning Network transactions offer significantly faster speeds and lower fees compared to on-chain Bitcoin transactions and traditional payment systems.

- Other Layer-2 Solutions: Other layer-2 scaling solutions are emerging, further improving Bitcoin's scalability and efficiency.

- Keywords: Lightning Network, Bitcoin scalability, transaction fees, Bitcoin adoption, layer-2 solutions.

Institutional Investment and Market Maturity

Increasing institutional investment is a major factor driving Bitcoin's price growth and market maturity.

- Institutional Players: Major financial institutions and corporations are increasingly allocating assets to Bitcoin, signaling a growing level of confidence in the cryptocurrency.

- Impact of Adoption: Institutional adoption contributes to price stability, increased liquidity, and reduced volatility.

- Keywords: Institutional investors, Bitcoin ETF, institutional adoption, market maturity, Bitcoin liquidity.

Factors Potentially Hindering Bitcoin's Ascent to $100,000

Despite the potential for growth, several factors could hinder Bitcoin's rise to $100,000.

Regulatory Crackdowns and Market Manipulation

Stricter regulations or increased market manipulation could negatively impact Bitcoin's price.

- Regulatory Intervention: Governments worldwide are increasingly scrutinizing cryptocurrencies, and unforeseen regulations could negatively affect Bitcoin's price.

- Whale Activity: Large holders ("whales") can significantly influence Bitcoin's price through their trading activity, potentially leading to manipulation.

- Keywords: Bitcoin regulation risks, market manipulation, price volatility, whale activity.

Environmental Concerns and Energy Consumption

Bitcoin mining's energy consumption raises environmental concerns.

- Environmental Impact: The energy used for Bitcoin mining has been criticized, contributing to carbon emissions.

- Sustainable Mining: The industry is shifting towards more sustainable practices using renewable energy sources.

- Keywords: Bitcoin mining, energy consumption, environmental sustainability, renewable energy, Bitcoin's carbon footprint.

Conclusion

The road to a $100,000 Bitcoin is complex, influenced by a range of factors. While Trump's policies played a role in shaping the economic landscape which impacted Bitcoin, the future price will depend on the interplay of technological advancements, regulatory developments, and market sentiment. While the potential for substantial growth exists, considerable risks and uncertainties remain. Understanding these factors is crucial for navigating the evolving cryptocurrency market. Continue your research into Bitcoin's future and its potential to navigate the evolving financial landscape. The potential for $100,000 Bitcoin remains a compelling possibility, warranting continued observation and analysis of Bitcoin price prediction models.

Featured Posts

-

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 09, 2025

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 09, 2025 -

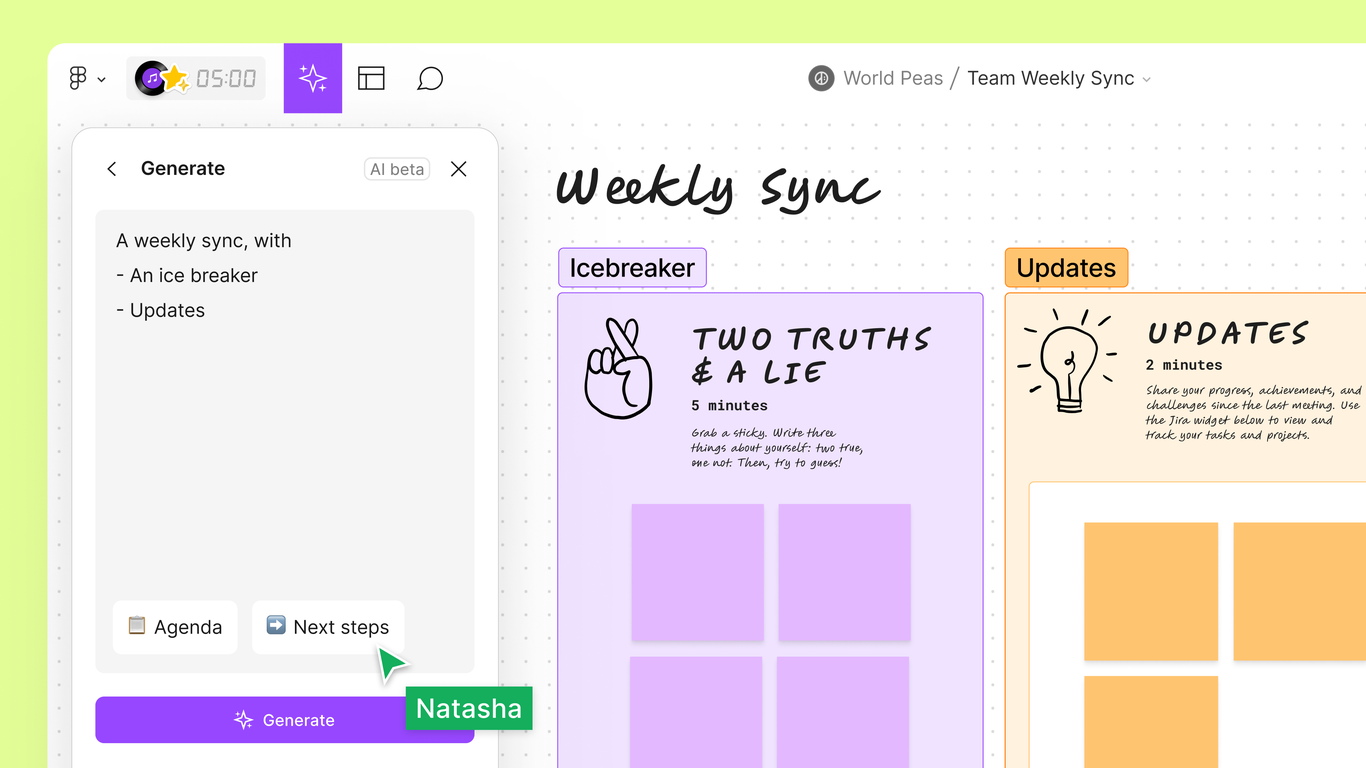

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025 -

Historic Castle Near Manchester To Host Major Music Festival Featuring Olly Murs

May 09, 2025

Historic Castle Near Manchester To Host Major Music Festival Featuring Olly Murs

May 09, 2025 -

Tien Giang Xu Ly Vu Bao Mau Danh Tre Em Va Tang Cuong Giam Sat Cac Co So Giu Tre

May 09, 2025

Tien Giang Xu Ly Vu Bao Mau Danh Tre Em Va Tang Cuong Giam Sat Cac Co So Giu Tre

May 09, 2025 -

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025