Bitcoin's Golden Cross: Analyzing The Implications For The Price

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin Golden Cross is a technical analysis pattern formed when the 50-day simple moving average (SMA) crosses above the 200-day SMA. In simpler terms, it means the short-term average price has surpassed the long-term average price, suggesting a potential shift towards an upward trend. This is widely considered a bullish signal, indicating a possible increase in Bitcoin's price. However, it's crucial to understand that the Golden Cross is not a guaranteed predictor of future price movements; it's just one piece of the puzzle. Relying solely on this indicator for trading decisions can be risky.

- Definition: Intersection where the 50-day moving average surpasses the 200-day moving average. This signifies a potential shift in momentum.

- Bullish Implication: Historically associated with upward price trends, indicating a potential buying opportunity. However, the magnitude and duration of the uptrend vary significantly.

- Not a Guaranteed Signal: The Golden Cross should be considered alongside other technical indicators like the death cross (200-day SMA crossing below the 50-day SMA), RSI, MACD, and fundamental analysis before making any investment decision.

- Risk Management: Essential to avoid solely relying on the Golden Cross for trading decisions. Diversification and careful risk management are crucial.

Historical Performance of Bitcoin's Golden Cross

Analyzing past instances of Bitcoin Golden Crosses reveals a mixed bag of results. While many instances have been followed by periods of price appreciation, the magnitude and duration of these increases have varied considerably. It’s also important to note instances where the signal failed to produce significant upward momentum. This highlights the importance of considering additional factors.

- Case Study 1 (Example): In [insert date], a Bitcoin Golden Cross occurred at approximately $[insert price]. The price subsequently increased by approximately [insert percentage] over the following [insert timeframe] weeks before encountering resistance.

- Case Study 2 (Example): [Insert date]: A Golden Cross was observed, leading to a short-lived rally followed by a correction. This highlights the importance of confirming the signal with other indicators.

- Case Study 3 (Negative Example): [Insert date]: A Golden Cross occurred but was followed by a relatively flat or even downward price trend. This illustrates that the Golden Cross alone is not sufficient to predict future performance.

- Data Sources: For this analysis, data was sourced from reputable exchanges such as Coinbase, Binance, and Kraken, as well as from established charting platforms like TradingView.

Factors Influencing Price Movements After a Bitcoin Golden Cross

While the Golden Cross provides a potential signal, several other factors significantly influence Bitcoin's price after its occurrence. These factors require careful consideration.

- Macroeconomic Conditions: Inflation, interest rate hikes, and global economic downturns can negatively impact Bitcoin's price, regardless of technical indicators.

- Regulatory Landscape: Government regulations and policies concerning cryptocurrency adoption and taxation directly influence market sentiment and price volatility. Stringent regulations can suppress price growth, while favorable regulations can boost it.

- Market Sentiment: Social media trends, news headlines (positive or negative), and overall investor confidence play a major role. Fear, uncertainty, and doubt (FUD) can quickly reverse any upward momentum.

- Network Activity: On-chain metrics such as transaction volume, hash rate, and active addresses provide insights into Bitcoin's underlying network activity and user engagement. Increased activity can be a positive sign.

Trading Strategies and Risk Management Around Bitcoin's Golden Cross

The Golden Cross can be incorporated into various trading strategies, but always with a focus on risk management.

- Long Position Strategy: A long position involves buying Bitcoin after the Golden Cross forms, anticipating an upward price movement. Careful selection of entry and exit points, target price levels, and stop-loss orders are crucial.

- Stop-Loss Orders: Stop-loss orders are essential to limit potential losses if the price moves against the trader's prediction.

- Position Sizing: Never invest more than you can afford to lose. Proper position sizing helps manage risk and prevents catastrophic losses.

- Diversification: Diversifying your investment portfolio across different assets is crucial to reduce overall risk. Don't put all your eggs in one basket.

Conclusion

Bitcoin's Golden Cross serves as a valuable technical indicator, offering insights into potential price movements. However, it's crucial to remember that it's not a foolproof predictor and should be used in conjunction with other analyses. By considering historical performance, macroeconomic factors, and implementing robust risk management strategies, investors can better navigate the complexities of Bitcoin trading following a Golden Cross. To stay informed about Bitcoin price trends and the implications of technical indicators like the Golden Cross, continue researching and analyzing market data. Understanding Bitcoin's Golden Cross is key to making informed investment decisions.

Featured Posts

-

360

May 08, 2025

360

May 08, 2025 -

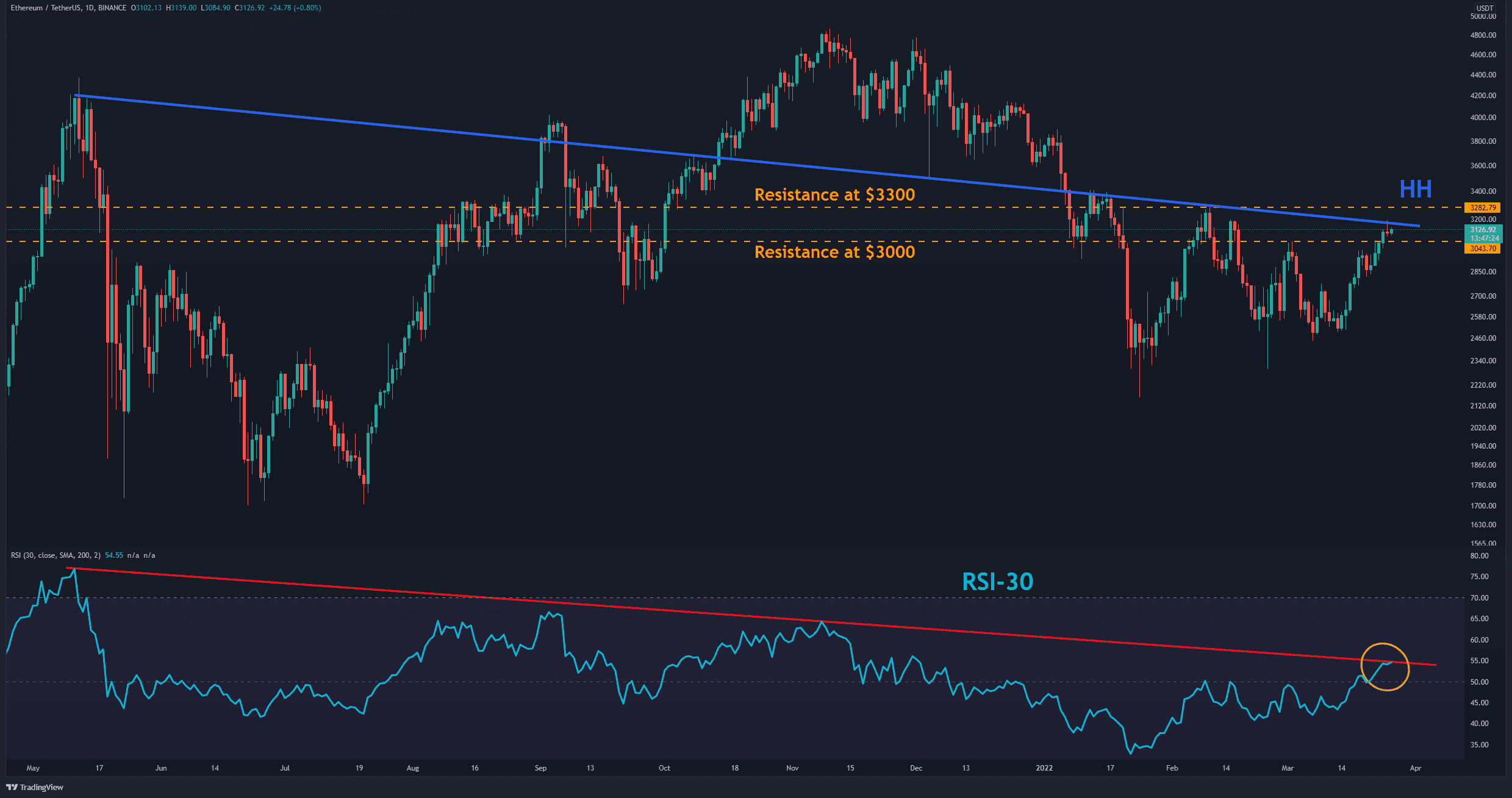

Is An Ethereum Price Breakout On The Horizon Analyzing Recent Resilience

May 08, 2025

Is An Ethereum Price Breakout On The Horizon Analyzing Recent Resilience

May 08, 2025 -

Sergio Hernandez El Entrenador Argentino Llega Al Flamengo

May 08, 2025

Sergio Hernandez El Entrenador Argentino Llega Al Flamengo

May 08, 2025 -

The Daily Lotto Friday April 18th 2025 Results

May 08, 2025

The Daily Lotto Friday April 18th 2025 Results

May 08, 2025 -

Test Your Nba Expertise A Playoff Triple Doubles Quiz

May 08, 2025

Test Your Nba Expertise A Playoff Triple Doubles Quiz

May 08, 2025