Bitcoin's Rise: US-China Trade Talks Fuel Crypto Rally

Table of Contents

Safe Haven Asset: Bitcoin as a Hedge Against Geopolitical Uncertainty

US-China trade disputes often inject considerable uncertainty into global financial markets, prompting investors to seek alternative assets. Bitcoin, with its decentralized and independent nature, is increasingly seen as a hedge against this instability, contributing significantly to Bitcoin's rise.

Decreased Trust in Traditional Markets

Geopolitical turmoil often erodes confidence in traditional markets. Investors, fearing losses in stocks and bonds, seek refuge in assets perceived as less susceptible to political influence.

- Investors move capital from potentially volatile stocks and bonds into Bitcoin. This capital flight significantly boosts demand and consequently, the price of Bitcoin.

- Increased demand pushes Bitcoin's price upward. This creates a positive feedback loop, attracting further investment and further fueling Bitcoin's rise.

- The decentralized nature of Bitcoin makes it less susceptible to government manipulation. This characteristic appeals to investors seeking to protect their assets from potential political fallout stemming from trade disputes.

Flight to Safety

During periods of heightened economic uncertainty, investors traditionally turn to "safe haven" assets like gold. However, Bitcoin is emerging as a compelling digital alternative.

- Comparison of Bitcoin's price movements with gold prices during trade war periods. Analyzing historical data reveals a correlation between heightened trade tensions and increased demand for both Bitcoin and gold, suggesting Bitcoin's growing role as a safe haven.

- Discussion of the role of fear and uncertainty in driving Bitcoin investment. Fear of losing value in traditional assets plays a critical role in the increased demand for Bitcoin during periods of geopolitical instability.

- Analysis of Bitcoin's correlation with other safe-haven assets. Comparing Bitcoin's performance with other assets commonly considered safe havens provides further insight into its role during times of global economic uncertainty.

Increased Demand from Emerging Markets

In countries with strict capital controls, Bitcoin offers a pathway to bypass these restrictions and move assets internationally. US-China tensions often exacerbate this need, particularly for investors in China and other emerging markets, contributing to Bitcoin's rise.

Circumventing Capital Controls

Governments often impose capital controls to manage their currency and prevent capital flight. However, Bitcoin's decentralized nature allows individuals to transfer funds outside these limitations.

- Examples of countries with capital controls and how Bitcoin usage is affected. Analyzing specific cases illustrates how Bitcoin's use increases in countries with strict capital controls, especially during periods of heightened geopolitical uncertainty like those generated by US-China trade disputes.

- Discussion of the potential impact of increased regulation on Bitcoin's use as a tool to circumvent controls. Increased regulatory scrutiny could limit this function, but Bitcoin's adaptability often finds ways to overcome such restrictions.

- Analysis of transaction volumes from countries known for capital controls. Examining transaction data from these countries reveals a direct link between increased geopolitical tension and Bitcoin transaction volume.

Diversification Strategies

Investors in emerging markets are actively diversifying their portfolios to mitigate risks associated with political and economic instability. Bitcoin is playing an increasingly important role in these strategies.

- Statistics on Bitcoin adoption in emerging markets. Data illustrating the growing rate of Bitcoin adoption in regions susceptible to US-China trade tensions showcases the diversification efforts of investors.

- Case studies showing how investors are using Bitcoin to diversify. Examples of individual investors or institutions using Bitcoin to hedge against geopolitical risk highlight the asset's growing importance.

- Future projections for Bitcoin adoption based on geopolitical factors. Forecasting future adoption rates based on the continuation of US-China trade tensions and other geopolitical risks provides insights into the future potential of Bitcoin.

Impact of Regulatory Uncertainty

The lack of clear regulatory frameworks for cryptocurrencies worldwide creates both opportunities and challenges. US-China trade talks can influence regulatory decisions, adding another layer of uncertainty that can affect Bitcoin's price.

Regulatory Ambiguity

The ambiguous regulatory landscape surrounding cryptocurrencies can create volatility. Differing regulatory approaches between the US and China, influenced by trade negotiations, further complicate matters.

- Analysis of recent regulatory pronouncements related to Bitcoin from major jurisdictions. Examining regulatory developments in key markets reveals the impact of global political dynamics on Bitcoin's regulatory environment.

- Discussion of the potential effects of differing regulatory approaches between the US and China on Bitcoin's price. Analyzing the potential impact of diverging regulatory stances helps understand how trade talks might influence investor behavior and Bitcoin's value.

- Examination of the relationship between regulatory clarity and investor confidence in Bitcoin. Regulatory clarity tends to boost investor confidence, leading to greater market stability, which can impact the price of Bitcoin.

Conclusion

The relationship between US-China trade talks and Bitcoin's price is complex but undeniable. As geopolitical uncertainty persists, Bitcoin's status as a potential safe haven asset and a tool for circumventing capital controls continues to drive demand, fueling Bitcoin's rise. Understanding the interplay between these macroeconomic factors and the cryptocurrency market is crucial for investors navigating this volatile landscape. To stay informed on the future of Bitcoin's rise and its connection to global events, continue following news and analyses of the cryptocurrency market and global trade relations. Understanding the dynamics of Bitcoin's price movements requires a keen eye on both technological developments and the wider geopolitical stage. Keep learning about Bitcoin's potential as a safe-haven asset in uncertain times.

Featured Posts

-

The Unseen Costs Liberation Day Tariffs And Their Effect On Stock Markets

May 08, 2025

The Unseen Costs Liberation Day Tariffs And Their Effect On Stock Markets

May 08, 2025 -

Surface Pro 12 Inch Affordable Productivity On The Go

May 08, 2025

Surface Pro 12 Inch Affordable Productivity On The Go

May 08, 2025 -

Selling Sunset Star Highlights Post Fire Landlord Exploitation In La

May 08, 2025

Selling Sunset Star Highlights Post Fire Landlord Exploitation In La

May 08, 2025 -

Bitcoin Madenciliginin Sonu Gercekler Ve Tahminler

May 08, 2025

Bitcoin Madenciliginin Sonu Gercekler Ve Tahminler

May 08, 2025 -

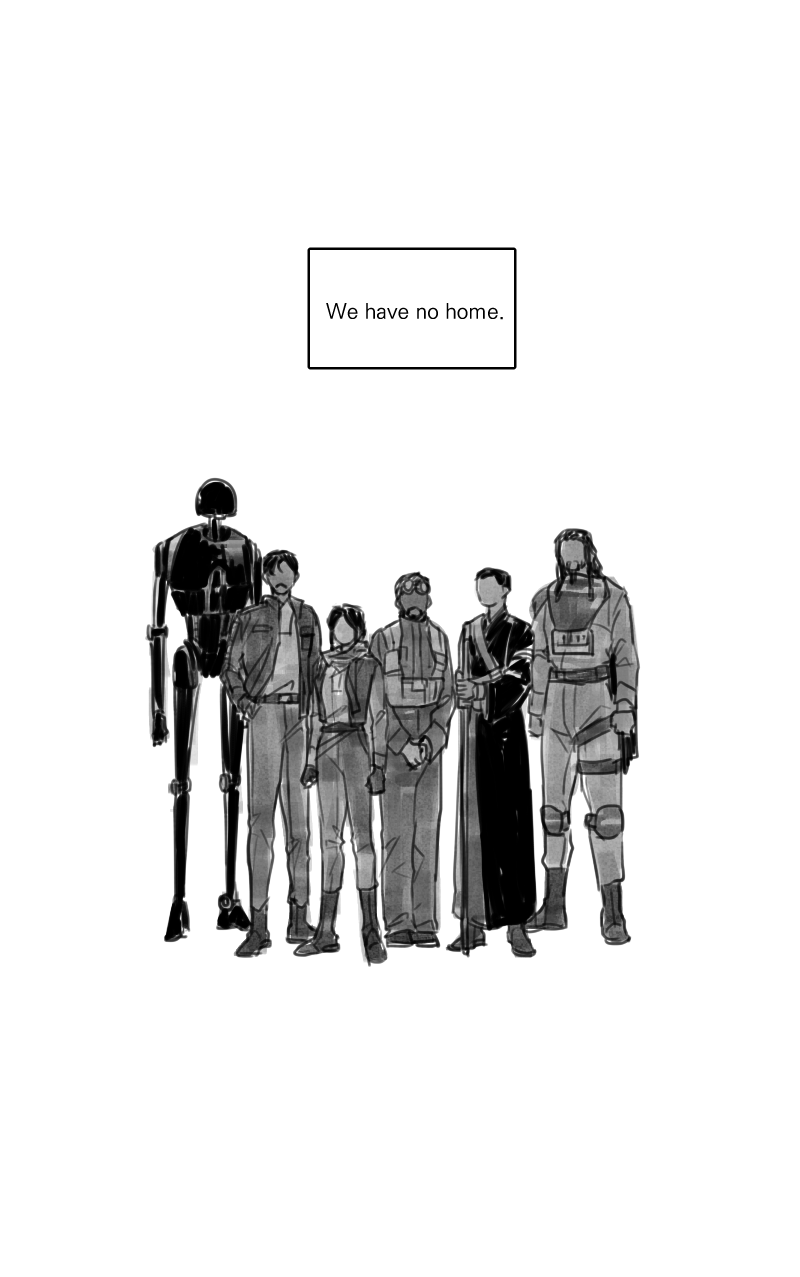

A Rogue One Stars Honest Opinion On A Fans Favorite

May 08, 2025

A Rogue One Stars Honest Opinion On A Fans Favorite

May 08, 2025