BlackRock ETF: A 110% Return Predicted – Is This The Next Billionaire Investment?

Table of Contents

Understanding the 110% Return Prediction

Source and Methodology of the Prediction

The 110% return prediction for a specific BlackRock ETF (the source and specific ETF will be detailed in the next section) originates from [Source Name – e.g., a specific analyst report from a reputable firm, a market research publication, etc.]. Their methodology reportedly involved [Explain methodology – e.g., a combination of fundamental analysis assessing the underlying assets' growth potential, technical indicators pointing towards bullish market trends, and macroeconomic forecasts predicting favorable economic conditions].

It's crucial to understand the limitations of this prediction. Any projection inherently carries assumptions and risks. For instance, the prediction may rely on specific economic scenarios unfolding as anticipated, a factor that's never guaranteed.

- Timeframe: The 110% return is predicted over a [Specify timeframe – e.g., 5-year, 10-year] period. Shorter time horizons might see significantly different results.

- Contributing Factors: The predicted growth is largely attributed to [List key factors – e.g., strong projected growth in the tech sector, anticipated increase in consumer spending, positive global economic outlook].

- Potential Risks: Factors that could negatively impact the prediction include [List potential risks – e.g., unexpected market downturns, geopolitical instability, changes in regulatory environments impacting the ETF’s holdings].

BlackRock ETF: A Deep Dive into the Investment

Which BlackRock ETF is Predicted to Yield 110%?

The specific BlackRock ETF under consideration is [Insert ETF ticker symbol here – e.g., iShares Core S&P 500 ETF (IVV)]. This is crucial information as the prediction isn't applicable to all BlackRock ETFs.

Analyzing the ETF's Holdings and Investment Strategy

The [Insert ETF ticker symbol here] ETF employs an [Explain investment strategy – e.g., market-cap weighted] strategy, focusing on [Explain sector focus – e.g., large-cap U.S. companies across various sectors]. It aims to track the performance of the [Explain underlying index – e.g., S&P 500 index]. This diversification is meant to mitigate risk compared to investing in individual stocks.

- Top Holdings: The ETF's top holdings typically include major companies like [List top 3-5 holdings – e.g., Apple, Microsoft, Amazon].

- Expense Ratio: The expense ratio is [Insert expense ratio – e.g., 0.04%], indicating the annual cost of managing the fund.

- Historical Performance: [Insert historical performance data, if available, for a relevant period. Compare it to relevant benchmarks]

- Risk Factors: Potential risks include market volatility, sector-specific downturns (e.g., a technology sector crash would negatively impact the ETF if heavily weighted in that sector), and macroeconomic factors.

Assessing the Risks and Rewards of Investing

Potential Downsides and Considerations

While the 110% return prediction is enticing, it's essential to acknowledge the risks. No investment guarantees a specific return, and even well-diversified ETFs are subject to market fluctuations.

Diversification Strategies

Investing in a single ETF, regardless of its potential, exposes you to concentrated risk. Diversification is key. Spread investments across different asset classes (stocks, bonds, real estate) and geographies to mitigate potential losses.

- Market Volatility: Market downturns can significantly impact the ETF's value, potentially offsetting projected gains.

- Geopolitical Factors: Global events can influence market sentiment and ETF performance.

- Risk Tolerance: Your personal risk tolerance and financial goals should guide your investment strategy. A high-risk investment like this may not be suitable for all investors.

- Alternatives: Consider alternatives, like lower-risk bond ETFs, real estate investment trusts (REITs), or index funds, depending on your risk tolerance.

BlackRock ETF vs. Other High-Growth Investments

Compared to other high-growth investments, the BlackRock ETF [Insert ETF ticker symbol here] offers [Compare to other options – e.g., individual stocks offering higher potential returns but with greater risk, or other ETFs with different sector focuses and associated risk profiles].

- Return Potential vs. Risk: Assess the potential return and risk for each option, noting that higher potential returns usually come with higher risk.

- Liquidity and Accessibility: ETFs are generally highly liquid, meaning they can be easily bought and sold.

- Investment Horizon: Consider your investment horizon – are you investing for the long term (10+ years) or short term? This impacts your choice of investment strategy.

Conclusion: BlackRock ETF: Weighing the Potential

The 110% return prediction for the BlackRock ETF [Insert ETF ticker symbol here] presents a potentially lucrative but risky investment opportunity. While the ETF’s diversification and underlying assets offer growth potential, market volatility and other unforeseen events could significantly impact its performance. Thorough due diligence, including understanding the prediction's methodology and limitations, and consulting with a financial advisor, is paramount before investing. Remember, no investment guarantees success, and past performance does not predict future results.

Learn more about BlackRock ETF investments and explore the potential of BlackRock ETFs for wealth creation today. However, always proceed with caution and conduct thorough research before committing your funds. Remember to diversify your portfolio and align your investment strategy with your personal risk tolerance and financial goals.

Featured Posts

-

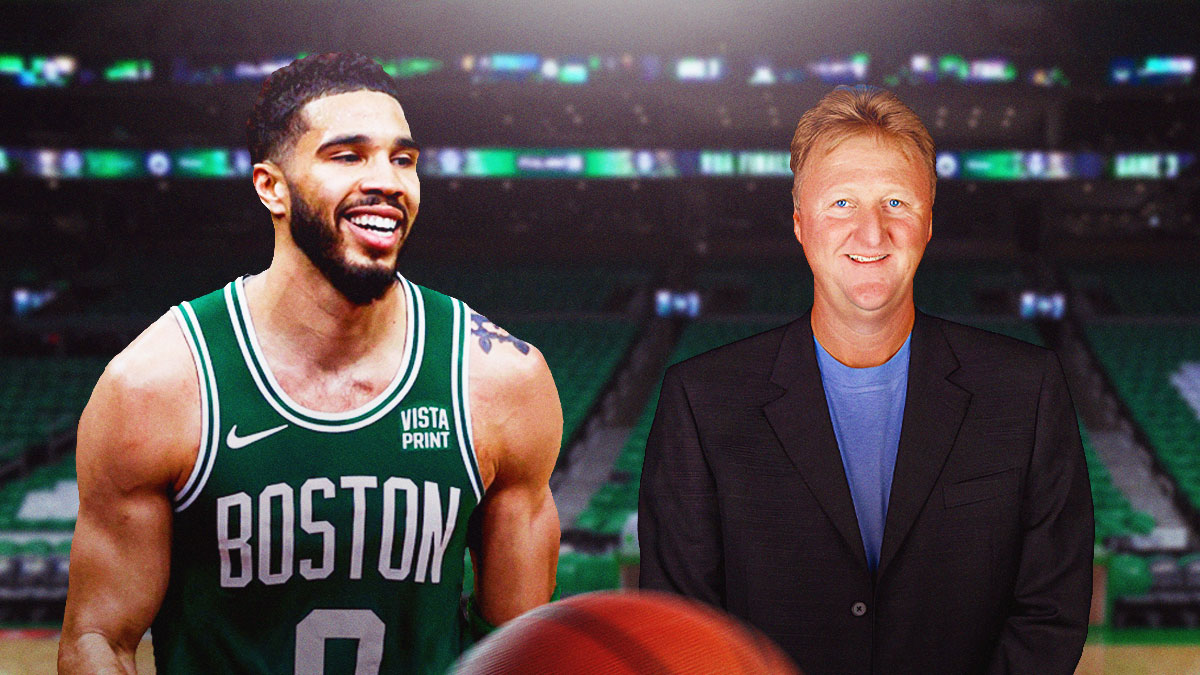

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025 -

See Counting Crows Live This Summer In Downtown Indianapolis

May 08, 2025

See Counting Crows Live This Summer In Downtown Indianapolis

May 08, 2025 -

Understanding Xrps 400 Price Increase And Future Outlook

May 08, 2025

Understanding Xrps 400 Price Increase And Future Outlook

May 08, 2025 -

Punjab Lahore Eid Ul Fitr Weather Update 2 Day Forecast

May 08, 2025

Punjab Lahore Eid Ul Fitr Weather Update 2 Day Forecast

May 08, 2025 -

Carneys Assessment Trump A Transformational President

May 08, 2025

Carneys Assessment Trump A Transformational President

May 08, 2025