BlackRock ETF: A Billionaire Investment Poised For Massive Growth?

Table of Contents

BlackRock's Dominance in the ETF Market

BlackRock, through its iShares platform, is undeniably a giant in the ETF industry. Its market share is a testament to its success, reflecting the trust and confidence investors place in the firm. This dominance stems from several factors:

- Extensive Product Range: iShares offers a vast array of ETFs, covering diverse asset classes, sectors, and investment strategies. This breadth allows investors to diversify their portfolios effectively and tailor their investments to specific objectives.

- Established Track Record: BlackRock's long history and experience provide a sense of stability and reliability. Investing with a large, established firm often translates to lower risk compared to smaller, less-established players.

- Advanced Technology and Research: BlackRock leverages cutting-edge technology and a team of expert researchers to optimize its ETF offerings and provide investors with valuable insights.

Successful BlackRock ETFs:

- iShares Core S&P 500 ETF (IVV): A cornerstone for broad market exposure.

- iShares Core U.S. Aggregate Bond ETF (AGG): A popular choice for fixed-income diversification.

- iShares MSCI Emerging Markets ETF (EEM): Offers exposure to rapidly growing emerging markets.

Investing in BlackRock ETFs means tapping into the resources and expertise of an industry leader, enhancing your chances of navigating the complexities of the ETF market. The BlackRock ETF market share is a clear indicator of its dominance.

Analyzing the Growth Potential of BlackRock ETFs

The growth potential of BlackRock ETFs is fueled by several key trends:

- Rising ETF Popularity: ETFs continue to gain popularity among both individual and institutional investors due to their transparency, liquidity, and low costs.

- Passive Investing Trend: Passive investing strategies, which rely on ETFs to track indices, are increasingly favored over active management. This shift is benefiting providers like BlackRock.

- Technological Advancements: Technological innovations are improving ETF trading efficiency and lowering costs.

BlackRock ETFs with High Growth Potential:

Growth potential varies depending on market conditions and specific sectors. Some BlackRock ETFs potentially positioned for strong growth include those focused on technology, renewable energy, and emerging markets. However, it's crucial to perform thorough due diligence before investing in any specific ETF.

Potential Risks and Challenges:

- Market Volatility: Like all investments, BlackRock ETFs are subject to market fluctuations. Downward trends can impact returns.

- Competition: The ETF market is competitive, and new entrants constantly challenge existing players.

- Sector-Specific Risks: ETFs focused on specific sectors are vulnerable to industry-specific headwinds.

BlackRock ETF Performance Comparison:

To evaluate growth potential, compare the performance of specific BlackRock ETFs against relevant market benchmarks over different time horizons. This will give you a clearer picture of their past performance and potential future trajectory.

Billionaire Investment Strategies and BlackRock ETFs

While specific details of billionaire portfolios are often confidential, it's widely known that many high-net-worth investors and institutional investors utilize ETFs as a core component of their diversification strategies. The appeal is clear:

- Diversification: BlackRock ETFs offer access to a vast range of asset classes, enabling diversification across different markets and sectors.

- Cost-Effectiveness: The low expense ratios of many BlackRock ETFs make them cost-effective options for building a diversified portfolio.

- Transparency and Liquidity: The transparency and liquidity of ETFs enhance their attractiveness for sophisticated investors.

Long-Term Investment Goals:

BlackRock ETFs can be valuable tools in achieving long-term investment goals, such as retirement planning or wealth accumulation. Their diversification and low-cost nature make them suitable for long-term buy-and-hold strategies.

Understanding the Risks and Rewards of BlackRock ETF Investments

Investing in BlackRock ETFs, like any investment, involves both risks and rewards. It's crucial to understand both sides of the equation:

Rewards:

- Diversification: Reduced risk through broad market exposure.

- Low Costs: Expense ratios are generally lower than mutual funds.

- Liquidity: Easy to buy and sell.

Risks:

- Market Downturns: ETF values can decline during market corrections.

- Specific Sector Underperformance: Sector-specific ETFs can underperform if that particular sector experiences difficulties.

- Expense Ratios: Although low, expense ratios still reduce returns over time.

Due Diligence and Risk Tolerance:

Before investing, conduct thorough due diligence, carefully assess your risk tolerance, and potentially seek advice from a qualified financial advisor. Understanding your investment risk tolerance is paramount.

Conclusion: Is a BlackRock ETF Right for Your Investment Portfolio?

BlackRock ETFs offer a compelling blend of diversification, affordability, and access to a wide range of market segments. While they present growth potential, it's vital to remember that investment returns are never guaranteed, and market volatility is a reality. This article has explored the potential benefits of BlackRock ETF investment strategy, highlighting their position within broader billionaire investment strategies and outlining the necessary due diligence to determine their suitability for your portfolio.

Remember, thorough research and understanding your risk tolerance are crucial before investing in any ETF. Consider seeking professional financial advice to ensure a BlackRock ETF investment strategy aligns with your financial goals. Start investing in BlackRock ETFs today, but proceed with caution and informed decision-making. Explore the range of BlackRock ETF offerings and learn more about building a diversified ETF portfolio. Your financial future could benefit from incorporating a well-researched BlackRock ETF investment strategy.

Featured Posts

-

Identifying Emerging Business Hubs A Nationwide Overview

May 08, 2025

Identifying Emerging Business Hubs A Nationwide Overview

May 08, 2025 -

Counting Crows Slip Out Under The Aurora Exploring The Songs Musicality And Influences

May 08, 2025

Counting Crows Slip Out Under The Aurora Exploring The Songs Musicality And Influences

May 08, 2025 -

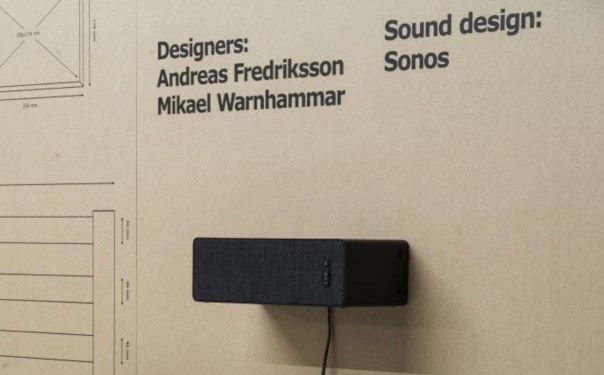

Ikea And Sonos Collaboration Officially Over What It Means For Consumers

May 08, 2025

Ikea And Sonos Collaboration Officially Over What It Means For Consumers

May 08, 2025 -

Xrp Regulatory Uncertainty The Secs Classification And Market Impact

May 08, 2025

Xrp Regulatory Uncertainty The Secs Classification And Market Impact

May 08, 2025 -

Black Rock Etf A 110 Return Predicted Is This The Next Billionaire Investment

May 08, 2025

Black Rock Etf A 110 Return Predicted Is This The Next Billionaire Investment

May 08, 2025