BOE Rate Cut Probabilities Lowered Following UK Inflation Figures: Pound's Positive Reaction

Table of Contents

UK Inflation Figures Exceed Expectations

Details of the Inflation Data

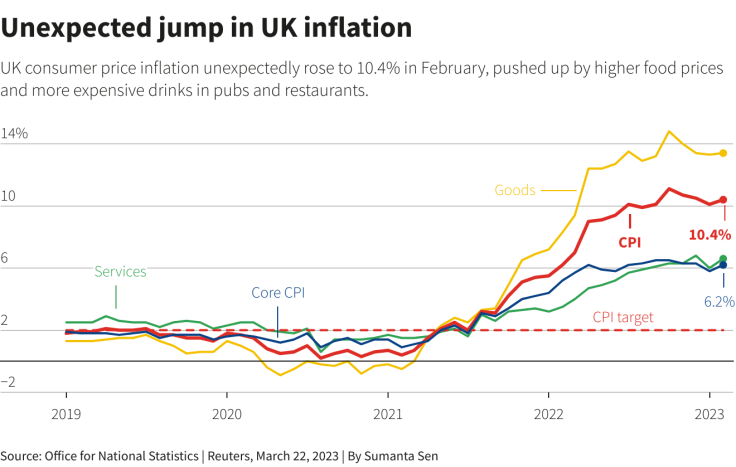

The Office for National Statistics (ONS) released data showing that UK inflation, as measured by the Consumer Price Index (CPI), reached 7.9% in June 2024. This figure surpasses market forecasts, which had predicted a slight easing to 7.7%, and remains significantly higher than the Bank of England's target of 2%. Comparing this to May's figure of 7.6%, we see a persistent upward trend. The Retail Prices Index (RPI), a broader measure of inflation, also showed a concerning increase.

- Inflation Rate: June 2024 CPI: 7.9%; May 2024 CPI: 7.6%; June 2023 CPI: 9.4%

- Inflation Contributors: Significant contributors to the persistent high inflation include soaring energy prices, continued food price increases, and rising service sector costs. The impact of global supply chain disruptions continues to be felt.

- Global Factors: The ongoing war in Ukraine, global energy market volatility, and persistent supply chain issues are all contributing factors to the stubbornly high UK inflation rate. These global factors complicate the BOE's ability to manage inflation effectively.

Market Reaction to Inflation Data

Pound Sterling's Strengthening

The pound sterling reacted positively to the unexpectedly high inflation figures. This seemingly counterintuitive reaction stems from the market's assessment that the data reduces the likelihood of a BOE rate cut. Higher inflation generally necessitates a more hawkish monetary policy response.

- GBP/USD: Following the release of the inflation data, the GBP/USD exchange rate saw a notable increase, rising by approximately 0.7% within the hour.

- GBP/EUR: Similarly, the GBP/EUR exchange rate strengthened, gaining roughly 0.5% in the immediate aftermath of the announcement.

- Impact on Asset Classes: UK government bond yields also increased, reflecting the market’s expectation of potential future interest rate hikes by the BOE. This indicates a shift in investor sentiment towards higher risk-free returns.

Revised BOE Rate Cut Probabilities

Analysis of Market Forecasts

Prior to the inflation data release, market forecasts suggested a considerable probability of a BOE rate cut in the coming months. The prevailing sentiment indicated that the central bank would prioritize economic growth over inflation control. However, the higher-than-expected inflation numbers have completely altered this perspective.

- Pre-Data Release Probability: Market analysts estimated a 40% chance of a rate cut at the next MPC meeting.

- Post-Data Release Probability: Following the inflation announcement, the probability of a rate cut has plummeted to below 10%, with many now anticipating a potential interest rate hike instead.

- Expert Opinions: Leading economists and analysts have revised their forecasts, suggesting that the BOE is more likely to maintain or even increase interest rates to combat persistent inflation.

Potential Implications for the UK Economy

Short-Term and Long-Term Outlook

The sustained high inflation and the reduced likelihood of a BOE rate cut have significant implications for the UK economy, both in the short and long term.

- Impact on Consumer Spending: Higher inflation erodes purchasing power, potentially leading to decreased consumer spending and slower economic growth.

- Impact on Business Investment: Uncertainty surrounding future interest rates may discourage business investment, further hindering economic expansion.

- Potential for Further Interest Rate Increases: The BOE may be forced to implement further interest rate increases to control inflation, which could further dampen economic activity. This tight monetary policy could increase borrowing costs and slow down economic growth.

Conclusion: BOE Rate Cut Probabilities Lowered Following UK Inflation Figures: Pound's Positive Reaction

In summary, the unexpectedly high UK inflation figures have dramatically altered the economic landscape. The higher-than-expected inflation data has resulted in a stronger pound, a significant reduction in BOE rate cut probabilities, and a shift towards a more hawkish monetary policy stance. The implications for the UK economy are complex and far-reaching, with potential consequences for consumer spending, business investment, and future economic growth. Understanding these dynamics is crucial for navigating the evolving economic conditions. Stay updated on the latest developments impacting BOE rate cut probabilities and their effect on the pound by subscribing to our newsletter!

Featured Posts

-

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

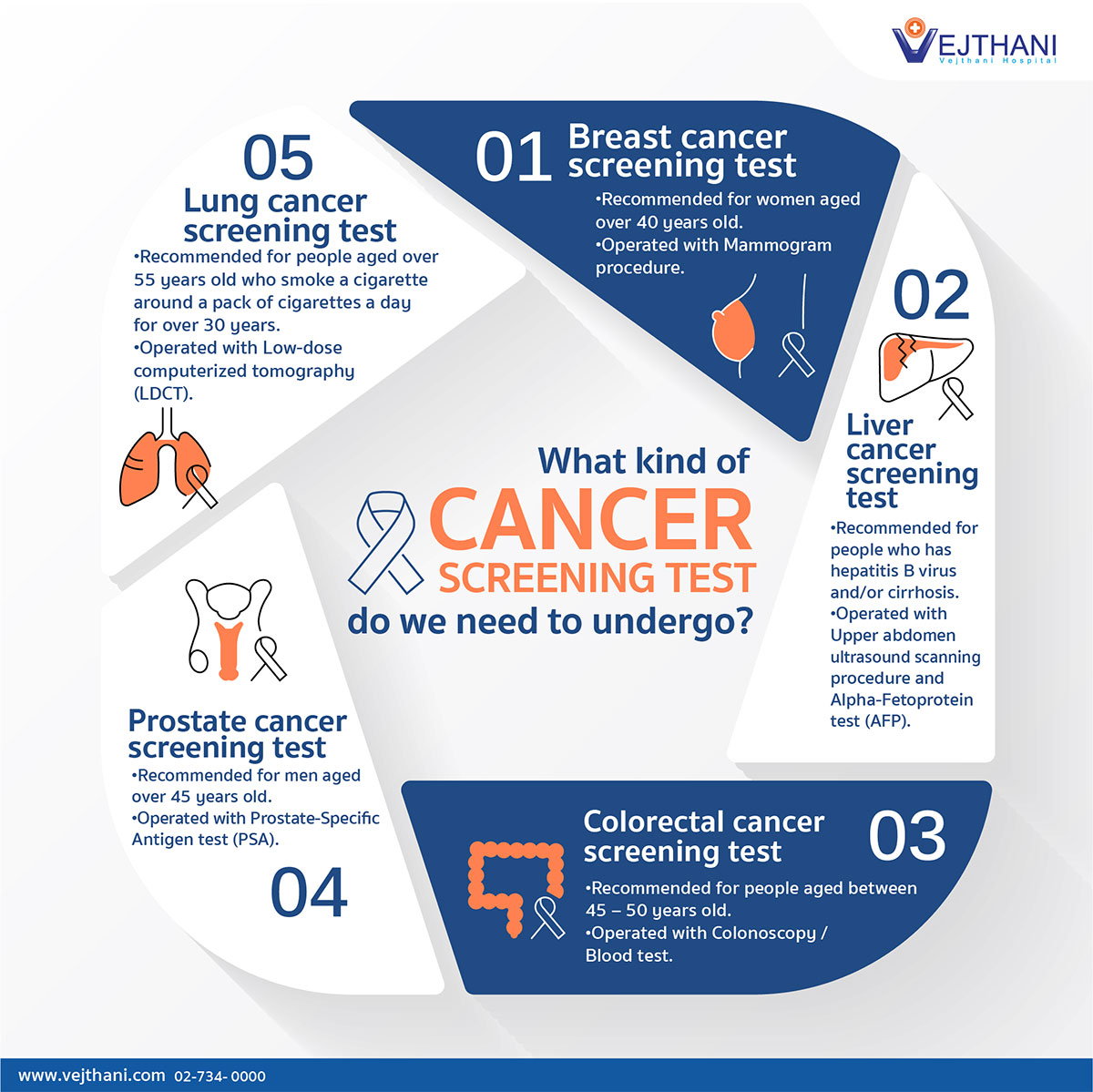

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025 -

New Peppa Pig Sibling Arrives The Family Secret That Has Fans Talking

May 22, 2025

New Peppa Pig Sibling Arrives The Family Secret That Has Fans Talking

May 22, 2025 -

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025 -

Swiss Government Criticizes Prc Military Drills

May 22, 2025

Swiss Government Criticizes Prc Military Drills

May 22, 2025

Latest Posts

-

Blake Lively Allegedly Involved News And Analysis From Bored Panda

May 22, 2025

Blake Lively Allegedly Involved News And Analysis From Bored Panda

May 22, 2025 -

Understanding The Blake Lively Alleged Controversy

May 22, 2025

Understanding The Blake Lively Alleged Controversy

May 22, 2025 -

The Blake Lively Alleged Incident Separating Fact From Fiction

May 22, 2025

The Blake Lively Alleged Incident Separating Fact From Fiction

May 22, 2025 -

Addressing The Allegations Against Blake Lively What We Know

May 22, 2025

Addressing The Allegations Against Blake Lively What We Know

May 22, 2025 -

Alleged Threat To Leak Taylor Swift Texts Investigation Into Blake Livelys Lawyer

May 22, 2025

Alleged Threat To Leak Taylor Swift Texts Investigation Into Blake Livelys Lawyer

May 22, 2025