BofA On Stock Market Valuations: Reasons For Investor Calm

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's recent report provides a nuanced assessment of current stock market valuations. While acknowledging the prevailing economic uncertainties, the report suggests that valuations, while not historically cheap, are not excessively high either. The analysis utilizes various valuation metrics, primarily focusing on the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), to gauge the market's overall health.

-

Summary of BofA's key valuation conclusions: BofA likely points to a range of valuations across different sectors, with some sectors appearing more richly valued than others. They likely highlight the need to consider individual company performance rather than relying solely on broad market indices.

-

Comparison of current valuations to historical data: The report probably contextualizes current P/E ratios against historical averages, revealing whether current valuations are above or below long-term norms. This comparison helps determine if the market is overvalued, undervalued, or trading within a reasonable range considering historical precedent.

-

Mention of any specific sectors or companies highlighted in the BofA report: BofA might identify specific sectors, like technology or energy, experiencing significant valuation changes based on individual company performance and sector-specific trends. They might highlight specific companies whose valuations are notably high or low compared to their peers.

The Role of Corporate Earnings in Maintaining Investor Calm

Strong corporate earnings play a crucial role in sustaining investor confidence, even amidst economic uncertainty. Many companies have reported better-than-expected earnings, demonstrating resilience and adaptability. This positive earnings momentum helps offset concerns about potential economic slowdowns. Earnings growth, particularly when outpacing inflation, is a significant factor underpinning investor calm.

-

Analysis of recent earnings reports: The majority of recent earnings reports have shown surprising strength, with many companies exceeding analyst expectations. This positive trend indicates that businesses are navigating challenges more effectively than anticipated.

-

Discussion of projected future earnings growth: Analysts' projections for future earnings growth remain relatively optimistic, suggesting continued corporate profitability. While uncertainty exists, the anticipated growth contributes to a positive market outlook.

-

Impact of strong earnings on stock prices: The positive earnings reports have generally supported stock prices, counteracting the negative pressure from inflationary pressures and interest rate hikes. This positive correlation reinforces investor confidence.

Impact of Monetary Policy and Interest Rates on Investor Sentiment

The Federal Reserve's (Fed) monetary policy, particularly its interest rate hikes and quantitative tightening (QT) measures aimed at curbing inflation, significantly influences investor sentiment. While rate hikes typically exert downward pressure on valuations, the market appears to be adapting to this new monetary policy environment.

-

Summary of current monetary policy: The Fed's current policy focuses on raising interest rates to control inflation, albeit at a slower pace recently. Quantitative tightening involves reducing the Fed's balance sheet, further impacting market liquidity.

-

Effect of interest rate hikes on valuations: Interest rate hikes increase borrowing costs, potentially impacting corporate investment and slowing economic growth. However, the market seems to be factoring these effects into current valuations.

-

Investor expectations regarding future interest rate changes: Investor expectations regarding future interest rate changes and the duration of the tightening cycle are crucial to understanding market behavior. A clear path toward controlling inflation could help to soothe investor anxieties.

Other Factors Contributing to Market Calm

Beyond corporate earnings and monetary policy, several other factors contribute to the current market calm. These include geopolitical considerations, supply chain dynamics, and technological advancements.

-

Analysis of current geopolitical risks: While geopolitical risks persist, the market has shown a degree of resilience in the face of these challenges. Recent events may be contributing to market uncertainty, but not to widespread panic.

-

Assessment of supply chain resilience: Improvements in global supply chains are reducing inflationary pressure on certain goods, easing concerns about shortages and price increases. This positive development boosts investor confidence.

-

Impact of technological advancements on market sentiment: Continued technological advancements and innovation often generate excitement in specific sectors, offsetting some concerns about the broader economy.

Conclusion

BofA's analysis suggests that current stock market valuations, while not exceptionally cheap, are not alarmingly high considering current corporate performance and the market's adjustment to evolving economic conditions. Strong corporate earnings, a gradual adaptation to the Fed's monetary policy, and other positive factors contribute to the relatively calm investor sentiment. However, ongoing economic uncertainties warrant careful consideration.

Call to Action: Stay informed about BofA's analysis and other market insights to make well-informed investment decisions. Regularly review stock market valuations and consider consulting with a financial advisor to tailor your investment strategy based on the latest information regarding BofA on stock market valuations and the ongoing market conditions. Understanding BofA's perspective on stock market valuations is crucial for navigating the current economic climate and making sound investment choices.

Featured Posts

-

Alien Rogue Incursion Enhanced Edition Escape The Vr Limitations

May 27, 2025

Alien Rogue Incursion Enhanced Edition Escape The Vr Limitations

May 27, 2025 -

1923 Season 2 Episode 6 Where To Watch It Tonight For Free

May 27, 2025

1923 Season 2 Episode 6 Where To Watch It Tonight For Free

May 27, 2025 -

Algerie Un Match Nul En Coupe De La Caf

May 27, 2025

Algerie Un Match Nul En Coupe De La Caf

May 27, 2025 -

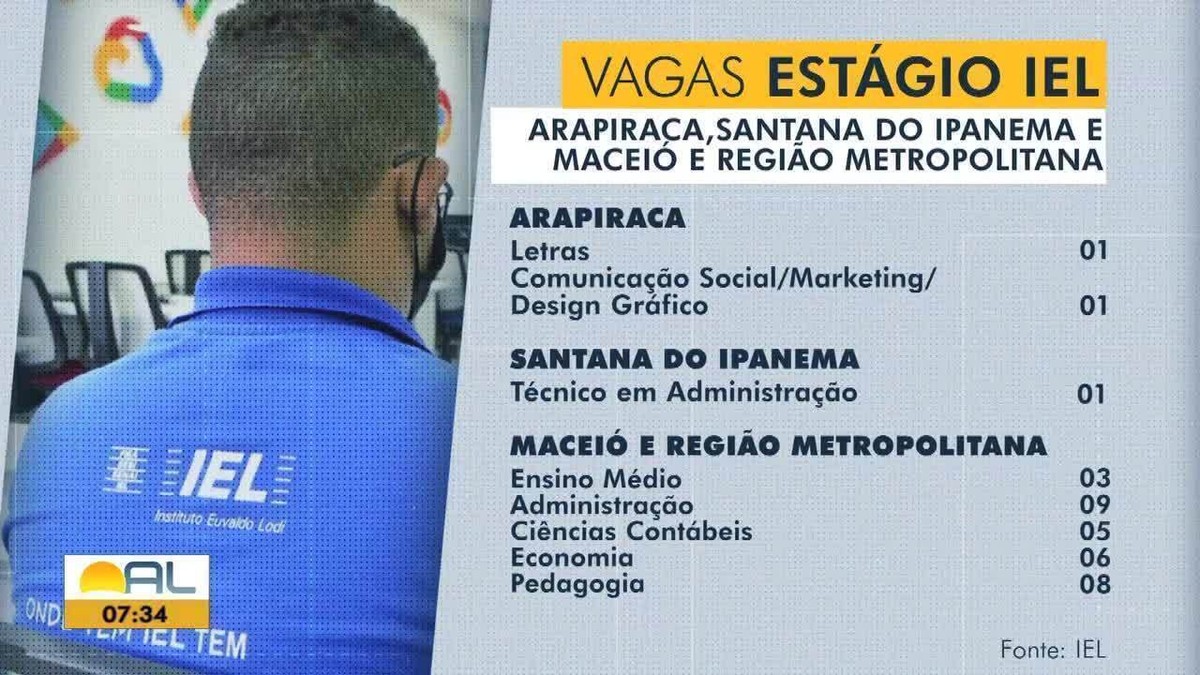

Como Conseguir Emprego Em Maceio Vagas No Sine

May 27, 2025

Como Conseguir Emprego Em Maceio Vagas No Sine

May 27, 2025 -

Karim Bouamrane Un Appel A L Union Au Congres Du Parti Socialiste

May 27, 2025

Karim Bouamrane Un Appel A L Union Au Congres Du Parti Socialiste

May 27, 2025

Latest Posts

-

Althyz Aldmny Thdyath Watharh Fy Almjtme Kma Rsdth Shyft Alryadyt

May 29, 2025

Althyz Aldmny Thdyath Watharh Fy Almjtme Kma Rsdth Shyft Alryadyt

May 29, 2025 -

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy Alsadm

May 29, 2025

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy Alsadm

May 29, 2025 -

Hl Altmyyz Aldmny Zahrt Tbyeyt Bhth Memq Mn Khlal Shyft Alryadyt

May 29, 2025

Hl Altmyyz Aldmny Zahrt Tbyeyt Bhth Memq Mn Khlal Shyft Alryadyt

May 29, 2025 -

Brshlwnt Yufajy Aljmye Bqrarh Bshan Alteaqd Me Tah

May 29, 2025

Brshlwnt Yufajy Aljmye Bqrarh Bshan Alteaqd Me Tah

May 29, 2025 -

Shyft Alryadyt Tkshf En Alensryt Almqnet Fy Almjtme

May 29, 2025

Shyft Alryadyt Tkshf En Alensryt Almqnet Fy Almjtme

May 29, 2025