BofA Reassures Investors: Why Current Market Valuations Are Not A Cause For Concern

Table of Contents

BofA's Rationale: Underlying Economic Strength

BofA's optimistic outlook is rooted in a strong assessment of the underlying economic fundamentals. They point to several key indicators suggesting that the current market valuations are supported by robust economic activity.

Strong Corporate Earnings Despite Inflation

Despite inflationary pressures, BofA highlights robust corporate earnings reports, demonstrating the resilience of many businesses. This suggests that companies are effectively navigating the challenging economic environment.

- Technology: The tech sector continues to demonstrate strong earnings growth, fueled by ongoing digital transformation and cloud computing adoption.

- Healthcare: Pharmaceutical and biotech companies continue to report solid earnings, driven by innovation and an aging global population.

- Energy: While volatile, the energy sector has seen significant revenue increases due to global demand and supply chain issues.

For example, analysis by BofA suggests that S&P 500 earnings grew by X% in the last quarter, exceeding expectations despite the inflationary environment. This resilience in corporate earnings provides a solid foundation for current market valuations.

Resilient Consumer Spending

BofA's analysis also points to surprisingly resilient consumer spending. Despite inflation impacting purchasing power, consumer spending remains relatively strong. This resilience is largely attributed to a robust labor market with low unemployment rates and strong wage growth.

- Low unemployment: The current low unemployment rate contributes to consumer confidence and spending power.

- Wage growth: Increased wages, albeit potentially outpaced by inflation in some cases, still offer increased spending capacity for many consumers.

Consumer confidence indices, while fluctuating, remain above critical thresholds, suggesting continued consumer optimism and spending. This sustained consumer demand further supports BofA's assessment of the current market valuations.

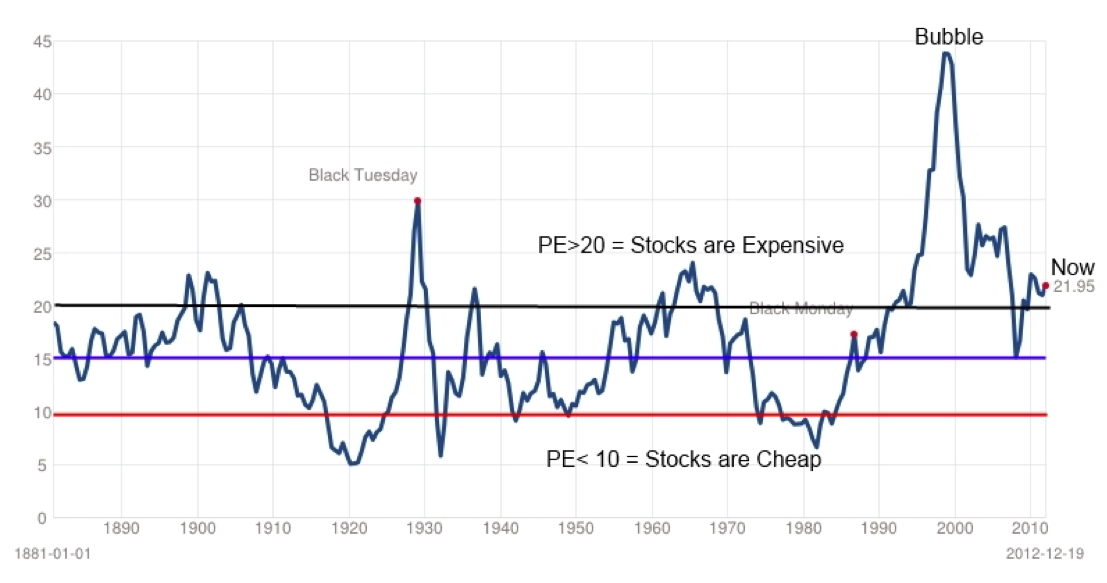

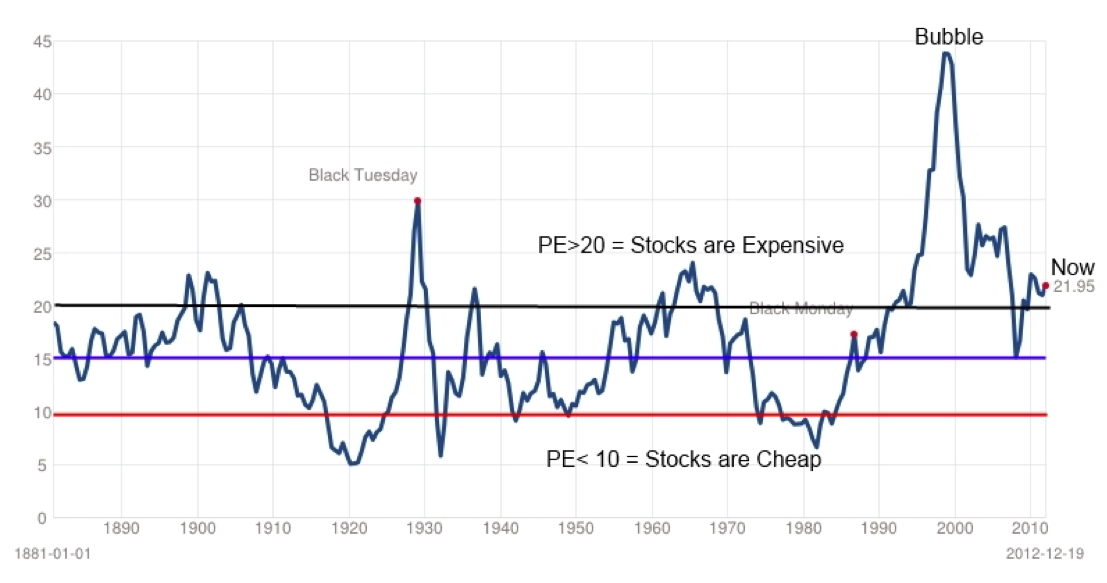

Addressing Valuation Concerns: A Long-Term Perspective

While concerns regarding market valuations are understandable, BofA's analysis encourages a long-term perspective.

Market Corrections are Normal

Market corrections are a natural and recurring part of the economic cycle. They are not inherently indicators of catastrophic failure, but rather healthy adjustments to reflect changing economic conditions. History is replete with examples of market corrections followed by periods of significant growth. Panicking and selling during these periods often leads to losses that could have been avoided with a longer-term strategy.

The Importance of Long-Term Investing

BofA likely advises investors to prioritize a long-term investment strategy focused on fundamental analysis rather than reacting to short-term market fluctuations. This approach emphasizes investing in fundamentally strong companies with proven track records, regardless of short-term price volatility. Successfully navigating market corrections requires discipline, patience, and a well-defined investment strategy aligned with individual risk tolerance.

Factors Contributing to BofA's Optimism: Beyond the Numbers

BofA's optimism extends beyond the readily available economic data, encompassing broader factors driving future growth and market potential.

Technological Innovation and Growth Potential

BofA likely recognizes the transformative power of technological innovation as a significant driver of future economic growth. This includes sectors like renewable energy and artificial intelligence, which hold substantial growth potential and could lead to higher valuations in the long run. Investment in these innovative sectors presents opportunities for significant long-term returns.

Government Policies and Infrastructure Spending

Government policies and infrastructure investments can also play a significant role in shaping the market outlook. Significant infrastructure spending, for example, can stimulate economic growth and create new opportunities for businesses and investors alike. BofA's assessment likely considers the potential positive impact of such initiatives.

BofA's Reassurance and Your Investment Strategy

In summary, BofA's reassurances regarding current market valuations stem from a strong assessment of underlying economic strength, resilient consumer spending, and the inherent cyclical nature of market corrections. While volatility is a normal part of investing, maintaining a long-term perspective and focusing on fundamental analysis is crucial for success.

Understand the reasoning behind BofA's reassurances and develop a well-informed investment strategy based on your risk tolerance and long-term financial goals. Learn more about how to navigate market valuations effectively. Even amidst short-term market fluctuations, the potential for long-term growth remains significant for those with a well-defined and patient investment approach.

Featured Posts

-

Medicaid Cuts Fuel Republican In Fighting

May 18, 2025

Medicaid Cuts Fuel Republican In Fighting

May 18, 2025 -

From Renovation Disaster To Dream Home The House Therapist Approach

May 18, 2025

From Renovation Disaster To Dream Home The House Therapist Approach

May 18, 2025 -

Trumps Middle East Trip A New Chapter In Arab Israeli Relations

May 18, 2025

Trumps Middle East Trip A New Chapter In Arab Israeli Relations

May 18, 2025 -

The Manhunt For Osama Bin Laden A Documentary Film Review

May 18, 2025

The Manhunt For Osama Bin Laden A Documentary Film Review

May 18, 2025 -

Taylor Swifts Eras Tour An In Depth Look At Her Stage Wardrobe

May 18, 2025

Taylor Swifts Eras Tour An In Depth Look At Her Stage Wardrobe

May 18, 2025

Latest Posts

-

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025 -

Kanye West Bianca Censori New Photos Emerge After Reported Split

May 18, 2025

Kanye West Bianca Censori New Photos Emerge After Reported Split

May 18, 2025 -

Pokhoronnaya Instruktsiya Kane Uesta Vdokhnovenie Ot Pashi Tekhnika

May 18, 2025

Pokhoronnaya Instruktsiya Kane Uesta Vdokhnovenie Ot Pashi Tekhnika

May 18, 2025 -

Kanye West Instruktsiya K Sobstvennym Pokhoronam Vdokhnovlyonnaya Pashey Tekhnikom

May 18, 2025

Kanye West Instruktsiya K Sobstvennym Pokhoronam Vdokhnovlyonnaya Pashey Tekhnikom

May 18, 2025 -

Ope Partners Welcomes Snl Alumna Leslie Jones

May 18, 2025

Ope Partners Welcomes Snl Alumna Leslie Jones

May 18, 2025