BofA Reassures Investors: Why Stretched Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Key Arguments Against Immediate Market Correction

BofA's confidence in the market's resilience stems from several key observations. Their analysis suggests that despite economic headwinds, several factors contribute to a more positive outlook than many investors currently anticipate.

Strong Corporate Earnings and Revenue Growth

Despite inflation and other macroeconomic challenges, BofA's analysis points to robust corporate performance. Many companies have demonstrated impressive resilience, exceeding expectations in several key areas. This strong performance suggests that the current market valuations, while high, are underpinned by substantial underlying strength.

- Robust Q3 2023 earnings reports across various sectors. Many companies reported better-than-expected earnings, defying pessimistic predictions.

- Resilient consumer spending despite inflation. While inflation has impacted purchasing power, consumer spending remains relatively strong, supporting corporate revenue streams.

- Strong pricing power for many companies. Many businesses have successfully passed on increased costs to consumers, mitigating the impact of inflation on profit margins. This demonstrates pricing power and the ability to adapt to a challenging economic environment.

Sustained Low Interest Rates (or Gradual Increases)

BofA's perspective on interest rate hikes is crucial to understanding their market outlook. While interest rate increases are a factor, their analysis suggests that the impact on stock valuations might be less significant than some fear. The bank likely considers the current rate environment and its potential evolution, suggesting continued monetary policy support, or at least a gradual and controlled approach, to inflation management.

- Analysis of current interest rate environment. BofA's assessment incorporates the current low interest rate levels relative to historical data.

- Projection of future rate increases (if any). The bank's predictions for future rate increases influence their assessment of the market's ability to withstand potential impacts.

- Impact of interest rates on corporate borrowing costs and investment. The cost of borrowing remains relatively manageable, allowing companies to continue investing and fueling growth.

Long-Term Growth Potential Outweighs Short-Term Risks

BofA's long-term outlook is significantly more optimistic than a purely short-term perspective might suggest. They likely view current market valuations in the context of long-term economic prospects, highlighting sectors poised for significant growth. This longer-term perspective helps contextualize the current market dynamics.

- Growth in emerging markets. Emerging economies offer significant growth opportunities, potentially offsetting slower growth in developed markets.

- Technological advancements driving innovation. Technological breakthroughs in sectors like AI and sustainable energy are creating new investment opportunities and driving long-term economic expansion.

- Long-term investment opportunities in sustainable energy and other growth sectors. These sectors represent significant future growth potential, contributing to a positive long-term market outlook.

Addressing Investor Concerns Regarding High Valuations

Concerns about high valuations are valid. However, BofA likely addresses these by providing context and perspective.

Valuation Metrics in Context

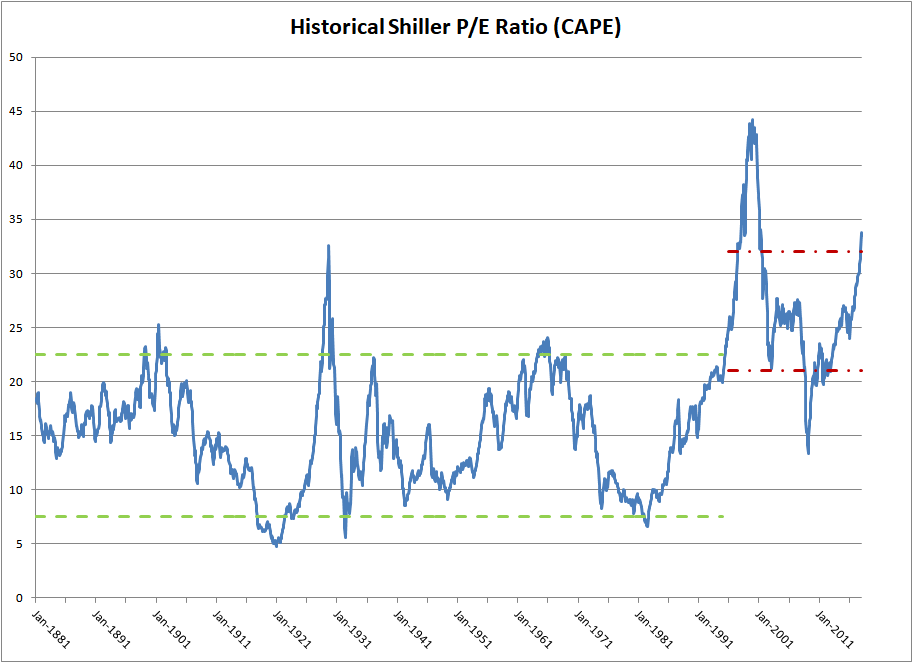

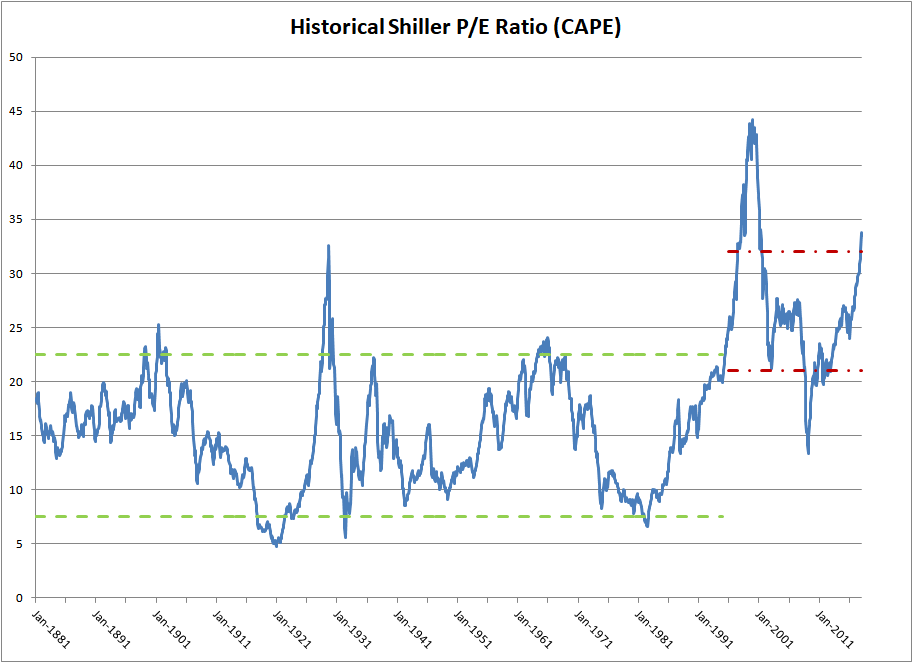

BofA likely acknowledges the high valuation multiples in the current market. However, their analysis likely contextualizes these metrics by comparing them to historical data, considering factors such as low interest rates, which can inflate valuation multiples.

- Comparison to historical market valuations. A historical perspective helps to gauge whether current valuations are truly unprecedented or fall within the range of typical market fluctuations.

- Consideration of low interest rate environment on valuation multiples. Low interest rates can justify higher price-to-earnings (P/E) ratios as investors are willing to pay more for future earnings.

- Discussion of different valuation metrics and their interpretations. BofA likely utilizes various valuation metrics (P/E ratio, price-to-sales ratio, etc.) to provide a comprehensive assessment, highlighting their limitations and interpretations.

The Role of Inflation in Market Dynamics

Inflation is a key factor affecting stock prices. BofA's analysis likely explores how companies are successfully managing inflationary pressures and how these strategies influence earnings and valuations.

- Analysis of inflation's impact on earnings and valuations. BofA's perspective likely takes into account the impact of inflation on both earnings and the valuation multiples used by investors.

- Strategies companies are employing to mitigate inflation. This might include efficiency improvements, pricing adjustments, and supply chain diversification.

- BofA's predictions for future inflation rates. Their forecasts for inflation directly impact their assessment of the market's future performance.

Conclusion

BofA's reassurances regarding stretched stock market valuations stem from a combination of factors: strong corporate earnings, potential for sustained (or gradually increasing) low interest rates, and significant long-term growth prospects. While market volatility is always a possibility, BofA's analysis suggests that the current stretched valuations shouldn't necessarily trigger immediate alarm. However, thorough due diligence and a long-term investment strategy remain crucial. Continue your research into understanding BofA's reassurances on stretched stock market valuations and develop a well-informed investment plan.

Featured Posts

-

Reactions To Megan Thee Stallion Verdict Prediction 50 Cent And Tory Lanez

May 13, 2025

Reactions To Megan Thee Stallion Verdict Prediction 50 Cent And Tory Lanez

May 13, 2025 -

Nba Tankathon Engaging Miami Heat Fans During The Off Season

May 13, 2025

Nba Tankathon Engaging Miami Heat Fans During The Off Season

May 13, 2025 -

Chris And Meg A Wild Summer

May 13, 2025

Chris And Meg A Wild Summer

May 13, 2025 -

Triumf Za Barnli Vrakjanje Vo Premier Ligata So Lids

May 13, 2025

Triumf Za Barnli Vrakjanje Vo Premier Ligata So Lids

May 13, 2025 -

Persipura Butuh Kamu Dukungan Masyarakat Papua Sangat Penting

May 13, 2025

Persipura Butuh Kamu Dukungan Masyarakat Papua Sangat Penting

May 13, 2025

Latest Posts

-

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025 -

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025 -

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025