BofA's Analysis: Addressing Concerns About Elevated Stock Market Valuations

Table of Contents

BofA's Valuation Metrics and Methodology

BofA employs a range of sophisticated valuation metrics and methodologies to assess the stock market. Their "BofA valuation models" incorporate both quantitative analysis and qualitative factors to provide a comprehensive picture. Key metrics include:

-

Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio can suggest overvaluation, but it's crucial to consider industry benchmarks and growth prospects.

- Strengths: Widely understood and readily available.

- Limitations: Can be distorted by accounting practices and doesn't account for future growth.

-

Price-to-Sales Ratio (P/S): This compares a company's stock price to its revenue per share. It's particularly useful for companies with negative earnings.

- Strengths: Less susceptible to accounting manipulation than P/E.

- Limitations: Doesn't reflect profitability directly.

-

Discounted Cash Flow (DCF) Analysis: This projects future cash flows and discounts them back to their present value. It's a more complex but potentially more accurate method.

- Strengths: Considers future growth and profitability.

- Limitations: Highly sensitive to assumptions about future growth rates and discount rates.

BofA's approach to stock market valuation metrics goes beyond these individual metrics. Their quantitative analysis incorporates macroeconomic factors such as interest rates, inflation, and economic growth projections, offering a more nuanced understanding of market valuations. This holistic approach to assessing stock market valuation is crucial in today's complex economic environment.

Identifying Sectors with Elevated Valuations

BofA's sectoral analysis has pinpointed specific sectors with particularly high valuations. While the specific sectors identified may shift over time, BofA's research often highlights sectors experiencing rapid growth, technological disruption, or benefiting from low interest rates. This market valuation analysis is dynamic and reflects the ever-changing conditions. Examples of sectors historically identified as potentially overvalued (according to BofA’s research at various points) might include certain technology sub-sectors or specific segments of the consumer discretionary market.

- Overvalued Stocks: BofA’s research frequently names individual stocks that it deems overvalued based on their chosen metrics and the prevailing economic climate. It is important to consult their most recent publications for the most up-to-date list.

- Reasons for Elevated Valuations: High valuations in certain sectors are often driven by several factors: strong earnings growth, expectations of future technological breakthroughs, and historically low interest rates influencing investor behavior. Understanding these drivers is essential for interpreting BofA's findings.

BofA's Outlook and Predictions

BofA's market outlook, informed by their analysis of elevated stock market valuations, typically includes predictions for future market performance, considering the identified risks and opportunities. Their suggestions for investment strategies often involve a combination of approaches:

- Sector Rotation: Shifting investments from overvalued sectors to those deemed undervalued.

- Defensive Positioning: Investing in less volatile assets to mitigate risks during periods of market uncertainty.

- Value Investing: Focusing on undervalued companies with strong fundamentals.

BofA's market predictions are always accompanied by a discussion of potential risks and uncertainties. Macroeconomic shifts, geopolitical events, and unexpected changes in investor sentiment can all significantly impact market performance. Their detailed stock market forecast accounts for these possibilities, offering a more realistic and cautionary view.

Addressing Investor Concerns

High stock market valuations naturally trigger concerns among investors:

- Market Correction: The fear of a significant market downturn, wiping out gains.

- Potential Bubble: The worry that valuations are unsustainable and a sharp correction is imminent.

BofA's analysis aims to address these investor concerns by:

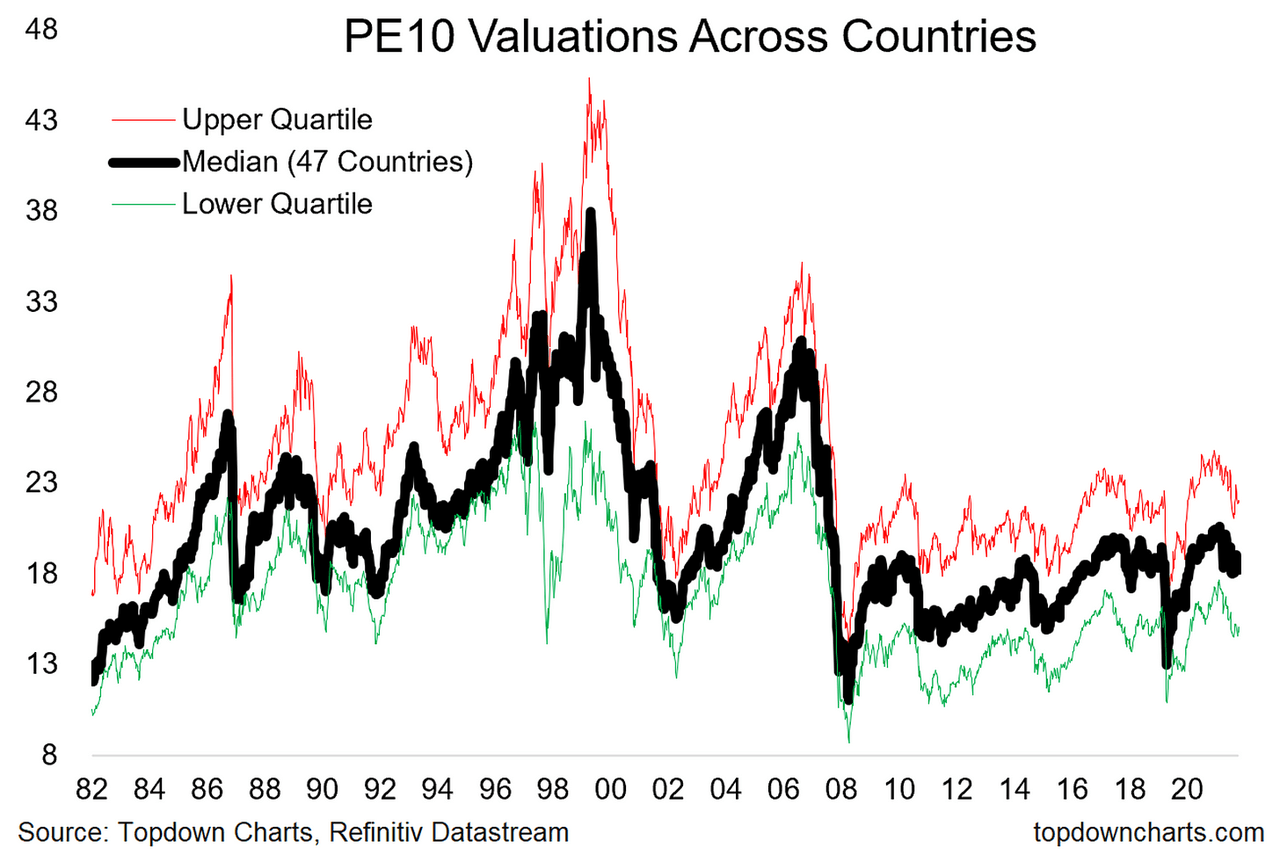

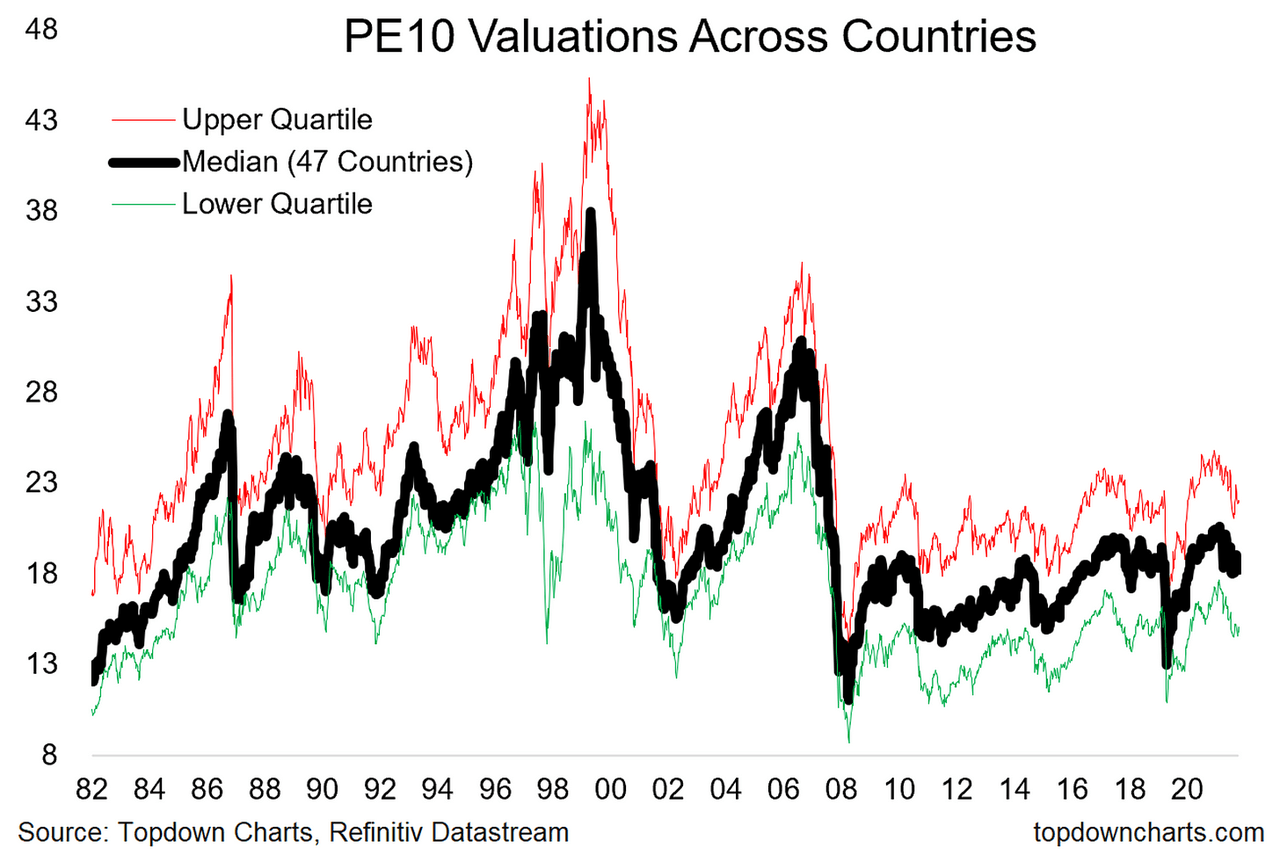

- Providing Context: Placing current valuations within a historical context and comparing them to past market cycles.

- Highlighting Mitigating Factors: Pointing out factors that might support current valuations, such as strong corporate earnings or low inflation.

- Offering Risk Management Strategies: Suggesting investment approaches that can help mitigate potential losses during market corrections.

BofA's responses to these investor concerns often highlight the importance of diversification, rigorous due diligence, and a long-term investment horizon. By providing a comprehensive understanding of the market, their analysis helps investors make informed decisions.

BofA's Analysis: Key Takeaways and Next Steps

BofA's analysis of elevated stock market valuations provides crucial insights for investors navigating the current market landscape. Understanding BofA’s assessment of various stock market valuation metrics, their identification of potentially overvalued sectors, and their outlook for future market performance are all vital for effective portfolio management. The key takeaway is that while high valuations present risks, a thorough understanding of the underlying factors and appropriate risk management strategies can help investors make informed decisions.

Understanding BofA's analysis of elevated stock market valuations is crucial for investors seeking to navigate this complex environment. Learn more about BofA's insights on managing elevated stock market valuations by reviewing their latest research reports and publications. This will allow you to develop a more comprehensive and informed investment strategy.

Featured Posts

-

Femicide What It Is And Why Its Increasing

May 21, 2025

Femicide What It Is And Why Its Increasing

May 21, 2025 -

A New Frontier In Computing Chinas Space Based Supercomputer Project

May 21, 2025

A New Frontier In Computing Chinas Space Based Supercomputer Project

May 21, 2025 -

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025 -

Vapors Of Morphine Northcote Concert Date And Ticket Info

May 21, 2025

Vapors Of Morphine Northcote Concert Date And Ticket Info

May 21, 2025 -

Abn Amro And The Dutch Central Bank A Bonus Dispute

May 21, 2025

Abn Amro And The Dutch Central Bank A Bonus Dispute

May 21, 2025

Latest Posts

-

Robert Burke Bribery Conviction Four Star Admiral Found Guilty

May 21, 2025

Robert Burke Bribery Conviction Four Star Admiral Found Guilty

May 21, 2025 -

Abc News Cuts Analyzing The Future Of Its Programming

May 21, 2025

Abc News Cuts Analyzing The Future Of Its Programming

May 21, 2025 -

Impact Of Abc News Layoffs The Fate Of Beloved Programs

May 21, 2025

Impact Of Abc News Layoffs The Fate Of Beloved Programs

May 21, 2025 -

Mass Layoffs At Abc News Whats Next For Popular Shows

May 21, 2025

Mass Layoffs At Abc News Whats Next For Popular Shows

May 21, 2025 -

Abc News Show Future In Jeopardy Following Mass Layoffs

May 21, 2025

Abc News Show Future In Jeopardy Following Mass Layoffs

May 21, 2025