BofA's Analysis: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Key Arguments Against Overvaluation Concerns

BofA's analysis, drawing on extensive economic data and corporate earnings projections, presents a compelling case against widespread overvaluation fears. Their methodology involves a detailed examination of various economic indicators, corporate financial reports, and historical market trends. The core arguments presented in their report can be summarized as follows:

-

Strong Corporate Earnings Growth Projections: BofA projects robust earnings growth for many sectors in the coming years, driven by factors such as technological innovation, increased consumer spending, and global economic recovery. These projections suggest that current valuations, while seemingly high, may be justified by future earnings potential.

-

Resilient Consumer Spending Despite Inflation: Despite persistent inflationary pressures, consumer spending remains relatively strong. This indicates a resilient economy capable of sustaining corporate profitability and supporting stock market valuations. BofA cites data showing consistent consumer spending in key sectors, even amidst rising prices.

-

Positive Economic Indicators Mitigating Recessionary Fears: While recessionary risks remain, various economic indicators analyzed by BofA, such as employment figures and manufacturing output, point towards a more resilient economy than many initially feared. This positive outlook bolsters their case for the sustainability of current market valuations.

-

Low Interest Rates (Relative to Historical Averages) Supporting Valuations: Although interest rates have risen, they remain relatively low compared to historical averages. This low-interest-rate environment continues to support borrowing costs for businesses and consumers, thereby fostering economic growth and potentially justifying higher stock market valuations.

-

Long-Term Growth Potential Outweighing Short-Term Risks: BofA emphasizes the importance of considering the long-term growth potential of the market. They argue that while short-term risks exist, the long-term prospects for many companies and sectors remain strong, justifying current valuations in a long-term investment context.

BofA's report (source citation needed here – replace with actual citation) provides detailed data to support each of these points, including specific figures on earnings growth projections, consumer spending patterns, and economic indicators.

Addressing Specific Valuation Metrics

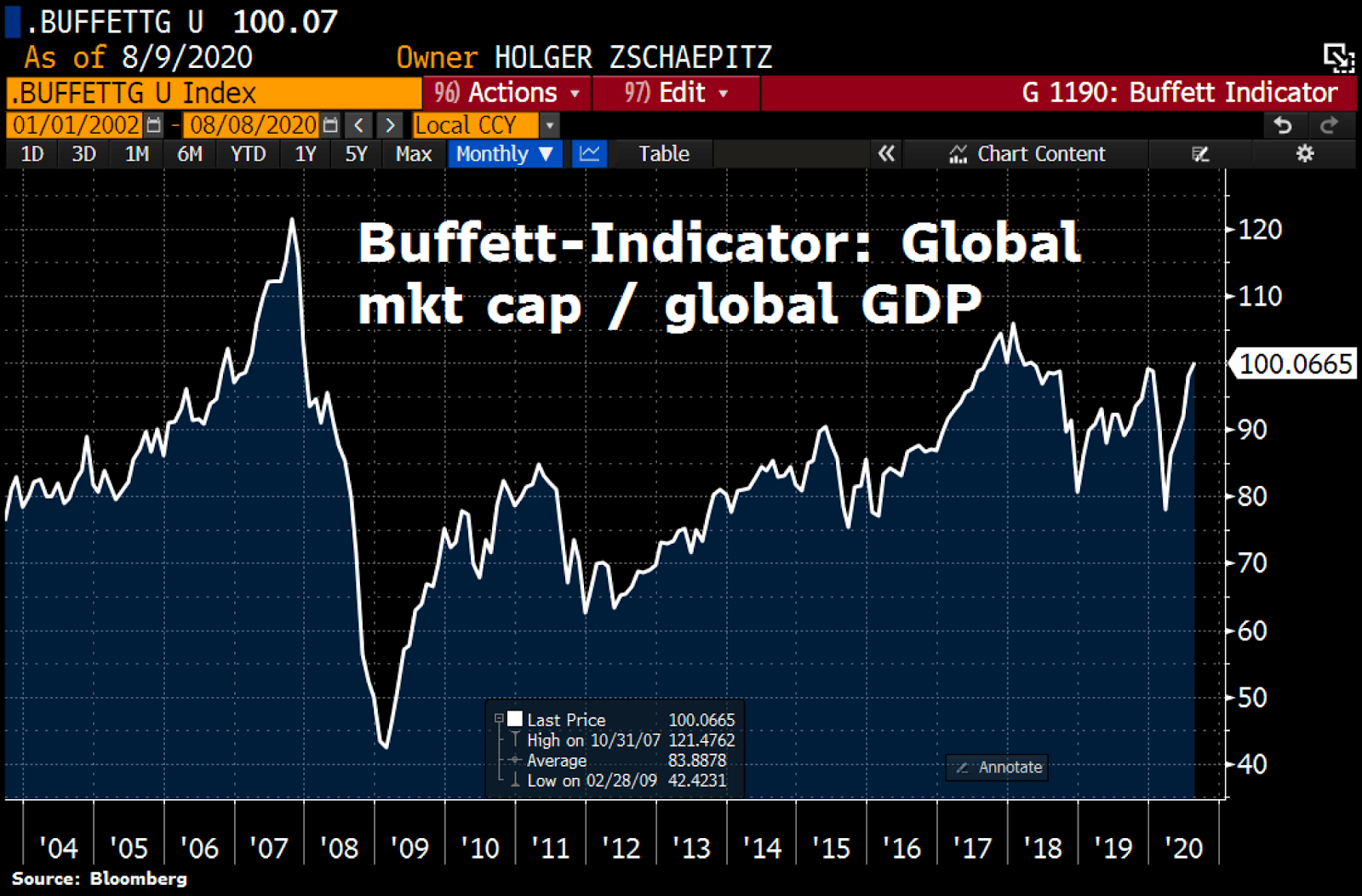

BofA's analysis goes beyond general observations, scrutinizing specific valuation metrics to support its conclusions. They examined several key metrics, including:

Understanding the P/E Ratio in the Current Market

The Price-to-Earnings (P/E) ratio, a commonly used valuation metric, compares a company's stock price to its earnings per share. BofA argues that while current P/E ratios may appear elevated compared to historical averages, they are not excessively inflated when considering the projected earnings growth discussed earlier. They provide comparative data showing that P/E ratios have been higher in past periods of robust economic growth.

Analyzing the Price-to-Sales Ratio

The Price-to-Sales (P/S) ratio assesses the valuation of a company relative to its revenue. Similar to their analysis of the P/E ratio, BofA finds that current P/S ratios, while high, are not necessarily indicative of a market bubble when considering the broader economic context and projected revenue growth. Their analysis includes a comparison of current P/S ratios with those observed during previous periods of economic expansion.

BofA’s analysis emphasizes that interpreting these valuation metrics requires considering the overall economic landscape and future growth prospects. Simply comparing current metrics to historical averages without accounting for these factors can lead to a misleading assessment of market valuations.

Potential Risks and Mitigation Strategies (Addressing Counterarguments)

While BofA presents a largely optimistic outlook, they acknowledge potential risks that could impact their projections. These include:

-

Inflation Risk: Persistently high inflation could erode corporate profits and consumer spending, potentially impacting stock market valuations.

-

Geopolitical Risk: Geopolitical instability, such as ongoing conflicts or escalating trade tensions, could negatively affect global economic growth and market performance.

-

Interest Rate Risk: Further interest rate hikes by central banks, aimed at curbing inflation, could increase borrowing costs and slow economic growth, potentially leading to a market correction.

BofA addresses these risks by incorporating various scenarios into their analysis, including simulations based on different inflation rates and interest rate trajectories. They also suggest potential mitigation strategies for investors, emphasizing:

-

Portfolio Diversification: Diversifying investments across different asset classes and sectors can help mitigate risks associated with specific economic or geopolitical events.

-

Long-Term Investment Horizon: Adopting a long-term investment horizon can help investors weather short-term market fluctuations and benefit from long-term growth opportunities.

By carefully considering these risks and implementing appropriate mitigation strategies, investors can better position themselves to navigate potential market challenges.

BofA's Reassuring View on Stock Market Valuations

In conclusion, BofA's analysis suggests that current stock market valuations, while perhaps higher than historical averages, are not necessarily a cause for immediate alarm. The projections of strong corporate earnings growth, resilient consumer spending, and positive economic indicators contribute to a positive outlook. While acknowledging potential risks, BofA emphasizes the importance of considering the long-term growth potential of the market. By focusing on long-term investment strategies and implementing appropriate risk mitigation measures, investors can navigate market volatility and potentially benefit from future growth.

Don't let concerns about stock market valuations derail your investment strategy. Review BofA's comprehensive analysis and make informed decisions based on your long-term goals and risk tolerance. Understanding Bank of America's market analysis regarding stock market valuations is crucial for developing a robust investment strategy.

Featured Posts

-

Chat Gpt Gets An Ai Coding Agent Implications For Developers

May 19, 2025

Chat Gpt Gets An Ai Coding Agent Implications For Developers

May 19, 2025 -

Mark Rylances Criticism Of Music Festivals Prison Like Conditions In London Parks

May 19, 2025

Mark Rylances Criticism Of Music Festivals Prison Like Conditions In London Parks

May 19, 2025 -

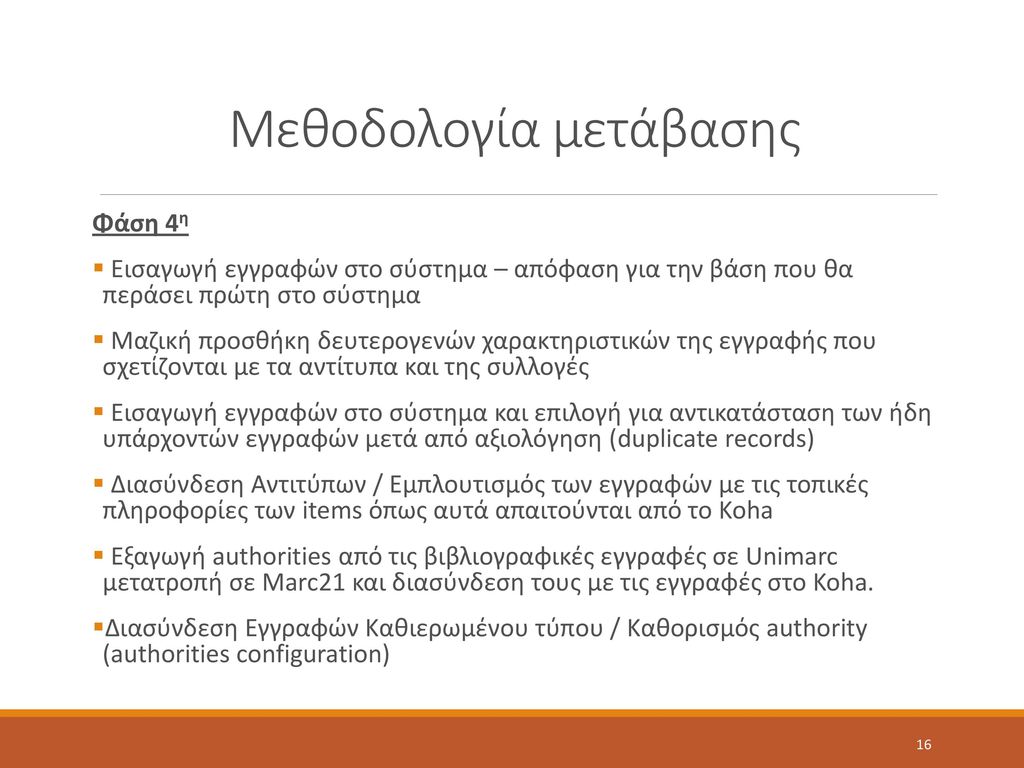

Kaysima Kyproy Eyresi Ton Fthinoteron Pratirion

May 19, 2025

Kaysima Kyproy Eyresi Ton Fthinoteron Pratirion

May 19, 2025 -

Cne Define Fecha Limite Inscripcion De Candidatos Sin Primarias

May 19, 2025

Cne Define Fecha Limite Inscripcion De Candidatos Sin Primarias

May 19, 2025 -

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025