BofA's Analysis: Why High Stock Market Valuations Are Not Necessarily A Risk

Table of Contents

BofA's Rationale: Low Interest Rates and Strong Corporate Earnings

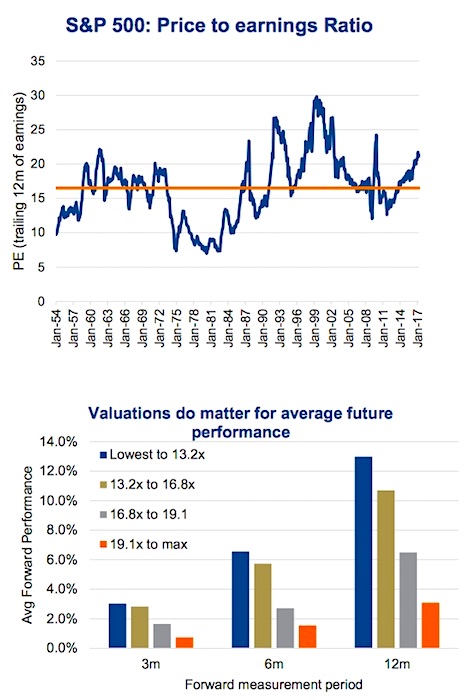

BofA's assessment hinges on two significant pillars: historically low interest rates and robust corporate earnings growth. These factors, according to their analysis, significantly influence stock market valuations and justify, to a degree, the current elevated levels.

-

The Impact of Low Interest Rates: Historically low interest rates directly affect discount rates used in valuation models. Discount rates represent the return an investor expects to receive from an investment. Lower discount rates, a direct consequence of low interest rates, lead to higher present values for future earnings. Essentially, future profits are worth more today when interest rates are low, thus supporting higher stock prices. This means that even with high stock prices, the relative value, considering the low cost of capital, may not be as excessive as initially perceived.

-

Strong Corporate Earnings Growth: BofA's analysis highlights that strong corporate earnings growth, often exceeding analysts' expectations, forms a solid bedrock for current valuations. Companies are demonstrating robust profitability, providing a tangible justification for the higher stock prices. This continued growth, projected to persist in several sectors, further reinforces the argument that high valuations are not necessarily unsustainable. The analysis emphasizes the importance of looking beyond the price-to-earnings ratio and considering the underlying strength of earnings growth.

-

Present Value Calculations and Interest Rate Environments: Understanding present value (PV) calculations is key to comprehending BofA's argument. PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Low interest rates decrease the discount rate used in these calculations, increasing the PV of future earnings and therefore supporting higher valuations. BofA's analysis likely incorporates detailed present value calculations to support its conclusion.

Addressing Inflation Concerns and Their Impact on Valuations

BofA acknowledges the justifiable concern surrounding inflation and its potential impact on valuations. However, their analysis doesn't view inflation as an automatic death knell for the market.

-

Central Bank's Role in Managing Inflation: The report emphasizes the central bank's capacity to manage inflationary pressures through monetary policy tools, such as interest rate hikes. While rate increases might temporarily dampen market enthusiasm, they're also viewed as necessary to maintain long-term economic stability. BofA's projections likely factor in the central bank's response to inflationary pressures.

-

Potential for a Soft Landing: A key element of BofA's analysis is the potential for a "soft landing," a scenario where inflation is brought under control without triggering a significant economic downturn. This possibility suggests that the necessary interest rate adjustments may not lead to a dramatic correction in stock market valuations.

-

Valuation Adjustments Based on Inflation Forecasts: Naturally, BofA's analysis incorporates potential valuation adjustments based on various inflation forecasts. The report likely presents scenarios reflecting different inflationary outcomes and their respective implications for market valuations.

-

Inflation-Resilient Sectors: Finally, the analysis likely identifies sectors of the economy that are less vulnerable to inflationary pressures. These sectors could offer compelling investment opportunities even in an environment of rising prices.

Technological Advancements and Long-Term Growth Prospects

BofA's perspective also incorporates the transformative power of technological innovation and its impact on long-term growth prospects.

-

Technological Innovation as a Growth Driver: The report likely underscores the role of technological innovation in driving long-term economic growth. This ongoing innovation, particularly in sectors like artificial intelligence, biotechnology, and renewable energy, creates new avenues for growth and profitability, justifying higher valuations for companies at the forefront of these advancements.

-

Disruptive Technologies and Future Market Trends: The analysis likely highlights how disruptive technologies are reshaping future market trends. These innovations can create new markets and significantly alter existing ones, offering exciting growth opportunities and making current valuations seem less extreme in the context of future potential.

-

Impact on Sector-Specific Valuations: BofA's analysis likely provides a sector-specific breakdown, focusing on how technological advancements are influencing valuations within different sectors. Growth stocks, particularly those in technology and related fields, are likely to be examined in detail.

-

Long-Term Future Value Implications: The report ultimately connects technological progress to the long-term future value of assets. The transformative potential of innovation supports the argument that current valuations, while seemingly high in the short term, might be justified by the long-term growth opportunities these technological advancements present.

Sector-Specific Analysis Within BofA's Report

While specific details may vary depending on BofA's exact report, a typical analysis would include insights into sector performance, helping investors make informed decisions about stock selection and portfolio diversification. This would likely involve identifying resilient sectors showing strength despite high valuations, highlighting specific companies as compelling investment opportunities, and offering guidance on building a diversified investment portfolio that mitigates risk.

Conclusion

BofA's analysis suggests that high stock market valuations, while deserving attention, are not automatically a sign of impending risk. Factors such as low interest rates, strong corporate earnings, and the promise of continued technological innovation paint a more nuanced picture. While acknowledging the potential headwinds of inflation, BofA’s report offers a balanced perspective, indicating that current valuations may be justifiable considering the broader economic context. Understanding BofA’s detailed analysis is key to navigating the market effectively.

Call to Action: Don't let the fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's full analysis to gain a deeper understanding of these complex market dynamics. Develop a robust investment strategy that accounts for these factors and explore potential opportunities within this evolving market landscape. Make informed decisions about your investment portfolio based on a comprehensive understanding of current valuations and their underlying drivers.

Featured Posts

-

Stephen Kings The Long Walk Mark Hamill In First Trailer Look

May 08, 2025

Stephen Kings The Long Walk Mark Hamill In First Trailer Look

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Speculation Among Fans

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Speculation Among Fans

May 08, 2025 -

Daily Lotto Draw Results Wednesday 16th April 2025

May 08, 2025

Daily Lotto Draw Results Wednesday 16th April 2025

May 08, 2025 -

Where To Start A Business Mapping The Countrys Hottest New Markets

May 08, 2025

Where To Start A Business Mapping The Countrys Hottest New Markets

May 08, 2025 -

Transferimi I Neymar Te Psg Agjenti Zbulon Detajet E Marreveshjes 222 Milione Euro

May 08, 2025

Transferimi I Neymar Te Psg Agjenti Zbulon Detajet E Marreveshjes 222 Milione Euro

May 08, 2025