BofA's Reassurance: Are High Stock Market Valuations Really A Worry?

Table of Contents

BofA's Stance on Current Market Conditions

BofA's recent reports suggest a nuanced perspective on current market valuations. While acknowledging the elevated levels, their analysts don't necessarily view them as an immediate cause for alarm. Their analysis often incorporates a broader macroeconomic view, looking beyond simple price-to-earnings (P/E) ratios.

- Key arguments: BofA often highlights the role of strong corporate earnings growth in justifying current valuations. They emphasize the resilience of the economy and the potential for continued growth, suggesting that higher valuations might be sustainable in the long term. They also point to specific sectors they believe are undervalued relative to their growth prospects.

- Sectoral analysis: BofA’s reports often detail specific sectors they consider potentially undervalued (e.g., certain segments of the technology sector showing strong innovation) or overvalued (e.g., sectors heavily reliant on consumer discretionary spending during periods of high inflation).

- Economic factors: BofA's assessment is heavily influenced by factors such as interest rate projections, inflation forecasts, and projected economic growth rates. Their analysis integrates these macroeconomic indicators to evaluate the sustainability of current stock prices. For instance, they might argue that while interest rates are rising, the pace of increase is manageable and doesn't necessarily warrant a significant market correction.

Counterarguments and Potential Risks

While BofA presents a relatively optimistic outlook, it's crucial to acknowledge counterarguments and potential risks associated with high stock market valuations. Simply put, high valuations inherently increase the risk of a significant market correction.

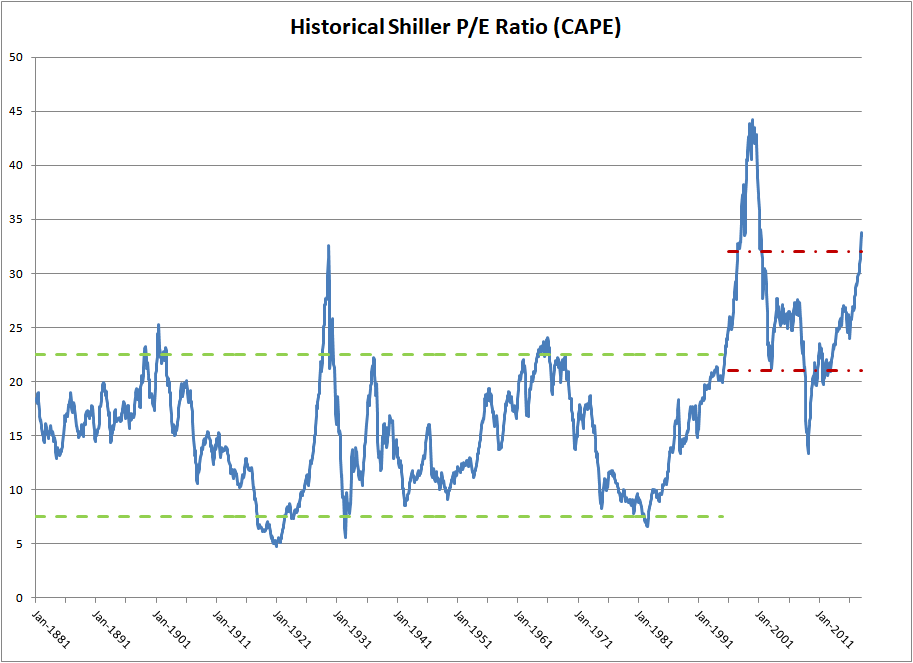

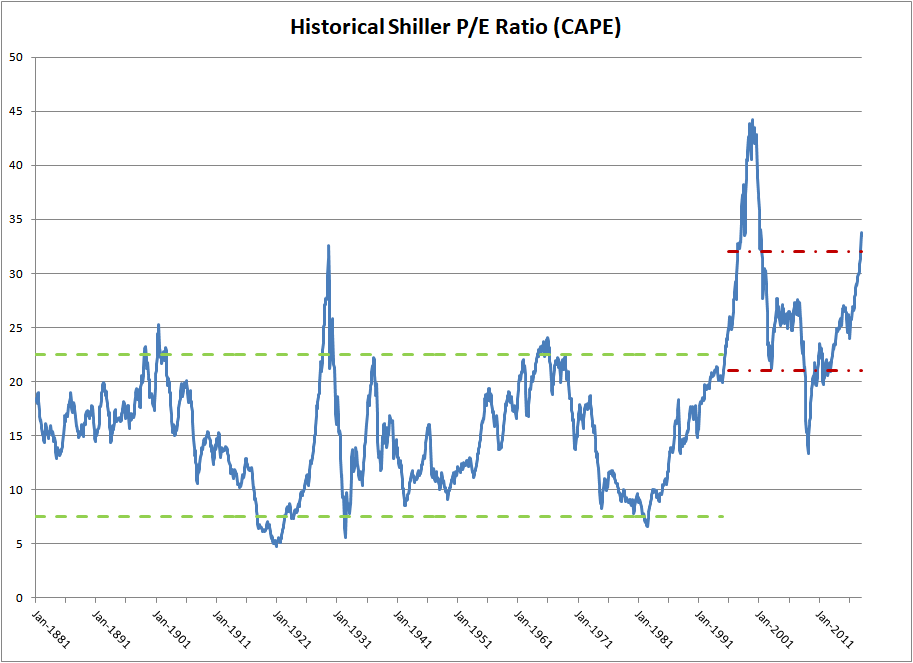

- High P/E ratios: Elevated price-to-earnings ratios across broad market indices indicate that investors are paying a premium for current earnings. This inherently increases vulnerability to negative surprises in future earnings reports. A sudden drop in corporate profits could trigger a sharp market downturn.

- Rising interest rates: The Federal Reserve's efforts to combat inflation through interest rate hikes directly impact stock valuations. Higher interest rates increase borrowing costs for companies, potentially slowing down growth and reducing future earnings, making current valuations less sustainable.

- Geopolitical risks: Global uncertainties, such as geopolitical tensions or unforeseen international events, can significantly impact investor sentiment and lead to market volatility, regardless of underlying valuations.

Analyzing BofA's Methodology and Track Record

To effectively utilize BofA's insights, it's vital to assess their analytical rigor and predictive accuracy.

- Strengths: BofA boasts extensive resources, a large team of analysts, and access to a wealth of market data. Their macroeconomic models are generally considered sophisticated.

- Weaknesses: Like any financial institution, BofA might face conflicts of interest, potentially influencing their analyses. Furthermore, predicting market movements with precision remains inherently challenging. Past performance is not necessarily indicative of future results.

- Historical accuracy: A critical review of BofA's past market predictions is essential. While they've had successful calls, it's important to acknowledge instances where their predictions deviated from actual market performance.

Investor Strategies in the Face of High Stock Market Valuations

Considering both BofA's perspective and the inherent risks of high valuations, investors need a well-defined strategy.

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors helps mitigate the impact of any single market downturn.

- Long-term investing: Focusing on the long-term potential of companies, rather than short-term market fluctuations, is a key strategy to weather market volatility.

- Undervalued stock identification: Employing fundamental analysis to identify potentially undervalued companies with strong long-term growth prospects can enhance returns.

- Alternative investments: Explore alternative investment options like precious metals or real estate to diversify further and potentially hedge against inflation or market downturns.

Conclusion: Navigating the Concerns of High Stock Market Valuations

BofA's analysis suggests that while high stock market valuations exist, they aren't necessarily an immediate cause for panic. However, it's crucial to acknowledge the inherent risks associated with these elevated valuations. The potential impact of rising interest rates, geopolitical risks, and the possibility of earnings disappointments cannot be ignored. Therefore, a balanced approach is needed. Understand the complexities surrounding high stock market valuations and make informed investment decisions. The ongoing debate surrounding high stock market valuations highlights the importance of continuous monitoring of market trends, economic indicators, and individual company performance. Remember, staying informed is key to successful long-term investing.

Featured Posts

-

Succession On Sky Atlantic Hd Character Analysis And Season Recaps

May 23, 2025

Succession On Sky Atlantic Hd Character Analysis And Season Recaps

May 23, 2025 -

Goroskopy I Predskazaniya Polnaya Astrologicheskaya Kartina

May 23, 2025

Goroskopy I Predskazaniya Polnaya Astrologicheskaya Kartina

May 23, 2025 -

Nicolas Tagliafico Man United Players To Blame For Ten Hags Failures

May 23, 2025

Nicolas Tagliafico Man United Players To Blame For Ten Hags Failures

May 23, 2025 -

Vybz Kartel Announces Nyc Barclay Center Show This April

May 23, 2025

Vybz Kartel Announces Nyc Barclay Center Show This April

May 23, 2025 -

Cat Deeleys Mint Velvet Dress Spotted In Liverpool One

May 23, 2025

Cat Deeleys Mint Velvet Dress Spotted In Liverpool One

May 23, 2025

Latest Posts

-

Actor Neal Mc Donough Tackles Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Tackles Pro Bull Riding In New Film

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025 -

Damien Darhks Power Could He Take Down Superman An Exclusive Interview With Neal Mc Donough

May 23, 2025

Damien Darhks Power Could He Take Down Superman An Exclusive Interview With Neal Mc Donough

May 23, 2025 -

New Bull Riding Video Neal Mc Donoughs Dedicated Training

May 23, 2025

New Bull Riding Video Neal Mc Donoughs Dedicated Training

May 23, 2025 -

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025