BofA's Take: Are High Stock Market Valuations Really A Worry?

Table of Contents

Keywords: High stock market valuations, BofA, stock market valuation, market valuation, high stock prices, stock market analysis, investment strategy, risk assessment, P/E ratio, Price-to-Sales, Price-to-Book, PEG ratio, interest rates, economic growth, market correction.

The stock market has reached impressive heights, leaving many investors wondering: are current high stock market valuations a cause for alarm? Bank of America (BofA), a leading financial institution, offers valuable insights into this critical question, examining factors far beyond simple price-to-earnings ratios. This article delves into BofA's perspective, helping you navigate the complexities of today's market and make informed investment decisions.

BofA's Assessment of Current Market Valuations

H3: Beyond P/E Ratios: A Deeper Dive into Valuation Metrics

Relying solely on the Price-to-Earnings (P/E) ratio to assess stock market valuation provides an incomplete picture. While P/E ratios offer a quick snapshot of how much investors are willing to pay for each dollar of a company's earnings, they often fail to account for crucial factors like future growth prospects and industry-specific dynamics. BofA's analysis likely incorporates a more comprehensive approach, considering a range of valuation metrics:

-

Price-to-Sales (P/S) Ratio: This metric compares a company's stock price to its revenue, offering insights even for companies with no earnings. It's particularly useful for evaluating young, high-growth companies.

- Strengths: Less susceptible to earnings manipulation than P/E; useful for companies with negative earnings.

- Weaknesses: Ignores profitability; can be inflated by high sales but low profits.

-

Price-to-Book (P/B) Ratio: This ratio compares a company's market capitalization to its book value (assets minus liabilities). It's often used to assess the value of asset-heavy companies.

- Strengths: Useful for valuing asset-intensive businesses; less sensitive to short-term earnings fluctuations.

- Weaknesses: Book value can be outdated; doesn't reflect intangible assets like brand value.

-

PEG Ratio: The Price/Earnings to Growth ratio considers the P/E ratio in relation to the company's expected earnings growth rate, offering a more nuanced perspective on valuation.

- Strengths: Accounts for future growth potential; helps identify undervalued growth stocks.

- Weaknesses: Relies on growth rate projections, which can be unreliable.

H3: The Role of Interest Rates in Stock Market Valuation

There's an inverse relationship between interest rates and stock valuations. Higher interest rates generally decrease stock valuations, as investors may shift their investments to higher-yielding bonds. Conversely, lower interest rates can boost stock valuations. BofA's analysis likely incorporates projections for future interest rate movements and their impact on different market sectors.

- Rising Interest Rates: Can lead to lower stock prices, especially for growth stocks that are heavily reliant on future earnings. Sectors like technology and consumer discretionary might be particularly affected.

- Falling Interest Rates: Can stimulate stock market growth by making borrowing cheaper for companies and encouraging investment.

H3: Economic Growth Projections and Their Influence on Valuations

BofA's economic growth forecasts, encompassing GDP growth, inflation rates, and unemployment figures, play a crucial role in assessing the sustainability of high stock market valuations. Strong economic growth typically supports higher valuations, while slowing growth or recessionary fears can lead to decreased valuations.

- Key Economic Factors Affecting Stock Prices:

- GDP Growth: Higher GDP generally indicates a healthy economy, supporting higher stock prices.

- Inflation: High inflation erodes purchasing power and can lead to higher interest rates, potentially impacting stock valuations negatively.

- Unemployment: Low unemployment signals a strong labor market, supporting consumer spending and economic growth.

Identifying Potential Risks Associated with High Valuations

H3: The Risk of a Market Correction

High stock market valuations inherently increase the risk of a market correction – a significant, short-term decline in stock prices. While predicting market corrections is impossible, BofA's analysis likely assesses the potential for a correction based on several factors:

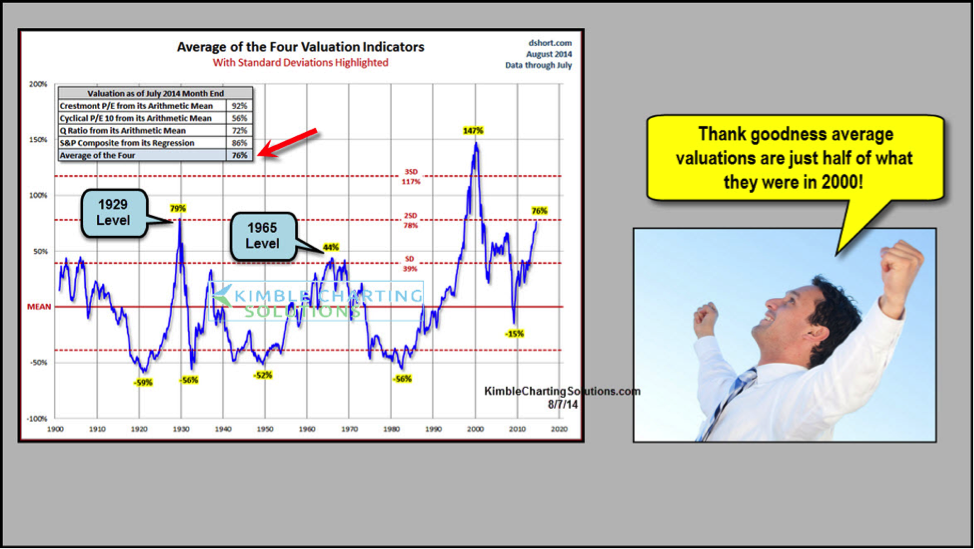

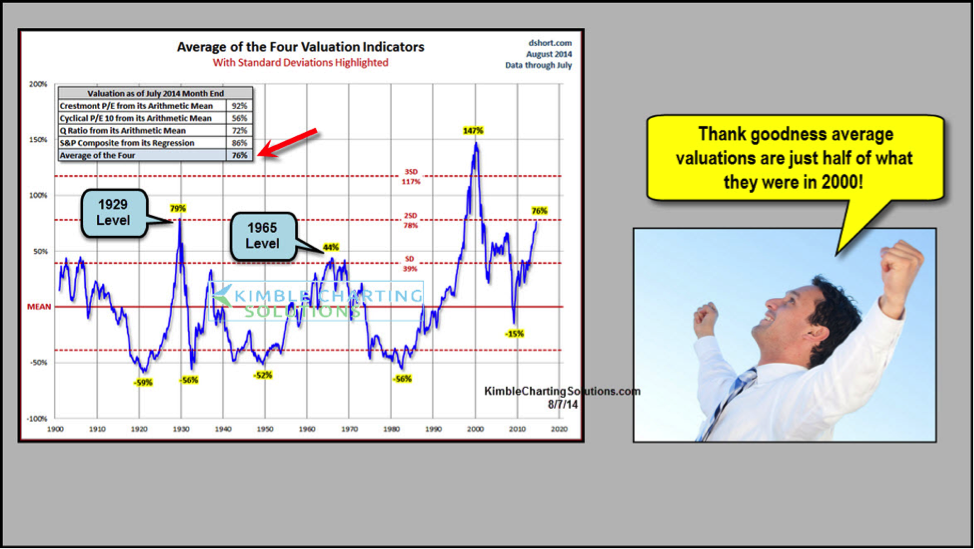

- Overvaluation: If valuations are judged to be significantly above historical averages, the risk of a correction increases.

- Economic Slowdown: Any signs of weakening economic growth can trigger a market correction.

- Geopolitical Events: Unforeseen geopolitical events can create market volatility and trigger a sell-off.

H3: Sector-Specific Risks and Opportunities

Not all sectors are equally vulnerable to valuation adjustments. BofA's analysis might identify sectors with particularly high valuations, suggesting a higher risk of correction. Conversely, some sectors might be less risky despite elevated valuations, offering potential investment opportunities.

- High-Valuation Sectors: Sectors like technology or certain parts of the consumer discretionary space often show high valuations and may be more vulnerable to market corrections.

- Lower-Valuation Sectors: Sectors like energy or utilities might offer relatively lower valuations and potentially less risk.

H3: Geopolitical and Macroeconomic Risks

External factors like inflation, geopolitical uncertainty, and supply chain disruptions significantly impact stock market valuations. BofA's analysts likely integrate these factors into their risk assessment.

- Key Geopolitical and Macroeconomic Risks:

- Rising inflation: Erodes corporate profits and investor confidence.

- Geopolitical instability: Can lead to market uncertainty and volatility.

- Supply chain disruptions: Impact production and increase costs.

BofA's Recommendations for Investors

H3: Strategies for Navigating High Valuations

BofA likely recommends a diversified investment strategy, including:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors minimizes risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals.

- Sector-Specific Strategies: Focusing on sectors with lower valuations or those less susceptible to economic downturns.

H3: The Importance of Long-Term Investment Horizons

Maintaining a long-term investment horizon is crucial for weathering market volatility. Short-term fluctuations are less significant when viewed within the context of a long-term investment strategy.

Conclusion

BofA's assessment of high stock market valuations highlights the importance of a holistic approach, considering multiple valuation metrics and external factors beyond simple P/E ratios. While the current market presents opportunities, it also carries risks, including the potential for a market correction. A diversified, long-term investment strategy is crucial for navigating these complexities. Understanding BofA's perspective on high stock market valuations is essential for informed investment decisions. Learn more about managing your portfolio effectively in the face of high stock prices by [link to relevant BofA research]. Don't let high stock market valuations leave you unprepared – take control of your financial future today!

Featured Posts

-

Ftcs Appeal Could Block Microsofts Activision Blizzard Acquisition

Apr 26, 2025

Ftcs Appeal Could Block Microsofts Activision Blizzard Acquisition

Apr 26, 2025 -

Stock Market Valuations Bof A Says Dont Panic

Apr 26, 2025

Stock Market Valuations Bof A Says Dont Panic

Apr 26, 2025 -

Anchor Brewings Legacy Closing Its Doors After 127 Years

Apr 26, 2025

Anchor Brewings Legacy Closing Its Doors After 127 Years

Apr 26, 2025 -

T Mobile Data Breaches Result In 16 Million Penalty

Apr 26, 2025

T Mobile Data Breaches Result In 16 Million Penalty

Apr 26, 2025 -

Investing With The Elite A Guide To Accessing Elon Musks Private Investments

Apr 26, 2025

Investing With The Elite A Guide To Accessing Elon Musks Private Investments

Apr 26, 2025