BofA's Take: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Market Outlook: A Deep Dive

BofA's analysts maintain a relatively positive outlook for the stock market, despite the challenges. Their forecast is built on several key pillars. This positive market outlook, detailed in recent reports and analyses, considers a number of factors to arrive at a bullish forecast, including predictions for economic growth and corporate earnings. The keywords here are BofA forecast, market predictions, economic growth, earnings estimates, and stock market forecast 2024.

-

Strong Corporate Earnings Growth: BofA projects continued, albeit potentially moderated, growth in corporate earnings throughout 2024 and beyond. This is driven by factors such as ongoing technological advancements, increasing global demand in certain sectors, and the resilience of the consumer.

-

Promising Sectors: BofA analysts highlight specific sectors like technology, healthcare, and certain areas of the consumer discretionary sector as particularly promising for investment. These sectors are expected to demonstrate robust growth despite economic headwinds.

-

Rationale for Optimism: BofA's optimism isn't unfounded. Their analysis incorporates a wide range of economic indicators, including GDP growth projections, inflation forecasts, and employment data. The bank's economic models suggest a path towards sustainable economic growth, supporting their positive market outlook. [Insert relevant chart or graph illustrating BofA's projections here, if available and appropriately sourced].

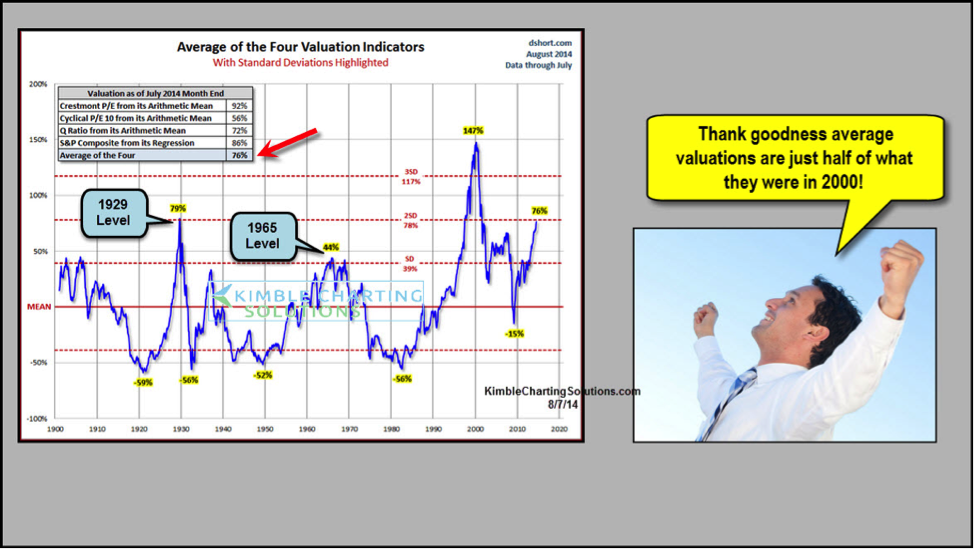

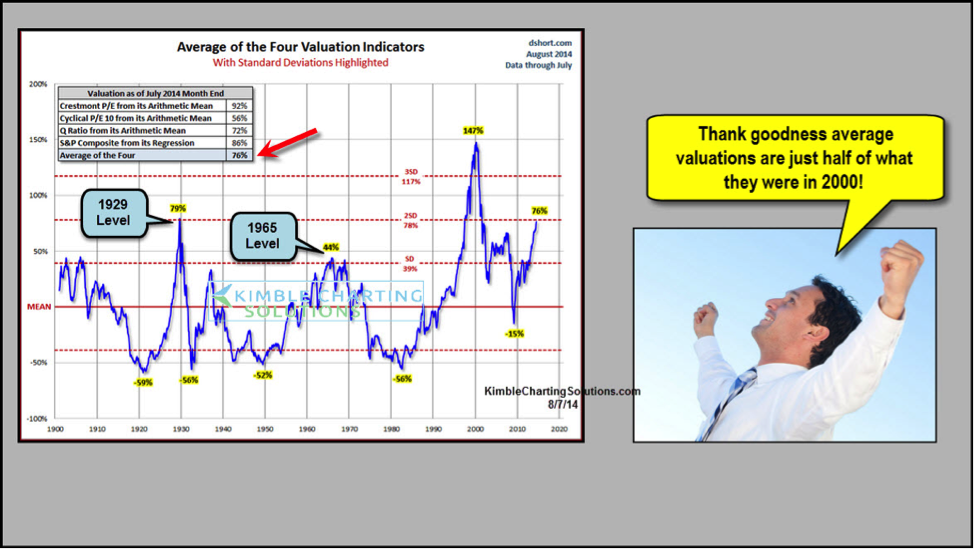

Addressing the Valuation Concerns: Why Current Prices Are Justified

A common concern among investors is that current stock market valuations are inflated. Let's examine this claim using key stock valuation metrics: Stock valuation metrics, P/E ratio, price-to-sales ratio, discounted cash flow, market capitalization, and intrinsic value are all important concepts to consider.

-

Understanding Valuation Metrics: Metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio help gauge whether a stock or the overall market is fairly valued. While some metrics might appear high compared to historical averages, BofA argues that these numbers are justified.

-

Refuting Overvaluation Claims: BofA counters the overvaluation argument by emphasizing:

- Strong Earnings Growth Projections: The projected growth in corporate earnings mentioned above helps justify higher valuations. Future earnings are expected to support current prices.

- Interest Rate Dynamics: While interest rate hikes impact valuations, BofA's analysis considers the potential for future rate decreases or stabilization, mitigating the negative impact on stock prices.

- Long-Term Economic Forecasts: BofA’s long-term economic outlook is positive, suggesting sustained growth that can support current market valuations.

- Undervalued Opportunities: BofA's analysis also highlights specific sectors or individual companies that they believe are currently undervalued, presenting attractive investment opportunities.

-

Inflation and Interest Rates: The impact of inflation and interest rates on valuations is a key consideration. While high inflation can initially pressure valuations, BofA's models suggest that the current inflationary pressures are manageable and temporary, and the effects on valuations are already being factored into the market.

The Importance of Long-Term Investing

Amidst short-term market volatility, a long-term investment strategy is crucial. Long-term investment strategy, risk tolerance, portfolio diversification, buy and hold strategy, and long-term growth are essential aspects to remember.

- Long-Term Perspective: Market fluctuations are normal. Focusing on long-term growth, rather than short-term gains or losses, is vital for successful investing.

- Short-Term Volatility: Short-term market dips don't negate the long-term potential for growth. These fluctuations are often opportunities for strategic investment.

- Portfolio Diversification: A well-diversified portfolio can mitigate risk and enhance overall investment performance. Spreading investments across different asset classes helps cushion against losses in specific sectors.

- Buy and Hold Strategy: A "buy and hold" strategy, involving acquiring quality assets and holding them for the long term, often outperforms attempts to time the market.

Opportunities Within the Current Market

Despite concerns, BofA identifies several attractive investment opportunities within the current market. Investment opportunities, undervalued stocks, sector-specific analysis, stock picking strategies, growth stocks, and value stocks all present viable options for savvy investors.

- Attractive Sectors: BofA highlights specific sectors they believe are poised for growth, taking into account their analyses of each sector's potential and current market conditions.

- Undervalued Stock Identification: BofA provides frameworks for identifying undervalued stocks, incorporating fundamental analysis and a thorough understanding of market dynamics.

- Examples (Disclaimer): [While specific examples could be included here, remember to always include a strong disclaimer stating that this is not financial advice and that individual investment decisions should be made with the help of a financial advisor.]

Conclusion

BofA's analysis suggests that current stock market valuations, while potentially high compared to historical averages, are largely justified by strong corporate earnings growth projections, manageable inflationary pressures, and a positive long-term economic outlook. Don't let short-term market anxieties overshadow the potential for long-term growth. Remember the importance of long-term investing, portfolio diversification, and aligning your investment strategy with your risk tolerance. Don't let concerns about current stock market valuations deter you from achieving your long-term financial goals. Learn more about BofA's investment strategies and market analysis today! Consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Salman Khans Box Office Performance A 4 7 Budget Return

May 13, 2025

Salman Khans Box Office Performance A 4 7 Budget Return

May 13, 2025 -

Analyzing The Lyrics Unpacking The Narrative Of Tory Lanezs New Album Peterson

May 13, 2025

Analyzing The Lyrics Unpacking The Narrative Of Tory Lanezs New Album Peterson

May 13, 2025 -

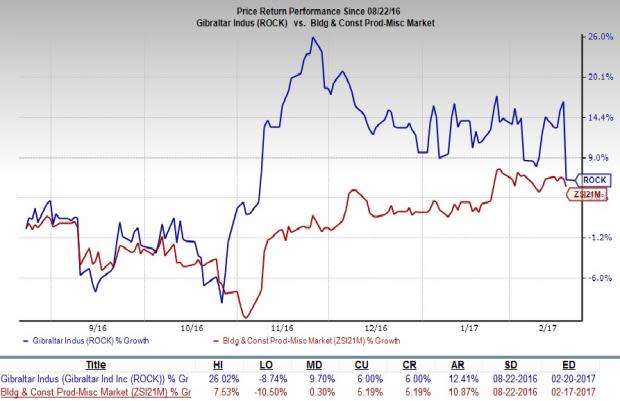

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025 -

Finding Off Market Luxury Homes The Luxury Presence Advantage

May 13, 2025

Finding Off Market Luxury Homes The Luxury Presence Advantage

May 13, 2025 -

Fans Rejoice Heist Film Sequel Hits Amazon Prime This Month

May 13, 2025

Fans Rejoice Heist Film Sequel Hits Amazon Prime This Month

May 13, 2025

Latest Posts

-

Sinner Makes Italian Open Last 16 Osakas Early Exit

May 14, 2025

Sinner Makes Italian Open Last 16 Osakas Early Exit

May 14, 2025 -

Paolinis Dubai Defense Crumbles Sabalenkas Dominant Victory

May 14, 2025

Paolinis Dubai Defense Crumbles Sabalenkas Dominant Victory

May 14, 2025 -

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025 -

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025

Sabalenkas Dubai Defeat Paolinis Reign Ends

May 14, 2025 -

Giants Success The Footprint Of A Legend

May 14, 2025

Giants Success The Footprint Of A Legend

May 14, 2025