BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Context

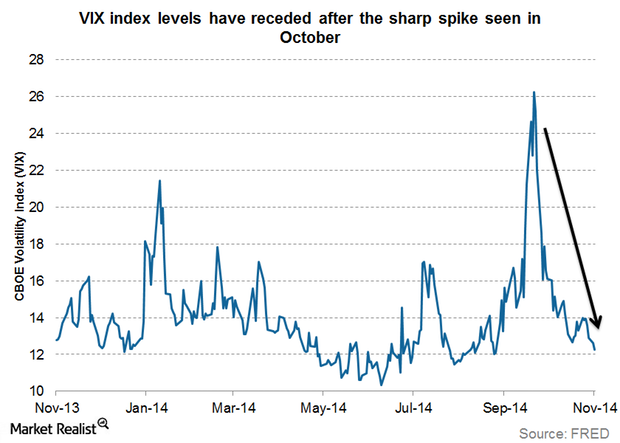

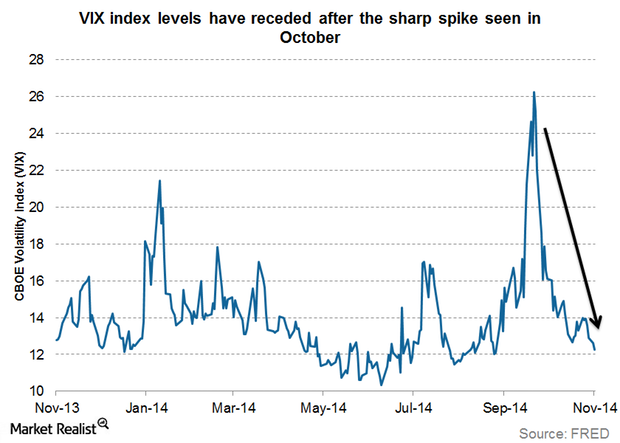

BofA's overall assessment of the current market acknowledges the challenges. Factors like persistent interest rate hikes by central banks aiming to curb inflation, ongoing geopolitical uncertainty (including the war in Ukraine and its impact on energy prices), and lingering supply chain disruptions all contribute to a complex economic landscape. However, BofA argues that these factors don't automatically translate into a market crash.

-

Summary of BofA's key arguments against immediate concern: BofA emphasizes that while valuations are high compared to historical averages, they are not unprecedented. They highlight the resilience of corporate earnings and the potential for continued growth in specific sectors, mitigating the impact of elevated price-to-earnings (P/E) ratios.

-

Specific economic indicators used in their analysis: BofA's analysis likely incorporates data points such as inflation rates (CPI and PCE), interest rate levels (federal funds rate, bond yields), GDP growth forecasts, unemployment figures, and consumer sentiment indicators. These are crucial in assessing the overall economic health and its influence on stock market valuations.

-

Counterarguments BofA acknowledges and how they address them: BofA likely acknowledges the risk of a potential recession or further market correction. However, their argument probably centers around the idea that such events are already somewhat priced into the market, and that selective investing in strong companies with robust fundamentals can mitigate these risks. They might highlight the historical precedent of markets recovering from periods of high valuation and volatility.

The Role of Low Interest Rates and Inflation in Valuation

Historically, low interest rates have fueled higher stock valuations. When borrowing costs are low, companies can invest more readily, leading to increased profits and higher stock prices. Conversely, high interest rates typically decrease valuations as they increase the cost of borrowing and reduce corporate profitability.

-

Discounted cash flow and valuations: The discounted cash flow (DCF) model is a crucial tool in valuation. It estimates a company's intrinsic value by discounting its future cash flows back to their present value. Lower interest rates result in lower discount rates, thus increasing the present value of future cash flows and leading to higher valuations.

-

Inflation's impact on valuation metrics: Inflation erodes purchasing power. While higher inflation might initially boost revenues for some companies, the increased cost of inputs and wages can significantly reduce profits. Valuation metrics like P/E ratios need to be carefully adjusted to account for inflation's impact on both earnings and the value of future cash flows.

-

Future interest rate adjustments and valuations: Future interest rate adjustments by central banks will significantly influence stock market valuations. Further rate hikes might put downward pressure on valuations, while rate cuts or pauses could potentially lead to an increase. This uncertainty underscores the need for careful analysis and a long-term investment perspective.

Long-Term Growth Prospects and the Importance of Patience

BofA's perspective likely emphasizes the importance of maintaining a long-term investment horizon. Focusing on short-term market fluctuations can be detrimental.

-

Strong growth sectors: BofA's analysis probably points to sectors like technology (AI, cloud computing), healthcare (biotech, pharmaceuticals), and renewable energy as having strong long-term growth prospects, potentially offsetting concerns about overall market valuations.

-

Historical market performance: Throughout history, the stock market has consistently shown periods of high valuation followed by periods of correction and subsequent growth. BofA's perspective likely leverages this historical context to suggest that current valuations, while elevated, don't necessarily predict an imminent market crash.

-

Diversified investment strategies: A diversified investment portfolio across various asset classes and sectors reduces the overall risk associated with individual stock performance or market volatility. This is crucial for mitigating the impact of stretched stock market valuations on the overall investment portfolio.

Identifying Opportunities Within a Stretched Market

Even in a market with stretched valuations, opportunities exist for discerning investors.

-

Value investing and undervalued companies: Value investing focuses on identifying companies trading below their intrinsic value. Thorough fundamental analysis, including examining financial statements, competitive landscape, and management quality, helps identify undervalued companies with strong long-term potential.

-

Analyzing company fundamentals: A deep dive into a company's financial health, including revenue growth, profit margins, debt levels, and cash flow, helps to determine its intrinsic value, regardless of the overall market valuation. This is critical in identifying companies that offer attractive risk-adjusted returns.

-

Long-term investment strategies: A long-term perspective allows investors to ride out market corrections and volatility, focusing on the long-term growth potential of their chosen investments. This strategy is crucial in navigating periods of stretched stock market valuations.

Conclusion

BofA's assessment suggests that while stretched stock market valuations are a valid concern, they shouldn't trigger panic selling. Their rationale incorporates the impact of interest rates, inflation, the potential for long-term growth in specific sectors, and the importance of strategic investing. Understanding the nuances of these factors is crucial for navigating the current market climate effectively.

While BofA suggests a measured approach, stay informed about market trends and consult with a financial advisor before making any investment decisions. Don't let concerns over stretched stock market valuations paralyze you; understand the nuances before formulating your investment strategy. Learn more about BofA's insights on stretched stock market valuations and discover how to navigate this market effectively.

Featured Posts

-

Auction Of Kid Cudis Belongings High Prices Revealed

May 16, 2025

Auction Of Kid Cudis Belongings High Prices Revealed

May 16, 2025 -

Nba Champions Quiz Identify The 2 Scorers Since 1977

May 16, 2025

Nba Champions Quiz Identify The 2 Scorers Since 1977

May 16, 2025 -

Breaking News Dodgers Recall Top Prospect Hyeseong Kim

May 16, 2025

Breaking News Dodgers Recall Top Prospect Hyeseong Kim

May 16, 2025 -

Analyzing The Knicks Near Miss In Overtime

May 16, 2025

Analyzing The Knicks Near Miss In Overtime

May 16, 2025 -

Everton Vina Vs Coquimbo Unido 0 0 Resumen Del Partido Y Goles

May 16, 2025

Everton Vina Vs Coquimbo Unido 0 0 Resumen Del Partido Y Goles

May 16, 2025