BofA's View: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Current Market Assessment and Valuation Metrics

BofA employs a rigorous methodology to assess market valuations, utilizing several key metrics to paint a comprehensive picture. Their analysis goes beyond simply looking at the overall market index and delves into individual sectors and company performance. Key metrics include:

-

Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating overvaluation. BofA analyzes both the current P/E ratio and compares it to historical averages across various sectors to identify potential overvaluation.

-

Price-to-Sales ratio (P/S): This ratio compares a company's stock price to its revenue per share. It's particularly useful for valuing companies with little or no earnings, like many high-growth tech firms. BofA's analysis of P/S ratios helps to identify potentially inflated valuations in these sectors.

-

Shiller PE ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric uses the average inflation-adjusted earnings from the past ten years, smoothing out short-term fluctuations and providing a longer-term perspective on valuation. BofA uses the CAPE ratio to assess whether current valuations are historically high or justified by long-term earnings growth potential.

BofA's findings often reveal that current valuations are elevated compared to historical averages. However, they also consider contextual factors. The current economic climate, interest rate environment, and anticipated future earnings growth all play crucial roles in their interpretation of these metrics. For instance, a high P/E ratio might be justified if a company is expected to experience significant future earnings growth. BofA's analysis carefully weighs these factors before reaching a conclusion.

- Example: BofA might report that the current S&P 500 P/E ratio is 25, significantly higher than the historical average of 15, but note that projected earnings growth for the coming years could partially justify this premium.

- Example: BofA's assessment of the impact of rising interest rates might include a warning that higher rates could reduce future earnings projections and negatively impact valuations.

- Example: BofA’s analysis of future earnings growth potential might suggest that while valuations seem high, the anticipated robust growth in certain sectors could support the current market levels, albeit with caveats.

Potential Risks Associated with High Stock Market Valuations

Investing in a market characterized by high stock market valuations presents several inherent risks, which BofA carefully analyzes:

-

Increased Market Vulnerability to Economic Downturns: When valuations are high, even a small negative economic shock can lead to significant market corrections, as investors rush to sell off assets.

-

Higher Potential for Capital Losses: High valuations mean there's less margin for error. A decline in earnings or a shift in investor sentiment can lead to substantial capital losses.

-

Impact of Rising Interest Rates on Stock Prices: Higher interest rates typically increase borrowing costs for companies, potentially reducing their profitability and making equities less attractive relative to bonds.

-

Increased Risk of a Market Correction: High valuations often precede market corrections or even crashes, as the market eventually adjusts to a more sustainable level.

BofA's risk assessment goes beyond these general points, often delving into specific sectors and identifying those most vulnerable to a market downturn given their valuations and economic sensitivities. They consider various scenarios, including unexpected geopolitical events and regulatory changes, to provide a comprehensive risk outlook.

BofA's Recommendations for Investors

Based on their analysis of high stock market valuations and associated risks, BofA usually offers investors a mix of cautious optimism and strategic guidance. Their recommendations might include:

-

Diversification Strategies: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors can help mitigate risk.

-

Sector-Specific Investment Advice: BofA might suggest focusing on undervalued sectors or companies with strong fundamentals and growth potential, even within a high-valuation market.

-

Hedging Strategies to Mitigate Risk: This might involve using options or other derivatives to protect against potential market downturns.

-

Suggestions for Adjusting Investment Timelines: For investors with longer time horizons, a slightly higher tolerance for risk might be acceptable, while those nearing retirement may need to prioritize capital preservation.

Alternative Perspectives and Considerations

While BofA's analysis provides valuable insights, it's crucial to acknowledge that other financial institutions and experts may hold different perspectives on high stock market valuations. Some may argue that current valuations are justified by factors like low interest rates and technological advancements, while others might express more pronounced concerns. BofA itself acknowledges limitations in its predictive models and the inherent uncertainty involved in market forecasting.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

Understanding BofA's perspective on high stock market valuations is crucial for making informed investment decisions. Their analysis highlights the potential risks associated with elevated valuations—increased market vulnerability, higher potential for capital losses, and the impact of rising interest rates. However, BofA's recommendations also emphasize the importance of strategic diversification, sector-specific analysis, and risk management techniques to navigate these challenges. Remember to conduct your own thorough research, consult with a financial advisor, and develop a robust investment strategy that accounts for the current high stock market valuations. By integrating BofA's insights into your decision-making process, you can strive for a more informed and successful investment approach.

Featured Posts

-

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025 -

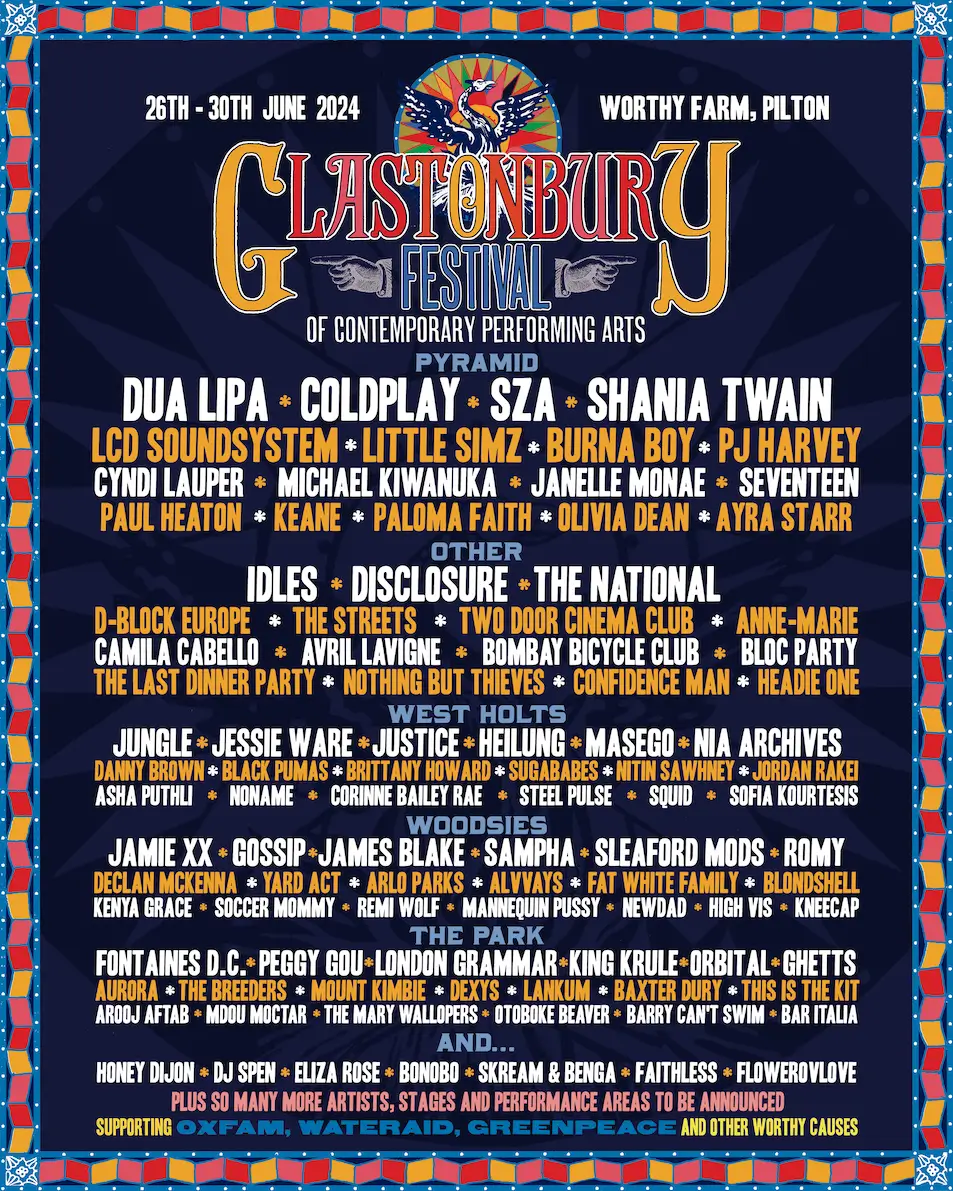

Mystery Us Band Possibly Playing Glastonbury Fan Theories Explode

May 24, 2025

Mystery Us Band Possibly Playing Glastonbury Fan Theories Explode

May 24, 2025 -

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025 -

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 24, 2025

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 24, 2025 -

Wildfire Wagers Examining The Ethics Of Betting On The Los Angeles Fires

May 24, 2025

Wildfire Wagers Examining The Ethics Of Betting On The Los Angeles Fires

May 24, 2025

Latest Posts

-

Understanding Dylan Dreyer And Brian Ficheras Partnership

May 24, 2025

Understanding Dylan Dreyer And Brian Ficheras Partnership

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 24, 2025

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 24, 2025 -

Today Show Host Dylan Dreyer Details Of A Near Disaster

May 24, 2025

Today Show Host Dylan Dreyer Details Of A Near Disaster

May 24, 2025 -

Dylan Dreyer And Brian Fichera A Look At Their Relationship

May 24, 2025

Dylan Dreyer And Brian Fichera A Look At Their Relationship

May 24, 2025 -

Dylan Dreyer And The Today Show A Close Call You Wont Believe

May 24, 2025

Dylan Dreyer And The Today Show A Close Call You Wont Believe

May 24, 2025