BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Case: Understanding Their Rationale

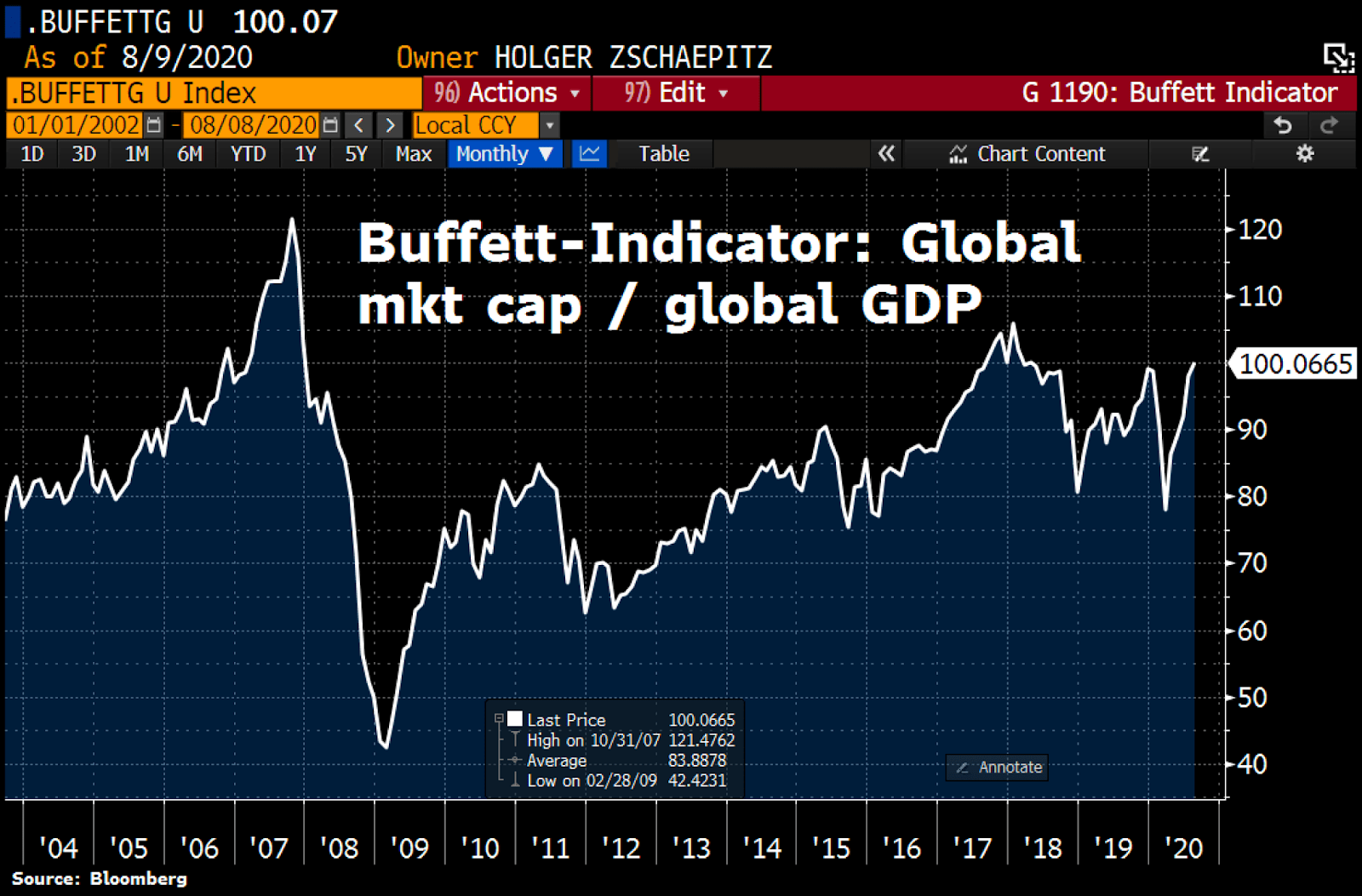

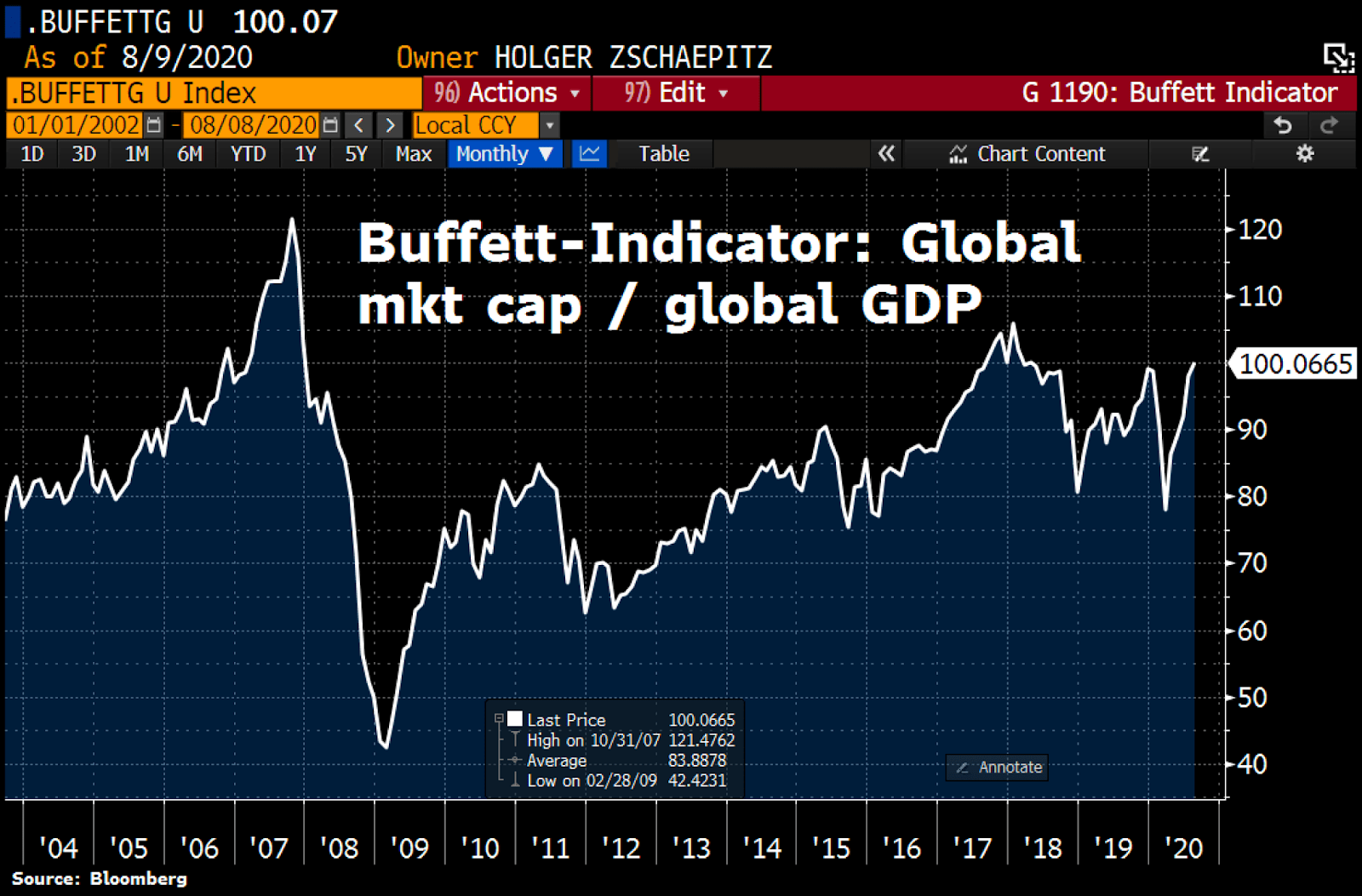

BofA's core argument centers on the idea that current stock market valuations, while seemingly high, are justified by a confluence of positive economic factors and strong corporate performance. They contend that focusing solely on traditional valuation metrics without considering the broader economic context can lead to a misinterpretation of the market's true potential.

- Strong corporate earnings growth projections: BofA's analysts predict continued robust earnings growth for many sectors, driven by factors such as increased consumer spending and global economic recovery. This anticipated growth helps to support current pricing multiples.

- Positive economic indicators despite inflation concerns: While inflation remains a concern, BofA notes that other key economic indicators, such as employment figures and consumer confidence, remain relatively strong. This suggests a resilient economy capable of withstanding inflationary pressures.

- Low interest rate environment (relative to historical norms): The current low-interest-rate environment, although changing, still supports higher valuations compared to periods of higher interest rates. Lower borrowing costs make it cheaper for companies to expand and invest, fostering growth and justifying higher stock prices.

- Technological advancements driving future growth: BofA points to the transformative power of technological innovation as a key driver of future economic expansion. Investments in technology, artificial intelligence, and other disruptive sectors are expected to yield significant returns, justifying higher valuations for related companies.

- Promising Sectors: BofA highlights the technology and healthcare sectors as particularly promising, citing their robust growth potential and strong earnings prospects. These sectors are expected to continue leading the market's upward trajectory.

Addressing the Concerns: Debunking Valuation Myths

Many investors are understandably anxious about high stock market valuations. However, BofA's analysis addresses these concerns directly, debunking several common myths.

- High P/E ratios don't always equate to market crashes: While high price-to-earnings (P/E) ratios can be a warning sign, they don't automatically predict a market crash. BofA argues that the context is crucial. High P/E ratios can be justified by strong future growth expectations and low interest rates.

- Influence of Low Interest Rates and Future Growth Expectations: Current valuations are significantly influenced by low interest rates and investors' expectations of future growth. These factors can inflate valuations, but that doesn't necessarily mean the market is overvalued in an absolute sense.

- The Impact of Quantitative Easing: The effects of quantitative easing (QE) on asset pricing are complex. While QE can artificially inflate asset prices, BofA's analysis suggests that the impact is less significant than the positive influence of underlying economic strength and corporate earnings.

- Manageable Risks in a Diversified Portfolio: BofA acknowledges the inherent risks in the market. However, they emphasize that these risks are manageable through a well-diversified investment portfolio that spreads risk across different asset classes and sectors.

Investment Strategies Supported by BofA's Analysis

BofA's optimistic outlook supports several specific investment strategies:

- Long-Term Growth Stocks: Given the expectation of continued corporate earnings growth, investing in long-term growth stocks remains a viable strategy. Focus on companies with strong fundamentals and a track record of innovation.

- Diversification: Diversification across sectors and asset classes is crucial to mitigate risk. Don't put all your eggs in one basket.

- Strong Fundamentals and Sustainable Business Models: Invest in companies with proven business models, strong financial positions, and sustainable competitive advantages.

- Dollar-Cost Averaging: Dollar-cost averaging can help mitigate the risk associated with market volatility. By investing regularly regardless of market fluctuations, you can reduce the impact of buying high and selling low.

- Investment Vehicles: Consider using ETFs (exchange-traded funds) and mutual funds to achieve diversification and access a broad range of investments efficiently.

Conclusion

BofA's analysis suggests that while current stock market valuations may seem high at first glance, they are largely justified by strong corporate earnings growth, positive economic indicators, and a relatively low-interest-rate environment. The bank acknowledges potential risks but emphasizes the importance of long-term investment strategies and diversification. Don't let fear of high stock market valuations dictate your investment decisions. BofA's analysis suggests a nuanced perspective that warrants careful consideration. Explore diversified investment strategies aligned with their optimistic outlook and consider seeking professional financial advice to build a portfolio that suits your risk tolerance and long-term financial goals. Learn more about navigating current stock market valuations and discover investment opportunities today. Keywords: Stock market valuations, investment strategies, financial advice, investment opportunities, long-term investment.

Featured Posts

-

Laurence Melys La Touche Feminine Du Cyclisme Sur Rtl

May 26, 2025

Laurence Melys La Touche Feminine Du Cyclisme Sur Rtl

May 26, 2025 -

Michael Schumachers Driving Style Aggressive Or Unfair

May 26, 2025

Michael Schumachers Driving Style Aggressive Or Unfair

May 26, 2025 -

Le Pen Ramadan Et La Morale Selon Enthoven Analyse D Une Declaration Choquante

May 26, 2025

Le Pen Ramadan Et La Morale Selon Enthoven Analyse D Une Declaration Choquante

May 26, 2025 -

F1 Drivers Press Conference Your Guide To The Post Race Interviews

May 26, 2025

F1 Drivers Press Conference Your Guide To The Post Race Interviews

May 26, 2025 -

Coriolanus Snow Casting Ralph Fiennes A Contender Fan Support For Kiefer Sutherland Strong

May 26, 2025

Coriolanus Snow Casting Ralph Fiennes A Contender Fan Support For Kiefer Sutherland Strong

May 26, 2025

Latest Posts

-

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025 -

Andre Agassi Marturie Neasteptata Despre Presiunea Competitiei

May 30, 2025

Andre Agassi Marturie Neasteptata Despre Presiunea Competitiei

May 30, 2025 -

Die Ungewoehnliche Ehe Regel Von Steffi Graf Und Andre Agassi

May 30, 2025

Die Ungewoehnliche Ehe Regel Von Steffi Graf Und Andre Agassi

May 30, 2025 -

Andre Agassi Declaratie Socanta Despre Nervi

May 30, 2025

Andre Agassi Declaratie Socanta Despre Nervi

May 30, 2025 -

Agassi Y Rios Una Batalla En La Cancha

May 30, 2025

Agassi Y Rios Una Batalla En La Cancha

May 30, 2025