BofA's View: Why High Stock Market Valuations Are Justified

Table of Contents

BofA's Underlying Economic Rationale

BofA's assessment of the current macroeconomic environment forms the bedrock of their argument for high stock market valuations. They point to several key indicators suggesting a strong and sustainable economic outlook:

-

Strong corporate earnings growth despite inflation: Despite inflationary pressures, many corporations have demonstrated impressive earnings growth, indicating resilience and pricing power. BofA's research highlights a continued upward trend in corporate profits, even after accounting for inflation's impact on input costs. This strong performance suggests that companies are successfully navigating the economic challenges and generating substantial returns for investors. Keywords: economic growth, corporate profits, inflation, earnings growth.

-

Sustained consumer spending and resilience: Consumer spending remains a significant driver of economic growth, and BofA's analysis indicates a surprising level of resilience despite inflation. Consumer confidence, although fluctuating, has remained relatively high, suggesting continued spending power and a positive outlook on the economy. This robust consumer demand supports the strong performance of many companies and underpins the justification for high valuations. Keywords: consumer spending, consumer confidence, economic resilience.

-

Positive long-term growth projections: BofA's economic models predict positive long-term growth, projecting a sustained period of expansion. This outlook, coupled with the other factors mentioned, contributes to higher valuations as investors anticipate future earnings growth. The bank's forecasts often consider factors such as technological advancements, demographic shifts, and global economic trends. Keywords: long-term growth, economic forecasts, future earnings.

-

Technological advancements driving innovation and productivity: BofA emphasizes the role of technological innovation in boosting productivity and driving economic expansion. This technological revolution is creating new markets, improving efficiency, and leading to higher corporate profits, all of which contribute to higher stock valuations. Keywords: technological innovation, productivity growth, economic expansion.

The Role of Historically Low Interest Rates

Historically low interest rates play a crucial role in influencing stock valuations. This is primarily because:

-

Lower discount rates increase the present value of future earnings: Lower interest rates translate to lower discount rates used in present value calculations. This means that the present value of future earnings is higher, making stocks appear more attractive and justifying higher valuations. Keywords: discount rate, present value, interest rates, stock valuation.

-

Impact on investor behavior and allocation strategies: Low interest rates encourage investors to seek higher returns elsewhere, often leading to increased investment in the stock market. This increased demand contributes to higher stock prices and valuations. Keywords: investor behavior, asset allocation, risk appetite.

-

Comparison to historical interest rate environments and valuation levels: BofA often compares current valuation levels to those observed during periods with similar interest rate environments. This historical context helps to assess whether current valuations are unusually high or within a reasonable range given the prevailing macroeconomic conditions. Keywords: interest rate environment, historical valuations, market comparisons.

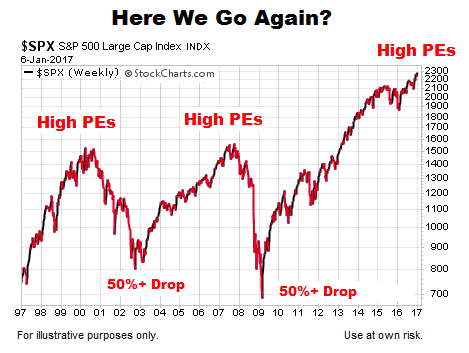

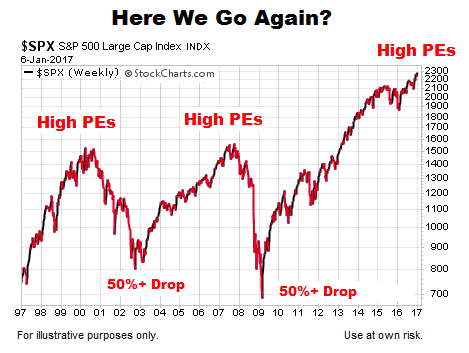

Addressing Concerns About High Price-to-Earnings Ratios (High P/E Ratios)

High price-to-earnings (P/E) ratios are a common concern among investors. However, BofA offers counterarguments:

-

BofA's counterarguments regarding the sustainability of earnings growth: BofA’s analysts emphasize the sustainability of earnings growth, arguing that the current high P/E ratios are justified by the expected long-term growth prospects discussed earlier. They focus on the underlying drivers of earnings growth rather than solely on the P/E ratio as a standalone metric. Keywords: price-to-earnings ratio, P/E ratio, earnings growth sustainability.

-

Comparison of current P/E ratios to historical averages, considering the current economic context: BofA's analysis compares current P/E ratios to historical averages, acknowledging that they may be higher than historical norms. However, they argue that this is justified by the current economic context, including low interest rates and strong growth prospects. Keywords: historical P/E ratios, market multiples, economic context.

-

Discussion of alternative valuation metrics beyond P/E ratios: BofA acknowledges the limitations of solely relying on P/E ratios and often employs other valuation metrics, such as price-to-sales ratios and discounted cash flow analysis, to gain a more comprehensive understanding of market valuations. Keywords: valuation metrics, discounted cash flow, price-to-sales ratio.

Technological Innovation and its Impact on Long-Term Growth

BofA strongly emphasizes the transformative power of technological innovation in shaping future earnings and valuations:

-

Specific examples of disruptive technologies impacting various sectors: BofA identifies specific examples of disruptive technologies, such as artificial intelligence, cloud computing, and biotechnology, and analyzes their impact on various sectors of the economy. This granular analysis demonstrates how innovation is driving growth and shaping future market performance. Keywords: technological innovation, disruptive technologies, sector impact, AI, cloud computing, biotechnology.

-

Long-term growth potential fueled by technological innovation: The bank highlights the immense long-term growth potential driven by technological innovation, emphasizing its role in boosting productivity, creating new markets, and improving efficiency. This long-term perspective underpins their justification for high valuations. Keywords: long-term growth, technological advancements, future growth potential.

-

BofA's predictions for the impact of these technologies on future stock market performance: BofA incorporates its predictions regarding the impact of technological innovation into its stock market forecasts, providing a roadmap for how these advancements might shape future valuations and investment opportunities. Keywords: future stock market performance, technology predictions, investment strategy.

Conclusion: Understanding BofA's Justification for High Stock Market Valuations

In summary, BofA's justification for high stock market valuations rests on a robust assessment of the current macroeconomic environment, the impact of historically low interest rates, and the transformative potential of technological innovation. Their analysis acknowledges concerns about high P/E ratios but emphasizes the sustainability of earnings growth and the importance of considering a broader range of valuation metrics within the context of long-term growth prospects. To gain a deeper understanding of BofA's analysis on high stock market valuations and their implications for your investment strategy, explore their latest research reports.

Featured Posts

-

Block Mirror Circumventing Trigger Blocks On Dystopian Websites

May 16, 2025

Block Mirror Circumventing Trigger Blocks On Dystopian Websites

May 16, 2025 -

Nhl Playoffs Game 2 Senators Vs Maple Leafs Prediction And Betting Odds

May 16, 2025

Nhl Playoffs Game 2 Senators Vs Maple Leafs Prediction And Betting Odds

May 16, 2025 -

The One Thing Holding Back Every Top 10 Nba Contender

May 16, 2025

The One Thing Holding Back Every Top 10 Nba Contender

May 16, 2025 -

Kid Cudis Auction Personal Items Sell For Stunning Amounts

May 16, 2025

Kid Cudis Auction Personal Items Sell For Stunning Amounts

May 16, 2025 -

Greenlands Ice Conceals A U S Nuclear Base Unveiling The Truth

May 16, 2025

Greenlands Ice Conceals A U S Nuclear Base Unveiling The Truth

May 16, 2025